Key Takeaways

- NIFTY 50: The NIFTY 50 is a benchmark index of India’s top 50 companies listed on NSE, reflecting the overall performance of the Indian equity market.

- Sectoral Representation: The index covers major sectors like banking, IT, energy, and FMCG, offering diversified exposure across India’s economy.

- Weightage & Calculation: NIFTY 50 is computed using the free-float market capitalization method, ensuring that only actively traded shares influence index movement.

- Review & Rebalancing: The index is reviewed semi-annually to maintain relevance by replacing underperforming companies with emerging leaders based on set criteria.

- Investment: Investors use NIFTY 50 as a benchmark for portfolio performance and can invest through index funds, ETFs, or derivatives for diversified market exposure.

- Key Takeaways

- What is NIFTY 50?

- How are Stocks Selected to be Part of the Index?

- Stock Selection’s Impact on Weightage of Different Companies and Sectors

- NIFTY 50 Performance: How Much Return Has It Generated?

- How to Invest in NIFTY 50?

- Which Is Better, Direct through Stocks or NIFTY 50 Index Funds?

- Benefits Of Investing Via NIFTY 50 Index Funds

- Bottomline

- Frequently Asked Questions (FAQs)

Investment experts use the term ‘NIFTY 50’ regularly while analyzing the stock market. However, do you know what NIFTY 50 actually means?

The NIFTY 50 index is made up of India’s most successful and well-known large-cap companies from various sectors. These companies are carefully selected based on their free-float market capitalization.

The NIFTY 50 index serves as a hypothetical portfolio that reflects the Indian stock market’s overall performance. The index’s movements are influenced by the stock prices of its 50 constituent companies, which are frequently reported in the news.

Later in this blog, we’ll go into more detail about how the top 50 large-cap companies are chosen.

What is NIFTY 50?

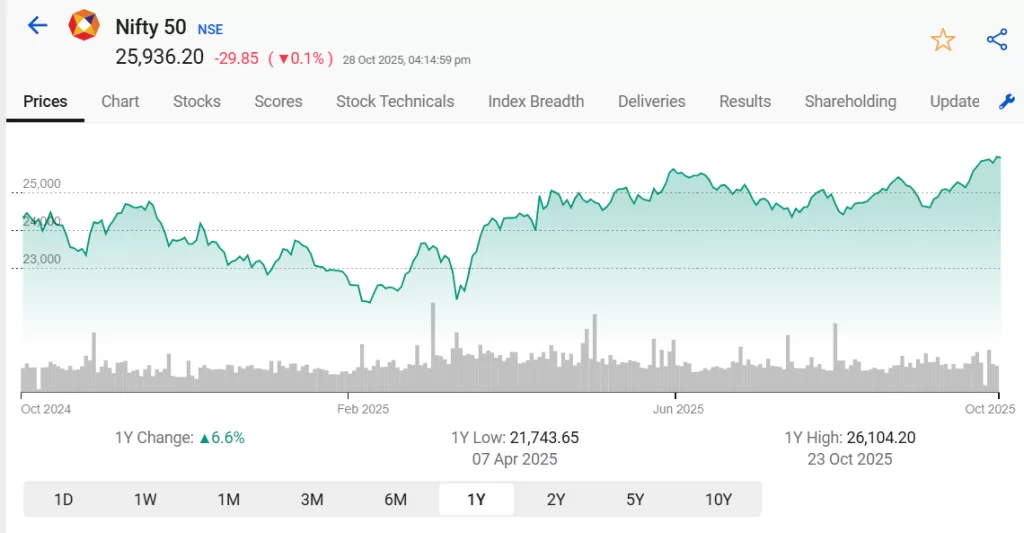

The NIFTY 50 represents the top 50 companies in India based on their market capitalization and are listed on the National Stock Exchange (NSE). It is a widely used barometer by investors to gauge the performance of the stock market along with the Sensex, which is an index of 30 stocks managed by the Bombay Stock Exchange (BSE). Below is the NIFTY 50 chart:

Although the NSE has over 1,300 stocks listed, the term “the market” typically refers to the index and its weighted average performance. For foreign investors, the NIFTY 50’s movement is their primary point of reference when tracking the Indian markets, and initial investments in India tend to be in NIFTY stocks.

Components of Nifty 50

Below is the list of Components of NIFTY 50 as on 15th October 2025:

| Company Name | Industry | Symbol | Weightage |

| Bharti Airtel Ltd. | Telecommunication | BHARTIARTL | 4.62% |

| Adani Ports and Special Economic Zone Ltd. | Services | ADANIPORTS | 0.92% |

| NTPC Ltd. | Power | NTPC | 1.38% |

| Power Grid Corporation of India Ltd. | Power | POWERGRID | 1.13% |

| Reliance Industries Ltd. | Oil Gas & Consumable Fuels | RELIANCE | 8.01% |

| Oil & Natural Gas Corporation Ltd. | Oil Gas & Consumable Fuels | ONGC | 0.83% |

| Coal India Ltd. | Oil Gas & Consumable Fuels | COALINDIA | 0.75% |

| Bharat Electronics | Defence | BEL | 1.26% |

| Adani Enterprises Ltd. | Metals & Mining | ADANIENT | 0.57% |

| Tata Steel Ltd. | Metals & Mining | TATASTEEL | 1.23% |

| JSW Steel Ltd. | Metals & Mining | JSWSTEEL | 0.94% |

| Hindalco Industries Ltd. | Metals & Mining | HINDALCO | 0.95% |

| Infosys Ltd. | Information Technology | INFY | 4.57% |

| Tata Consultancy Services Ltd. | Information Technology | TCS | 2.61% |

| HCL Technologies Ltd. | Information Technology | HCLTECH | 1.36% |

| Tech Mahindra Ltd. | Information Technology | TECHM | 0.8% |

| Wipro Ltd. | Information Technology | WIPRO | 0.61% |

| Sun Pharmaceutical Industries Ltd | Healthcare | SUNPHARMA | 1.50% |

| Cipla Ltd. | Healthcare | CIPLA | 0.75% |

| Dr. Reddy’s Laboratories Ltd. | Healthcare | DRREDDY | 0.65% |

| Eternal Ltd | IT Services | Eternal | 2.12% |

| Apollo Hospitals Enterprise Ltd. | Healthcare | APOLLOHOSP | 0.68% |

| HDFC Bank Ltd. | Financial Services | HDFCBANK | 12.86% |

| ICICI Bank Ltd. | Financial Services | ICICIBANK | 8.59% |

| Trent | Retailing | Trent | 0.9% |

| Kotak Mahindra Bank Ltd. | Financial Services | KOTAKBANK | 2.72% |

| State Bank of India | Financial Services | SBIN | 3.16% |

| Bajaj Finance Ltd. | Financial Services | BAJFINANCE | 2.43% |

| Axis Bank Ltd. | Financial Services | AXISBANK | 2.88% |

| Bajaj Finserv Ltd. | Financial Services | BAJAJFINSV | 1.02% |

| SBI Life Insurance Company Ltd. | Financial Services | SBILIFE | 0.71% |

| HDFC Life Insurance Company Ltd. | Financial Services | HDFCLIFE | 0.7% |

| ITC Ltd. | Fast Moving Consumer Goods | ITC | 3.32% |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | HINDUNILVR | 1.92% |

| Nestle India Ltd. | Fast Moving Consumer Goods | NESTLEIND | 0.75% |

| Tata Consumer Products Ltd. | Fast Moving Consumer Goods | TATACONSUM | 0.62% |

| Jio Financial Services | Financial Services | JIOFIN | 0.88 |

| Asian Paints Ltd. | Consumer Durables | ASIANPAINT | 0.92% |

| Titan Company Ltd. | Consumer Durables | TITAN | 1.26% |

| UltraTech Cement Ltd. | Construction Materials | ULTRACEMCO | 1.26% |

| Grasim Industries Ltd. | Construction Materials | GRASIM | 0.93% |

| Larsen & Toubro Ltd. | Construction | LT | 3.87% |

| Shriram Finance Ltd. | Financial Services | SHRIRAMFIN | 0.82% |

| Mahindra & Mahindra Ltd. | Automobile and Auto Components | M&M | 2.67% |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | MARUTI | 1.83% |

| Tata Motor Passenger Vehicles | Automobile and Auto Components | TMPV | 0.7 |

| Eicher Motors Ltd. | Automobile and Auto Components | EICHERMOT | 0.82% |

| Bajaj Auto Ltd. | Automobile and Auto Components | BAJAJ-AUTO | 0.86% |

| Max Healthcare | Healthcare Services | MAXHEALTH | 0.74% |

| Interglobe Aviation | Airlines | INDIGO | 1.1% |

View the list of NIFTY 50 Companies and their latest price

How are Stocks Selected to be Part of the Index?

To be added to the NIFTY 50 index, there are specific guidelines that a company must follow:

1. Universe

The first requirement is that the company must be listed on the National Stock Exchange (NSE), and its stocks must be available for trading in NSE’s Futures & Options segment. If a company does not meet these criteria, it cannot be included in NIFTY 50.

2. Construct

From the NSE universe, the best 50 large-cap companies are picked based on their free-float market capitalization. To determine the free-float market cap, a company’s stock price is multiplied by the number of shares that are easily accessible in the market. For instance, if a company has 100,000 readily available shares in the market and the price per share is Rs. 30, then the company’s market capitalization is Rs. 3,000,000.

3. Liquidity

The liquidity of a stock is a vital aspect to be taken into account while considering its addition to the index. This entails that the stocks included in the NIFTY 50 index must have a high trading volume and should be readily available for purchase and sale.

4. Re-Balancing

The list of companies in the index is not permanent. A semi-annual rebalancing takes place in June and December every year. During this process, stocks that have fallen in market cap or have undergone suspension or delisting are removed from the index. These stocks are then substituted with rising stocks that have increased in market cap. As a result of this rebalancing, the exposure of the index to emerging stocks and sectors is automatically increased.

Stock Selection’s Impact on Weightage of Different Companies and Sectors

It is a stock market index that comprises the top 50 companies in India based on their market capitalization and is listed on the National Stock Exchange. Investors commonly refer to the NIFTY 50 and the Sensex, which is a similar index of 30 stocks managed by the Bombay Stock Exchange, to gauge the performance of the Indian stock market.

A technique known as the free-float market capitalization-weighted method is used to determine the NIFTY 50 index. In relation to a base period value (November 3, 1995), it reflects the aggregate market value of all stocks in the index.

The total value of a company’s shares held by all shareholders, including the business itself, is its market capitalization, also known as market cap. The total market value of the shares that are available for public trading, i.e., those that are not held by company owners or the government, is represented by the free-float market cap.

When calculating the index using the weighted method, each stock’s component is given a weight based on the market value of all of its outstanding shares.

Despite having 1,300 stocks listed on the NSE, when people mention that “the market was up today,” they are typically referring to the index. This means that the weighted average performance of those 50 stocks was positive. The FII investment in India mainly tracks the NIFTY movement, and they often invest in NIFTY stocks as their first few investments in India.

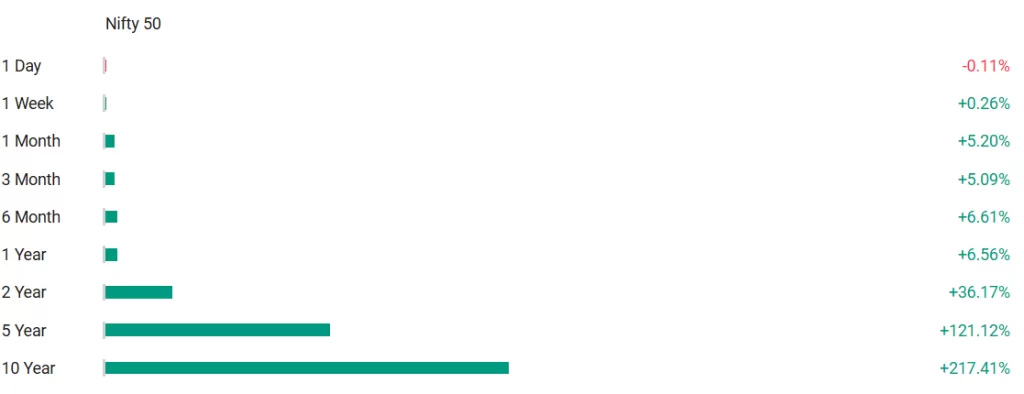

NIFTY 50 Performance: How Much Return Has It Generated?

The index has experienced various fluctuations since its establishment in 1996, owing to the unpredictable nature of the equity market. Although the index has seen surges of over 217.14% in the last 10 years, and has shown substantial growth in the long run. Over the past 5 years, the index has provided an average annual return of 121.12%

As depicted in the chart, the initial returns may not have been significant. In fact, there were instances when the investment would have gone into the negative after 2-3 years. However, if the investment was held onto, the slow growth curve suddenly picked up pace due to the effects of compounding and impressive returns.

How to Invest in NIFTY 50?

NIFTY50 is a compilation of the leading companies in India, and investing in it means that you become a part-owner of these exceptional companies.

There are two ways to invest in NIFTY 50. You can either purchase stocks directly in the same proportion as their weightage in the index, or you can opt for Index Mutual Funds that track the index.

These funds replicate the index and have a portfolio precisely like the index. A NIFTY 50 index fund will have 50 stocks in the same proportion as the NIFTY 50, and you can invest in these funds with the amount you prefer.

1. Derivatives Contracts

Investors have the option to trade NIFTY 50 stocks through derivative contracts and analyze derivatives data for a better understanding of the index movement. These contracts utilize the index as an underlying asset, which means that the price fluctuations are linked to the NIFTY Index.

Overall, F&O contracts enable market participants to buy and sell stocks or indices at a specific price and/or on a future date. Although NIFTY derivatives are considered a great trading option, they may not be suitable for novice investors. This is because they are more of a short-term strategy with contracts expiring in three months. Additionally, the F&O segment is mainly dominated by hedgers and speculators who have a higher risk appetite and are more adept at monitoring market performance due to the high level of speculation involved.

2. Exchange Traded Funds

For those of you looking to invest with a long-term perspective in mind and lower risk involved, investing in NIFTY via index mutual funds or an ETF is the best option for you. These are a type of mutual fund with a portfolio comprising stocks, bonds, indices, currencies, etc., and are created to match/track the components of a market index such as the NIFTY.

You can also visit the Mutual Funds Section in StockEdge

These funds have the same portfolio of stocks that feature in the NIFTY index, thus, allowing you to be on the receiving end of a host of benefits.

Which Is Better, Direct through Stocks or NIFTY 50 Index Funds?

Investing directly in stocks, based on their weightage in the NIFTY 50, can prove to be a complex and expensive endeavor. This is because you cannot purchase a fraction of stocks in India, which means you must buy the complete stock instead of a part of it.

As a result, you will need to invest a significant amount of money to buy all the 50 stocks in the index.

For instance, if you plan to invest Rs. 20,000 every month in NIFTY 50, buying just one stock of Nestle would cost you over Rs. 17,500, while one stock of Bajaj Finance would cost you over Rs. 6,000. This means that purchasing one stock of each of these two companies would exceed your monthly investment limit of Rs. 20,000. Now imagine the amount of money you would need to buy all the stocks in the NIFTY 50 index.

Apart from the vast amounts of money, investing directly in stocks can pose several other challenges.

You may also like our analysis on : Top 5 Blue Chip Stocks

Benefits Of Investing Via NIFTY 50 Index Funds

If you’re looking to invest but don’t have a lot of money to start with, index funds might be a good option for you. Mutual fund companies allow you to invest as little as Rs. 500 a month through SIPs, which means you can be a part-owner of all 50 stocks of NIFTY 50 in the same proportion as the index.

Additionally, investing in NIFTY 50 via index funds offers a lot of flexibility. You can increase or decrease the amount you’re investing at any time you want, making it a hassle-free process. Finally, index funds are a low-cost investment option since they simply replicate the NIFTY 50 index without the need for a team of analysts and researchers. This means there’s no active buying and selling of stocks, making the expense of managing NIFTY 50 relatively low.

Bottomline

Investing in the NIFTY 50 index allows you to invest in 50 top-performing companies across various sectors. This presents an excellent opportunity to build substantial wealth over time. Moreover, opting for index Mutual Funds can make investing in the NIFTY 50 index hassle-free, straightforward, and economical.

Frequently Asked Questions (FAQs)

1. What are the 50 stocks of NIFTY 50?

The Nifty 50 companies list consists of the top 50 largest and most established companies in India that are listed on the National Stock Exchanges. This well-diversified index reflects the overall market conditions and is computed using the free-float market capitalization method. Some of the top companies included in the Nifty 50 are Reliance Industries, HDFC Bank, Infosys, ICICI Bank, TCS, Kotak Mahindra Bank, HDFC, L&T, HUL, ITC, and more.

2. Which share is best in NIFTY 50?

To determine the most suitable Nifty 50 index share to invest in, your preference, future predictions, and risk appetite will play a significant role. The Nifty 50 index comprises 50 stocks from different sectors, including Financial Services, IT, Automobiles, Oil & Gas, Consumer goods, Metals, construction, telecom, and more. These stocks are considered market leaders in their respective industries, providing you with the flexibility to select stocks from sectors you are most optimistic about.

3. How many companies are there in NIFTY 50?

The Nifty 50 index comprises 50 companies that are chosen from various sectors in India. These companies are predominantly from the Financial Services, IT, Oil & Gas, consumer goods, and Automobile industries.

4. How can I buy NIFTY 50 stocks?

You have the option to purchase any of the stocks featured on the Nifty 50 companies list directly from the stock market by using your Demat account. These companies are actively traded on the National Stock Exchange (NSE), so you can easily buy them via stockbrokers with your Demat account. Alternatively, if you wish to invest in all of the Nifty 50 companies, you can invest in Nifty 50 Index funds. These funds are offered by various AMCs in India and their portfolio replicates the stock constituents of Nifty 50 stocks.

5. What are the eligibility criteria for the selection of NIFTY 50 stocks?

To be considered for inclusion in the NIFTY 50, potential constituent stocks must meet certain eligibility criteria. Firstly, they should have an average market impact cost of 0.50% or less over the last six months for 90% of the observations, for a basket size of Rs. 100 Million.

This metric accurately reflects the costs associated with trading an index. Additionally, companies must have a listing history of at least six months and be permitted to trade in the F&O segment. Finally, if a company has recently launched an IPO, it may still be eligible for inclusion if it meets the normal eligibility criteria for a 3-month period instead of the usual 6 months.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans and now you can also buy & sell shares using our app.

this article is well written, simple and is to grasp.