Table of Contents

One of the primary driving forces of any economy irrespective of its geographic location is the banking and financial services sector. The same holds for India. The country’s healthy economy is strongly supported by its smooth functioning banking system. Finance and banking form the backbone of industry, trade and commerce proceedings of the countries. Hence, banking stocks are an integral part of any seasoned trader’s portfolio.

In this deep dive, we will discuss one of the foremost banking stocks of India – IndusInd Bank stock. Incorporated in 1994, IndusInd Bank has emerged as one of the fastest-growing banks in India.

IndusInd Bank Ltd. – Company Overview

IndusInd Bank was the brainchild of Shri Srichand P Hinduja, the head of the Hinduja Group. Incorporated in 1994, the bank merged with Ashok Leyland Finance in June 2004, one of the largest leasing finance and hire purchase companies in India at that time.

Since then, IndusInd Bank has grown manifold, making its mark in the banking sector. As of 5th March 2024, the bank has 2728 branches and banking outlets and 2939 ATMS spread across India including 1,53,000 villages. The bank also has representative offices in Dubai, Abu Dhabi and London. The Bank’s network also includes 3,492 branches of BFIL (Bharat Financial Inclusion) and vehicle financing’s 534 outlets with a total customer base of 3.7 crores.

The bank’s domain expertise lies in retail loans, credit cards, business banking, vehicle financing, micro-finance and gems and jewellery business. It has also established fee-generating verticals which helps in diversifying its income, leading to better return ratios.

In terms of personal banking, the bank offers a wide range of products and services including deposits, loans, insurance, investment, forex services, demat services, wealth management services and online services. It also has a strong NRI banking proposition including money transfer and investment products such as mutual funds, online share trading and international deposits. It also offers property solutions and insurance loans.

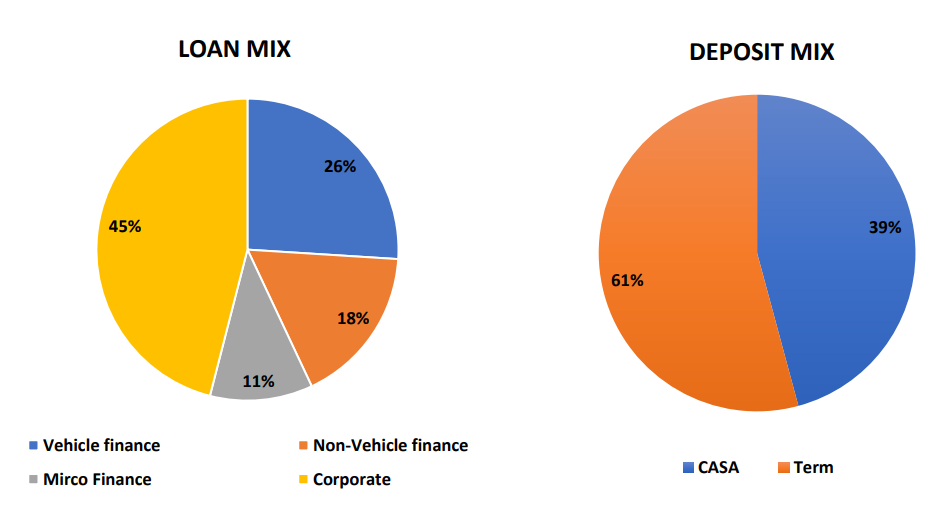

Primary sources of revenue for the bank include assets i.e. loans and liabilities i.e. deposits. The revenue mix from these two components can be seen in the image below:

On the loans side, corporate loans and vehicle finance are two main contributors accounting for 45% and 26% of revenue respectively. On the deposit side, 61% of revenue comes from CASA (current account, savings account) while 39% comes from fixed deposits.

Sector Outlook – Banking

Before deep diving into the financials of IndusInd Bank, let us take a quick look at what lies ahead for the banking sector of India. This can help you decide whether this sector is worth investing in or not.

An important factor used to assess the health of the banking system of an economy is credit-to-GDP, which is calculated as the outstanding amount of debt at the end of a financial quarter vs the sum of the last four quarters of nominal GDP.

The credit-to-GDP ratio for India is around 55%, which is lower than developed as well as BRICS countries. This data, coupled with the fact that 67% of the total Indian population is within the working age, shows immense potential for sustainable credit growth in the long run in India.

Experts suggest that credit demand for working capital requirements has increased, which is reflected in the good corporate growth pickup of IndusInd Bank in the past few quarters.

Loan demand is increasing from a few retail segments while capex requirements are coming in from both private and government. The 35% spike in CAPEX outlay announced in the union budget FY23 should push credit demand from the corporate side as well.

As per recent RBI’s fortnightly release, bank credit has shown a growth of 20% YoY for September 2023. This growth momentum has been on a rising trend ever since the impact of the second wave of the pandemic has been waning.

The vehicle finance segment is expected to pick up pace with rising auto sales and IndusInd being a major player in this segment should benefit from the same.

Competitive Landscape of IndusInd Bank

With domain expertise in the vehicle finance segment, IndusInd Bank is among the top 5 private banks in India. The bank should be one of the prime beneficiaries of the rising vehicle sales in the country, due to its expertise in this segment.

The bank has made its mark in rural India and thus should benefit from its microfinance segment. With pan India presence, healthy capital position and operational efficiency the bank is set to grab market share, especially from PSU counterparts in the medium term.

The Nifty 50 stocks represent a diverse range of India’s largest and most actively traded companies across various sectors, including banking, pharmaceuticals, information technology, manufacturing, and telecommunications.

Growth of IndusInd Bank

Credit Growth

The bank has a total loan book size of ₹3.27 lakh crores as of Q3 FY24, with a YoY growth of 20%. Vehicle loans portfolio increased by 20.1% YoY as of Q3 FY24. Affordable home loans showed a promising increase of 37% YoY for the same time, mainly owing to its lower base.

During Q3 FY24, the company saw its highest-ever disbursement in the vehicle segment worth ₹13,714 crores. Microfinance business also recorded a growth of 20% YoY during Q3 FY24. The bank reported a 4% market share in the auto loans segment.

Overall, the bank has reported a healthy CAGR of 14.9% in the past 5 years for its loans business.

The above image represents the loan growth of IndusInd Bank over the last 9 years.

Deposit Growth

The growth in the deposit segment is slightly higher than the loans segment with a CAGR of 17.3% in the last five years. As of Q3 FY24, the bank has reported a YoY deposit growth of 13.4% to ₹3.68 lakh crores. The bank also reported a 20% YoY growth in retail deposits with its share in total deposit base standing at 45%. 75% of incremental deposits during Q3 FY24 came from the retail segment.

NII Growth

IndusInd Bank’s NII (net interest income) has grown by a CAGR of 18.6% in the last five years, mostly driven by the improvement in net interest margin. Total NII reported for Q3 FY24 is ₹5,296 crores, which is a 17% YoY growth. The strong momentum in NII was driven by a healthy trajectory of loan growth and stable margins.

PAT Growth

The Net profit or PAT of IndusInd bank has grown by a CAGR of 15.4% for the last five years. The slower growth of PAT can be attributed to the drop in asset quality during the pandemic leading to higher provisions during the first and the second wave.

The bank’s concentration on improving its operating metrics has led to robust net profit growth in FY23.

Profitability of IndusInd Bank

Now, let us delve deeper and take a look at the profitability of the bank.

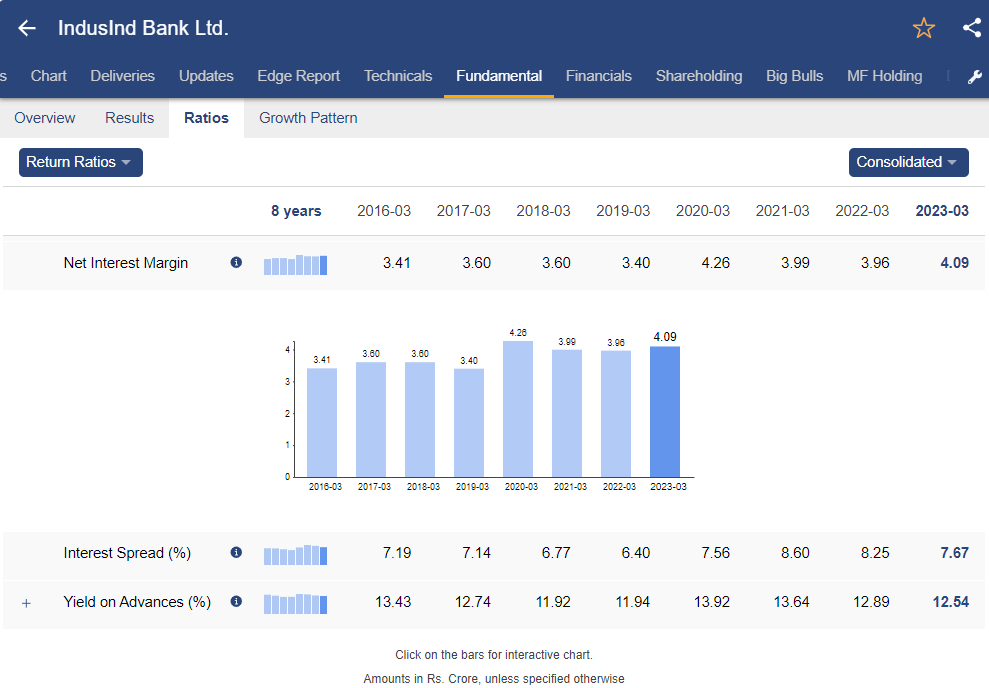

Net Interest Margin (NIM)

In Q3 FY24, NIM has remained stable at 4.29%, as yield and cost of funds moved up by similar value on a QoQ basis. Overall the net interest margin or NIM of IndusInd Bank stock has shown steady improvement in NIM, achieved by reducing the cost of borrowings. With deposit costs catching up due to re-pricing, the borrowing cost can be checked, and in turn, NIMs too.

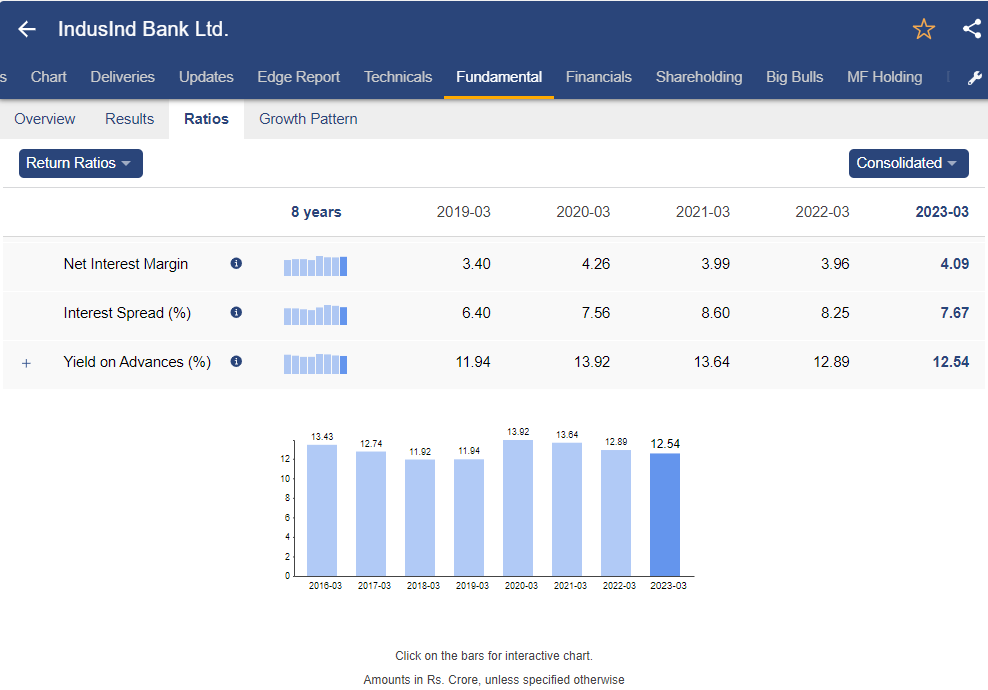

Yield on Advance

The yield of advances for a bank refers to its average lending rate. The yield on average advances for IndusInd Bank for FY23 was 11.3%, due to the impact of repricing of loans and better asset quality has started showing its results.

In Q2 FY24, yield in the corporate portfolio declined 2 bps to 8.97% sequentially while in consumer banking yields moved from 14.76% to 14.84% QoQ, up 8 bps.

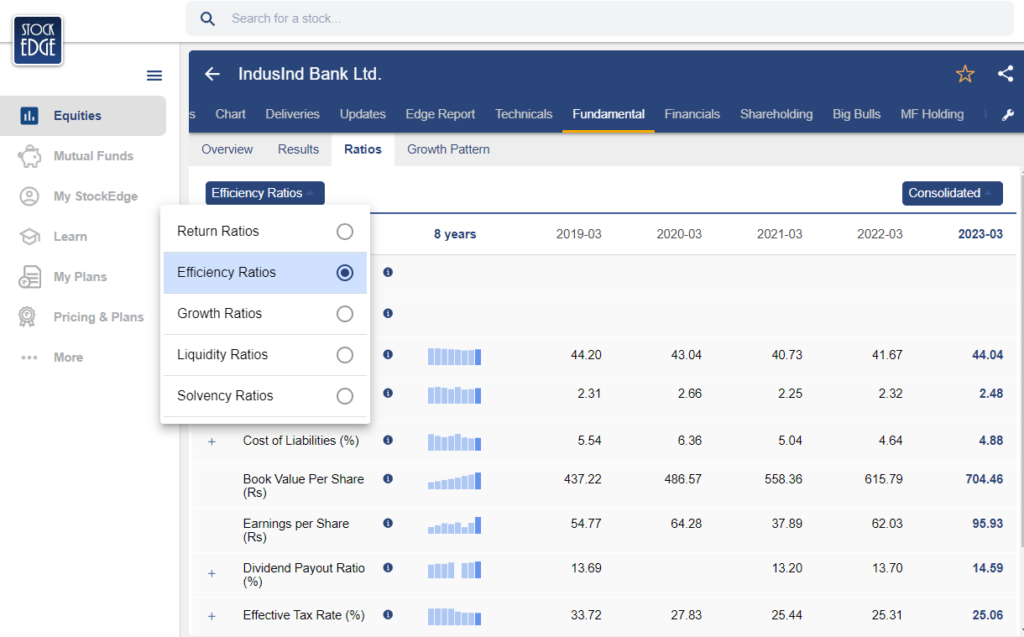

Efficiency of IndusInd Bank

Analysis of IndusInd Bank stock is incomplete without studying other financial ratios like, efficiency, liquidity and solvency. All such financial ration can be easily analyzed from StockEdge app itself.

Cost to Income Ratio

The cost-to-income ratio (C/I ratio) is an important measure of the efficiency of cost management of banks. This ratio is expressed as the percentage of operating expenses in relation to its total income. The lower the ratio, the better the cost control and operational efficiency of the bank.

The cost-to-income ratio of IndusInd Bank is just over the 40% mark, which is better than most peers. However, historical trend shows that it has been trending down.

While the C/I ratio was reported as 48% in Q3 FY24, the management has confirmed that the C/I ratio would stabilise around 45% by the end of FY24.

Credit Cost

There has been some rise in the credit cost owing to stress on the loan book, but as the impact of the pandemic receded there was a meaningful reduction in provisions in FY23.

Provisions during Q2 FY24 declined 14.7% YoY and 1.8% QoQ owing to better asset quality. Going ahead as the overall business outlook improves and thus asset quality, the provision requirement is expected to stay benign, which should help profitability.

Gross NPA & Net NPA (Net Performing Assets)

Non-performing assets for a bank are the total value of loans that are not being repaid on time. Gross and net performing assets are important indicators of a bank’s asset quality and financial health. The lower the quality, the better the financial health of the bank.

The gross NPA of IndusInd Bank in Q3 FY24 was reported as 1.92%, 1bps lower than the previous quarter. Net NPA was reported as 0.57% QoQ, the same as the previous quarter. Restructured book declined 12 bps QoQ to 0.54%

The trend in the past few years shows a sharp deterioration in asset quality owing to slippage in some infra accounts. Microfinance book was also impacted by the pandemic. The Bank held outstanding contingent provisions of ₹1,520 crore and standard asset provisions worth 1,397 crore as of September 2023.

Liquidity & Solvency of IndusInd Bank

Credits-Deposits Ratio

Another important ratio, the credits-deposits ratio (C/D ratio) is the proportion of a bank’s loans vis-à-vis its total deposits. This indicates the extent of utilisation of the bank’s deposits for its lending activities. A higher credit deposit ratio suggests a more aggressive lending approach by the bank and vice versa.

Historically the C/D ratio of IndusInd Bank has remained over the 95% mark, but due to slow business growth during Covid, it dipped to 82%. As of September 2023, the C/D ratio for IndusInd Bank was 87.7%. With the increasing pace of loan growth, this ratio should see improvement.

CASA Ratio

IndusInd Bank has a strong CASA profit with CASA ratio being 38% in Q3 FY24. The consistent rise in the CASA ratio has helped the bank to control its cost of borrowings and thus aid NIM improvement and sustainability.

Capital Adequacy Ratio

Historically, IndusInd Bank has maintained a strong capital adequacy ratio, which is well over the regulatory requirement. A healthy CRAR of 18.2% will ensure as and when credit demand picks up in the economy the bank is sufficiently capitalised to make most of the opportunity without raising much capital leading to dilution.

Valuation of IndusInd Bank

Price Earning Ratio (PE Ratio)

The price-earnings ratio or PE ratio of any company is the ratio of the company’s stock to its earnings per share (EPS). It is one of the most popular metrics for measuring the valuation of a stock and shows how expensive or cheap is the current market price of the stock.

The PE ratio of IndusInd Bank as of 10th March 2024 is 13.85, while the average PE of the banking sector is 24.37. This means that IndusInd Bank is trading at a cheaper price than most of its counterparts.

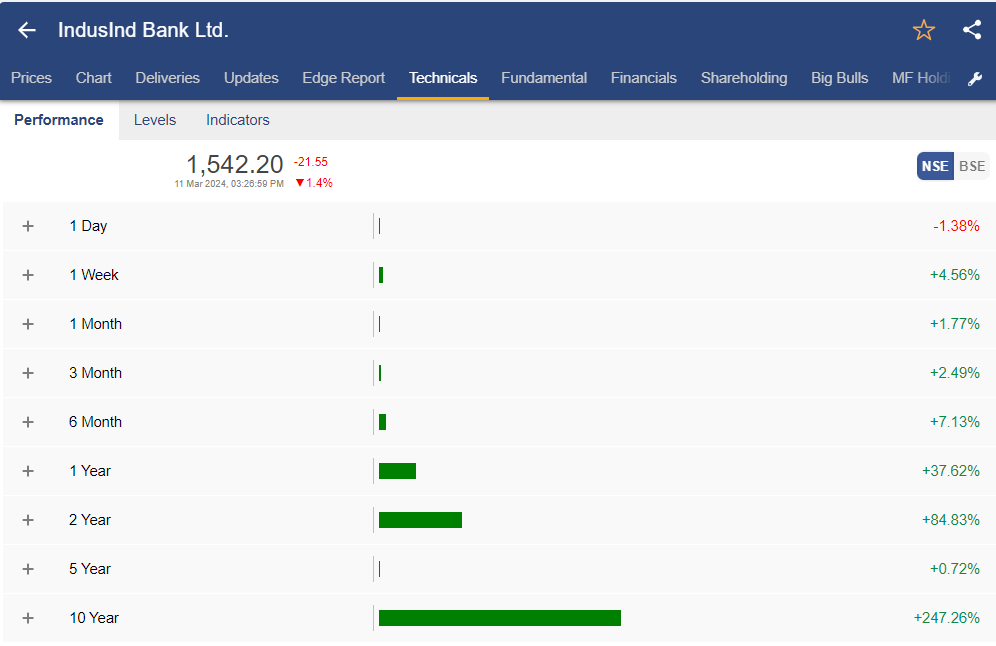

Performance of IndusInd Bank Stock

Now that you have a clear understanding of the financials of the company, it is time to take a look at the performance of the IndusInd bank stock in the markets.

IndusInd Bank stock had been on a downtrend for the last couple of years, even before the pandemic, mainly due to asset quality issues. This was further exacerbated by the onset of COVID-19 when the stock reached a low of ₹236 in March 2020, falling from ₹1550 levels at the beginning of 2020. Post this, IndusInd Bank stock has recovered giving a return of 84% and 37% over the past 2 years and 1 year respectively.

Although price has seen some recovery, however it continues to trade below its historic highs.

Going forward, the zone of ₹1250-₹1350 would act as a strong base and can be used by long-term investors for accumulation.

Case Study of IndusInd Bank

Want to know what our experts think? Head onto the Investment Ideas section on StockEdge to learn more about the bank.

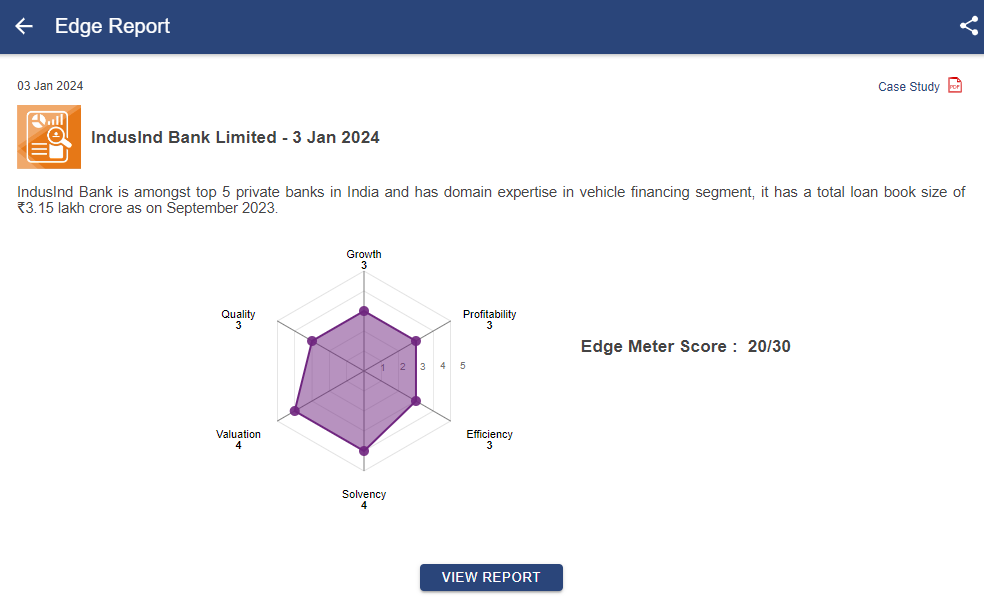

Our expert team of analysts have evaluated various aspects related to the bank and rated it on six important parameters – growth, quality, profitability, efficiency, solvency and valuation, as can be seen from the image below.

If you are find other opportunities in the private banks, then read; Unlocking Potential: HDFC Bank Stock Analysis

Management Quality and Shareholding Pattern

The management of a company has far-reaching effects on its future, as all the key decisions are taken by them.

Currently, Mr. Sumant Kathpalia is the Managing Director and CEO of the bank, who has taken the chair from banking veteran Mr. Romesh Sobti in March 2020. Before joining IndusInd Bank, Mr. Kathpalia worked with ABN AMRO Bank, where he held several critical leadership positions including Head-Consumer Bank for ABN AMRO, India.

With 39 years of experience in the banking industry, Mr Arun Tiwari is the Chairman of the bank. He has previously served as CMD of Union Bank of India.

You can view the shareholding pattern of IndusInd Bank stock from StockEdge.

As of FY23, 16.45% of the company is owned by promoters, 83.55% is owned by the public and 26.57% is owned by DIIs. Out of the publicly owned portion, 42.47% is owned by the FII and FPI. The top public holders include SBI Nifty ETF (3.29%), Bridge India Fund (2.68%), Life Insurance Corporation of India (2.42%) and HDFC Trustee Top 100 fund (2.25%).

Future Outlook of IndusInd Bank

So, what lies ahead?

Well, credit growth should pick up as economic activity rises and the corporate segment should see rising demand for credit. The management has a loan growth of 18-23% in the next three years.

The total customer base is targeted to reach 5 crore in the next two years. Owing to the rising demand in the automobile sector, disbursement in this segment is expected to rise.

The bank aims to focus on the home loan segment and reach a sizable book in the coming few years. Affordable housing book is targeted at ₹5,000 crore in the medium term.

The cost-to-income ratio is expected to stabilize around the 45% mark in FY24. Credit cost is expected to remain in the range of 1.1% to 1.3% in FY24. Thus, return ratios are expected to improve with operational levers in favor of the bank.

A Final Word

Being one of the most prominent private banks in the country, IndusInd Bank is expected to make its mark in the Indian economy.

The bank expects NIM to be in the range of 4.2%-4.3% going ahead. Deposit re-pricing is at fag end of its upward trajectory and would soften post that. The bank does not expect the need to raise capital immediately. Deposit growth is anticipated to be around 15%-16% going ahead.

The bank expects the credit cost to be around 110 bps for FY25. Credit growth is expected to be in the range of 18%-22% in FY24 and FY25. The bank plans to add 1,000 branches in the next two years. The cost-to-income ratio should reach around 41-43% range in the coming two years and the bank aims to maintain unsecured retail loans at 5%-5.5% going ahead.