Table of Contents

Insurance has become a necessity for us, especially after Covid 19, we Indians who used to neglect buying life insurances have started to understand the importance of it. Life insurance is not a push-sell product anymore in our country it has now become a pull-sales product. So, should you bet SBI Life share, which is one of the top private insurer in India.

SBI Life Insurance, a joint venture between SBI and BNP Paribas, was established in 2001. It provides a range of individual and group insurance plans, including traditional and unit-linked policies. Its offerings cover life, health, annuity, pension, and variable insurance. As a significant player in the insurance sector, SBI Life Insurance is also a prominent stock listed on the Nifty 50 index, reflecting its strong position in the Indian financial markets.

The SBI Life share was listed on the National Stock Exchange on 3rd Oct 2017 and over the past 5 years SBI Life share has surged nearly 140% as of March 2024. So, should you consider SBI life shares a good investment for your portfolio?

In this blog, let’s analyze the risks and rewards of investing in SBI Life shares for the long term.

Company Overview

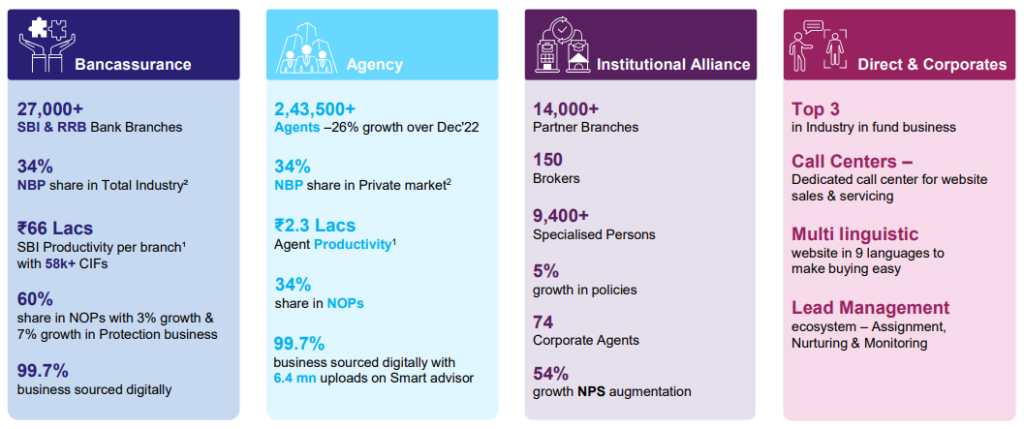

SBI Life provides a wide array of life insurance and pension products at competitive rates, focusing on delivering exceptional customer service and maintaining world-class operational efficiency. The company’s individual and group products, including savings and protection plans, are designed to cater to the diverse insurance needs of our customers. What’s more, our multi-channel distribution network, which includes an expansive Bancassurance channel with SBI and a large and productive agent network, is strategically placed for your convenience.

Here is a glimpse of SBI Life’s strong distribution channel.

Financial Highlights

SBI Life witnessed an increase in net premium income, reaching ₹22,317 crore, a growth of 16.4% YoY.

As in the above image you can view the quarterly net sales which is basically net income from premiums received for insurance companies. Using StockEgge, you can visually track the quarterly net sales growth for SBI life.

The company reported a value of new business of ₹4,040 crore for 9M FY24, with a renewal premium of ₹12,720 crore for Q3 and a new business premium of ₹26,000 crore for 9M FY24. The solvency ratio stood robust at 209%, indicating a strong financial position, and the 13th-month persistency ratio improved to 85.3%.

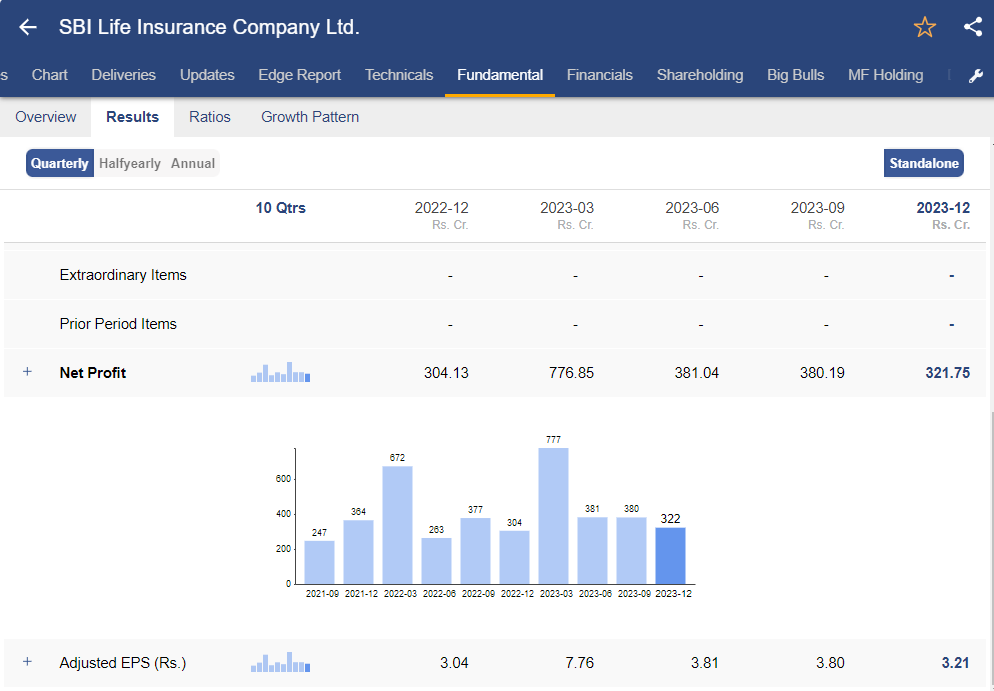

Net Profit rose to ₹321.8 crore, increasing 5.8% YoY. Using StockEdge, you can view the Quarterly PAT of SBI Life.

However, the company’s growth in premiums was fueled by a 16.6% YoY rise in renewal premiums, with single and first-year premiums also showing significant increases. SBI Life maintained its market leadership in individual new business premiums, commanding a market share of 29.1% in 9M FY24. Total protection new business premium contributed 11.4% to the total premium, growing by 17% YoY.

SWOT analysis of SBI Life Share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strength

Life Insurance holds a strong position in the Indian life insurance market. Being one of the most trusted life insurance companies in India, it has gained a reputation for its reliability and customer-centric approach. With a widespread network of offices and agents across the country, including bancassurance partnerships and other distribution channels, SBI Life has established a strong presence and efficient distribution of its products. Company remained the market leader during the quarter in terms of Individual new business premium with market share of 26.8%.

Weakness

During the quarter, the value of new business declined slightly, and the margin was also lower than last year. Net premiums and net commissions also declined sequentially. The decline in the value of new business margin from 29.6% to 28.1% on a YoY basis was attributed to higher Unit Linked Insurance Plan (ULIP) contributions.

Opportunities

India stands out as a rapidly expanding insurance market on a global scale, currently ranking 9th in terms of life premium volume and forecasted to become the 5th largest by 2032. The country’s demographic advantage is noteworthy, boasting one of the world’s highest proportions of young population with a median age of 28 years. Moreover, the increasing trend of urbanization further contributes to growth, with the urban population rising at a CAGR of 2.4% between FY 15 and FY 20. These favorable factors position SBI Life Insurance to capitalize on the evolving landscape and emerging opportunities in the insurance industry.

Threat

The Life Insurance Industry faces some macroeconomic risks like interest rate change, the slowdown in GDP, adverse changes in tax structure, etc. Regarding microeconomic factors, with the dominant position of LIC in the domestic market, private players need to continuously innovate to attract customers and manage the return expectations of policy holders.

The Bottom Line

SBI Life’s future outlook appears positive, with plans to focus on savings products in the non-par segment and the deferred annuity segment. The company expects VNB margins to be maintained around 28%, and it anticipates minimal impact from changes in discussed surrender value norms. The growth guidance for Annualized Premium Equivalent (APE) in FY25 is around 18%.

Despite challenges, SBI Life maintains a balanced product mix, with a significant agent count increase of 26% YoY and assets under management (AUM) growing by 24% to approximately ₹3.7 lakh crore. The company’s strategic focus on different segments and its robust financial health position SBI Life well for sustained growth in the evolving insurance landscape. Thus, we keep a positive view of the stock.

Although, SBI Life share is a good investing opportunity for long term. You may also read our blog on Understanding the Implications of Investing in HDFC Life Insurance Shares if you are interested investing in life insurance business in India.

Happy Investing!