Table of Contents

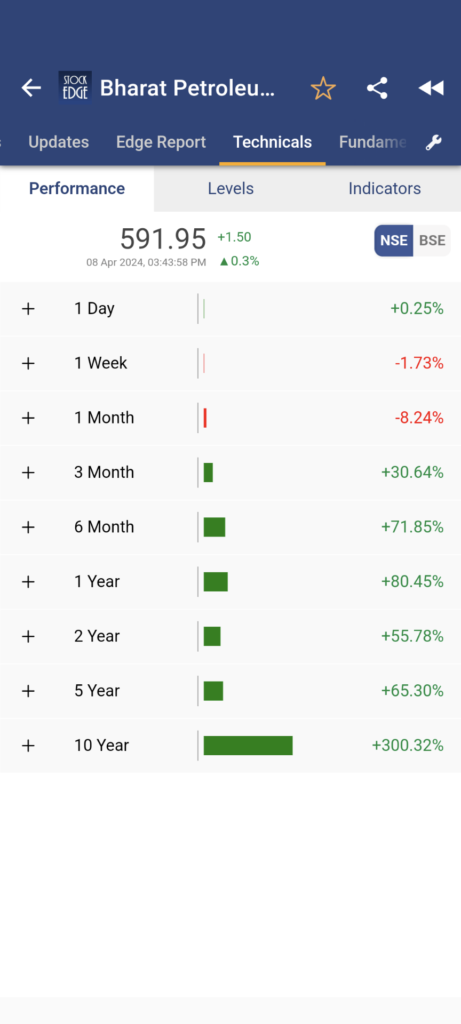

BPCL share in the past 10 years has performed phenomenally as the stock price surged by 300%. More recently, BPCL shares gained 80% in 1 year as you can see the performance of BPCL shares from the StockEdge app.

Bharat Petroleum Corporation Limited (BPCL) was established in 1952. It is a Government of India Enterprise listed on the National Stock Exchange (NSE) on 13th Sep 1995. BPCL is in the business of refining crude oil and marketing petroleum products. So, the company’s operations are heavily influenced by crude oil.

As you can see majority of times, BPCL shares have an inverse relation to crude oil. In the above chart, BPCL share and WTI crude oil is plotted along with it the operating margin of BPCL. When crude oil was trading at $120/barrel, BCPL shares were underperforming and so its operating profit margin was declining to negative. Slowly and gradually when crude oil price decreased the operating margins improved and so did BPCL shares.

Although, movements of crude oil usually determine the ups and downs of BPCL share in the short term. But while you are investing for the long term it is essential to analyze the financial statements of the company. In today’s blog, let’s analyze the fundamentals of BPCL in the current market scenario to find out whether it can be a good investment or not?

Company Overview

Established in 1952, BPCL has grown to become a key player in the refining, marketing, and distribution of petroleum products in India. In 2023, it ranked 233 out of the Fortune 500 list of companies globally. BPCL is India’s 2nd largest Oil Marketing Company (OMCs) and 3rd largest in terms of crude oil refining capacity. The Govt. of India conferred BPCL with “MAHARATNA” status in Sep 2017. Additionally, it is a NIFTY 50 stock.

Financial Highlights

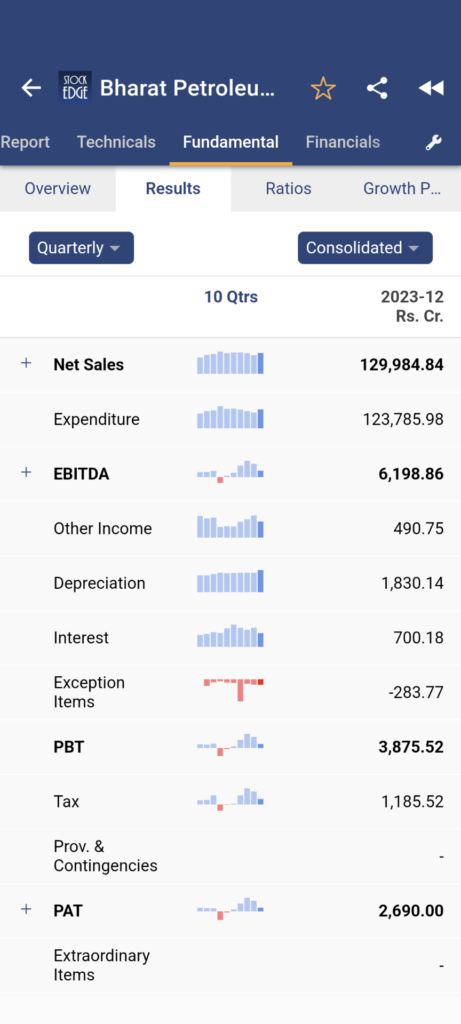

During Q3 FY24, Revenue decreased marginally by 2.5% to ₹1,29,984.8 crore, and the consolidated Net Profit surged significantly by 82.1% to ₹3,181.4 crore compared to the same quarter last year. The robust net profit was primarily attributed to operational efficiency. The quarterly statements of the BPCL can be viewed from StockEdge.

As you can see, the above image from the StockEdge app not only shows the current figures for the quarter but also the previous 10 quarters in the form of bar charts for ease of analysis.

The company incurred an exceptional expense of ₹283.8 crore due to the impairment of its subsidiary, Bharat PetroResources Limited, in Mozambique. Despite this, BPCL managed to maintain a healthy debt position with a standalone debt-to-equity ratio of 0.23x and a consolidated ratio of 0.6x.

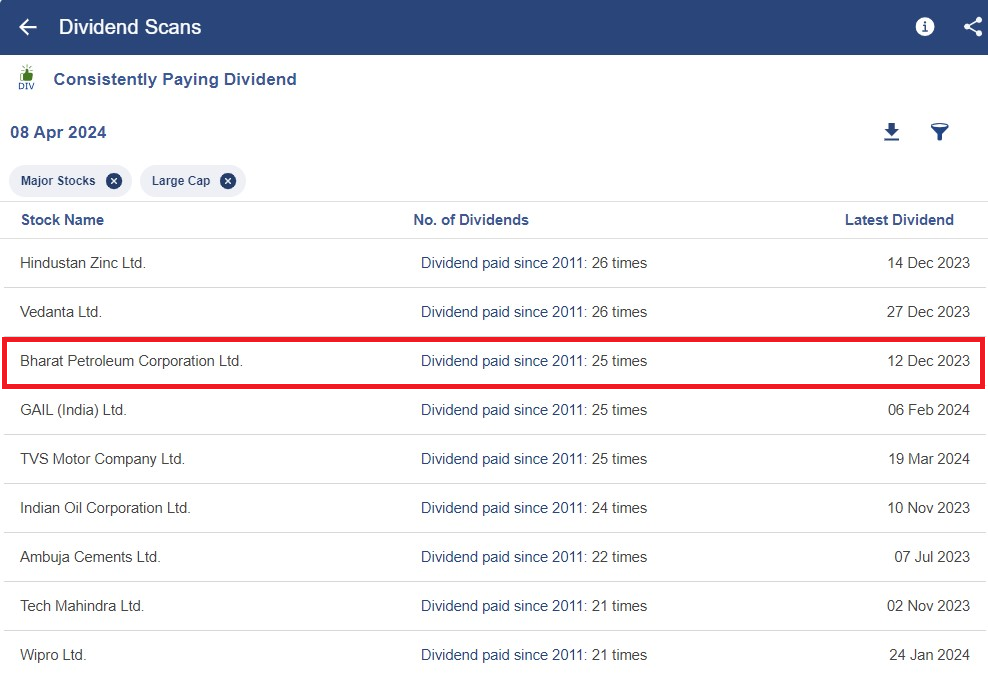

The company also recommended an interim dividend of ₹21 per share during the quarter. It is one of the companies that has been consistently paying dividends to its shareholders.

So, for those who are looking for passive income from the stock market, investing in such companies can be a wise investment decision. Using StockEdge, you can easily scan stocks that are Consistently Paying Dividend

Coming back to analysis of BPC Share, the operational performance, revenue from downstream petroleum and exploration & production of hydrocarbons stood at ₹1,29,946.6 crore and ₹38.24 crore, respectively. BPCL maintained a strong market share in petrol and diesel, with approximately 29.62% and 29.71% respectively during 9M FY24. However, the average gross refining margin (GRM) declined to $13.35 per barrel from $18.49 per barrel in the previous quarter. The company faced challenges with crude sourcing, with approximately 40% of crude procurement sourced from Russia. Additionally, the temporary shutdown of the Mumbai refinery plant in October and November 2023 affected operations.

SWOT Analysis of BPCL share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

BPCL boasts a robust network of over 16,000 retail outlets across India, ensuring widespread brand presence and accessibility of their products. This vast network allows them to cater to a wide customer base and capitalize on the growing fuel demand in the country. The company enjoys a well-established brand image in the Indian market. High brand recall and consumer trust built over decades position them favourably against competitors.

BPCL operates two of India’s largest refineries, strategically located in Mumbai and Kochi. This significant refining capacity allows them to meet domestic fuel demands efficiently and potentially expand production in the future. The company prioritizes R&D, investing in innovative technologies to enhance product quality, optimize operations, and explore cleaner fuel alternatives. This commitment to innovation positions them well to adapt to the evolving energy landscape.

Weaknesses

BPCL’s operations are primarily concentrated in India, a highly competitive market. This restricts their growth potential compared to competitors with a broader international footprint. Exploring strategic expansion into new markets could open avenues for increased profitability.

The refining process inherently generates pollution. BPCL’s environmental track record might require improvement to address growing concerns about sustainability. Investing in cleaner technologies and adopting environmentally responsible practices could mitigate these concerns and enhance brand image.

BPCL encountered several hurdles during Q3 FY24, including geopolitical tensions impacting energy and crude prices. The temporary shutdown of the Mumbai refinery plant disrupted operations, affecting overall production and refining margins. Moreover, the impairment of the subsidiary in Mozambique resulted in an exceptional expense, impacting the overall financial performance.

Opportunities

India’s energy consumption is projected to rise significantly in the coming years, driven by factors like urbanization and industrial growth. This presents a significant opportunity for BPCL to expand its market share and increase profitability. The growing focus on clean energy presents an opportunity for BPCL to diversify its product portfolio. Investing in biofuels, electric vehicle charging infrastructure, and renewable energy sources could position them as a leader in the evolving energy sector.

Government policies promoting energy infrastructure development and fuel efficiency could create favourable conditions for BPCL’s business. Aligning their operations with these initiatives could lead to growth opportunities.

The company plans to ramp up its capital expenditure, with a target of ₹15,000 crore for FY25. Planned shutdowns at the Kochi and Bina plants are expected in FY25, which may temporarily affect production. However, BPCL aims to capitalize on growth opportunities

in the motor spirit and petrol segments, projecting a steady growth trajectory over the next five years. The company also aims to enhance the utilization of its PDPP plant and achieve a consolidated debt-to-equity ratio of ~1x in the next five years. Additionally, BPCL has ambitious plans for capital expenditure, focusing on refineries, petrochemical projects, upstream business, gas and marketing infrastructure, exploration projects, and renewable energy plants. With a commitment to becoming a net-zero carbon company by 2040, BPCL is poised to navigate challenges and capitalize on growth opportunities in the evolving energy landscape.

Threats

The global oil and gas market is susceptible to price fluctuations. Unforeseen price swings can significantly impact BPCL’s profitability and require strategic risk management measures. The Indian fuel sector is fiercely competitive, with both private and public players vying for market share. This competition can put pressure on BPCL’s margins and necessitate strategies to differentiate their offerings.

Increasingly stringent environmental regulations could raise operational costs for BPCL. Compliance with these regulations and proactive adoption of sustainable practices is crucial to navigate this evolving landscape.

The Bottom Line

The company’s vision is to go global, go green, go digital & go patches. Significant potential for domestic Oil & Gas companies, given low per-capita oil consumption and growing demand. The government has consistently compensated OMCs, including BPCL, for under-recoveries and ensured reasonable profitability. India is the 3rd largest consumer post-U.S & China. BPRL is well on its path to taking its revenue generation to the next level. Thus, in the long term, we are positive about the company.

However, we may witness short-term volatility owing to higher windfall tax imposed by the government. The windfall tax has been increased by 40%, i.e., ₹4,900 per tonne to ₹6,800 per tonne. Higher taxation is going to impact the profitability of the upstream companies, while higher oil prices will put pressure on the OMCs such as BPCL.