Table of Contents

Hello Friends, let’s talk about the StockEdge Premium Version.

Our free features of the StockEdge App are so user-friendly that you can’t resist knowing more. You must have seen our scans, which are powerful tools for filtering stocks in a flicker of a second. This makes your work much easier and saves you time, so it makes your trading and investing more targeted.

Thus we focus on making stock markets much easier for you through our charts, scans and ready tools. So we provide you with a full platter of StockEdge premium features to trade right and sit tight.

Let us see what we have in our StockEdge Premium version of the Stockedge App for you.

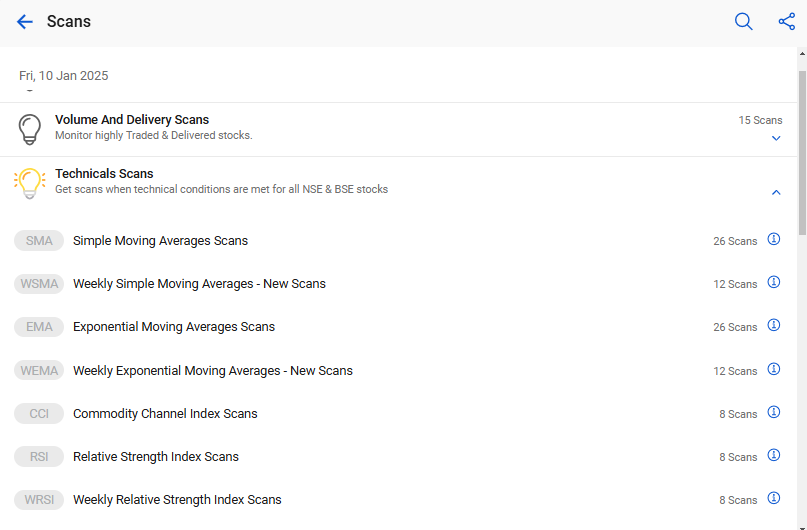

Feature 1: Advanced Technical Scans

We have inbuilt Bullish and Bearish Technical scans to help you filter out stock within seconds to trade in. We have many scans like Exponential Moving Averages (EMA), MACD, ADX, ATR, Bollinger Band, and Stochastic & Parabolic SAR as paid scans. These algo-based scans help you identify stocks for the next day with just a single click.

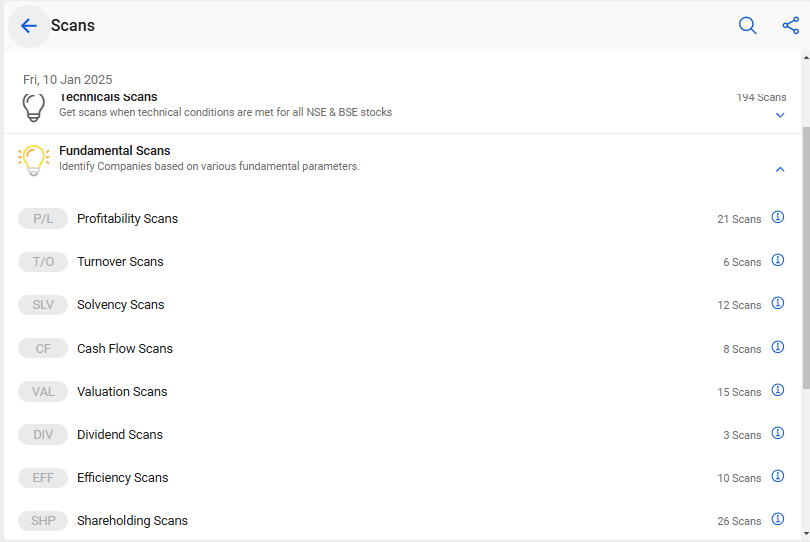

Feature 2: Fundamental Scans

We also have built-in fundamental scans, which will help you filter good or bad stocks without having to spend hours on fundamental research. We have 50+ fundamental scans based on profitability, sales, PAT, EPS, and important ratios like free cash flow, Operating cash flow, PE ratio, DE ratio etc. These scans will also help you with your trading as well as investment decisions.

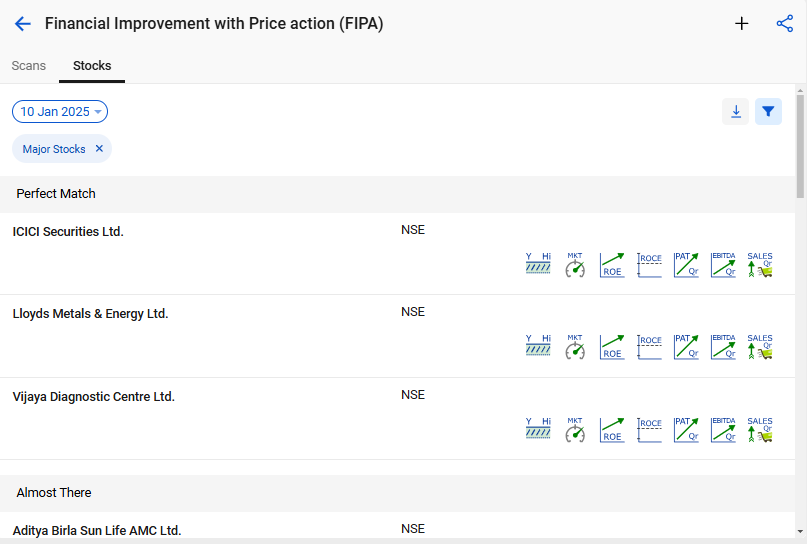

Feature 3: Combination Scans

You can even combine technical and fundamental parameters and see their effects on the charts or build your own techno-funda parameter with a combination scan to identify stocks that will fulfil the combination of parameters you selected.

Feature 4: Advance charts

This is the first time that you can plot fundamental indicators in the chart on a mobile app. The Advance charts feature will let you plot your own indicators to understand the technicals with fundamentals in the charts. You can even save the template for future use. You have to simply select the stocks from the Search bar and then click on the chart. Next, you have to select the indicators. For Example, in Asian Paints, we have added volume, bollinger bands and quarterly EBITDA indicators.

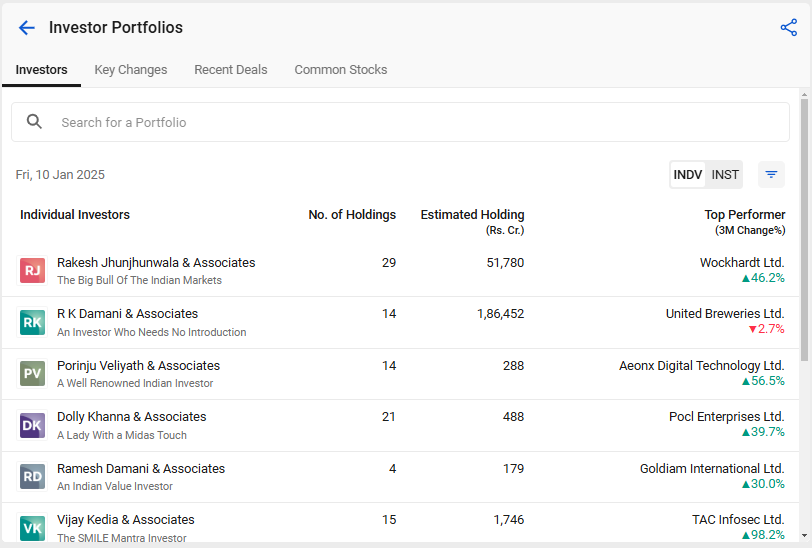

Feature 5: Investor Portfolio

Get access to the Readymade portfolio of more than 150 Ace Investors like Rakesh Jhunjhunwala, Dolly Khanna, Porinju Veliyath, Vijay Kedia, R K Damani and many more. Start following them and understand their investment style. With this feature, we have solved the problem of having a holistic view of these investors as the investments are in different names, including spouses, children, different entities, etc. For example, we have combined all 76 investors and given you the latest consolidated holding of Rakesh Jhunjhunwala. 76 names include his wife Rekha, father Radeshyam, Rare Enterprise etc..

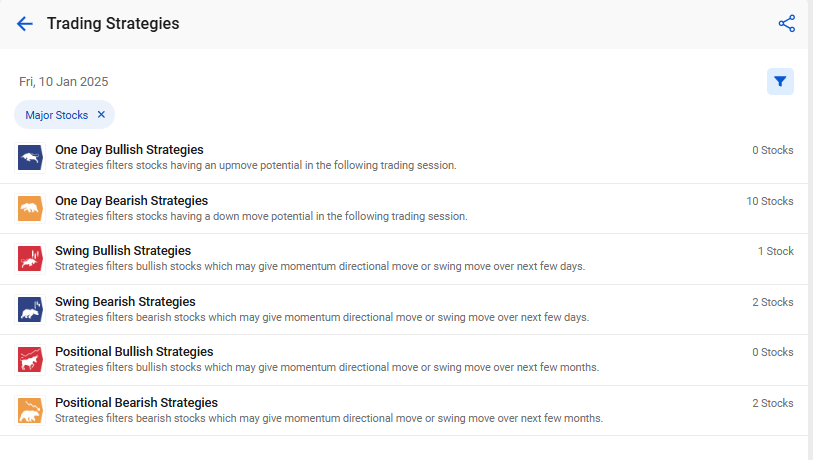

Feature 6: Trading Strategies

Now, learn, analyze, and apply trading strategies based on a choice of bullish and bearish intraday or swing trading strategies. We design them using a combination of multiple scans so you can focus on identifying quick opportunities.

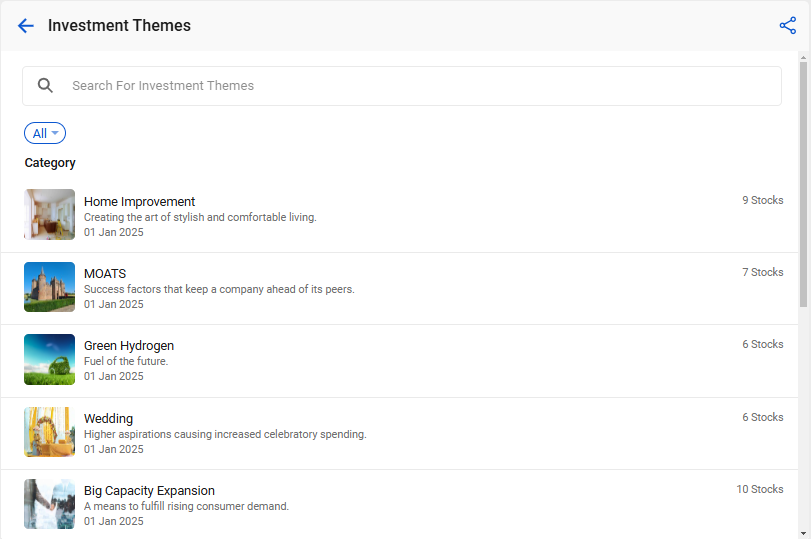

Feature 7: Investment Themes

Identify and track stocks that are likely to be impacted by current themes like Rising crude prices, Falling Rupee or Upcoming Elections. Regularly updated by us, Readymade for you!

To know more reasons for using StockEdge, read our blog Why you should use the StockEdge App!

Stockedge Club

You can become our paid member by one more criterion, that is to join the Stockedge Club. Here, you will not only have the facility to use all our paid features but also have another facility to have access to our technical and fundamental club to help you understand on a real-time basis and solve all your queries regarding any stock. Thus, we help you out with any stock that you are stuck in, based on which you can make your own prudent decision. We help you to understand and gain knowledge in the club and become a smart investor.

There are also some freebies that come with the club membership. You have access to unlimited webinars and courses, 20% off on Elearnmarkets (ELM) courses, and exclusive Pro features and Social Edge to connect with like-minded traders, which will be exclusively for annual Club members only.

Bottomline

To be an informed and intelligent investor, our app is the one that will make you stand out from the crowd and make you a more prudent and wise investor in undertaking the right decisions.

So what are you waiting for?

Subscribe to our app, become a member, and become a happy investor or a trader.

Subscribe Now: StockEdge Club

Comments 1