Table of Contents

Time to update!

StockEdge is happy to release Version 7.6. With this update, we have onboarded features that will make financial research more efficient and improve the user experience.

The new features introduced by StockEdge are:

- NSE Prices updated every minute

- 6 new Profitability Scans

- Price-Earning/Growth (PEG) Ratio & Scans

- 10 Year timeframe in Price Chart.

- Price Change data in Forthcoming Results Tab

Let’s take a look at each of these StockEdge features individually to understand how they help users.

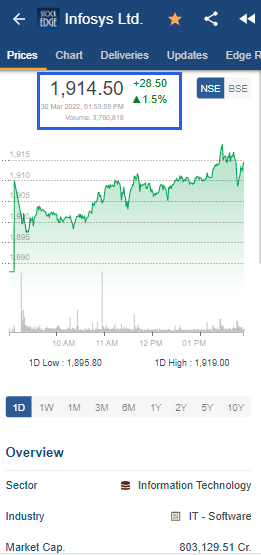

NSE Prices updated every minute

With this version update, stock prices of NSE listed stocks will be updated close to real-time i.e at an interval of 1 minute. Since, the NSE prices are updated every minute, users will now be able to keep a better track of the markets using StockEdge. This addition will benefit intraday traders as well.

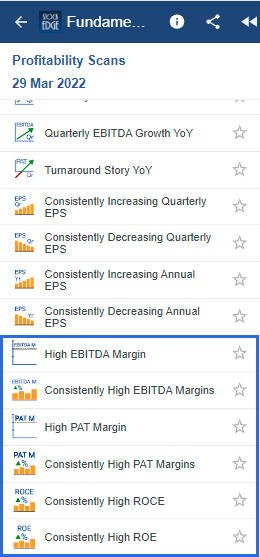

6 new Profitability Scans by StockEdge

The profitability metric evaluates a company’s ability to generate profits from sales or operations, balance sheet assets, or capital. They show how efficiently a company can generate profits and value for its shareholders. For most profitability indicators, having a high value compared to the values of competitors or relative to the same ratios of the previous period indicates that the company is performing well. Profitability metrics are most useful when compared to average metrics for similar companies, company history, or the company’s industry.

- High EBITDA Margin: Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) Margin measures the operational efficiency of the company in terms of operating profit as a percentage of revenue. Those companies that have an EBITDA Margin greater than 20% for the latest financial year are included in this scan, indicating strong operational efficiency of the company due to lower operating expenses and/or higher revenue.

- Consistently High EBITDA Margin: Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) Margin measures the operational efficiency of the company in terms of operating profit as a percentage of revenue. The companies that have an EBITDA Margin greater than 15% for each of the last 4 financial years qualify for this scan, which is an indication of stable cash flows for the company due to operational efficiency.

- High PAT Margin: Profit after Tax (PAT) Margin is a financial performance ratio that is calculated by dividing net income by net sales. Those companies that have a PAT Margin greater than 10% for the latest financial year are included in this scan, indicating higher after tax profits from the given revenue stream due to efficient management of expenses.

- Consistently High PAT Margins: Profit after Tax (PAT) Margin is a financial performance ratio that is calculated by dividing net income by net sales. The companies that have a PAT Margin greater than 10% for each of the last 4 financial years qualify for this scan, which is an indication of stable after tax profits for the company on each unit of revenue earned.

- Consistently High ROCE: Return on Capital Employed (ROCE) is a financial ratio that shows if a company is doing a good job of generating profits from its capital and is calculated by dividing EBIT by total capital employed. The companies that have a ROCE greater than 15% for each of the last 4 financial years qualify for this scan, which is an indication of greater availability of funds to be reinvested for further growth in EPS.

- Consistently High ROE: Return on Equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity. The companies that have a ROE greater than 15% for each of the last 4 financial years qualify for this scan, which is an indication of stable returns for the equity shareholders due to efficient use of the equity base by the management.

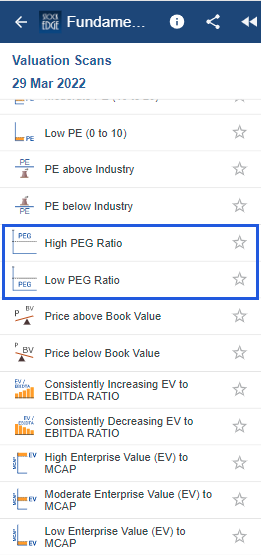

Price/Earning to Growth (PEG) Ratio & Scans by StockEdge

PEG Ratio is used to determine a stock’s value while incorporating the company’s expected earnings growth as well. PEG Ratio is calculated by dividing the PE Ratio of a stock by the earning’s growth rate over a specified time period. The growth rate has to be determined by the analysts. It can be a forward or historical growth rate and the time period chosen may differ between analysts. At StockEdge, we have estimated the growth rate using 5 year historical profit figures. The PEG Ratio of a company can be viewed on the price page of the stock.

2 new scans relating to PEG Ratio have been added. They are as follows:

- High PEG Ratio: A high PEG Ratio indicates that the company is overvalued and the growth rates do not justify the price. All stocks that have a PEG Ratio greater than 1 qualify for this scan. Avid followers of the PEG Ratio have a bearish view on stocks with PEG Ratio greater than 1.

- Low PEG Ratio: A low PEG Ratio indicates that the company is undervalued and the growth rates have not fully been incorporated into the price. All stocks that have a PEG Ratio less than 1 qualify for this scan. Avid followers of the PEG Ratio look out for stocks having a PEG Ratio less than 1 and form a bullish view on those stocks.

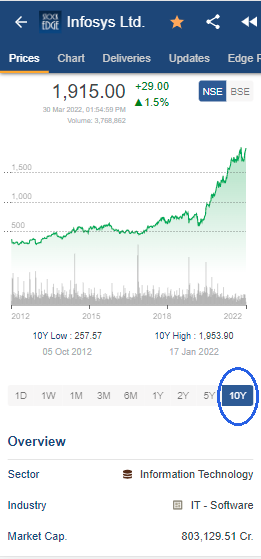

10 Year timeframe in Price Chart

Users will now be able to see the 10 Year price history of a stock on the price chart. This will provide a long term view of the performance history of a company to the user.

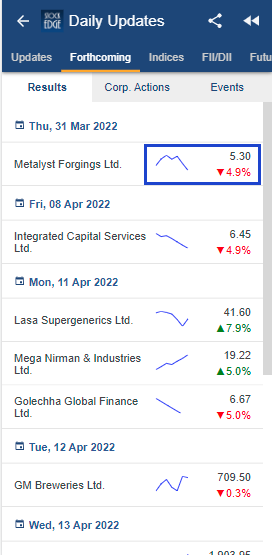

Price Change data in Forthcoming Results Tab

Users can now view the change in the 1 day price and see the 1 week spark line for stocks that will declare results soon in the future. This helps users understand the expectations of the result and the sentiment of the marker participants.

This is it for now from Team StockEdge. We hope these features enhance your investment journey and make StockEdge more valuable to you. If you enjoy using StockEdge, don’t hold back from sharing the platform with your near and dear ones.

Check out StockEdge’s Premium Plans to get the most out of it.

Also, keep watching this space for our midweek and weekend editions of ‘Trending Stocks‘ and ‘Stock Insights‘.