Table of Contents

Today we will talk about the merger of India’s largest housing finance company HDFC Ltd. with HDFC Bank, the country’s largest private sector bank.

The Deal Structure

HDFC and its two subsidiaries currently hold a 21% stake in HDFC Bank, which will be extinguished following the merger. This will allow for a 7% increase in foreign portfolio investment (FPI) ownership. The current shareholders of HDFC Ltd. will own 41% of the merged entity. The Bank will hold all of HDFC Ltd’s subsidiaries and associates following the merger.

Shareholders will receive 42 HDFC Bank shares for every 25 HDFC Ltd. shares and as of today these are the HDFC Bank Share Price and HDFC Ltd. Share Price.

Given the regulatory changes (Liquidity Coverage Ratio requirements for NBFCs, harmonization of Asset Quality norms, and reduction in cash reserve ratio/Liquidity Coverage Ratio requirements) and low-interest-rate environment, the merger decision was made (leading to lower negative carry on raising funds). An alternate structure for the merged entity will be considered if the regulator requires it.

The merged entity would be led by Sashidhar Jagdishan, the current CEO of HDFC Bank.

The merger is expected to take place in the 2nd or 3rd quarter of FY24 if all necessary approvals are obtained.

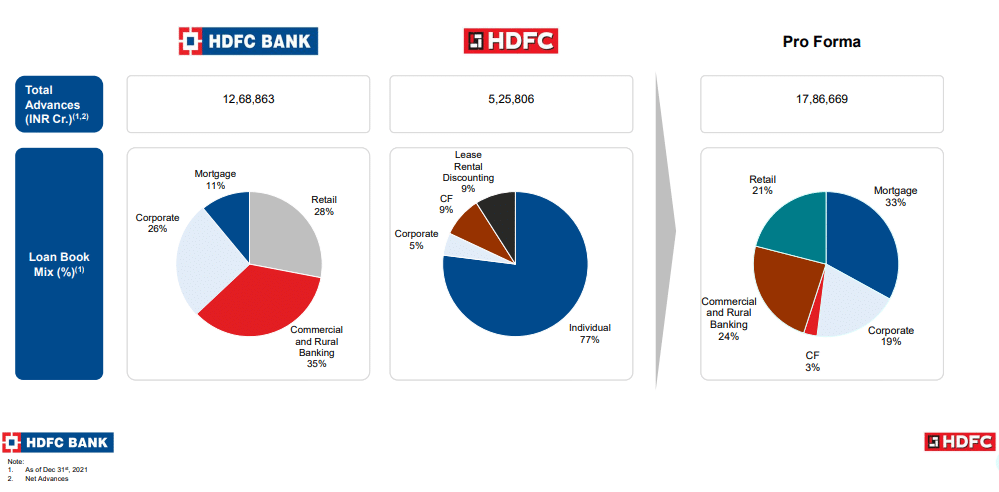

Post-merger, mortgages to constitute a large chunk of the Bank’s loan book

What is the rationale behind the merger OF HDFC and HDFC Bank?

RBI tightens NBFC regulations

The default of IL&FS four years ago was one of the most significant financial crises involving a large conglomerate, seizing the financial system and depleting liquidity. The debt involved was approximate Rs.1 lakh crore, of which only Rs 55,000 crore was resolved, leaving approximately 62% unresolved.

Following the ILFS crisis in 2018, a severe funding drought caused a liquidity crisis in the NBFC and corporate sectors, resulting in the failure of several companies, including the DHFL and Reliance Anil Ambani groups.

Since then, the RBI has been closely monitoring NBFCs. As a result, the RBI mandated that NBFCs with an asset size of ₹50,000 crores and above convert into commercial banks, provided they have completed ten years of operations. As HDFC Ltd’s asset base exceeds Rs.50,000 crore and they have completed 10 yrs of operations long back, it made more sense to merge into a banking institution.

The NBFC NPA recognition norm is at par with that of banks.

The RBI’s NPA recognition norms for banks and NBFCs are now nearly identical, with a loan that has been un-serviced for more than 90 days classified as an NPA. In these circumstances, it made more sense for HDFC Ltd. to merge into a banking institution.

Low-cost borrowing for HDFC Ltd.

Financing companies, especially house finance companies, rely on wholesale fundraising or bank borrowings, which are highly expensive. So, the NBFC will be able to access well-diversified low-cost borrowing due to the merger. This will also provide the amalgamated entity with a competitive advantage over its banking competitors.

Reduction in SLR rates

SLR is a percentage of total deposits that deposit-taking NBFCs and banks are required to keep in the banks. Over the last three decades, SLR for banks has been reduced from 38.5% to 22%. With the reduction in SLR rates, banks must keep a lower deposit amount in liquid cash.

Deepening of affordable housing bond market

India’s real estate sector is experiencing a healthy increase in demand, which is expected to continue for the rest of the year. As a result, the overall market outlook for the real estate industry is positive, from commercial spaces to the residential market.

The Government of India has launched several initiatives to incentivize real estate purchases. The announcements made in the Union Budget 2022-2023 will contribute to creating a thriving environment in the real estate sector.

The government prioritizes affordable housing while also looking for ways to strengthen existing financing systems to provide liquidity to stalled real estate projects.

Due to this, a lot of attention from private equity, banks, and foreign investors is seen in the affordable to the mid residential segment. In addition, the expansion of the affordable housing bond market gives the merged entity a significant advantage in reaching out to investors and expanding its loan book, owing to its much larger balance sheet.

Reducing HDFC Bank’s exposure to unsecured loans and opportunities for cross-selling

The merger will combine HDFC Ltd.’s expertise in housing finance with HDFC Bank’s expertise in loan scaling, distribution, and servicing. The combined entity will be able to cross-sell banking and housing finance products to both existing and new customers. As a result, both entities will be able to leverage their respective strengths, increasing profitability.

70% of HDFC customers do not bank with HDFC Bank. A similar proportion of HDFC bank customers do not have a mortgage, implying a significant cross-sell opportunity within the existing customer base, including products like insurance and investment products like mutual funds.

Accelerate priority sector lending

The Reserve Bank of India (RBI) is in charge of priority sector lending (PSL). They require all banks to allocate a percentage of their loans to specific sectors, primarily those that struggle or underperform or those that can benefit the country, thereby boosting the economy. This would enable the merged entity to increase lending to priority sectors, as required by the government, including lending to agriculture, SMEs, housing, education, renewable energy, etc.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Road Ahead

The merger is in line with the financial industry’s overall consolidation trend. The first round of consolidation in public sector banks has already occurred, partly fueled by the need to strengthen balance sheets. For example, Citibank’s Indian consumer business was recently acquired by Axis Bank. Other banks, particularly those in the private sector and non-banking financial companies (NBFCs), may now seek acquisitions to strengthen their balance sheets and gain scale. However, there are high regulatory costs that companies will need to consider moving forward carefully.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!