Table of Contents

For a majority of investors, diversification is a key ingredient to a balanced portfolio. But in the financial markets, there are always exceptions to be found.

Certain investors believe that portfolio diversification, though great from a safety perspective.

It is not ideal for those looking for higher returns.

Since most mutual fund schemes offer returns similar to benchmark indices, returns usually range between 9-12% depending on the overall market conditions.

But for investors with a capacity to undertake higher risks, their financial objective is to not only beat the benchmark index but of multiplying their wealth.

They are usually investors with a larger corpus of wealth and therefore have the ability to take greater risks.

To attract such investors, Asset management companies offer Focused Funds.

While mutual funds can have a wide variety of stock holdings which can exceed 60 stocks, Focused Funds only invest in a few stocks.

These funds are equity oriented mutual fund schemes and do not emphasis on diversification. These funds are also known as Concentrated Funds.

Features and Taxation of Focused Funds:

According to the Securities and Exchange Board of India, Focused Funds cannot invest in more than 30 stocks at any given time.

At least 65% of the total investments by the fund should include equity and related instruments.

The remainder of the portfolio may be held in the form of cash and debt securities such as bonds.

The idea behind Focused Funds is to avoid diversification. This is because having too many stocks from multiple sectors can tend to limit a portfolio’s returns.

During any economic cycle, it is highly unlikely that every sector or industry does well. Thus Focused Funds try to avoid the disadvantages of portfolio diversification.

A Focused fund is built with heavily researched, and carefully evaluated instruments, which can provide high capital growth in the future. Their strategy is to only invest in stocks which can provide high capital appreciation.

Since Focused Funds fall under the category of Equity Funds, they are taxed in the same manner as them.

So if you invest in a Focused Fund for a period less than 12 months, a short term capital gains tax of 15% will be deducted from your total profits.

In case the holding period is greater than 1 year then a long term capital gains tax of 10% will be deducted on profits above Rs.1,00,000.

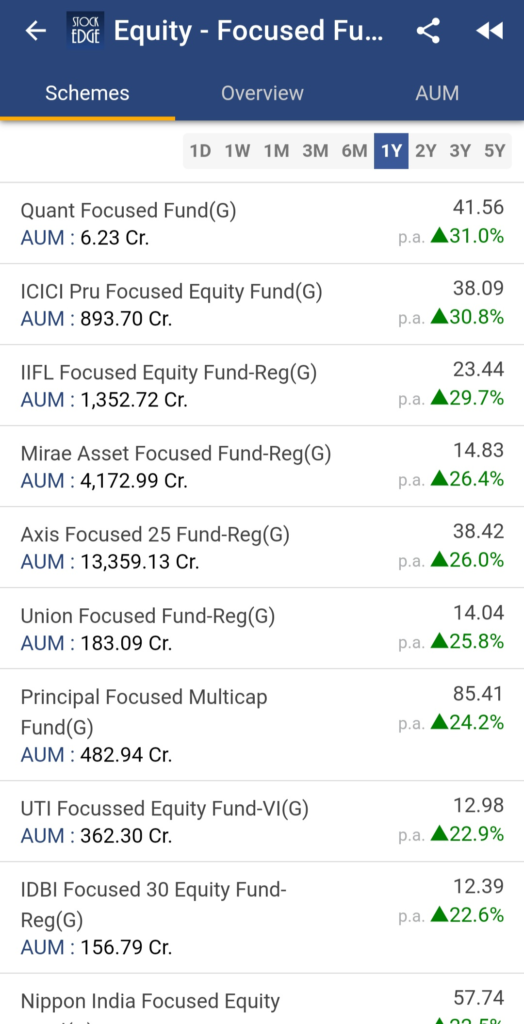

Top performing Focused Funds over the past 1 year on the StockEdge App:

Benefits of Focused Funds:

- Careful Stock Selection – The fund managers carefully research and analyse the various aspects of a company before investing. Since they only invest in a handful of stocks, one wrong selection could have a serious impact on the returns. So a huge amount of effort goes in the selection process.

- Sectoral and Market Cap Diversification – Focused funds have the liberty to invest in any and all types of companies. So companies of all sizes and from various industries can be a part of the holdings.

- Higher Returns – These funds can make substantially higher returns for investors and outperform the benchmark indices by a huge margin.

See Also: Mutual Fund Ratios to check before investing!

Disadvantages of Focused Investing:

- High Volatility – The NAV of a Focused fund can have serious up and down movements over the investment horizon. Making them only for investors who have the ability to stay invested during uncertain time periods.

- Fund Manager Dependent – Such funds are highly dependent on the quality of research and the expertise of the fund manager. The conviction of the fund manager is what makes or breaks such a fund.

- High Risk Investments – The risks associated with such investments are significant. If the stock selection of the fund goes wrong, it can have serious consequences on your capital. During market downturns, such funds usually perform worse than the benchmark indices.

Points to remember before investing:

- Focused Funds are meant for long term investments with a horizon of at least 5-7 years.

- It is important to research about the fund manager’s expertise and past performance during market downturns.

- Understand the holdings of a particular fund and compare it with funds from the same class to get an idea about the type of instruments the fund invests in and its expense ratios.

- Focused funds are meant for investors with a high risk taking capacity and also with prior experience with mutual fund investments.

You can also view the video below to know more about Focused Funds!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Comments 1