Table of Contents

When we think of making an investment in a mutual fund, it is advisable to analyze its performance on the basis of certain mutual fund ratios so that it helps you to estimate the future returns and determine whether it will be beneficial for you to invest in the respective fund or not. Here are a few key mutual fund ratios that will help you to evaluate the performance of the mutual fund.

Average

It is the mathematical average of a series of returns generated over a period of time (maybe 1 year, 2 years, 5 years, 10 years, etc.). An average return is calculated in a similar manner a simple average is calculated for any set of numbers.

The formula for Average Return:

Average Return = Sum of Returns/ Number of Returns

What is the significance of Average Return?

The average return is a very important mutual fund ratios it tells an investor what kind of returns for an asset or a fund has been in the past or what the returns of a portfolio of companies are. It is not the same as an annualized return. The average return does not factor in compounding.

Semi Standard Deviation

The semi-standard deviation is used to measure the below-mean fluctuations in the returns on investment. It reveals the worst-case scenario performance to be expected from a risky investment. It is an alternative measurement to standard deviation which is most often used to evaluate the downside risk of an investment considering only at the negative price fluctuations.

In the stock market, the semi-standard deviation is used to measure the dispersion of an asset’s price from an observed mean or target value.

The objective is to determine the gravity of the downside risk of an investment. The asset’s semi-deviation number can be then compared to the benchmark number, such as an index, to see if it is more or less risky than other potential investments.

Standard Deviation

It is a statistical measure which tells us the dispersion of a dataset with respect to its mean and is calculated as the square root of the variance. If the data points are away from the mean, the deviation is higher within the data set; therefore, if the spread out the data is more, the standard deviation is higher.

A volatile stock will have a high standard deviation, while the deviation of a stable blue-chip stock like Infosys is low. The standard deviation calculates all uncertainty as risk, even when it’s in the investor’s favor for example above average returns.

An index fund is likely to have a low standard deviation compared to its benchmark index, as the objective of the fund is to replicate the index. Similarly, one can expect growth funds to have a high standard deviation compared to its relative stock indices, as the fund managers make aggressive bets to generate higher returns.

Beta

Beta is a metric used in fundamental analysis to determine the sensitivity of an asset or portfolio/fund with respect to the overall market. The market has a beta of 1.0, and individual stocks are ranked accordingly on how much they deviate from the market.

A stock that fluctuates more than the market has a beta > 1.0. If the stock moves less than the market, the stock’s beta is < 1.0. Stocks with high beta value tend to be riskier but the potential for higher returns is also high whereas stocks with low beta have less risk therefore yielding low returns.

Therefore, beta is often used as a risk-reward measure which helps investors determine how much risk they are willing to take for the desired return.

How Beta is calculated?

The covariance between the return of the stock/portfolio/fund and the return of the market must be known, as well as the variance of the market returns.

Beta = Covariance/ Variance

Where, Covariance = measure of a stock’s return relative to that of the market

Variance = Measure of how the market moves relative to its mean

Covariance measures how two stocks move together. A positive covariance means the stocks tend to move together when their prices go up or down. A negative covariance means the stocks move opposite of each other.

Variance, on the other hand, refers to how far a stock moves relative to its mean. For example, the variance is used in measuring the volatility of an individual stock’s price over time. Covariance is used to measure the correlation in price moves of two different stocks.

The formula for calculating beta is the covariance of the return of an asset with the return of the benchmark divided by the variance of the return of the benchmark over a certain period.

Calculating the Beta with the help of an example:-

Let’s assume an investor, Rohan, wants to calculate the beta of Stock X as compared to the Index XYZ. Based on data over the past 10 years, Stock X and Index XYZ have a covariance of 0.044, and the variance of Index XYZ is 0.026.

Beta of X =0.044/0.026 = 1.69

In this case, Stock X is considered more volatile than the market as its beta of 1.69 indicates that the stock experiences 69% more volatility than the Index XYZ.

See also: 5 Steps to analyze Mutual Funds for better Investments

Correlation

Correlation is a statistical measure that tells us the degree to which two assets move in relation to each other. Correlations are used in portfolio management, computed as the correlation coefficient, which has a value that falls between -1.0 and +1.0. A perfect positive correlation means that the correlation coefficient is exactly 1 which implies that if the price of one asset moves up or down, the price of the other asset moves in the same direction. A perfect negative correlation means that two assets move in opposite directions when the correlation coefficient is -1, while a 0 correlation implies that there is no linear relationship between the assets.

For example, Large-cap mutual funds generally have a high positive correlation to the NIFTY.

Correlation helps portfolio management to measure the amount of diversification among the assets contained in a portfolio. The objective is to optimize expected returns against a certain level of risk taken. Assets that have a low correlation to each other helps in reducing the amount of overall risk for a portfolio.

Beta Correlation

It measures a fund’s volatility compared to that of a benchmark. It is used to evaluate how much a fund’s performance would swing compared to a benchmark.

Calculating the Beta with the help of an example:-

An investor, Rakesh, wants to calculate the beta of Stock A as compared to the Index ABC. Based on data over the past 10 years, the correlation between Stock A and Index ABC is 0.88. Stock A has a standard deviation of return of 25% and Index ABC has a standard deviation of return of 36%.

Beta of Stock A = 0.88× (0.25/0.36) =0.611

In this case, Stock A is considered less volatile than the market as its beta of 0.611 indicates that the stock experiences 39% less volatility than the Index ABC.

How to find the different mutual fund ratios in StockEdge?

It’s very difficult to calculate all the above mutual fund ratios and compare before investing especially in a country like India where there are more than 2500 active schemes. So StockEdge provides all the above ratios calculated for all the mutual funds’ schemes so it becomes easy for the users to compare and analyze before investing. All you need to do is download the application click on the Mutual Fund tab, and explore. Steps to be followed:

- Click on the M.F tab on the home screen of the application.

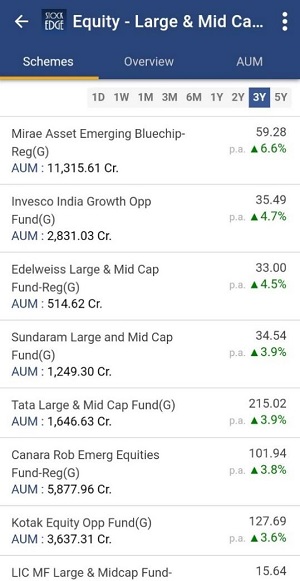

- Click on Classes and select the type (Equity, Debt, Hybrid, Others). For e.g.:- You select Equity and select “Market Cap Fund – Large & Mid Cap”.

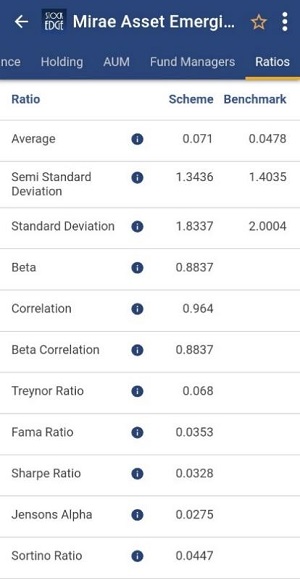

- You can select the different schemes and can compare their mutual fund ratios like in the picture depicted below:-

- Select the first fund and scroll towards the right to check the mutual fund ratios section. Now you can compare the ratios with other funds and schemes and use this information along with other parameters. Also, you can check the holdings of the fund by clicking on the section.

Conclusion

So StockEdge is the only platform where you get filtered information, which helps in making your analysis faster, better, and easier within minutes. So what are you waiting to start using Stock and Mutual Fund Analytics today and become a profitable and smart trader cum investor.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Very good article.

thank you

This is really useful, very detailed and scientific

Agar aalsi ho gaye, toh Mutual Fund Sahi Nahin Hai !

Verygoodtknowledgefromstockedge