Table of Contents

You must be very curious to know about how a small cotton trading company of the late 20th century turned out to be the fastest growing group of national and international companies of recent times.

Yes, we are talking about the Aditya Birla Group, which is one of India’s largest multinational conglomerates, established in the 1960s by Shri Aditya Birla, one of the most influential entrepreneurs at that time.

Now let us take a look and get some handful insights about the Aditya Birla Group:

The origins of the Birla family fortunes lay in the second half of the 19th century, when in 1870 Seth Shiv Narayan Birla started a cotton and jute trading business in the town of Pilani, in Rajasthan, India.

Despite the British occupation, and the attempt to establish monopolies by the British trading companies, Birla succeeded in building the family’s first fortune by overcoming all the challenges.

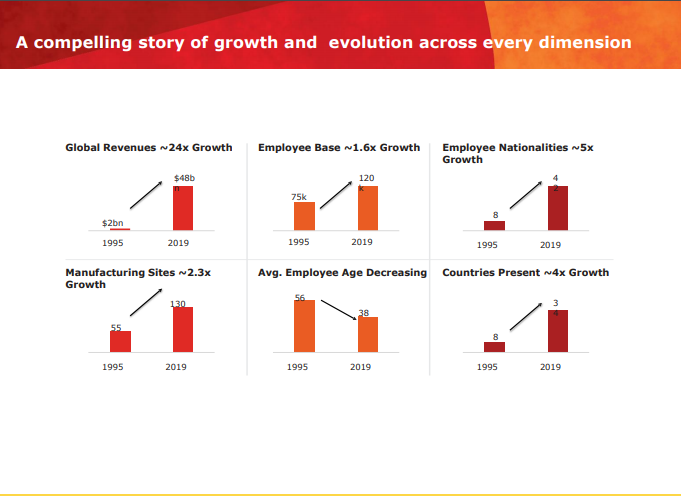

With an extraordinary force of over 1,20,000 employees and more than 50% of its operations spanning over more than 36 countries, the Aditya Birla Group claims to be one of the most international corporations of India.

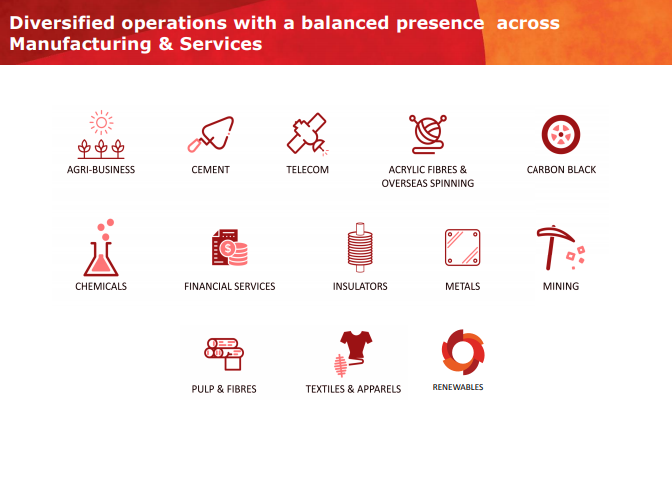

The group has diversified interests in various fields and is largely recognized in areas like cement, financial services, chemicals and fertilizers and telecom.

See also: Adani Group – Empowering India – Shaping a new future

The company also took advantage of the liberalization of India’s economy, launched during the country’s economic crisis in 1991, to enter a number of new areas.

Here is a glimpse of key operations that led to the success of the Aditya Birla Group –

- In 1870, Seth Shiv Narayan Birla started a cotton and jute-trading business in the town of Pilani, in Rajasthan, India.

- In 1919, his grandson, Shri Ghanshyamdas Birla started a jute mill, to diversify industry holdings.

- In 1947, the group started the Grasim weaving plant, later adding production of rayon.

- In 1958, the company founded Hindalco and engaged their operations in the production of aluminium.

- In 1966, the Indian Rayon Corporation was established.

- In 1969, under the guidance of Shri Aditya Birla, the company entered into international expansion, founding Indo Thai Synthetics in Thailand.

- In 1988, a new subsidiary in the form of Indo Gulf was established for the production of fertilizers under Hindalco.

- In 1995, the operations were passed on to Mr. Kumar Mangalam Birla, who is responsible for a major streamlining and restricting of the business. In the same year, a joint venture of the Birla group, AT & T was formed.

- In 1998, Indo Gulf started its copper production. Moreover, the group enters the premises of Canada with the purchase of Atholville Pulp Mill in New Brunswick.

- In 2000, Birla AT&T merged with Tata Communications and entered the telecom sector.

- In 2002, Indo Gulf’s copper business was merged with Hindalco, creating a non-ferrous metals powerhouse.

- In 2003, Liaoning Birla Carbon, Aditya Birla Group’s first carbon black company in China, was incorporated. In the same year, Aditya Birla Group Board was reconstituted with Mr. Kumar Mangalam Birla taking over as Chairman.

- In 2015, Aditya Birla Fashion and Retail Limited, ABFRL, was born after the consolidation of the Group’s branded apparel businesses of Madura F&L and Pantaloons.

- In 2018, merger of Idea Cellular and Vodafone India was completed to create India’s largest telecom service provider – Vodafone Idea Limited.

- In 2019, merger of cement business of Century Textiles and Industries Limited with Ultratech Cement. Ultratech Cement became one of the leading cement producers globally, and the only cement company globally (outside of China) to have more than 100 million tonne capacity in one country.

The current Chairman of the Aditya Birla Group is Mr Kumar Mangalam Birla. He heads the Boards of all of the Group’s major companies in India and globally.

Major Business Segments

Some of the major companies include some established names in today’s market.

1. Ultratech Cement Ltd. –

UltraTech Cement Limited is the biggest producer of concrete in India and positions among the world’s driving cement makers. The organization has a merged capacity of 102.75 million tons for each annum (MTPA) of dark concrete. As of today’s date, this is UltraTech Cement share price.

2. Grasim Industries Ltd. –

It is the flagship company of the Aditya Birla Group. It began as a textile manufacturer in India in 1947. Today, it is a main worldwide part in VSF and the biggest synthetics (Chlor-Alkali-s) major part in India. As of today’s date, this is Grasim Industries share price.

3. Hindalco Industries Ltd. –

Hindalco Industries Limited is the flagship company of Aditya Birla Group. It is the world’s biggest aluminum moving organization and is additionally a main maker of copper. The organization works over the worth chain – from bauxite mining to alumina refining, aluminum purifying, rolling, and expulsions. As of today’s date, this is Hindalco Industries share price.

4. Vodafone Idea Ltd. –

Vodafone Idea Limited is an Aditya Birla Group and Vodafone Group Joint Venture. It is one of the leading telecom service providers in India. The Company provides pan India Voice and Data services across 2G, 3G, and 4G platforms. As of today’s date, this is Vodafone Idea share price.

5. Aditya Birla Capital Ltd. –

Aditya Birla Capital Limited (ABCL) is the holding organization of all the financial services organizations of the Aditya Birla Group. It is likewise one of the biggest asset management organizations and general insurance brokers in the nation. As of today’s date, this is Aditya Birla Capital share price.

6. Aditya Birla Fashion and Retail Ltd. –

ABFRL is a combination of two renowned Indian fashion icons, Madura Fashion & Lifestyle, and Pantaloons, and therefore has the competitive advantage that will act as the nucleus of the future fashion businesses of the Aditya Birla Group. It has a strong presence with a network of 3,031 brand stores across the country. Some of the leading brands include Louis Philippe, Van Heusen, Allen Solly, and Peter England. As of today’s date, this is Aditya Birla Fashion and Retail share price.

Frequently Asked Questions

How many companies are there in Aditya Birla Group?

There are 33 companies in Aditya Birla Group. Some of the major companies include some established names in today’s market. For e.g.:- Ultratech Cement Ltd., Grasim Industries Ltd., Hindalco Industries Ltd., Vodafone Idea Ltd., Aditya Birla Capital Ltd., Aditya Birla Fashion and Retail Ltd.

Who is the CEO of Aditya Birla Group?

Mr. Kumar Mangalam Birla is the Chairman of the Aditya Birla Group. He chairs the Boards of all of the Group’s major companies in India and globally. However, each business segment of the group has a different CEO.

What are the products of Aditya Birla Group?

The group provides various services and products through different business segments. Some of the popular and well known products and services are Ultratech Cement, Birla white, clothing brands from Allen Solly, Peter England, Louis Phillipe, etc. Telecom Service from Vodafone Idea, different financial products for investing such as mutual funds, insurance policies, etc.

Why is Aditya Birla Group big in your life?

There are so many daily routine activities that are linked with the Aditya Birla Group for all of us. To start off, People have bought insurances, mutual funds from Aditya Birla Capital Ltd for financial planning.

The telecom Group Vodafone Idea cellular is one of the largest telecom companies in India which ensures that we have hassle-free to and fro communication with our family, friends, etc. For clothing, going to Pantaloons for shopping, brands like Allen Solly, Peter England, Van Heusen, and Louis Phillipe provide us an exclusive range of products in optimal price ranges. Then, UltraTech Cement is India’s largest cement company. It has been a regularly and widely used cement for various construction works across the nation. In the food Industry, Frewshwrapp Aluminum Foil has ensured that food is always kept fresh and hygienic. The group has established numerous Birla temples in India with magnificent and aesthetic architectural designs. The CSR initiatives by the group in Healthcare, Education, Infrastructure and its actions in making model villages i.e. transforming the underprivileged villages with sustainable developments is indeed a stepping stone towards a better society and country. This is how Aditya Birla Group is big in our life.

Is Aditya Birla a good company?

It is a global conglomerate, and the Aditya Birla Group is in the League of Fortune 500 which speaks for itself, the Group is built on a strong foundation of stakeholder value creation. With over seven decades of responsible business practices, the businesses have grown into global powerhouses in a wide range of sectors – metals, pulp and fiber, chemicals, textiles, carbon black, telecom and cement. Today, over 50% of Group revenues flow from overseas operations that span 36 countries in North and South America, Africa, and Asia. It is one of the best well-managed and reputed companies in India.

Watch the entire video on the Journey of Aditya Birla Group here:

Know more about Aditya Birla Group by using the Business Houses tab in the StockEdge Web

Business Houses are one of the paid tools offered by the StockEdge App

Check out StockEdge Premium Plans.

Great achievement and commitment to the nation and to the society as a whole I am a associate member of the Birla group family very proud to honour Mr Kumarmangalam as a chairman _ a leader and a great person who has the vision of devolopment and contributer to the Indian economy.