Key Takeaways

- Focus on Future Winners: Get highlights of five companies with strong growth potential that could deliver significant returns by 2025.

- In-Depth Company Analysis: Each stock is examined for its financial health, business model, and growth prospects.

- Key Financial Metrics: Get insights into revenue growth, profit margins, and return ratios to support the investment thesis.

- Strategic Industry Positioning: Understand in detail how these companies are positioned within their industries and the broader market trends they are tapping into.

- Investment Rationale: Learn why these stocks are considered potential multi-baggers, considering factors like innovation, market demand, and management effectiveness.

Investing in the stock market is like being on a thrilling roller coaster ride – it’s exciting, it’s exhilarating, and it can leave you feeling both scared and amazed at the same time. But fear not! With the right mindset and a keen eye on indicators like top gainers NSE or stocks hitting their 52 week high, you could be on your way to discovering the next multibagger stocks that could change your life forever.

Peter Lynch, the legendary investor and author of the best-selling book “One Up On Wall Street”, popularized the term “multibagger” – stocks that have more than doubled in value and has the potential to deliver returns of two, three, or even more times the initial investment. Multibagger stocks are like finding a diamond in the rough or discovering a hidden treasure that has been waiting for you all along.

But to achieve such remarkable returns, you need to be patient and willing to take calculated risks. The stock market can be a daunting place, but with the right stock market research tool attention to volume shockers on NSE and analysis, you can navigate through it like a pro. And when you find multibagger stocks that have the potential to skyrocket, it’s like hitting the jackpot – the rewards can be life-changing!

Factors Influencing Multibagger Stocks

Business growth possibilities

A company’s growth prospects are a crucial indicator of its potential of delivering multibagger returns. Businesses with excellent growth potential and a clear path to that growth are more likely to be multibagger stocks, offering significant long-term profit potential for investors, like Blue Chip Stocks.

Industry growth potential

Businesses operating in industries with significant growth potential are more likely to become multibagger stocks. Sectors that are quickly developing and have an extensive capacity for development often provide more effective opportunities for organizations to grow and create large profits.

Competitive advantage

A significant competitive advantage may assist a company in maintaining its market position and achieving high earnings growth in the long run therefore businesses with a sustained competitive edge are also more likely to become multibagger stocks.

Financial performance

The financial performance of an organization is a crucial aspect in assessing its potential of becoming multibagger stocks. Businesses with good economic performance, such as high revenue growth, high-profit margins, and low debt levels, are more likely to earn considerable long-term returns.

Valuation

A company’s value is crucial to examine when determining its potential to become multibagger stocks . A company undervalued by the market may have tremendous upside potential, whereas an overpriced company may have limited opportunity for significant gains.

You may also like our analysis on: Electric Vehicle(EV) stocks

Important Ratios to Consider Before Investing in Multibagger Stocks

Return on Equity (ROE)

The Return on equity (ROE) ratio assesses a company’s profit concerning the shareholder equity invested. Businesses with a high ROE are often considered more appealing for investment since they generate more profit per dollar of shareholder equity. This has the potential to result in multibagger returns.

Free Cash Flow (FCF) Ratio

The Free Cash Flow (FCF) ratio the cash generated by a company’s activities after deducting capital expenditures. Businesses with a high FCF ratio may have greater freedom to engage in growth prospects, potentially leading to multibagger returns.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio compares the current stock price of a company to its earnings per share (EPS). A low P/E ratio may imply the company is cheap, making it an excellent investment candidate. A high P/E ratio, on the other hand, may suggest that the company’s stock is overpriced, limiting the possibility of multibagger returns.

Price-to-Book (P/B) Ratio

The ratio compares a company’s stock price to its book value. A low Price-to-Book (P/B) Ratio may imply the company is cheap, making it an excellent investment candidate. A high P/B ratio, on the other hand, may signal that the company’s stock is overpriced, limiting the possibility of multibagger returns.

5 Multibagger Stocks to Look for Potential Returns

Aarti Industries Ltd.

Aarti Industries Limited (AIL) is a globally competitive benzene-based speciality chemical company, renowned for its de-risked portfolio encompassing multiple products, geographies, customers, and industries. With over 100 products supplied to more than 1,100 customers across 60 countries, including major markets like the USA, Europe, and Japan, AIL boasts a truly global footprint. The company leverages diverse feedstock materials and a wide range of reactions to serve leading chemical companies worldwide, focusing on key value chains such as Nitro Chloro Benzenes (NCBs), Di-Chloro Benzenes (DCBs), and Phenylenediamines (PDAs). Its products find applications across vital end-user industries like agrochemicals, pharmaceuticals, home & personal care, dyes & pigments, and polymers.

Financial Performance

Aarti Industries has navigated a dynamic market landscape, demonstrating resilience in the face of external pressures. In FY24, sales declined 4% year-over-year (YoY) to ₹6,372 crore, primarily due to oversupply from China, global inventory destocking, and slowdowns in key developed markets. However, the company demonstrated a significant rebound in 9M FY25, with sales growing 16% YoY to ₹5,323 crore, largely driven by an impressive 23% volume growth, despite a decline in price realization. Notably, it has been in an aggressive capital expenditure phase, investing ₹1,280 crore in FY24 and ₹1,372 crore in FY25, with plans for ₹950-₹1,000 crore in FY26, primarily for Zone-4 projects. The company’s debt-to-equity ratio in FY24 stood at a manageable 0.60x.

What Makes Aarti Industries Stand Out?

Aarti Industries is well-positioned for future growth due to several strategic advantages and prevailing industry tailwinds. As a global leader in benzene-based derivative products, it holds top-three global positions in Nitro Chlorobenzenes (NCB) and Dichlorobenzenes (DCB), making it a ‘Partner of Choice’ for major customers. The company’s aggressive capex phase is expected to deliver high double-digit growth going forward, with consistent volume growth anticipated over the next three years. Management expects annual EBITDA to reach ₹1,800-₹2,200 crore by FY28, driven by volume and margin ramp-up from capacity additions.

Furthermore, the company is strategically focusing on high-growth value chains like chloro toluene and toluene for fluorination, catering to the agrochemical, pharma, and dyes markets. It also benefits immensely from the “China plus one strategy” adopted by global chemical players, which aims to de-risk supply chains and diversify manufacturing away from China.

To explore the future growth potential and in-depth analysis of these multibagger stocks, read the latest Edge Report.

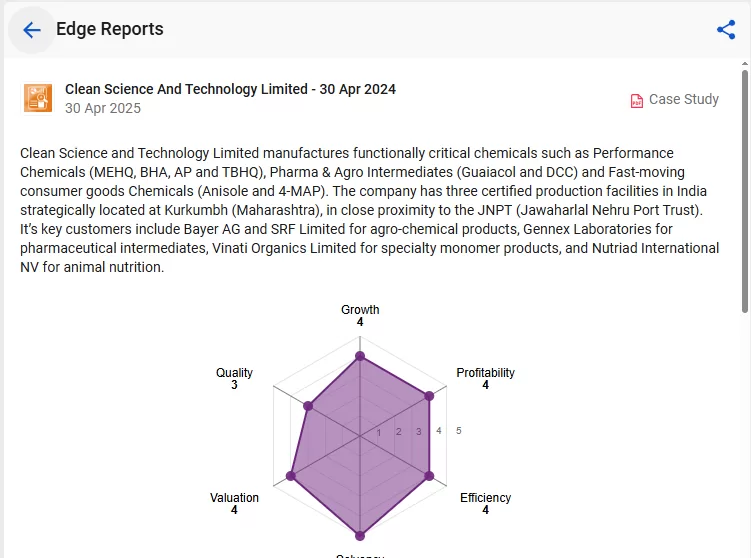

Clean Science And Technology Ltd.

Clean Science and Technology Ltd. (CSTL) is an innovation-driven specialty chemical manufacturer focused on functionally critical chemicals, including Performance Chemicals, Pharma & Agro. Their performance chemicals segment is the largest and fastest-growing, featuring key products like MEHQ, BHA, AP, and TBHQ. Notably, the company employs a unique vapor phase technology for manufacturing Anisole, a key raw material for approximately 80% of its products, making them the only company globally to use this route. The company’s key customers include Bayer AG and SRF Limited for agrochemical products, Gennex Laboratories for pharmaceutical intermediates, Vinati Organics Limited for speciality monomer products, and Nutriad International NV for animal nutrition. The company has four wholly owned subsidiaries i.e., Clean Aromatics Private Limited, Clean Science Private Limited, Clean Organics Private Limited and Clean Fino-Chem Limited.

Financial Performance

Clean Science and Technology Ltd. has shown strong financial resilience, with sales rising by 25% year-on-year (YoY) to ₹703 crore in 9M FY25, mainly driven by increased volumes. Although its EBITDA fell by 17% YoY to ₹332 crore in FY24, it recorded a 19% YoY growth to ₹283 crore in 9M FY25. Likewise, Net Profit (PAT) dropped by 17% YoY to ₹244 crore in FY24 but increased by 9% YoY to ₹190 crore in 9M FY25, despite some impact from higher costs associated with its new subsidiary, Clean Fino-Chem Limited (CFCL). For FY25, the company aims to spend ₹550 crore on capital expenditure.

What Makes Clean Science Stand Out?

Clean Science and Technology Ltd. stands out due to its dominant market position and strategic operational advantages. It is a beneficiary of the “China plus one” strategy, as global companies seek to diversify supply chains, aligning with India’s chemical industry’s remarkable transformation, projected to reach $330 billion by FY25. The company is actively focusing on new growth drivers, such as the HALS series, being the first to develop it in India and expecting it to be a significant growth driver, with plans to produce 3,000 tonnes in FY26. Furthermore, CSTL is expanding its product portfolio with new pharma intermediates, such as DHDT, and new performance chemicals, with projected annual revenue potentials of ₹60-₹80 crore and ₹300-₹350 crore, respectively. Management expects to grow revenue to approximately 2.5 times its current level in the next three years, supported by its aggressive capital expenditure plans and continued focus on high-margin products and R&D.

For more insights into the future prospects of these multibagger stocks, read the Edge Report.

Data Patterns (India) Ltd.

Data Patterns (India) Ltd. is a vertically integrated defence and aerospace electronics solutions provider, deeply engaged in India’s indigenously developed defence products industry. Its offerings include critical products for prestigious projects, such as the Light Combat Aircraft (LCA), HAL Dhruv, Light Utility Helicopter (LUH), and the BrahMos missile program, alongside precision approach radars and various communications and electronic intelligence systems. The company operates a 2,00,000 sq. ft. manufacturing facility in Chennai, equipped with advanced technologies, and serves a strong customer base both in India and international markets, including the United States, Europe, and Asia.

Financial Performance

Data Patterns (India) Ltd. has shown a robust financial trajectory, with revenue from operations increasing by 36.3% year-over-year (YoY) to ₹708 crore in FY25, a significant rebound from a 7.5% YoY decline in 9M FY25 that was attributed to lower development contracts and delivery deferments. For FY25, Net Profit grew by 22.1% YoY to ₹222 crore, although it had de-grown by 3% in 9M FY25. The company’s EBITDA for FY25 stood at 39%, with the EBITDA margin improving by 210 basis points to 40.2% in 9M FY25, driven by a favourable product mix. In FY24, EBITDA grew by 29.2% YoY to ₹222 crore.

What Makes Data Patterns Stand Out?

Data Patterns (India) Ltd. distinguishes itself through its vertically integrated model and strategic alignment with national priorities. Its unique approach of designing and building entire systems, coupled with its focus on “reusable building blocks,” helps achieve better margins and faster development times for new products. The company is a key beneficiary of India’s push towards self-reliance in defence through initiatives like “Make in India” and “Aatmanirbhar Bharat Mission,”. With the Indian defence electronics market projected to grow significantly to $6.9 billion by CY30, Data Patterns is strategically positioned to capitalize on large contracts in radar, electronic warfare, and satellite markets. It is part of major programs like the BrahMos missile program, supplying critical components, and is actively bidding for large tenders with the Ministry of Defence. Furthermore, its expanded manufacturing facility can support up to ₹1,000 crore in revenue, and management expects to achieve 20%-25% revenue growth with sustainable EBITDA margins of 35%-40% going forward, anticipating strong order inflows of ₹1,000-₹2,000 crore in FY26.

To explore the future potential and detailed analysis of these multibagger stocks, read the latest Edge Report.

Central Depository Services (India) Ltd.

CDSL, founded in 1999 and promoted by BSE Ltd., is one of only two security depositories in India. It plays a crucial role in the Indian capital market by facilitating the holding and trading of securities in electronic form. As of March 31, 2025, CDSL commanded a significant market share of approximately 79.5% with 15.29 crore investor accounts. The company offers a suite of digital services, including “easi” for monitoring demat accounts, “easiest” for online transaction instructions, “e-Voting,” and the “Myeasi Mobile App,” which extends its reach to over 97% of India’s PIN codes, including tier-2, tier-3, and tier-4 cities. Its wholly owned subsidiary, CDSL Ventures Limited (CVL), handles customer profiling and KYC record keeping for mutual fund investors.

Financial Performance

CDSL has exhibited a robust financial performance over recent years. In FY25, its net sales surged by 33.2% year-over-year (YoY) to ₹1,082 crore, driven by increased operational performance across transaction charges, KYC business, IPO/Corporate action income, and annual issuer charges. While revenue growth was somewhat subdued in H2 FY25 due to lower transaction income from SEBI circulars and market volatility, and a decline in Q4 FY25 revenue by 6.8% YoY, the overall FY25 revenue still showed strong growth. The company’s EBITDA increased by 27.6% to ₹624 crore in FY25, maintaining healthy margins despite increased technology expenses. Its Net Profit (PAT) also rose by 24.5% YoY to ₹524 crore in FY25. Notably, CDSL operates as a debt-free company, funding its operations and investments primarily through internal accruals and maintaining a strong cash and investment balance of ₹174 crore and ₹782 crore respectively, as of March 31, 2025.

What Makes Central Depository Services Stand Out?

What truly distinguishes CDSL as a potential multibagger is its unique market positioning and strategic advantages. Operating in a duopolistic industry, CDSL benefits from significant entry barriers, with NSDL being its only competitor. Its dominant market share, with over three times the investor accounts compared to NSDL, underscores its leadership. CDSL boasts an asset-light business model with low capital expenditure requirements and a cash-rich balance sheet, providing inherent financial stability and flexibility for future growth.

For in-depth insights and future outlook on these multibagger stocks, please read our comprehensive Edge Report.

Arvind Ltd.

Arvind Limited, incorporated in 1931, stands as one of India’s leading vertically integrated textile companies. Part of the diversified Arvind Lalbhai Group, it has strategically streamlined its focus by demerging its brand retail and engineering businesses in 2018 to enhance its core textile operations in both domestic and international markets. It is a prominent player in denim, woven & knits, garmenting, and advanced materials. Its Textile division has been a pioneer in Indian denim since the 1980s, supplying iconic brands globally, and boasts extensive capacity in woven fabrics and garmenting for the US and EU markets. Beyond traditional textiles, its Advanced Material Division (AMD) creates specialized functional apparel for human protection (e.g., firefighters, soldiers) and innovative industrial products, including composites for automotive and construction sectors. Arvind also engages in other ventures like e-commerce and water treatment through Arvind Envisol Limited. In FY24, textiles contributed 75% of its revenue, with AMD accounting for 18%.

Financial Performance

Arvind Limited has demonstrated a solid financial trajectory. For FY2025, the company reported revenue from Operations of ₹8,329 crore, marking a 7.6% year-over-year (YoY) growth. Its net profit increased by 5% YoY to ₹367 crore. The most recent quarter, Q4 FY25, was particularly strong, with revenue from operations rising 7% YoY to ₹2,221 crore, and a significant 48.1% YoY surge in net profit, reaching ₹155 crore. The EBITDA margin for Q4 FY25 stood at a healthy 12.4%. While the company manages debt, its consistent revenue and profit growth, coupled with strategic investments, underscore its financial resilience.

What Makes Arvind Limited Stand Out?

Arvind Limited distinguishes itself through aggressive strategic capacity expansions and diversification into high-growth areas. The company is significantly ramping up its garment capacity, projected to grow from ~40 million pieces to ~50 million by FY26 end, aiming for ~60 million in FY27, with the highest growth anticipated in the knitted category. Investments are also geared towards speciality fabrics for innovation and cost competitiveness. Its Advanced Material Division (AMD) shows robust potential, with Human Protection garment utilization at 100% due to a strong order book, and the defence segment expected to see government orders pick up from Q2 FY26. It plans to incur a substantial capex of approximately ₹450-₹475 crore for FY26 to fuel this expansion. Management is targeting an ambitious ROCE of 20% from its textile business and envisages AMD contributing 30%-32% to total revenue in the next three years. With a focus on increasing renewable energy usage and evaluating opportunities from the Gujarat Textile Policy 2024, Arvind is strategically positioned for sustained long-term growth and enhanced profitability.

For more information on the future prospects of these multibagger stocks, read the edge report.

Final thought

To conclude, multibagger stocks are enormous winners that may make you a lot of money if you choose the right ones. Yet, let’s be honest; life isn’t all rainbows and unicorns. Investing in stocks is a risky business because the odds can go against you! So you should do your research before diving in.

Examine the company’s finances, management team, competitors, and possibilities for development. Remember to diversify your assets to spread the risk.

Another thing to remember is that past success does not automatically guarantee future success.

Just because a stock has previously been a multibagger does not guarantee that it will continue to be a winner. Market circumstances might shift, and a company’s fortunes can suffer as a result.

However, keep in mind that not all multibagger stocks are made equal. Some may have a greater risk profile than others, and it is your responsibility to decide if the possible rewards outweigh the dangers. Make educated judgements based on sound study and analysis rather than being persuaded by hype or supposition.

Frequent Asked Questions (FAQ)

1. Which are multibagger stocks?

Multibagger stocks are stocks which return money many times their cost price in the long run. These are typically fundamentally sound businesses with high growth prospects, good management, and a sustainable business model. Some examples include Infosys, Titan, and Asian Paints.

2. How to buy multibagger stocks?

To buy multibagger stocks, open a demat and trading account with a reliable broker. Do thorough research or consult financial experts before investing. Once identified, purchase the stock through your broker’s platform and monitor its long-term performance regularly without reacting to short-term market fluctuations.

3. How to find multibagger stocks?

Identify companies with solid fundamentals, minimal debt, high return on equity and stable earnings growth. Identify sectors with long-term growth. Examine historical performance, quality of management, and industry trends. Multibaggers are typically found early, hence the need for patience and thorough research.

Excellent knowledge and honest approach

Good analysis sir। Very helpful for retailers।

Made good reading. Thorough research seems to have gone into its making. Some more info regarding growth potential would have helped. Overall good work .

Added for study.

good

good

excellent. Analysis

Found the analysis handy.

Amazing

Good analysis