Table of Contents

With above 9000 mutual fund schemes to choose from, selecting just 4-6 funds for your portfolio can be quite a daunting task. So to make life easier, a good way to start is by identifying the right mutual fund classes.

Out of the many different classes of Equity mutual funds that we have discussed on our previous blogs, today we are going to discuss the last one under the equity oriented category, Value Funds!

A Value Fund is designed around a unique investment strategy known as “Value Investing”. The strategy revolves around selecting stocks which are fundamentally undervalued in price .

What is Value Investing?

Value Investing as a concept was developed by Benjamin Graham and was later popularized by stock market stalwarts such as Warren Buffet and Peter Lynch. The success of such investors brought the entire concept of value investing in the forefront of all investing strategies.

How does Value Investing work?

Value investing is the art of identifying stocks which are mispriced by the markets. Stocks that are trading at a certain price below their intrinsic value are known as Value Stocks. Similarly, stocks that trade at a price above their intrinsic value are called overvalued stocks.

Not all stocks in the market are indicative of their true worth. The method for finding out such undervalued stocks is by calculating the intrinsic value of stocks.

Note: There is no fixed method to calculate the Intrinsic value of a company. The fund manager calculates it based on various factors such as the company’s business model, management, financials and the fund manager’s own perception of the company.

Why Stock Mispricing Happens?

Stock mispricing is a very good thing for anyone who believes in “value buys”. But there are 2 reasons why a stock’s price deviates from it’s true value;

- The calculation of intrinsic value depends on a number of factors. Certain numbers are also based on assumptions, hence two investors might not calculate the same intrinsic value for a stock. So for someone a stock may be overvalued and for another, undervalued.

- Stock markets can be very volatile. Prices of stocks are extremely vulnerable in the sense that they react to any news, big or small. Even the news of a famous investor buying shares of a particular company may bring extreme volatility to a stock’s price.

Also Read: What are Thematic Funds?

Value Mutual Funds

Value Funds are mutual fund schemes where the fund manager, following extensive research, selects stocks which he believes are undervalued with the hope that the masses will one day realise the stock’s true value and make the prices go higher.

According to SEBI(Securities & Exchange Board of India), A value fund is an open ended equity scheme which follows a value investing strategy with a minimum investment of 65% in equity and equity related instruments.

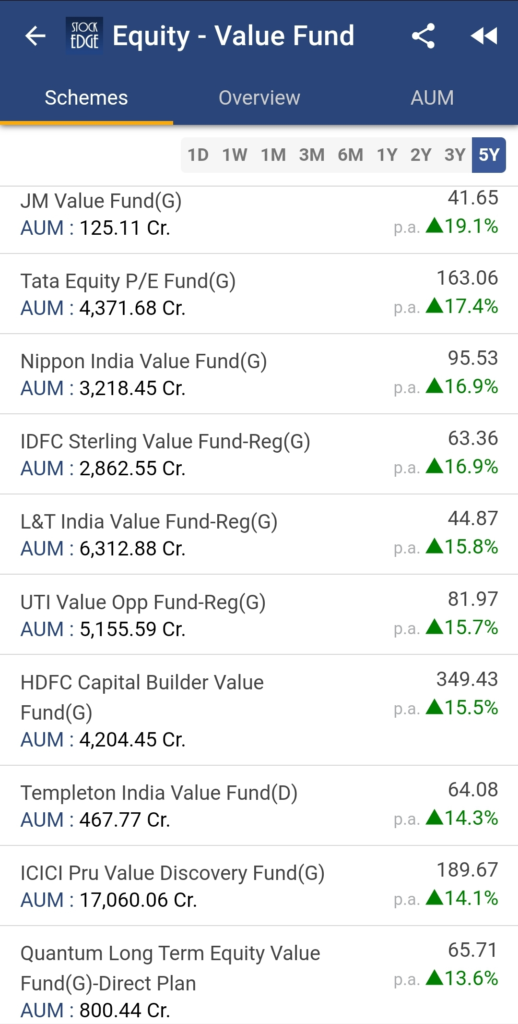

Best Value Funds as per 5 year performance in the StockEdge App:

Advantages of Value Funds

- Value investing holds the capacity to truly multiply an investor’s wealth over a long term time period. But in India, the average return over a 5 year period for Value Funds has been around 14-15%.

- Value stocks are less vulnerable to bear market conditions. This is because by theory, value stocks are already undervalued by nature. So during market downturns their potential downside risks are limited.

- Value funds allow for a diversified portfolio as they include investments from various different sectors and industries.

Things to know before investing in Value Funds

If you are interested in value investing but do not have the requisite knowledge or the time to put in the effort to identify value stocks yourself, then Value Funds are a good option for you. But before investing in them make sure you have the read the following factors:

- Value Funds are for long term investments – If a stock is undervalued, it is possibly because of being a cornered stock. It could take years for the market to realise a company’s true potential. Thus for short term gains, value funds are not exactly ideal.

- Value Funds and Small Cap funds are not the same – Many people are under the assumption that value investing means buying cheap stocks or penny stocks. But this is far from the truth. Most Value Funds have diversified portfolios with a significant presence of both large and mid cap companies in its portfolios.

- Do not invest a lot of wealth in Value Funds – The performance of value funds can be extremely volatile in the short term. Moreover their long term performance depends heavily on the quality of research and stock selection by the fund manager. So it is recommended to not invest more than 15% of your portfolio in such funds.

You can also view the video below to know more about Value Funds!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.