Table of Contents

There are many ways one can select a stock for trading or investment strategy. Some may use purely technical scans; some may mix derivative and fundamental scans along with technical analysis to choose stocks for trading. In the Stockedge app, you will find more than 440 such individual scans, and in the combination scan section, you can combine a few of them to create your customized stock selection criteria.

Our in-house research team has created many such strategies and front-tested them over many months. In the Strategies section, we have listed a few of them that came out with the best results throughout testing. We continue to work on more such strategies and look forward to enriching this section in the coming days.

How to use StockEdge Trading Strategies Features?

Here, we have given some trading strategies, i.e. predefined Combination scans segregated into specific categories, which can help Traders and Investors pick winning stocks.

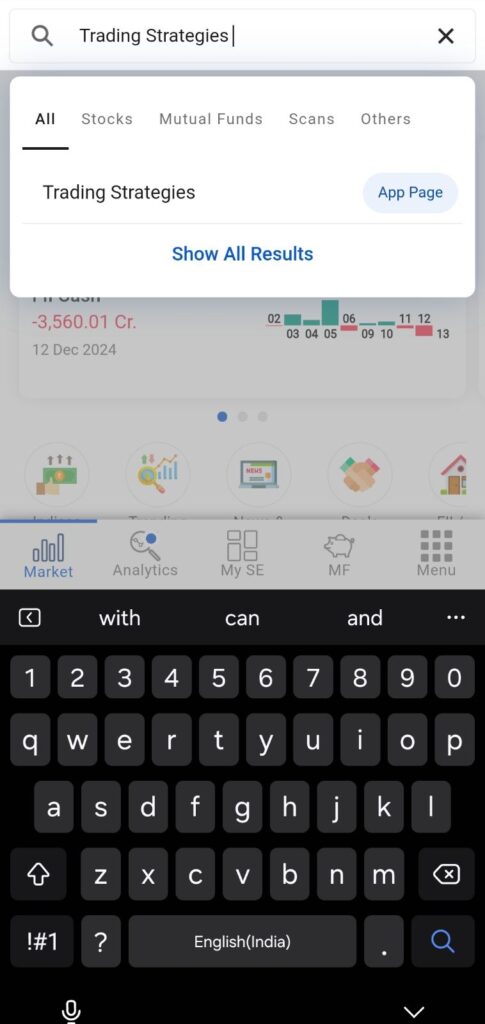

In the New Age of StockEdge, you can simply find the Trading Strategies in just one click. You have to simply search “Trading Strategies” features in the search bar.

Another way to do this is on the webpage, select the Analytics section and click on the “Trading Strategies” tab to see various technical scans.

Under this tab, there are six broad categories based on intraday, swing and positional bullish and bearish views. Depending upon your style of approaching the market and time frame, you may select the option.

Say you click on the first option- “One Day Bullish Strategies”, which is a bullish intraday strategy. You have a number of intraday scans based on the combination of different technical parameters. Let’s look into one of the scans and discuss it.

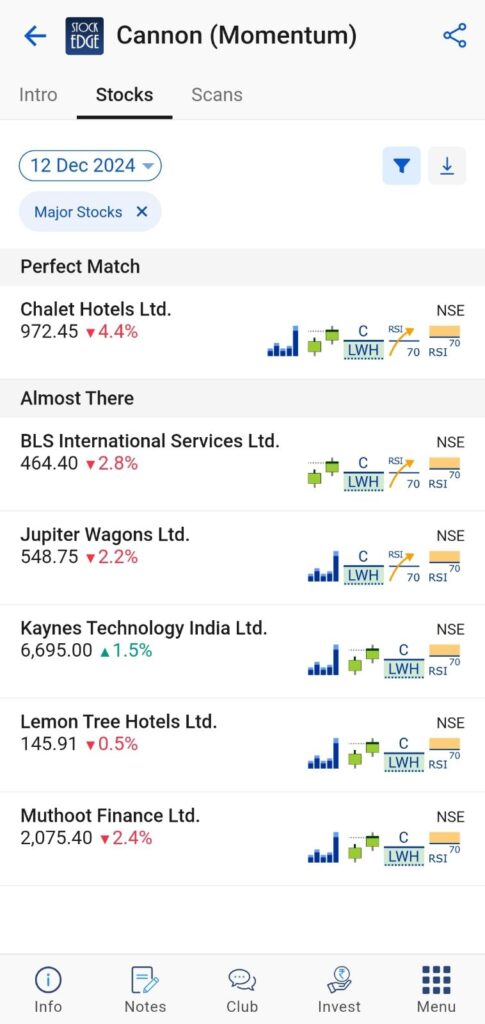

When you click on the first scan, which is “Cannon”, which shows the stocks that have good momentum, you get the following three sub-tabs, as you can see in the picture below.

Further, you can click on Stocks to get a list of shares that fulfill the Criteria set in Cannon Strategies. Stocks under Perfect Match are the stocks that fulfil 100% of the criteria. Meanwhile, stocks in the ‘almost there’ category fulfill 75% of the requirements.

Similarly, you may select other scans based on your trading style, whether intraday or swing.

To know how to use trading strategies features, read our blog StockEdge Investing & Trading Strategies made more powerful

Basic Guidelines

The first sub-tab talks about basic guidelines for the intraday scan, which include execution criteria, risk-reward, length of trade, etc.

Suppose someone wants to trade based on this intraday scan. Here are some of the guidelines he/she should know before executing the trade:

- The buy-side intraday position will be taken only above the high of the first 15-minute candle.

- The intraday target will be 1.5% from the entry, keeping 1% as a stop loss.

- The buy position will be taken only if the price breaks the high of the first 15-minute candle before 1 p.m.

- Every day at 2:30 pm, one may put the cost price as SL for trades that are in profit and may look to square off between 3-3:15 pm.

Some other important guidelines that you need to keep in mind when you should avoid doing the trade:

- In case of any important political event like the Indian state election

- If there are any major global events like the Brexit poll or the US Presidential election.

- If there is any major movement in the US market overnight (excess of 2% in Dow)

- When the movement in Crude overnight or intraday rises more than 5%

- In case India VIX moves by 5% up or down within 9:30 am from the previous day’s level

More such guidelines are mentioned in General Trading Guidelines in the “Intro” sub-tab of the respective scans.

How to use Investment Ideas Features

The Investment Ideas feature is a powerful addition to the Analytics section, designed to streamline the process of identifying stocks with strong potential. Here’s a breakdown of its features and how you can leverage it effectively:

This section provides a curated list of stocks that the StockEdge Analyst Team is optimistic about. Each stock is accompanied by detailed case studies, an Edge Score, and visual tools like Spider Charts and Key Levels, making investment decisions simpler and more informed.

Here the spider chart reflects six qualities of a stock and an edge meter score, which depicts the stock’s performance. This section considers six parameters: Growth, Profitability, Efficiency, Solvency, Valuation, and Quality of the stock.

Combination Scans for Investing/Trading

Now, you can create Combination Scans by combining up to 10 individual scans. These scans generate a tailored list of stocks that meet your specific criteria.

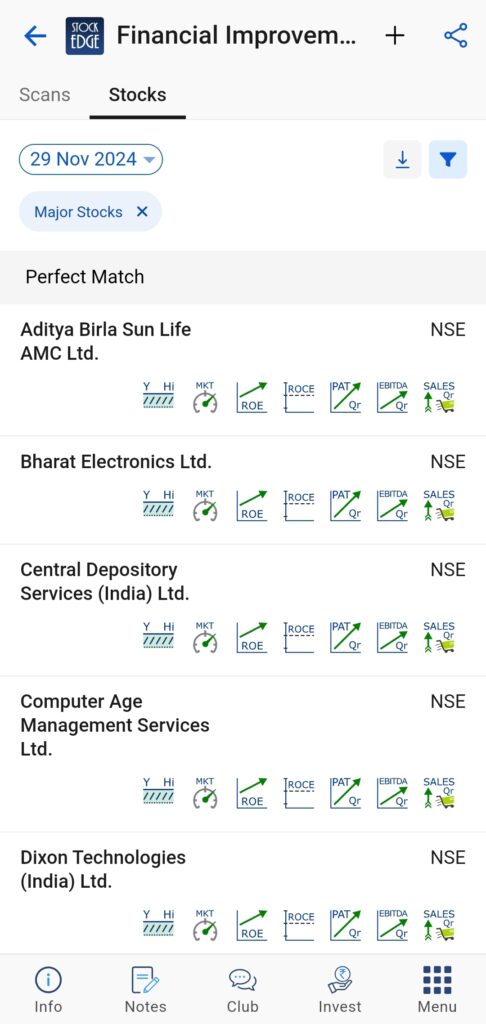

For example, here is a techno-funda scan named FIPA (Financial Improvement with Price action), created by Mr. Vivek Bajaj

Discover the art of momentum investing with our mentor, Mr. Vivek Bajaj, in the insightful session “My 7 Momentum Investing Profitable Strategies.”

This session is a must-watch for anyone aiming to refine their trading approach and uncover powerful strategies.

Bottomline- Trading/ Investment Strategy

The best part of using a combination scan is that you do not need to hunt for stocks in an arbitrary manner. Moreover, following the guidelines helps you maintain discipline. A risk-reward of about 1:1.5 will fetch you profit even if you are right with 50% of your trades.

Also, these scans are not in any way recommendations from team StockEdge for trading and investing. We have experimented with some rules and just put forward the strategies that we found good over the fact that the market dynamics and volatility may change. These combination scans may cease to provide great results. We recommend you experiment with your own strategies and try to improve them over time.

Disclaimer: The securities quoted are for illustration only and are not recommendatory. These are only suggestive technical rules that have been found to work well over time in the market. These are not any trading or investing recommendations. We suggest you take advice from certified experts for trading and investing. Neither StockEdge nor any of its associates are responsible for any trading or investing loss.

Read more blogs in the StockEdge blog sections.

Very good app

very good app ,and we have learned more about this app