Table of Contents

Tata Chemicals Ltd. reported its latest quarterly results on 29th October 2020 and while the company could not gather much profit compared to last year, there’s been a lot of optimism surrounding its future prospects. As of today’s date, this is Tata Chemicals share price.

So in this week’s Stock Insights, we thought we could look at Tata Chemicals and see what may be the road ahead for the company.

Tata Chemicals Limited is a subsidiary company of Tata Group conglomerate. It is one of the largest chemical companies in India and is the world’s third largest producer of soda ash.

The products of the company are used in diverse industries, such as glass, detergents, silicates, textiles, food, pharmaceuticals, animal feed, mining and chemical processing.

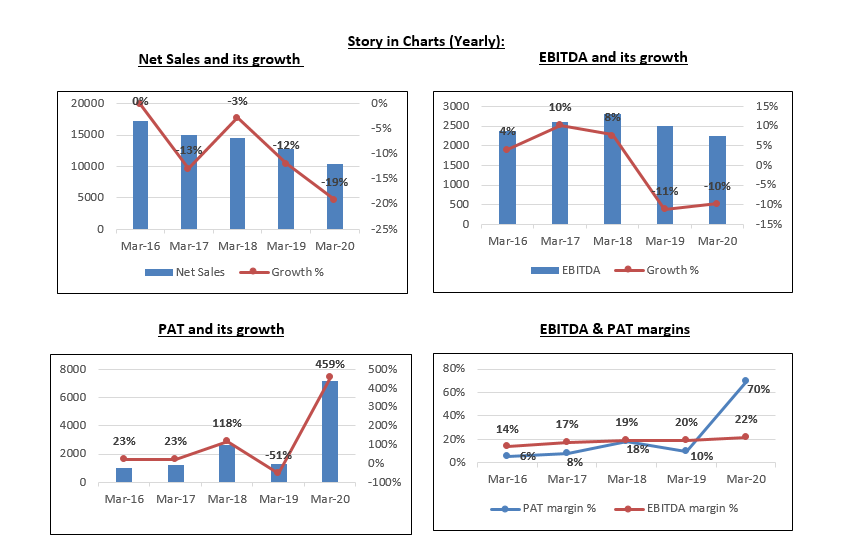

In FY20, the company completed the demerger of its consumer product business to Tata Consumer Products Ltd (erstwhile Tata Global Beverages Ltd).

The company had also acquired the remaining 25% stake through its wholly-owned subsidiary, Valley Holdings Inc. in Tata Chemicals (Soda Ash) Partners (TCSAP) for USD 195 million, therefore increasing its ownership to 100%.

Tata Chemicals Ltd. has a global presence with subsidiaries in the United Kingdom, Kenya and the United States of America.

Operational Highlights of Tata Chemicals Ltd:

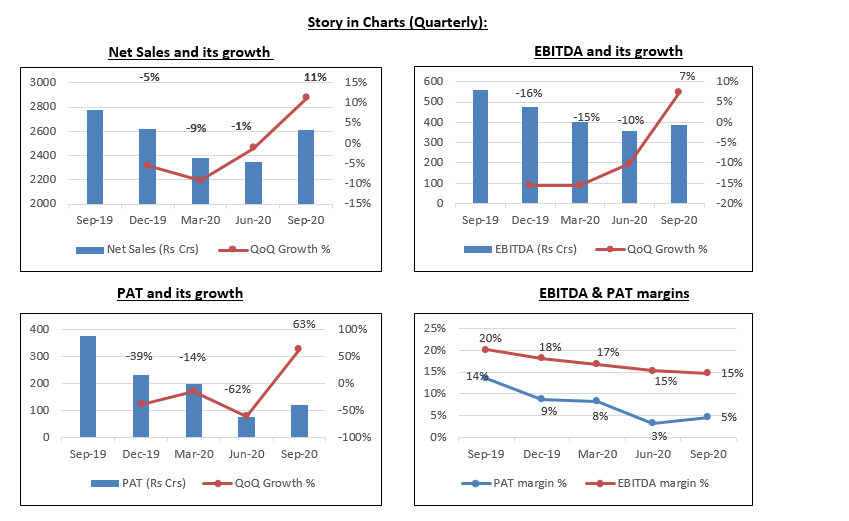

- During Q2FY21, the company reported net sales of Rs. 2,609.35 cr, a decline of 5.84% YoY. This was mainly due to muted demand and pricing pressure in certain markets, which led to decline in soda ash volumes which saw a decline of 15% YoY.

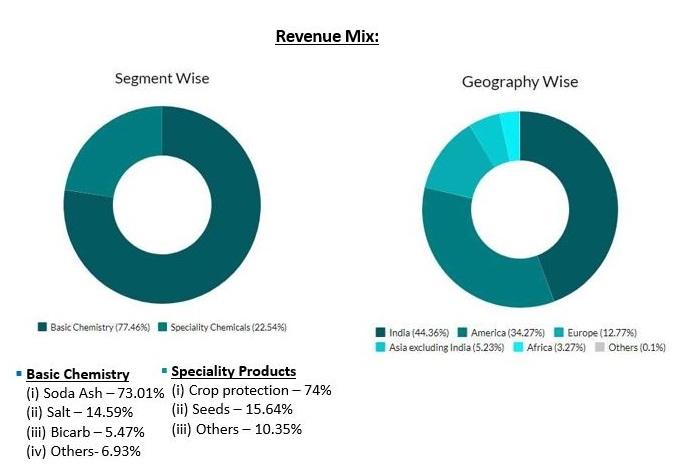

- Segment wise revenue performance:

Basic chemistry saw a revenue decline of 10.58% YoY. Revenues were impacted due to volume and price decline in soda ash however, the revenue fall was partially restricted by gain in the edible salt segment.

Specialty products on the other hand saw a revenue growth of 7.43% YoY. Growth in the segment was led by growth in the nutritional and silica business. Thus, leading to better volumes and improved realizations.

- Indian markets fared better compared to other geographies : North America, UK and Africa,

- EBITDA was Rs 386.25 cr, a decline of 31.11% YoY. EBITDA margin was 14.80%, contraction of 543 bps YoY.

See also: Bharti Airtel Limited- Connecting homes-Touching millions of lives

Operating performance was impacted due to floods leading to higher cost of production and one time expenditure of Rs. 11 cr due to damages to inventory and other assets. Additionally, annual wage settlement to a tune of Rs. 14 cr also impacted the operating profitability.

- PAT was Rs 121.67 crore, a decline of 66.57% YoY impacted by subdued operational performance, lower other income (-23.93% YoY) along with higher tax rate (30% v/s 6%).

- Debt as of September 2020 was Rs. 6,806 cr as compared to Rs. 7,514.37 cr as of March 2020.

- Cash and cash equivalents as on September stood at Rs. 3,039 cr.

- Rallis India Performance (50% subsidiary) – Revenues declined by 3% YoY and EBITDA declined by 1%. The performance was impacted by lower business from Crop care’s international business and contract manufacturing segment. However, the domestic seed business could manage to restrict further decline.

Future Outlook:

- Going forward, the Tata Chemicals Ltd is focusing on four main verticals – performance materials, nutritional sciences, agro sciences and energy sciences.

- The flat glass comprises ~30-40% of soda ash demand in the international market. Since the auto construction sector is expected to see slow pick up across the globe due to the ongoing pandemic, thus we expect soda ash consumption to be affected. Impacting the revenue growth as it is the major revenue contributor.

- However, the expected recovery of flat glass demand (especially from real estate and auto sector) would improve by the end of this fiscal and can support better demand growth from next year.

- The company’s focus remains on the specialty portfolio, which should likely inch up in the years to come, resulting in an improvement in operating margins and is incurring a CAPEX of Rs. 24 billion at its Mithapur plant for various categories, which is expected to come on line in a phased manner.

- The company is gaining traction for rubber and non rubber grade silica in the market. Moreover, its engagement with larger tyre manufacturers is also moving as planned. Once finalized would be adding to the revenue growth.

- Rallis India, its subsidiary, commenced commercial production and sales of its products – Sarthak, ‘Zygant 0.7% Gr’- Insecticide and ‘Ayaan 48% WG’ – Fungicide for rice crops. The company is also aggressively focusing to grow its Specialty Products Business through a strong science differentiated, innovative product pipeline. It also has a significant investment pipeline of projects across Salt, Sodium Bicarbonate, Soda Ash and Energy units

- It is building on technologies in lithium ion battery / cell manufacturing by leveraging MOU signed for cell manufacturing and next generation chemistries. It is also looking to scale up its lithium battery recycling business.

- Many of the projects, pertaining to soda ash capacities, have been stalled due to cash crunch. Additionally, many Chinese capacities have shut down, helping to keep the inventory at low levels. Thus, leading to better pricing.

Key risks:

The domestic soda ash business remains susceptible to volatility in international prices, driven by capacity addition and competition from imports.

Pricing is always based on import parity. Hence, if the rupee depreciates, prices increase and vice versa.

StockEdge Technical Views:

Tata Chemicals witnessed sharp move post breakout from weekly chart and any pullback to 335-340

can be looked upon as a buying opportunity in the stock. Technical parameters and volume looks

quite strong as of now. Presently the stock is trading right at 78.6% Fib extension level and likely to

see some profit booking if the stock fails to hold 390 level. Next probable resistance as per Fibonacci

extension comes at 422 level.

Bottom Line:

Tata Chemicals Ltd has a strong diversified business risk profile, driven by its established market presence, and healthy financial risk profile because of strong liquidity and financial flexibility. Recently, the promoter group Tata Sons bought additional 2.21 million equity shares of Tata Chemicals Ltd.

Operating efficiency of the company is expected to remain healthy, backed by availability of low – cost natural soda ash from North America, and benefits from restructuring of operations in the United Kingdom and Kenya. The company’s soda ash plant in Mithapur, Gujarat, is one of the lowest-cost producers of synthetic soda ash, aided by proximity to limestone quarries and economies of scale.

However, the near-term softness in soda ash demand due to scaled down operations globally across various end use sectors such autos, construction, container glass and chemicals, including silica used in tyres and lithium carbonate for EV batteries as will weigh on company’s earnings growth, in the near term.

As per “IHS Markit” the soda ash cycle may not recover until CY22. The demand recovery in Indian markets will comparatively be at a faster pace than other geographies.

Join StockEdge Club to get more such Stock Insights. Click to know more!

You can check out the desktop version of StockEdge.

Disclaimer:

This document and the process of identifying the potential of a company has been produced for only learning purposes. Since equity involves individual judgements, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.

ThanQ for sending this information its very knowlegdeable

thank you

Graph is incorrect for :

1. Net Sales

2. EBITDA

regards

samir

we have corrected the graph and thanks for your valuable feedback

Nice way of details analysis

thank you