Table of Contents

The first bank to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994, Yes right we are talking about the HDFC Bank Limited, the largest bank in India in terms of assets and market capitalization.

HDFC Bank Limited – part of the Business House: HDFC Group is one of India’s leading private banks & offers a diverse range of financial products and banking services to customers through a growing branch and ATM network and digital channels such as Netbanking, Phone Banking and MobileBanking.Today, HDFC Bank has a banking network of 5,430 branches and 15,292 ATMs spread across 2,848 cities and towns.

HDFC Bank has been a integral part of Nifty 50, Nifty Bank and Nifty financial Services Indices.

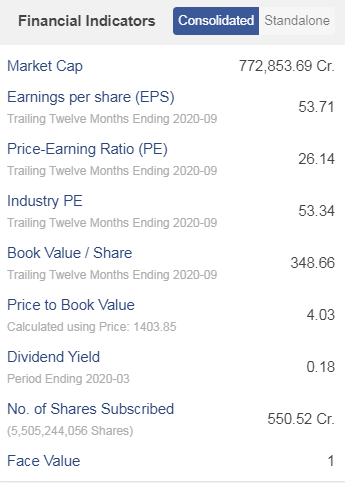

HDFC Bank Limited offers a wide gamut of commercial and transactional banking services to businesses and organizations of all sizes. Bank’s services include working capital finance, trade services, transactional services and cash management. Under Treasury services, bank’s focus is on three main product areas: foreign exchange and derivatives, local currency money market and debt securities, and equities. The bank has system loan market share of 8.5% as of FY19. It has a loan portfolio of Rs 8.2 lac crore, a high-quality deposit franchise, well-diversified revenue mix, strong asset quality, and consistent financial performance. As of today’s date, this is HDFC Bank share price

Financial Performance

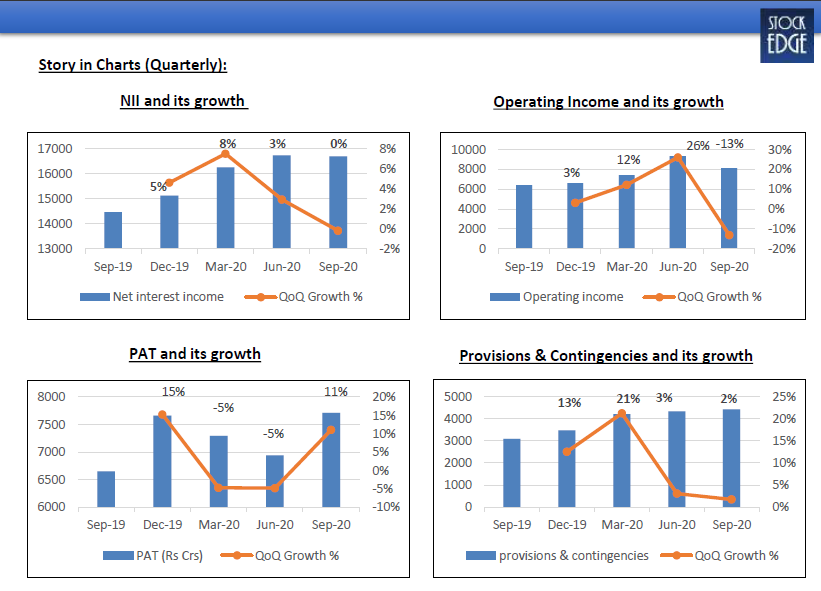

- The net interest income in Q2 FY21 was at Rs.16,709.1 crore which increased by 15.6% from Rs.14,458.4 crore in Q2 FY20.

- Net profit in Q2 FY21 stood at Rs.7,711.4 crore, an increase of 16% from Rs.6,648.80 crore in Q2 FY20.

- The advances grew by 14.9% and stood at Rs.10,88,948 crore in Q2 FY21 from Rs.9,47,440 crore in Q2 FY20.

- Net interest margin for Q2 FY21 was 4.1%.

- Liquidity coverage ratio stood at 153%.

- Capital adequacy ratio was at 19.1%.

- The Cost to Income ratio was at 36.8% in Q2 FY21 as compared to 38.8% in Q2 FY20. In the loan book, there was 95% demand resilience seen in the month of September, an improvement of 2%, i.e 97% is expected to be seen in October. In pre-Covid levels it stood at 99%.

- Mean reversion is seen on the moratorium book, a positive trend overall.

Operational Highlights

- The deposit growth continued strong at 20% YoY led by CASA/Term deposits up YoY CASA ratio improved to 42%. Of the overall deposits ~ 80% is retail in nature

- Operating performance remained stable, led by steady business growth and cost control. However, margins moderated QoQ on account of higher liquidity and a change in the asset mix.

- Reported G/NNPAs stood at 1.1/0.2% vs 1.4/0.3% QoQ on the Supreme Court’s standstill directive. If there had been no standstill directive, G/NNPAs would have been ~1.4/0.4%. PCR improved by ~830 bps qoq to ~84% in Q2FY21

- Loan book growth (~16%), strong treasury and continued costs controls drove the operational performance. Sequential pick-up in fee income, up 76.6% is heartening.

- Due to lower retail loan origination, subdued use of debit and credit cards and waiver of certain fee led to decline of other income to Rs.800 crore.

- Operating expenses for Q2 FY21 stood at Rs.8,055.1 crore, an increase of 8.8% from Rs.7,405.7 crore in Q2 FY20. The growth in expenses were due to lower loan origination and sales volumes.

- Pre-Provision Operating Profit (PPOP) was at Rs.13,813.8 crore.

- Provisions and contingencies in Q2 FY21 stood at Rs.3,703.5 crore comprising specific loan loss provision of Rs.1,240.6 crore and general and other provisions of Rs.2,462.9 crore.

- Total provisions for Q2 FY21 includes contingent provisions of Rs.2,300 crore for proforma NPA.

Analyse and Study all fundamentals and technicals about HDFC Bank on StockEdge.

Business Verticals

- The bank’s deposit book stood at Rs.12,29,310 crore, an increase of 20.3% over previous quarter.

- Current Account Savings Account (CASA) deposits grew by 27.5% with savings account deposits at Rs.3,48,432 crore and current account deposits at Rs.1,63,019 crore.

- Total advances stood at Rs.10,38,335 crore in Q2 FY21, an increase of 15.8% from Q2 FY20.

- Domestic advances grew by 15.4%.

- Sales has improved in two wheelers, tractor and gold loan businesses. Card businesses are improving on merchant banking and issuance front.

- The bank acquired 1.8 million liability customers this quarter due to rapid digitization.

- The revenue from fees and commission stood at Rs.3,940.3 crore. Foreign exchange and derivatives revenue were at Rs.560.4 crore.

- The gain on sale/revaluation of investments stood at Rs.1,016.2 crore.

- Domestic retail loans grew by 5.3% and domestic wholesale loans grew by 26.5%.

- The total loan book grew by 2.3% to Rs.57,014 crore.

- Wholesale Small and Medium Enterprises (SME) added 1,550 new customers which is three times higher than that of Q1. Disbursements were 2.65 times, which stood at an all-time high.

New Launches and Appointment

- The bank has launched a 45 day Festive Treats 2.0 program in collaboration with Amazon and other partners for over 1,000 brands.

- It recently launched a tie up with Apollo Hospitals for instant financing delivered digitally. It received a sign up of 1,20,000 customers in HealthyLife platform within a week of its launch.

- The bank will be launching Auto First- a separate space dedicated towards digitized platform of retail lending, for 2 wheelers and 4 wheelers predominantly focusing towards online booking of test drives, sales and exchanges, etc.

- There has been an appointment of Mr Sashidhar Jagdishan as the Managing Director and Chief Executive Officer

See also: Tata Chemicals Ltd.-Serving Society through Science

Future Outlook

- The management continues to guide for NIM of 4.1-4.4%. Disbursements in retail are improving month on month and stood at ~80% of pre-Covid levels

- Management commentary was overall positive. Collection efficiency in October is likely to be ~97% and ~99% in coming months reaching pre-Covid levels.

- Credit inquiries in Auto and home loans are back to pre-covid levels. Semi-urban and rural areas are outpacing urban areas due to good monsoon. LAP and WC loans are also back to pre-covid levels. Management Update

- The overall collections of ~95% on the retail book in September 2020. In particular, the non-moratorium book saw ~99% collections similar to pre-Covid levels

- Retail disbursements are at 80-85% of pre-Covid levels. Normalcy in retail is returning with double-digit sequential monthly growth with normalization expected to return to normal levels in Q3.Wholesale/SME book also saw a pick-up in demand ahead of the festival season due to inventory and restocking requirements

- While the demand for restructuring has not been meaningful till now, this might change given that the window is open till the end of the calendar year.

StockEdge Technical Views:

HDFC Bank consolidating in a rising channel in the hourly chart and immediate support comes at

1390-1400 zone and probable resistance from upper line of the channel comes at 1480-1490 zone.

The stock looks quite strong in the weekly chart and important weekly support comes at 1300 level.

Bottom Line:

The bank continues to command the highest market share amongst private banks. It is to traverse through these tough times and will gain market share led by strong leadership position across segments, large distribution, digital focus and strong capital adequacy.

Strong governance and equally strong asset quality has always been the hallmark of HDFC Bank setting it apart from its peers. Given its superior business model, the bank’s resilience across cycles will play out positively.

The bank has the ability to capitalize on any opportunities in the current macro uncertainties and maintain its growth without compromising on quality, the overhang with respect to the successor is over and Sashidhar has been appointed as the New chief of the bank after Aditya Puri.

The bank is one of the best banks in the country and the trajectory from a medium to long term basis is very positive. Since the successor overhang is over, the downside looks limited at the current juncture.

Frequently Asked Questions

How strong is HDFC Bank?

HDFC Bank offers a strong balance sheet and higher residual capital than most banks. The higher residual capital ensures that its best-in-class franchise can support an adequately large balance sheet on the other side of this crisis and fulfill its earnings potential. Its strong risk-adjusted NIMs, healthy non-interest streams, one of the best cost-efficiency ratios in the industry, strong non-specific provisions buffer and reasonably high levels of capital keeps the return metrics in good stead.

What is the turnover of HDFC Bank?

HDFC Bank’s annual turnover is 114812.65 Cr. as per FY19-20.

Who is owner of HDFC?

Housing Development Finance Corporation is the parent organization of HDFC Bank.

Is HDFC a nationalized bank?

HDFC Bank Limited is an Indian banking and financial services company headquartered in Mumbai, Maharashtra. HDFC Bank is India’s largest private sector bank by assets. It is the largest bank in India by market capitalization as of March 2020.

Join StockEdge Club to get more such Stock Insights. Click to know more!

You can check out the desktop version of StockEdge.

Disclaimer:

This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.

Excellent.

thank you

Excellent knowledge.