Table of Contents

Gati Ltd.- Gaining Speed

“Our Logistics should move at the speed of a cheetah,” said Prime Minister Modi at the launch of the National Logistics Policy a couple of months ago.

Generally speaking, industries that the government is keeping an eye on for new policy implementation tend to perform well in the stock markets. Last year’s sugar sector and the current outperformance of the defense stocks are perfect examples of this.

The Government aims to reform the Logistics Industry

Similar to the Ethanol story for Sugar stocks and Atma Nirbharta for Defence Stocks, the age-old Logistics Industry also has a story brewing.

The Indian logistics industry is estimated to be over $200 billion and employs 2.2 crore people. Moreover, the sector is expected to grow by more than 10% annually to at least $320 billion by 2025.

Overall, the logistics industry is enormous in size and forms the backbone of Corporate India. But this industry suffers from a myriad of problems that have caught the government’s attention.

- Only 10% of the entire sector is organized in which large players operate. 90% of it is unorganized, comprising smaller regional players.

- Governmental regulatory departments are quite defragmented. According to the Commerce Ministry, more than 20 government agencies, 40 PGAs (Partner Government Agencies), and over 500 certifications for the $200 billion market.

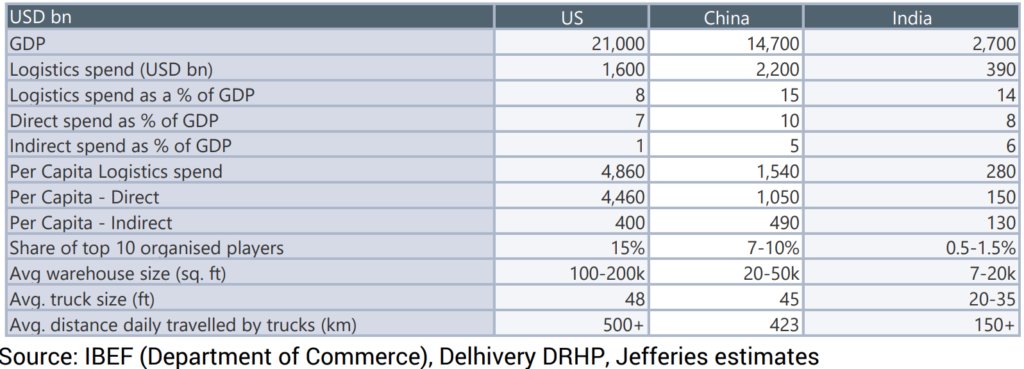

- Due to the above-mentioned complications coupled with a lack of developed infrastructure and poor management by the unorganized sector(such as pilferage, fuel theft & license issues), the indirect Logistics cost in India is around 6% of the GDP.

- India’s logistics cost is as high as 14% of the GDP compared to 7-9% for developed economies.

The government has introduced several measures to quell the above problems that ultimately stunt India’s economic growth.

- Recently, Prime Minister Narendra Modi unveiled a new National Logistics Plan to cut logistics costs — from 13–14% of the GDP to around 8%.

- Formalizing the Indian economy, with GST and eWay Billing being key drivers, would lead to more business for the larger, organized players.

- Improved infrastructure through Bharat Mala, Sagar Mala, Dedicated Freight Corridor, and Gati Shakti projects.

Such industry-level initiatives would create lucrative opportunities for organized players. And today, we’re going to discuss one such potential beneficiary, which we believe has limited downside risk.

The Stock Insight – Gati Ltd.

Gati Ltd, established in 1989 by Mr. Mahendra Agrawal, is one of India’s largest road transport companies and as of today this is Gati share price Today, the company’s coverage spans India through air and road, providing logistics services to more than 19,800 PIN Codes and 735 of India’s 739 districts.

At the group level, they have a network of over 668 offices, including 31 large hubs with 4.1 Mn sq. ft warehousing space across locations. It operates a fleet of 5,000 trucks on the road.

Key Statistics (FY22)

Source: Company data

The Business Structure :

The company primarily provides B2B Surface Logistics services comprising surface express(road), air express(through a partnership with a commercial airline), and supply chain management services.

On a consolidated level, the Surface Logistics business(core business) is housed under the subsidiary Gati Kintetsu Express Private Limited (GKEPL). GKEPL is a joint venture between the company and Kintetsu World Express Inc (KWE) – One of Japan’s leading logistics providers, having a shareholding of 70:30 respectively.

A Dismal Past :

Gati Ltd. was once a market leader in the express logistics space. To fuel growth, the then promoters(led by Mahendra Agarwal) shifted their focus from their core business to expand into other verticals such as Fuel stations, Power plants, and Logistics ventures(forwarding, cold chains, full truckload services, etc.) – none of which were profitable.

They gradually started losing market share year after year. Debt piled up, profits started eroding, and the promoter’s majority stake got pledged.

The Hero’s Entry :

In 2020, Allcargo Logistics Ltd, a leading global Non-Vessel-Operating Carrier led by Shashi Kiran Shetty, acquired a majority stake to become the promoter of Gati. ALL acquired a stake of 46.86% from the erstwhile promoters and a public open offer (in March 2020 @Rs.75 per share). By June 2021, ALL had increased its stake to 47.30%.

Gati Ltd. acquisition was strategic to ALL. It is expected to integrate operations by providing end-to-end services to its customers through its domestic reach via road, air, and rail transport and service support. In FY21, it contributed 12% of ALL’s consolidated revenue.

Changes Brought About by the New Management under GATI Ltd 2.0 :

Post-acquisition by ALL, the company has adopted an Asset Light approach and has been hiving off its non-core businesses to improve profitability and deleverage the balance sheet.

- Exited several loss-making asset-heavy businesses such as the cold chain, fuel stations & trading/ freight forwarding businesses.

- Let go of ~1500 employees whilst adding newer positions in the hierarchy to increase efficiency.

No. of Employees

- Changes in the Key Management and the appointment of Pirojshaw Sarkari, ex-head of Mahindra Logistics.

- Reduced the debt levels significantly from around Rs.500 crore to Rs.161 crore as of FY22. Tax-related Contingent Liabilities of Rs.135 crores are also down to Rs.25 crores.

The management’s focus is basically to streamline its business and regain the lost market share and efficiency it once possessed.

We believe the new management has been right in hiving off its non-core and loss-making entities to 1) shift focus back to express logistics to regain its lost market share and trust and 2) improve operational efficiencies to get back to profitability.

The Road Ahead :

- Synergies with Allcargo are visible now, backed by a strong promoter group of cash-rich Allcargo Logistics; improvements in efficiencies are already visible for the company with the opening of their largest hub in the NCR region, with many more to come.

- Impressive Forward Guidance The management has set an exit revenue target of Rs.3,000 crores ( vs. Rs.1,500 FY22) in 3 years and the exit FY24E EBITDA 12-15% (vs. 4.5% Q1FY23), respectively.

- Several Industry Tailwinds Organised players are set to lead the charge in the coming years in the Express segment of the logistics industry. Organized players accounted for only ~10% of the logistics market in FY20. They are expected to grow at a CAGR of >25% between FY20 & FY26, taking their share to 17% of the logistics market.

Threats to the Story :

Corporate Restructuring

There have been reports about a possible merger of Gati Ltd. into Allcargo. However, the management in the con calls has expressed its desire to leave it as a separate entity.

In a recent concall, the management highlighted that AllCargo will be buying the residual 30% stake in Gati GWE, which is a positive development in our opinion. However, whether the residual stake will be held by Allcargo or be merged into Gati Ltd. is still unclear.

The Competitors of Gati Ltd.

Since 90% of the logistics space is driven by unorganized players, its key competitors are smaller regional players.

In the Organized space, the closest competitors(surface express) are:-

- TCI Express

- Bluedart

- Delhivery(through the acquisition of Spoton)

- Safexpress(unlisted)

- Mahindra Logistics(through the acquisition of Rivigo)

Safexpress and TCIE are the industry leaders, as the company’s market share has deteriorated over the past few years. According to certain industry reports, the company’s market share in the organized space is less than 15%. It is, therefore, vital for the company to increase its market share to make the most of the industry tailwinds.

Apart from these players, there is a potential threat from technology-driven logistics startups backed by deep-pocketed International PE Players.

Other Risks

- The inability of the management to defend its market share & failure to meet its future guidance.

- The shift from unorganized to organized took longer than anticipated.

Bottomline :

The company can potentially deliver significant returns to its investors if the management can deliver on its FY25 guided numbers. However, in the short term, the overhand remains of the corporate structure rejig at Allcargo Logistics and the concerns of the 30% remaining stake in Gati KWE. In our opinion, this doubt should be cleared in the next 1-2 quarters.

Until then, an investor must surely have the company on their radar and track the latest developments around the company.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

We hope you liked our content, so keep an eye out for the next blog under the “Stock Insights” section. Also, please share it with your friends and family.

Happy Investing!

Vry informative helps in decision making.

I could learn what GATI is