Table of Contents

Key Takeaways

- India’s Defence Sector Growth: India ranks 4th globally in military strength. In 2023-24, domestic defence production reached a record $15.1 billion, marking a 16.8% year-on-year growth.

- Government Initiatives: The Indian government allocated ₹6.22 lakh crore for the defence budget in the 2024-25 fiscal year, up from ₹5.94 lakh crore the previous year, reflecting a commitment to strengthening the sector.

- Investment Considerations: Assess company fundamentals such as order books, revenue growth, and profitability. Be aware of risks including regulatory changes and market volatility.

- Top 5 Defence Stocks:

- Hindustan Aeronautics Ltd. (HAL)

- Bharat Dynamics Ltd. (BDL)

- Mazagon Dock Shipbuilders Ltd.

- Data Patterns (India) Ltd.

- Paras Defence and Space Technologies Ltd.

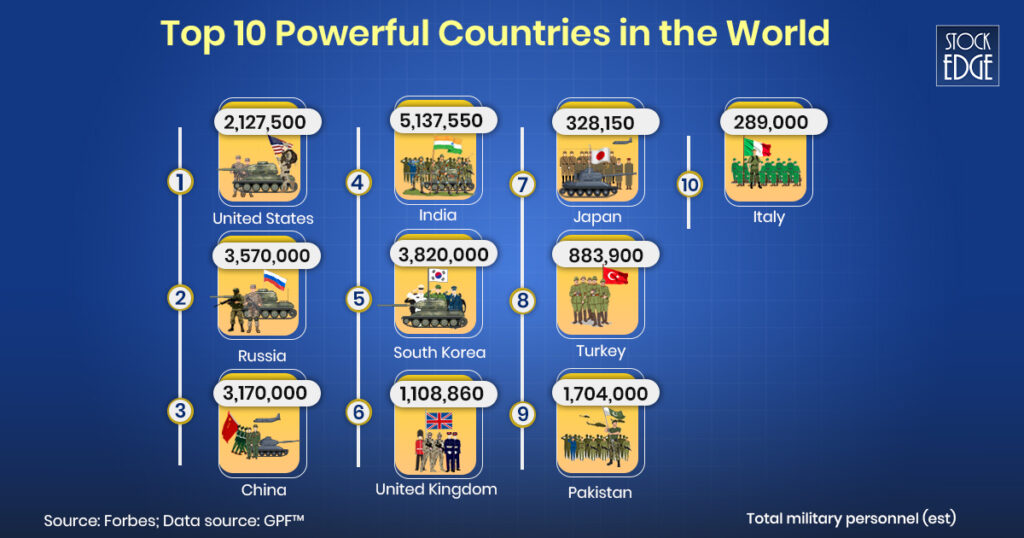

Ever wonder what makes a country ‘A Superpower’? It’s all about who has the biggest and boldest defence system. The USA and Russia have been at the top for years, flexing their military muscles. But now, China and India are stepping up as the new heavyweights in the global ring.

Today, India ranks 4th most powerful country in the world in terms of total military strength. In 2024, here are the top 10 powerful countries in the world:

India has stepped into an era of Self-Reliance. India’s defence sector has been growing Military rapidly over the past few years. According to the Ministry of Defence (MoD) in 2023-2024, the domestic defence production had reached a record $15.1 billion, registering a 16.8% growth YoY. With this rapid growth, several defence stocks have emerged as top gainers, especially in the top gainers NSE list—showing strong momentum and investor interest. With this rapid growth, several defence stocks have emerged as top gainers, especially in the top gainers NSE list—showing strong momentum and investor interest.Therefore, defence stocks have immense potential and opportunities for investors in the market. In today’s blog, let’s explore the opportunities and identify the top most defence stocks in India for 2024.

What are Defence stocks?

Defence stocks are publicly listed companies that are involved in creating, developing and manufacturing military equipment, systems and technology for our nation’s army, navy and other defence organisations. Moreover, India also started to export military equipment to other nations in the world. Not all defence stocks are public sector undertakings (PSUs); there are private organisations as well, which are listed companies in India’s defence sector. According to the Ministry of Defence, public sector undertakings (PSUs) were responsible for 79.2% of India’s defence manufacturing, while the private sector contributed 20.8% in 2023-24.

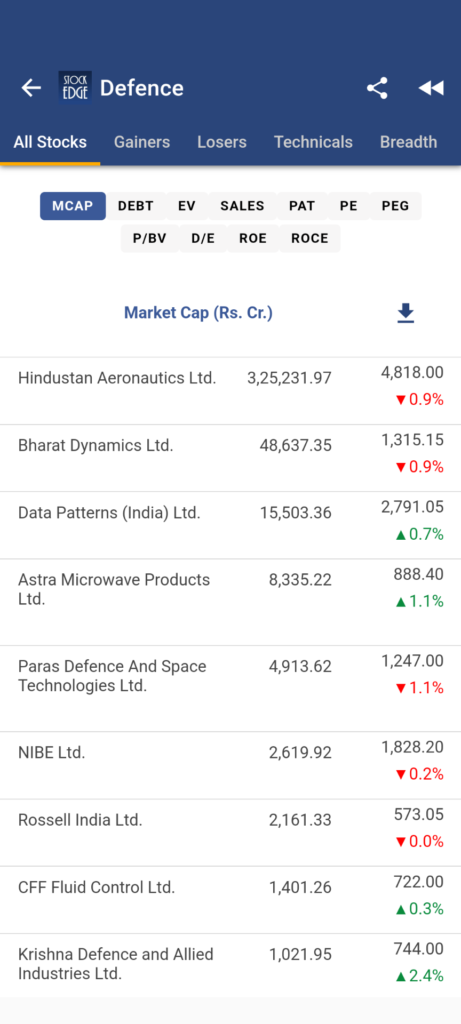

List of Major Defence Stocks in India

In the StockEdge app, you can find the list of defence stocks in India categories under the sector. Defence stocks are listed based on their market capitalization from highest to lowest. Moreover, you can view key fundamental parameters like PE, ROCE, ROE, Sales, PAT, and more. The app also allows you to track technical data such as the 52 week high low and identify whether a stock is nearing its all time high stock levels or trading close to its all time low stock.The app also allows you to track technical data such as the 52 week high low and identify whether a stock is nearing its all time high stock levels or trading close to its all time low stock. This makes comparing all the major defence stocks easy for your analysis.

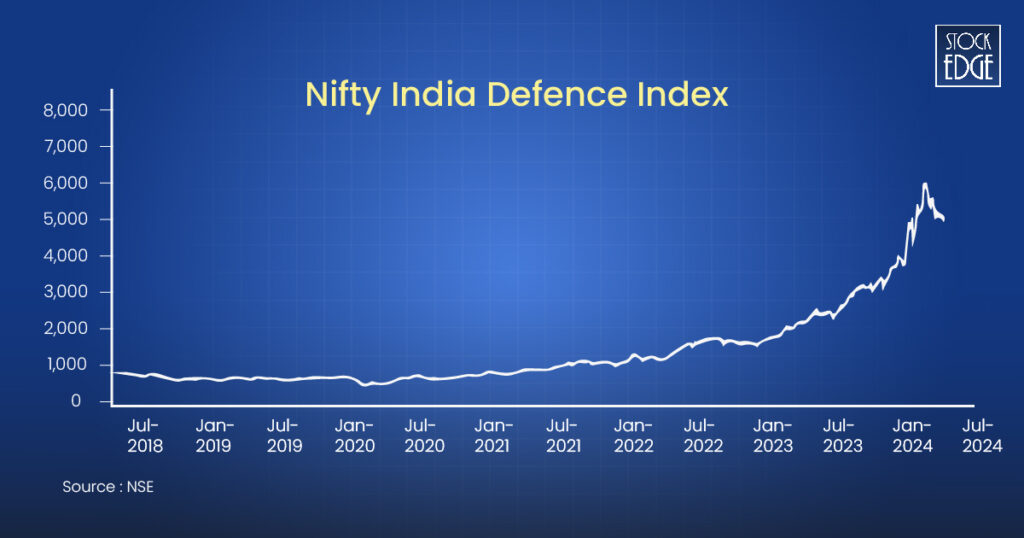

Historical Performance of Defence Stocks

The Nifty India Defence Index which aims to track the performance of major defence stocks in India has strongly outperformed the Indian benchmark index NIFTY 50. As of 30th Aug, the India Defence Index surged by nearly 115% in the past year, whereas Nifty 50 climbed 31% last year.

Sector Outlook: Defence Sector Overview

India’s Defence Sector is the backbone of the country’s security, playing a key role in protecting its borders, maintaining national sovereignty. According to IBEF, the Indian defence sector is one of the world’s largest and most profitable industries, with a 10-year pipeline of over US$ 223 billion in aerospace and defence capital expenditure and a projected medium-term investment of US$ 130 billion. Being an investor, defence stocks offer you a unique opportunity to be part of overall growth in this sector. Investing in leading defence stocks that align with India’s focus on modernization and self-reliance can help you build a strong portfolio, much like the country’s resilient defence system.

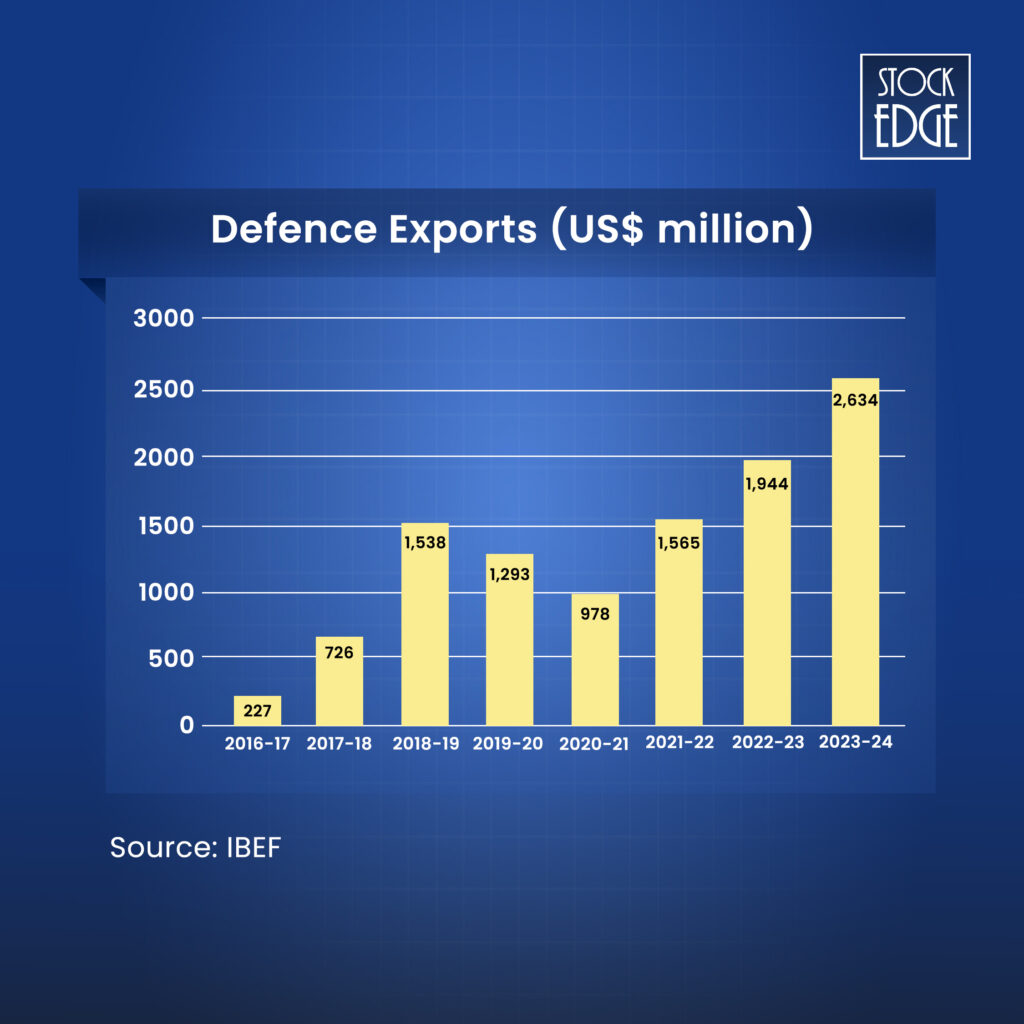

India’s vision of “Atmanirbhar Bharat” and mission of “Make in India” has transformed the defence sector from being majorly as importer of defence equipment and technology to emerging as an exporter to the world. India’s defence export has surged 30x in the last decade, largely due to global conflicts like; Russia-Ukraine war, Israel-Hamas conflict.

Defence exports stood ₹21,083 crores (US$ 2.63 billion) in 2023-24 which is 32% increase from previous year.

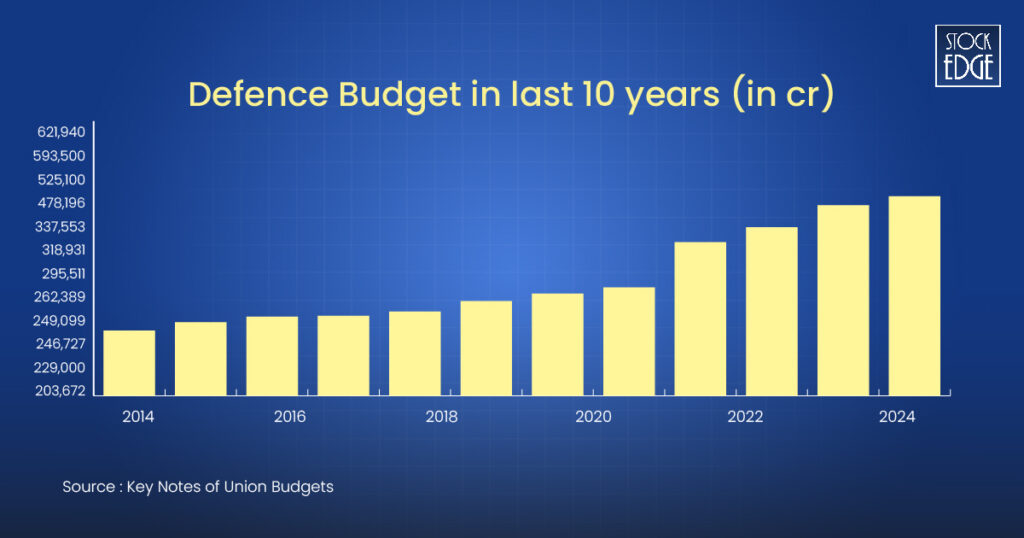

Additionally, initiatives by the government of India have powered up the growth of major defence stocks. There has been huge government spending to boost the growth in the entire defence sector. The Indian government has allocated ₹6,21,940 crore for the defence budget in the 2024-25 fiscal year, reflecting a rise from the previous year’s allocation of ₹5.94 lakh crore. The government has been increasing the budget allocation for the defence sector in the last 10 years to make our national defence strong and robust. Here is a trend analysis of defence expenditure in the past decade.

As you can see in the above chart, the budget allocation for the defence sector has steadily increased by the government, indicating the growth story of the defence sector is intact. Therefore, investing in defence stocks can be an opportunity for you to ride the long-term growth in India’s defence industry.

Key Growth Drivers of India’s Defence Sector

The growth in India’s defence sector stocks started with a vision to make indigenisation of military equipment and hardware, which basically means defence manufacturing. Earlier, India used to import a considerable amount of its defence equipment from Russia, USA, UK, Israel and France, which accounted for 9.5% of total global arms imports. Let’s explore the list of factors which is fueling the growth of the defence sector:

- Make in India Campaign: The “Make in India” campaign promotes local manufacturing of defence equipment, boosting self-sufficiency and supporting the expansion of domestic defence industries.

- Geopolitical Factors: Ongoing global geopolitical shifts underscore the need for a strong defence infrastructure, increasing the demand for advanced defence technology and solutions. Read more on geopolitical risks that can affect the stock market from this blog: Top 3 Geopolitical Risks for Stock Market: How to tackle them?

- Modernization of the Defence system: The government’s dedication to upgrading the armed forces and improving defence capabilities drives investment in cutting-edge technology and equipment.

- FDI in Defence Manufacturing: FDI in the defence sector is now permitted up to 74% through the automatic route, an increase from the previous cap of 49%, for companies applying for new industrial licences. FDI inflow in the defence industry was US$ 19.87 million between April 2000 and March 2024. These trigger investment opportunities are in the areas of modernization of armed forces, Supply chain sourcing opportunities, R&D, Infrastructure development, and more.

- Import Embargo: In February 2024, Defence Minister Mr Rajnath Singh announced 75% of the capital acquisition budget would be used for procurement from local companies. That’s a boost to defence stocks which are directly or indirectly related to manufacturing of military equipment.

Why Should You Invest in Defence Stocks?

Investing in defence stocks can be advantageous to your portfolio. The top reason is diversification into a growing sector of India. Other than this, there are several other reasons, which are as follows:

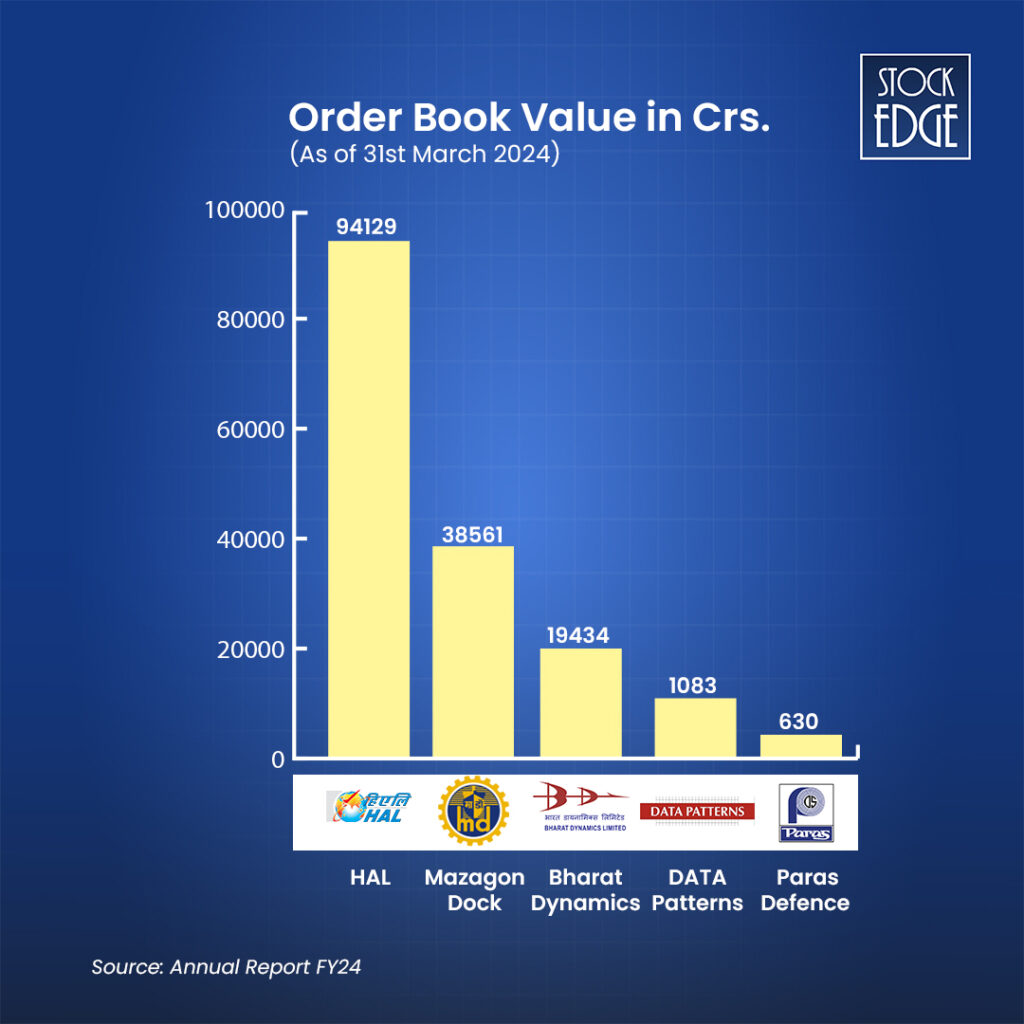

High Demand: The defence sector of India, enjoys strong demand for military equipment and technologies for domestic as well as for the export market especially from the government. This provided benefits for high order books in major defence stocks in India. Here is a list of top defence stocks with high order book as of 31st March 2024.

Government Support: The sector gets massive support from the Indian government with high budget allocation every year that’s benefiting the strong growth for defence stocks. To support the domestic defence sector the government ensures transparency and ease of doing business by creating a robust ecosystem and supportive government policies. That provides a positive outlook for defence stocks in the long-run.

Native Design & Development: The indigenous production of defence equipment lies at the heart of the ‘Make in India’ initiative. Leading defence manufacturers are now channelling their efforts into designing and developing homegrown weapons and critical products.

Key Factors to consider before investing in Defence stocks

- Defence Spending: Keep a close watch on the defence budget allocations, as increases can drive demand for defence-related equipment and supplies.

- Technological Innovation: Prioritise defence stocks that heavily invest in research and development to maintain a technological advance product portfolio.

- Political Uncertainty: Keep track of changes in government policies in the defence sector. The industry is vulnerable to any shift in policy support that can jeopardise the long term growth of the overall sector and major defence stocks.

- Regulatory Landscape:Keep track of government policies concerning defence procurement, licensing, and foreign direct investment, as they can have a major impact on the industry.

Best 5 Defence stocks in India

These below mentioned defence stocks have not only shown robust fundamentals but have also emerged as top gainers in recent market sessions, reflecting strong investor confidence and sectoral momentum.

Hindustan Aeronautics Ltd.

The company came into existence on 1st Oct 1964 through an amalgamation of the two companies i.e. Hindustan Aircraft Limited and Aeronautics India Limited by an amalgamation order issued by the Government of India. Today Hindustan Aeronautics Limited is a public sector aerospace and defence company, headquartered in Bangalore. HAL is one of the oldest and largest aerospace and defence manufacturers in the world. It is also a Navaratna Status Public Sector Undertaking (PSU) under the Ministry of Defence. HAL has been the Integral part of NIFTY 100 Index.

The company is engaged in the design, development, manufacture, repair, overhaul, upgrade and servicing. It has a wide range of products, that includes aircraft, helicopters, aero-engines, avionics, accessories and aerospace structures.

Financial Highlights

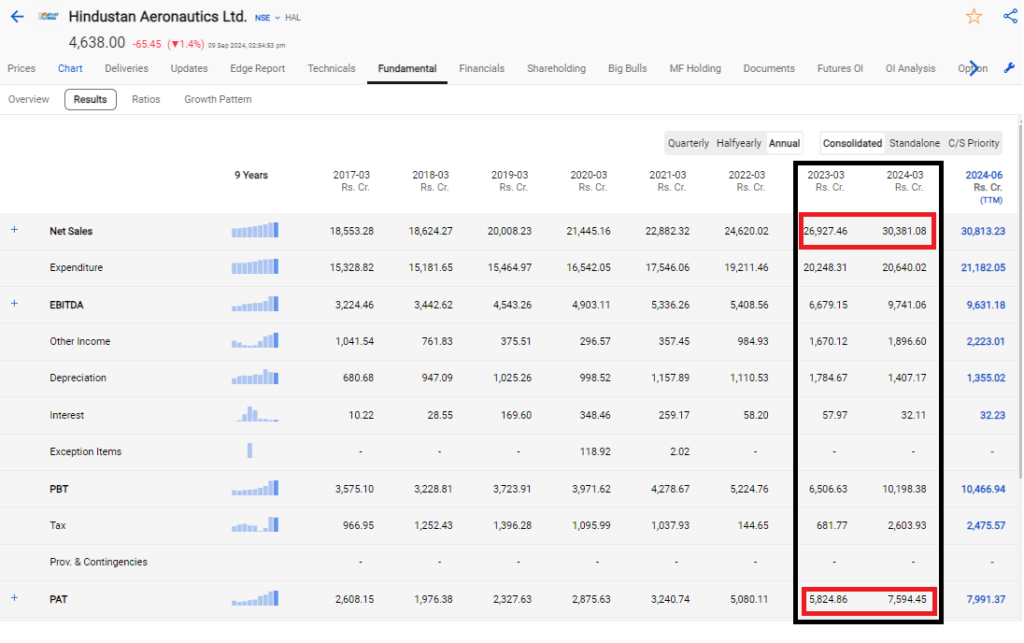

In the financial year 2023-24, the company’s consolidated annual net sales increased by 13% YoY. from ₹26,927.46 cr in FY23 to ₹30,381.08 cr in FY24. Also, the annual profit after tax (PAT) surged by 36% YoY. You can view the profit & loss statement of HAL from the StockEdge app:

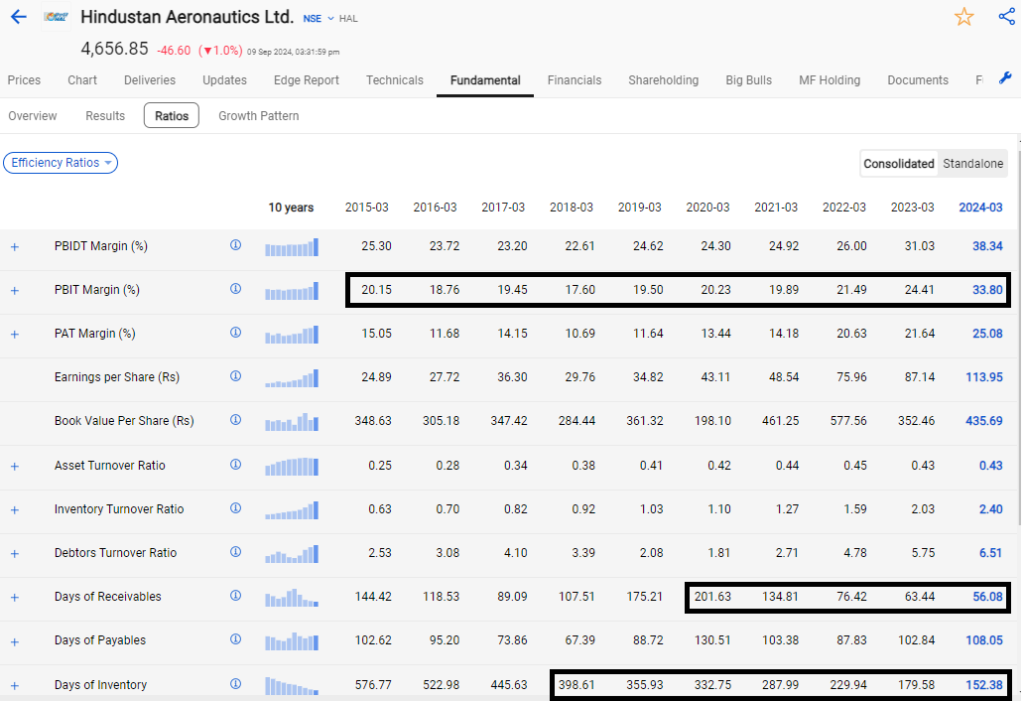

Profit margins are currently at its highest at 25%. The inventory days have also seen a substantial decrease, from about 398 days in FY18 to around 152 days in FY24, with no plans to reduce it further. The debtor days have reached an optimal level of roughly 56 days in FY24, a remarkable improvement from about 201 days in FY20. These efficiencies have led to cost optimization and an overall enhancement in the company’s profitability. In fact, Hindustan Aeronautics Ltd. has occasionally appeared among the volume shockers on NSE, reflecting sudden surges in trading volumes, often triggered by key announcements or investor interest.

Other than efficiency ratios, you can view other key financial metrics like ROE, ROCE etc. using the StockEdge.

Future Outlook

The management anticipates a good pipeline of orders going forward.Once these orders are fructified, the order book positions further get strengthened and puts us on a higher trajectory of growth, to achieve a double-digit growth from ’24-’25 onwards. As India’s economy heads towards the $5 trillion mark, its security and defence would only increase. The company has witnessed consistent growth in its fundamentals. The future looks very stable and promising as it is undergoing many positive developments including getting new orders and rising export markets which will lead to growth in the near term.

One important announcement: HAL has announced a stock split of its 1 fully paid up equity shares of ₹10 into 2 fully paid up equity shares of ₹5 each. The record date would be on 29th september, 2023.

Bharat Dynamics Ltd.

Established in Hyderabad in 1970 as a Government of India Enterprise under the Ministry of Defence. Bharat Dynamics (BDL), is engaged in the manufacturing of guided missiles and allied defence equipment. Additionally, the company provides Ground Equipment, Launchers, Missiles, Underwater Weapons & Decoys, Airborne Countermeasures, Weapon System Integrator, Integration of Airborne System with Platforms and Refurbishment.

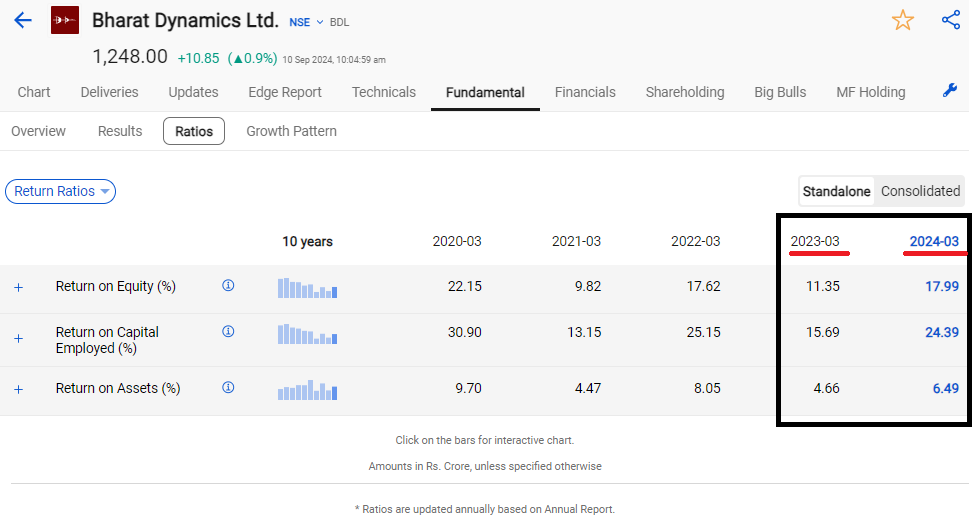

Financial Highlights In FY24, the company’s Profit After Tax (PAT) jumped by 74% YoY. It has registered ₹612.3 Crs of profit in 2023-24 in comparison to ₹352.3 Crs. in previous year 2022-2023. Additionally, the return ratios of the company like ROE, ROCE and ROA has improved significantly from previous year.

Using StockEdge, you can view YoY increase where ROE has improved from 11.35 in FY23 to 17.99 in FY24. Moreover from FY23 to FY24, the ROCE and ROA both improved from 15.69 and 4.06 to 24.39 and 6.49 respectively. Thus, it shows improving financial strength of the company.

Future Outlook

The company ended the financial year 2024 with record high PAT and increased production. Also, the current order book is astonishing, reaching a staggering figure of ₹19434 crore as of 31 March 2024. However, there is a current setback due to geopolitical tensions between Europe and the Middle East causing delays in receipt of input materials. But the company is confident and in talks with diplomatic channels to

sort out the supply chain issues and ensure smooth production.

Mazagon Dock Shipbuilders Ltd.

Mazagon Dock Shipbuilders Limited is the oldest shipyard in India with the inception in 1774, incorporated in 1934, and taken over by the Government of India in 1960. The company is a defence public sector undertaking shipyard under the Department of Defence Production. It operates in two major business divisions: (i) shipbuilding and (ii) submarine and heavy engineering.

Financial Highlights

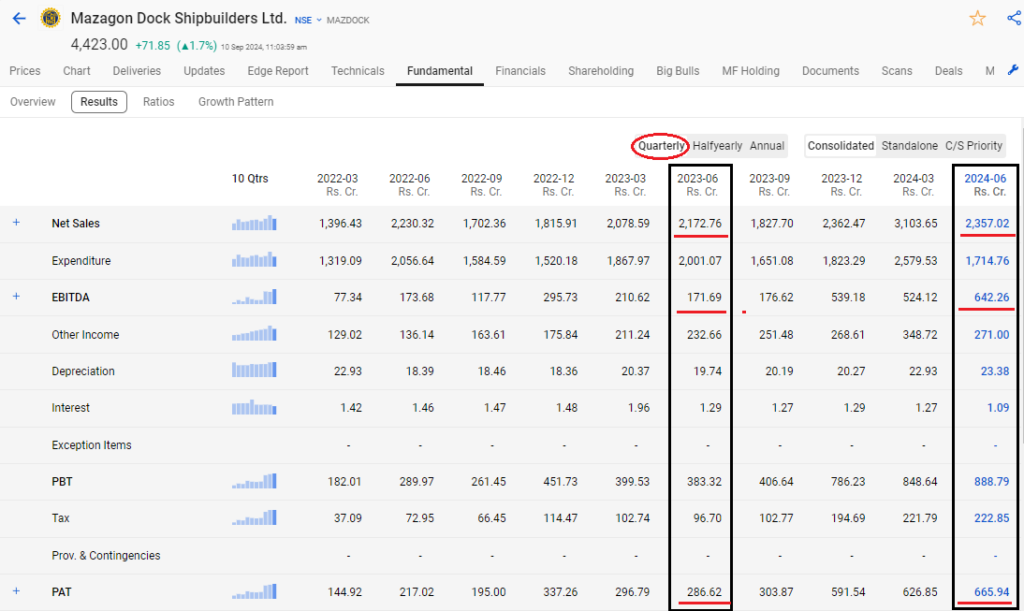

In FY24, the company reported a turnover of ₹9,466.58 cr – registering yearly growth by 20.94%. Also, the company’s profit margins are at its highest 19.11% in FY24. In the latest quarter, of Q1 FY25, the company reported a turnover of ₹2,357.2 cr – registering yearly growth by 8.48%. EBITDA for the quarter ended at ₹642.26 higher by 274.08% YoY owing to the release of excess provisions related to completed projects. Profits stood at ₹665.94 cr – registering growth by 132.34% YoY. This indicates that the company is financially sound. And this has helped the company occasionally feature among the top gainers NSE. Using StockEdge, you can view the company’s quarterly statement as well.

Future Outlook

The company is optimistic about the defence sector, particularly given the government’s emphasis on indigenization and naval modernization. Export opportunities are also being actively explored. The recent upgrade to Navratna status has provided the company with enhanced operational autonomy, allowing it to independently take on projects and collaborations valued up to ₹1,000 crore. This strategic flexibility is expected to drive growth. The company anticipates a steady inflow of orders from the defence sector, driven by geopolitical factors and the substantial requirements of the Indian Navy. Strategic investments in infrastructure and capacity expansion are aimed at sustaining long-term growth and profitability.

Data Patterns (India) Ltd.

Data Patterns (India) is among the few vertically integrated defence and aerospace electronics solutions providers catering to the indigenously developed defence products. It caters to the entire spectrum of defence and aerospace platforms – space, air, land and sea. The company’s major product groups consist of Radars, Underwater electronics / communications / other systems, Electronic warfare suite, BrahMos programme, Avionics, small satellites, ATE for defence and aerospace systems, and COTS.

Financial Highlights

In FY24, the company registered a growth of 14.63% YoY in revenue from its operations. The company recorded net sales of ₹519.80 Crs in 2024, compared to ₹453.45 Crs in 2023. The EBITDA has also increased to ₹221.62 Crs in FY24 from ₹171.81 Crs in FY23 registering a growth of 29% YoY. The company remains debt free from the last two financial years with no major long term borrowings in its balance sheet.

Future Outlook

The management reiterated to achieve revenue growth of 20%-25%, with sustainable EBITDA margins of ~35%-40%, going forward. They expect orders inflows of ~₹1,000 crore in FY25, most of it is expected to come in H2 FY25. As on 30th June 2024, the order book stood at ₹1,000+ crore.

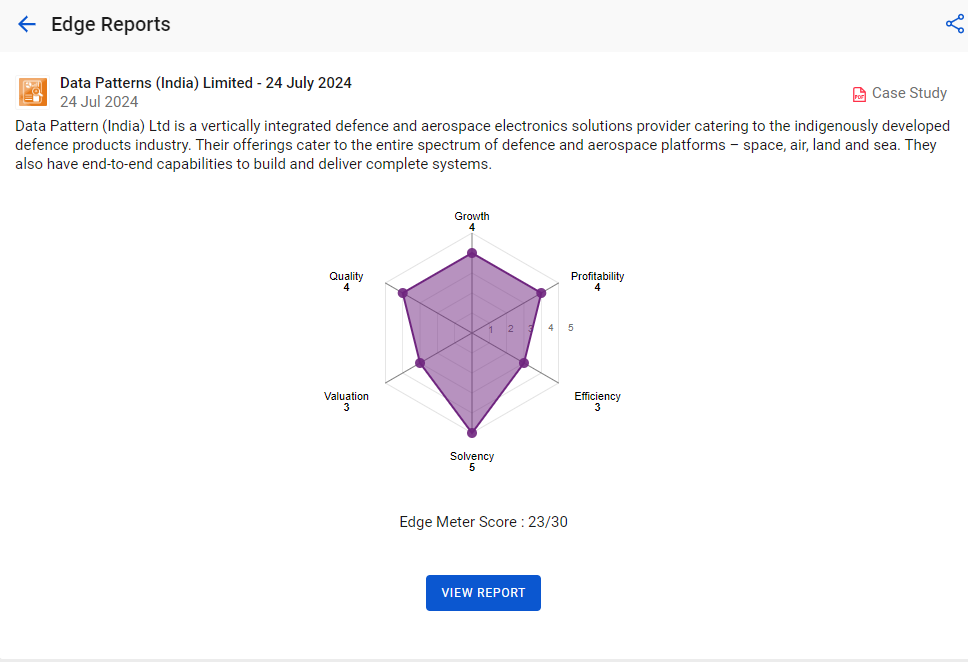

At StockEdge, we have prepared a detailed research report on Data Patterns (India) Ltd. The company is vastly analysed based on 6 major fundamental parameters namely; profitability, efficiency, solvency, quality, growth and valuations. You can read the case study on Data Patterns (India) ltd. before taking an investment decision.

Paras Defence And Space Technologies Ltd.

One of the last defence stocks from the top 5 list is a small cap company with an market capitalization of just ₹4591 Cr as of 10th Aug 2024. However it is one of the leading ‘Indigenously Designed Developed and Manufactured’(IDDM) category private sector companies in India. The company is primarily engaged in the designing, developing, manufacturing, and testing of a variety of defence and space engineering products and solutions. The company has five major product category offerings – Defence & Space Optics, Defence Electronics, Heavy Engineering, Electromagnetic Pulse Protection Solutions, and Niche Technologies. The company is also into manufacturing of new age Drones in India. To know other drone stocks in India, you can read: Top 4 Drone Stocks in India

Financial Highlights

In FY24, the company revenue from operations increased by 13% YoY. It has recorded net sales ₹253.5 Crs in comparison to ₹222.43 Crs in FY23. But unfortunately, the EBITDA for FY24 dipped by -10.03% YoY mainly due to high mainly owing to increase in the cost of materials consumed, whereas profit declined by -16.60% YoY – majorly owing to high employee cost. Nevertheless, the order book of the company has been strongly growing and currently stood at ₹630 Crs as of 31st March 2024. Thus the recent orders pipeline and financial strength, Paras Defence seems to be beneficial going in the longer term.

Future Outlook

The company expects its revenue and order inflows to grow by 30-40% in coming years and the company is targeting Rs100 cr of revenue from the drone business by FY25 with a guidance on profit margin intact at 30-40% backed by strong order book.

Risk Associated to Investing in Defence Stocks

- Global Economic Slowdown: A worldwide economic downturn could result in tighter government budgets, potentially affecting defence spending by the government. This could lead to reduced or postponed orders for defence stocks, limiting the growth potential.

- Project Delays: There could be technical challenges or bureaucratic obstacles that can cause slowdown in project execution, disrupting cash flow and impacting profitability. Such delays could lead to a dip in defence stocks and weaken investor confidence.

- Policy Shifts: Changes in government leadership or shifting priorities could result in adjustments to defence procurement policies. This uncertainty may introduce volatility among the defence stocks.

- Geopolitical Instability: Although the ongoing geopolitical tensions can drive short-term increases in defence spending, prolonged instability could create uncertainty, impacting long-term growth prospects for defence stocks.

The Bottom Line

Investing in defence stocks in India presents a promising opportunity, particularly with the government’s focus on indigenization and increasing defence budgets. However, investors should be mindful of risks such as global economic shifts, policy changes, and potential project delays. With strong demand from the Indian armed forces and expanding export opportunities, defence stocks offer growth potential, but a balanced approach considering both opportunities and risks is essential for long-term success.

Want to explore more investment opportunities? Start with our Beginner’s Guide to Investing and build a strong foundation today!

Happy Investing!

Frequent Asked Questions (FAQ)

Which defence stock is best?

Defence stocks like HAL, Bharat Dynamics, Data Patterns India LTD, and Paras Defence show strong potential. However, always make sure to do your own research and analysis before investing.

Are defence stocks a good investment?

Defence stocks can be a good long-term investment due to the government’s increasing budget allocation for the sector and increasing geopolitical tension. India’s defence stocks have outperformed in the stock market.

Do defence companies typically offer dividends?

Yes, defence companies pay dividends according to their financial performance.

BEST DEFENCE STOCK ANALYSIS

This is very useful and knowledgeable and helpful information.

powerful insights

Thank You so much!