Table of Contents

According to a SEBI Study, when IPO returns exceeded 20%, retail investors sold 67.6% of the shares by value within a week. In contrast, only 23.3% of shares by value were sold when returns were negative.

So, it clearly shows that people engage in this market to earn listing gain.

Today, another IPO from a Non-Banking Financial Company (NBFC) that offers retail loans named Northern ARC Capital Limited, has its initial public offering open for subscription.

However, the main question for potential investors is whether this IPO is worth investing in.

Let’s understand whether the Northern ARC Capital IPO is worthy of your consideration for subscription or not.

Northern ARC Capital IPO is open for subscription from (16th Sep 2023) today onwards!

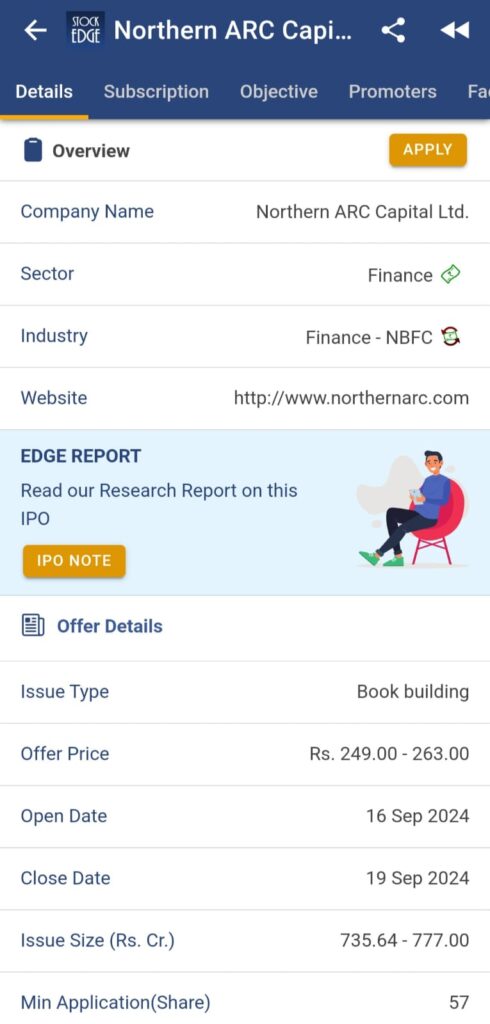

Northern ARC Capital IPO Details:

- IPO Open Date 16th September 2024, Monday

- IPO Close Date 19th September 2024, Thursday

- Price Band ₹249 to ₹263 per share

- Lot Size 57 shares

- Face Value ₹10 per share

- Issue Size at upper price band ₹777 cr (Fresh Issue ₹500 Cr & Offer For Sale ₹277 Cr)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on September 19, 2024

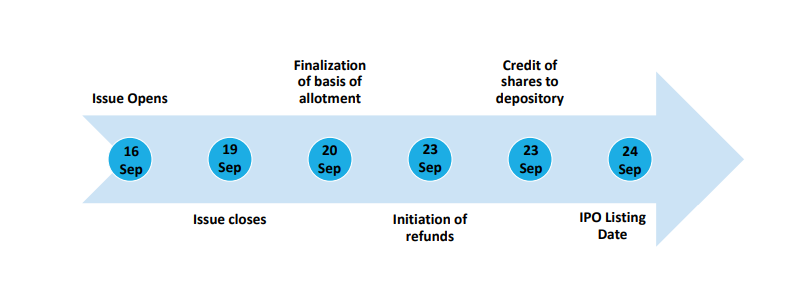

The tentative timeline for the Northern ARC Capital IPO is as follows:

- Basis of Allotment 20th September 2024, Friday

- Initiation of Refunds (if not allotted) 23rd September 2024, Monday

- Credit of Shares to Demat (if gets allotments of shares) 23rd September 2024, Monday

- Listing Date 24th September 2023, Tuesday

About the Company

Northern ARC Capital, established in 2009, is a diversified financial services platform dedicated to meeting the varied retail credit needs of underserved households and businesses in India. They have facilitated financing of over ₹1.73 lakh cr, reaching more than 10.2 cr people across India. Their focus areas are micro, small, and medium enterprise (MSME) finance, microfinance (MFI), consumer finance, vehicle finance, affordable housing finance, and agriculture finance. As of 31st March 2024, they have 316 physical branches and 50 originator partners.

The company’s revenue mainly comes from five states: Tamil Nadu (14.6%), Maharashtra (12%), Karnataka (9.5%), Gujarat (6%), and Rajasthan (5.3%), while other states contribute the balance.

They are currently into 5 different segments, which are as follows:

- MSME- They provide loans to underserved MSME businesses and NBFCs involved in MSME financing, either directly or through originator partners. Their debt financing supports various needs like secured and unsecured small business loans, merchant financing, supply chain financing, etc. The average tenure of the loan ranges from 2-7 years while ticket size ranges from ₹50,000 to ₹5 cr.

- MFI- They provide microfinance loans to underserved individuals, either directly or through its dedicated rural finance subsidiary, Pragati. The average tenure of the loan ranges to ~2 years while ticket size ranges from ₹10,000 to ₹1,25,000. The asset quality in this segment improved.

- Consumer Finance- They provide loans to individuals from new-to-credit backgrounds and other underserved categories, including both employed and self-employed individuals. The solutions include a range of products such as consumer durable loans, cash or personal loans, salary advance loans, buy-now-pay-later financing, etc. The average tenure of the loan ranges to ~4 years while ticket size ranges from ₹1,000 to ₹5,00,000.

- Vehicle Finance- This includes loans for the purchase of commercial vehicles, two-wheelers, and electric vehicles (EVs). Additionally, they also support companies involved in the e-mobility EV fleet services segment. The GNPA stood at 0.82% in FY24.

- Affordable Housing Finance- They collaborate with originator partners, primarily housing finance companies (HFCs), to provide loans for the purchase of residential property, home improvement, and home extension to self-employed and salaried individuals.

You can check the sector-wise AUM of the company:

NBFC Sector Outlook in India

The NBFC sector has significantly evolved over the years, expanding in size, operational scope, and technological sophistication and entering new areas of financial services and products. From FY20 to FY24, NBFC credit experienced a compound annual growth rate (CAGR) of ~12%. This growth was driven mainly by the retail segment, which accounts for around 48% of overall NBFC credit and saw a CAGR of about 15%. In contrast, non-retail NBFC credit grew at ~9% during the same period. This sector is expected to grow at a rate of 16%-18% between FY24 to FY26. The retail industry, including housing, auto, and microfinance segments, will primarily drive this growth. A robust economic recovery is expected to boost consumer demand in FY25, contributing to strong growth for NBFCs. Additionally, the industry is experiencing organic consolidation, with larger NBFCs increasing their market share through mergers and acquisitions.

The growth in small business loans was bolstered by a rise in disbursements within the non-loan against property (LAP) segment (both unsecured and secured) due to rapid industrialization and loans targeting the micro-segment. As economic activity picked up and cash flows improved, NBFCs boosted their funding in the unsecured loan segment while scaling back on LAP lending due to asset quality issues from previous years. Additionally, growth was supported by better underwriting practices and increased funding for the unsecured portfolio.

Financial Performance

Northern ARC Capital Ltd. has demonstrated impressive financial performance over the past three fiscal years. Their revenue from operations saw significant growth, increasing from ₹990 crores in FY 22 to ₹1890 crores in FY 24. This growth in revenue reflects the company’s expanding business activities. Their net profit has been on an upward trend, increasing from ₹182 crores in FY22 to ₹318 crores in FY24.

They also improved their NIM (net interest margin) to 8.4% in FY24. Their AUM (Asset under management) also increased from ₹7,108 crores in FY22 to ₹11,710 crores in FY24. The company also maintained a healthy Provision Coverage Ratio, which was reported at 82.7%. These strong metrics show the company has enough reserves to cover potential losses from bad loans and a capital buffer that exceeds regulatory requirements. It shows the remarkable financial performance of the company, which indicates its effective management and successful endeavours in its respective industries.

Now, let’s look at the key fundamental parameters of Northern ARC Capital IPO and how it compares with its peer companies, CreditAccess Grameen Ltd, Fusion Micro Finance Ltd and Five-Star Business Finance Ltd in this competitive landscape.

Northern ARC Capital IPO stands out with its strong asset quality, reflected in a low GNPA of 0.45% and a robust NNPA of 0.1%. This performance surpasses its peers, who generally exhibit higher levels of non-performing assets. Moreover, the company’s P/B ratio is 1.50x. This ratio is usually used to evaluate a company’s value and determine if a stock is overvalued or undervalued. As compared to its peers, it appears relatively attractive, suggesting potentially undervalued stocks. However, CreditAccess Grameen Ltd has significant revenue growth. To find out which mutual funds are investing in this company, visit our blog, Top 10 Mutual Funds For SIP In 2024-2025.

Objectives of the Issue

Northern ARC Capital IPO intends the net proceeds of ₹777 cr, out of which the fresh issue of ₹500 cr, to utilize the Net Proceeds to meet future capital requirements toward onward lending.

They have a clear objective of expanding their lending business, but can it live up to the expectations of its shareholders? Only time will tell. There is no such investment in the market that is risk-free. Here are the risks that are highlighted for Northern ARC Capital IPO:

Risk Factors

Let’s access the risk factors of Northern ARC Capital IPO:

- A significant portion of the investments are in unsecured credit facilities and debt instruments that may be allocated to other creditors. Failure to recover these investments may result in greater levels of non-performing assets (NPAs), thereby negatively impacting the business.

- Secondly, they face intense competition from various public and private sector banks as well as from other NBFCs.

- Management relies on specific key lenders for a substantial portion of borrowings, with the top 5 and top 10 lender sources accounting for 34.1% and 52.2% of borrowings, respectively.

- Any negative developments in their focused sectors like MSME, MFI & consumer finance could have a detrimental impact on their business. Additionally, these 3 segments account for ~88% of their business.

- The company’s financial performance is susceptible to interest rate risk. Failure to effectively manage this risk could significantly impact net interest income, operations and cash flows.

Should you subscribe to Northern ARC Capital IPO?

Before you decide to invest, it’s crucial to have a strong understanding of the potential risks and rewards involved. In this blog, we’ve presented a detailed overview of both the benefits and possible drawbacks associated with participating in the initial public offering (IPO) of Northern ARC Capital Ltd. Our team of experts at StockEdge has assessed the Northern ARC Capital IPO and provided an Average rating. Additionally, we’ve compiled a comprehensive IPO Note that dives deep into the company’s financial standing and SWOT analysis, offering thorough analysis to provide you with a more profound insight into the company’s prospects.

StockEdge has a separate section on IPOs under the Explore tab, where you can see a list of upcoming, ongoing, and recently listed IPOs.

Join StockEdge Club, where our team of research analysts will be dedicated to solving your queries related to your investment, trading, or IPO journey.

Happy investing!