Table of Contents

When it comes to disciplined investing in the stock market for long-term growth, there is nothing better than SIPs in mutual funds.

Systematic Investment Plans (SIPs) are easy to set up and manage, allowing you flexibility in terms of investment amount and duration. By consistently investing, you tap into the power of compounding—where your returns start earning returns, too!

Plus, SIPs offer the advantage of Rupee Cost Averaging (RCA), helping you make the most of your investments even in volatile markets. But, to truly make your SIPs work for you, it’s crucial to pick the right mutual funds for SIP that can deliver strong returns.

Scroll down for the top mutual fund schemes that you can invest in 2024-2025 as per your risk appetite.

Top 10 Mutual Funds for SIP in 2024-2024

Following are some of the most popular mutual funds for SIP across different fund categories:

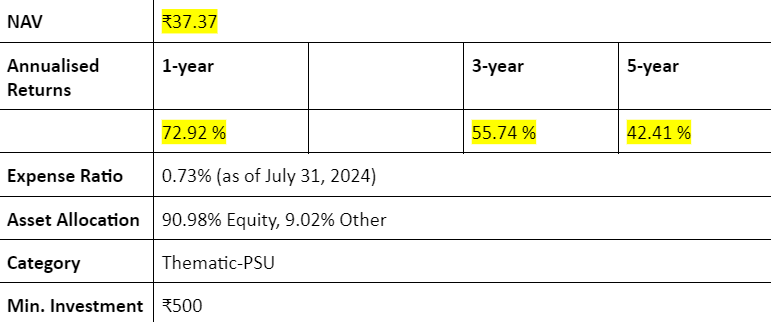

The SBI PSU Direct Plan-Growth is an equity mutual fund offered by SBI Mutual Fund. Launched on 01/01/2013, it has been operational for over 11 years and, as of 30/06/2024, has an AUM worth ₹4,602 Crores. This fund’s asset allocation mainly consists of large-cap stocks and provides exposure to sectors like Energy, Capital Goods, Financial, and Insurance.

Since its launch, this fund has generated 13.61% annual returns, thus doubling the money of investors every two years. State Bank of India, Power Grid Corporation of India Ltd., GAIL (India) Ltd., Bharat Electronics Ltd., and Bharat Electronics Ltd. are the top stocks in its portfolio.

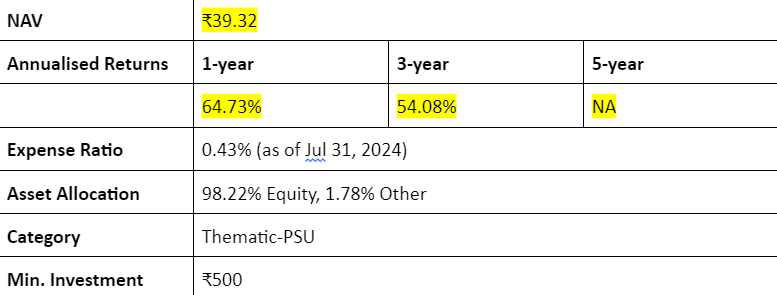

Aditya Birla Sun Life PSU Equity Fund Direct-Growth is an equity mutual fund that offers investors exposure to the Financial, Energy, Materials, Capital Goods, and Metals & Mining sectors. It was launched on 09/12/2019 by Aditya Birla Sun Life Mutual Fund and, as of 30/06/2024, has ₹5,823 Crores assets under management (AUM).

This fund has a majority of its allocations in large-cap stocks. Some of the top companies in its portfolio are State Bank of India, National Thermal Power Corporation Ltd., Power Grid Corporation of India Ltd., Oil & Natural Gas Corporation Ltd., and GAIL (India) Ltd.

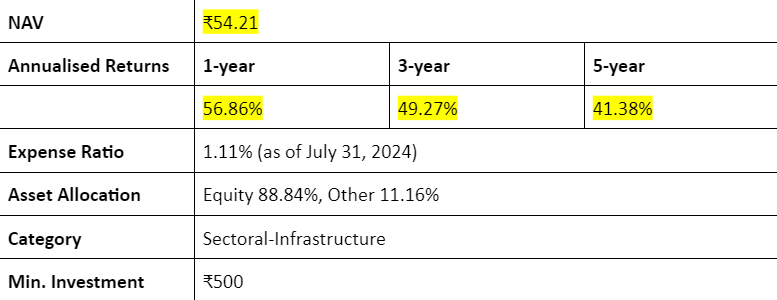

Offered by HDFC Mutual Fund, the HDFC Infrastructure Direct Plan-Growth is an equity scheme that offers exposure to sectors like Construction, Financial, Energy and Capital Goods. It has been active for more than 11 years and, as of 30/06/2024, has an AUM worth ₹2,533 Crores.

Since its launch, this scheme has doubled the money invested every 2 years, generating 14.52% average annual returns. A few of its top allocations are in ICICI Bank Ltd., J. Kumar Infraprojects Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., and Coal India Ltd.

Thus, if you are looking for mutual funds for SIP that offer long-term growth prospects, this scheme can be an ideal choice.

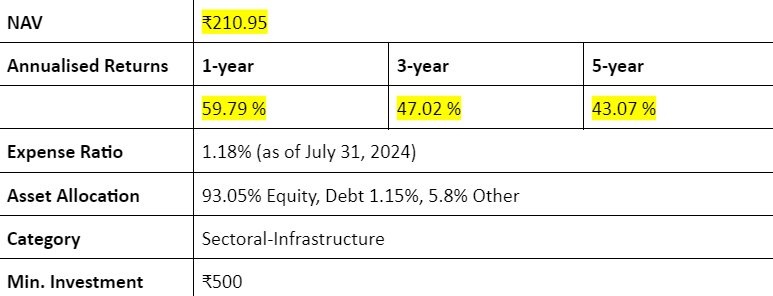

ICICI Prudential Infrastructure Direct-Growth is an equity mutual fund that offers exposure to segments like Financial, Energy, Construction, and Metals & Mining. It is a sectoral-infrastructure scheme that has generated 18.83% average annual returns since its inception in 01/01/2013.

As of 30/06/2024, this scheme has assets under management worth ₹6,063 Crores and generates consistent returns, which are in line with other top-rated funds in its category. NTPC Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., HDFC Bank Ltd., and Kalpataru Power Transmission Ltd., are some of its top allocations.

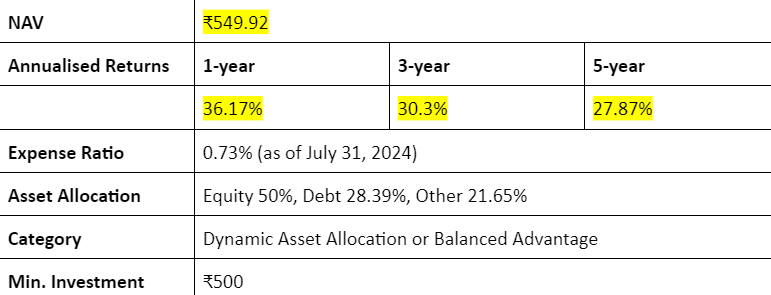

Launched on 01/01/2013, the HDFC Balanced Advantage Fund Direct Plan-Growth is one of the best mutual funds for SIP if you are looking for dynamic asset allocation. It provides exposure to large-cap, mid-cap, small-cap and debt instruments, along with covering sectors like Financial, Energy, Automobile and Technology.

As of 30/06/2024, this mutual fund has assets under management worth ₹94,048 Crores. Since its inception, it has generated 16.89% average annual returns and doubled investor’s funds every 4 years. HDFC Bank Ltd., ICICI Bank Ltd., SBI, Coal India Ltd., and National Thermal Power Corporation Ltd. are some of its top allocations.

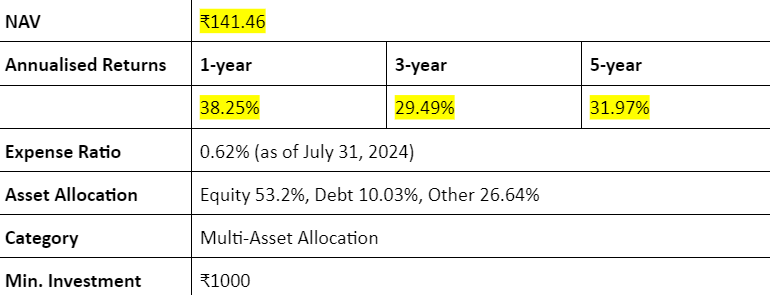

Quant Multi Asset Fund Direct-Growth is a multi-asset allocation scheme that offers exposure to equity, debt and other assets. It is offered by Quant Mutual Fund and covers sectors like Energy, Consumer Staples, Insurance and Finance. This fund has been active for over 11 years and, as of 30/06/2024, has an AUM worth ₹2,605 Crores.

Also, since its inception, it has generated 16.28% average annual returns and doubled the funds invested in it every 4 years. ITC Limited, LIC India, Reliance Industries Ltd., Jio Financial Services Ltd., and Tata Power Co. Ltd. are some of its top holdings.

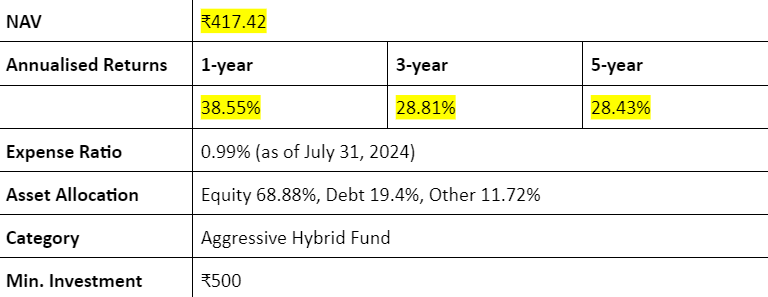

ICICI Prudential Equity & Debt Fund Direct-Growth is a hybrid mutual fund scheme that provides exposure to large-cap, mid-cap and small-cap stocks along with debt instruments.

Its top sectors are Financial, Energy, Automobile and Healthcare, and as of 30/06/2024, has assets under management worth ₹39,091 Crores. National Thermal Power Corporation Ltd., ICICI Bank Ltd., Maruti Suzuki India Ltd., HDFC Bank Ltd., and Sun Pharmaceutical Industries Ltd. are some of its top allocations.

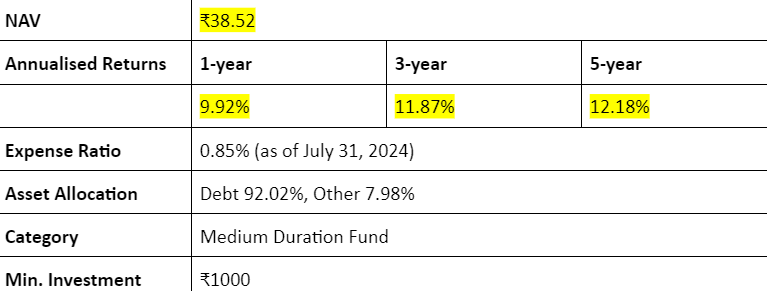

The Aditya Birla Sun Life Medium Term Plan Direct-Growth is a medium-duration debt mutual fund scheme. It is a medium-sized fund of its category that has been operational for more than 11 years and, as of 30/06/2024, has AUM worth ₹1,869 Crores.

This fund provides investors exposure to fixed-income instruments like GOI Securities, Debentures, Infrastructure Investment Trust, and Non Convertible Debentures. Its top allocations are GOI, JSW Steel Ltd., CreditAccess Grameen Ltd., and Belstar Microfinance Pvt Ltd.

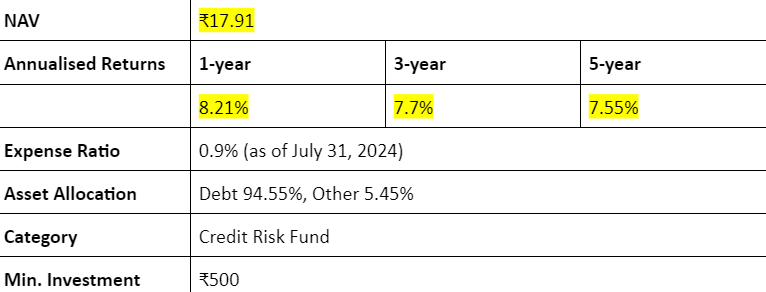

Launched on 01/01/2013, the UTI Credit Risk Fund Direct-Growth scheme has been active for more than 11 years. It is a debt mutual fund offered by UTI Mutual Fund, which as of 30/06/2024, has AUM worth ₹370 Crores. This scheme offers exposure to fixed-income instruments like Debentures, Non-Convertible Debentures, GOI Securities, and Net Current Assets.

Since its launch, this scheme has delivered average annual returns of 5.01%, which is in line with most of the popular funds in its category. GOI, Piramal Capital & Housing Finance Ltd., Tata Motors Ltd., and Godrej Industries Ltd. are some of its top holdings.

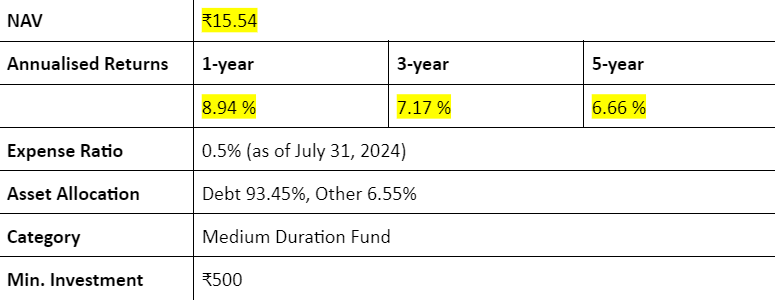

The Nippon India Strategic Debt Fund Direct-Growth is a debt mutual fund that was launched on 06/06/2014. It is offered by Nippon India Mutual Fund, and as of 30/06/2024, had assets under management worth ₹117 Crores. Since its inception, this fund has delivered 4.43% average annual returns to its investors.

It offers exposure to debt instruments like GOI Securities, Debentures, Non-Convertible Debentures, and Securitised Debt. GOI, Reliance Jio Infratel Pvt. Ltd., Pipeline Infrastructure (India) Pvt. Ltd., and Aadhar Housing Finance Ltd. are some of its top holdings.

*All return and NAV values are valid up to 28.08.2024.

Which Mutual Fund is the Right One for You?

When investing in mutual funds for SIP, it is essential to use a SIP calculator to choose the best scheme that best aligns with your risk tolerance level and minimum investment amount. You can go for pure equity funds if you are comfortable with a high-risk portfolio, or you can opt for a hybrid fund if you want to take a more balanced risk. Short-term debt funds are especially ideal for conservative investors who seek high liquidity.

In addition to the annualised returns of a fund, consider factors like past performance, sectors covered, expense ratio, and exit load and determine whether they are in line with your financial goals.

Also, it is advisable to spread out your investment over multiple funds rather than invest in one scheme to lower portfolio risk.

To expand your knowledge about financial markets, opting for online courses can be highly beneficial. At Elearnmarkets, you can learn from the best – know the ins and outs of mutual fund investing with masterclasses, self-paced courses, and mentorship programs offered by industry experts.

Try our courses today and take your investing game to the next level!

Frequently Asked Questions

- What are the top equity mutual fund schemes in 2024-2025?

SBI PSU Direct Plan-Growth, Aditya Birla Sun Life PSU Equity Fund Direct-Growth, HDFC Infrastructure Direct Plan-Growth, and ICICI Prudential Infrastructure Direct-Growth are some of the top equity mutual funds in 2024-2025.

- Which mutual funds provide 30% returns?

SBI PSU Direct Plan-Growth, HDFC Balanced Advantage Fund Direct Plan-Growth, Aditya Birla Sun Life PSU Equity Fund Direct-Growth, HDFC Infrastructure Direct Plan-Growth, and ICICI Prudential Infrastructure Direct-Growth offer more than 30% in terms of 3-year returns.

- Are SIPs completely risk-free?

Although SIPs are relatively safer than other stock market instruments, they have their fair share of risk. Their returns depend upon the performance of the underlying stocks and how well the fund managers handle asset allocations and market fluctuations.