Table of Contents

India is one of the world’s 3rd largest importers of Crude Oil. Nearly 80% of its oil requirements are met through imports. Nearly 60% of its imports constitute Crude oil making it at least 2% of India’s full-year GDP. Rising Crude affects India’s balance of payments thus increasing Fiscal or current account deficit thereby reducing the probability of rating upgrade or economic growth. The rise in Crude also affects Rupee adversely as more money flows out of the system to buy dollars for making crude payments. According to Nomura, every $10 increase in Oil prices affects India’s CAD by 0.4%. An increase in the price of crude oil means that would increase the cost of producing goods. This price rise would finally be passed on to consumers resulting in inflation. Experts believe that an increase of $10/barrel in crude oil prices could raise inflation by 10 basis points

Crude and India Effect

Global crude oil prices fluctuate on the back of geopolitical fears or overpotential demand-supply disruption or any policy stance taken by the OPEC countries (Middle East) as they are the major producers. Any economic growth or disruption in the rest of the world or any currency headwinds or any warlike situations also make crude rise. India is the world’s third-largest oil importing nation and the world’s seventh-largest economy. It is a major loser in the case of rising Crude prices and a beneficiary in the event of falling Crude prices.

Crude Usage

The byproducts of crude oil are many like lubricating oils, diesel fuel, jet fuel, petrol, chemicals, liquefied petroleum gas, waxes, polishes, bitumen for roads and roofing, fuel for ships and factories & others include plastics, alcohol, medicines, rubber, etc. Aviation fuel is the lifeline of the Aircraft Industry and is a specialized type of petroleum-based fuel used to power aircraft. The pace at which the economy is rising increases the need to import cruder to meet the country’s industrial as well as domestic requirements. Thus fluctuation in crude prices fuels Inflation as it’s used as raw material by industries to manufacture goods. The requirement for crude oil has been increasing at a rapid pace which has made India dependent on crude oil imports. The basic price of crude oil is always lesser than the import taxes make it more costly for a common man. The price of petrol or other related products increases accordingly which results in an increase in the expenditure of a common man.

Oil and its Segment

The upstream oil sector refers to the exploration and production of crude oil and natural gas. For eg. Reliance, Ongc, etc and the downstream oil sector refers to the refining of crude oil, and the selling and distribution of natural gas and products derived from crude oil for eg HPCL, IOC, etc. Tyre, Aviation, Paints, and Plastics have crude as their major raw material component. Upstream and downstream companies are fully dependent on crude for their bottom-line growth.

Check Out Also: Effect Of Strengthening Rupee

Where can you find them?

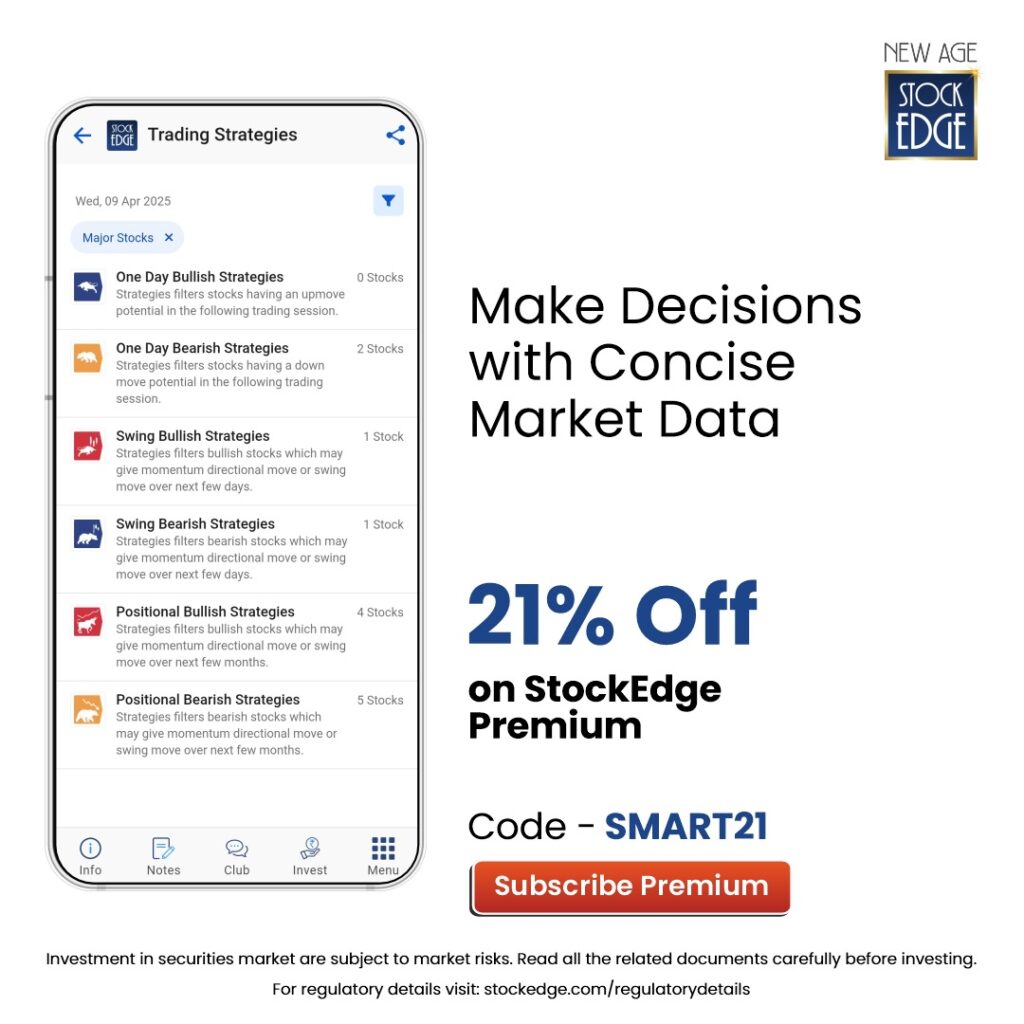

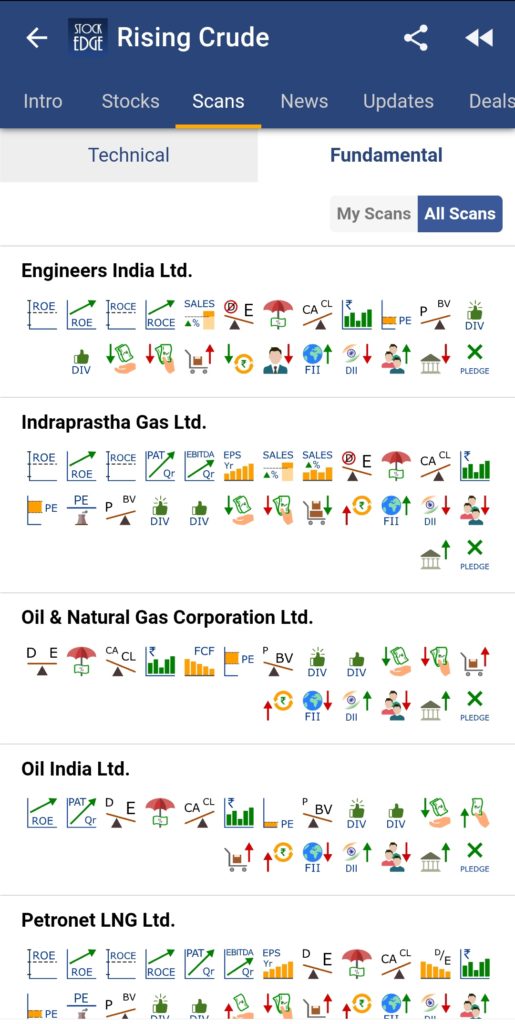

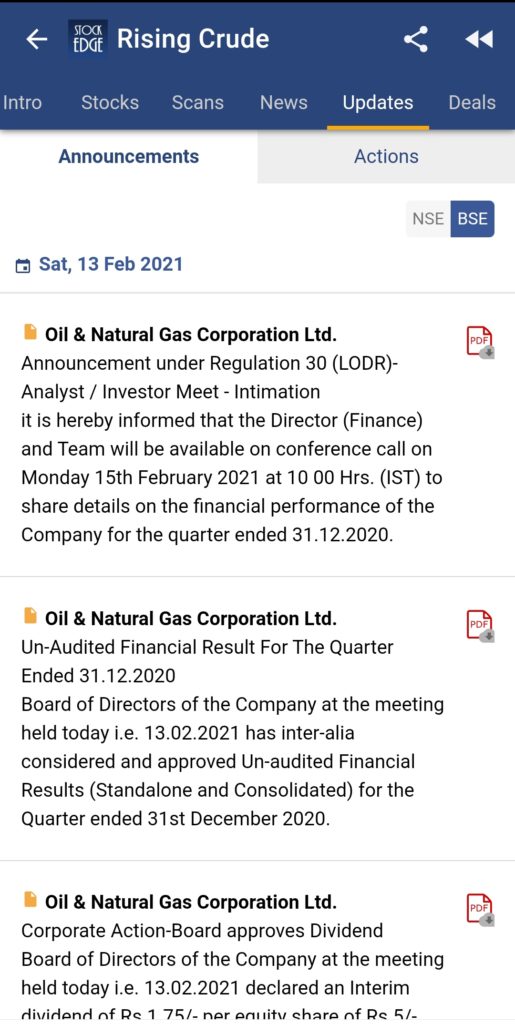

Under the Stockedge App in Premium tab, we have a ready watchlist section that outlines some themes and stocks which can get impacted from various criteria like the Government policies, the trade war, the monsoon, the rising crude, the rising rupee, etc. Here you can check out all the scans under which the stocks fall, all the news flow in the outlined stocks, and any corporate announcements or corporate actions that have taken place for the stocks outlined. You can even check out if any bulk or block deals have happened for the chosen stocks. All in all, you can have a 360-degree outlook on the theme that is playing out. Thus if any of these themes catch markets fancy then you can know which stocks can generate the best return for you.

Bottomline

If you want to know more about the stocks impacted by the same then subscribe to know more about the premium features click here: Premium Features of StockEdge App and if you haven’t subscribed to our app then click here to become a Premium member