Table of Contents

An explainer on how to use Investor Portfolios.

If you want to find where the Big Bulls of the Indian Stock Market are investing and in which stocks they are increasing and decreasing their stake then you have landed at the correct page . These Big Investors like Ramesh Damani, Rakesh Jhunjhunwala, Ashish Kacholia, Vijay Kedia know very well how to separate wheat from the Chaff and identify potential multi-baggers to stay on top of their game.

They are self-made billionaires who have survived the markets’ roller coaster rides and made a fortune through sheer common sense and hard work. They are real-life examples that show that if we follow the basic rules of the stock market, we can also achieve great heights.

To empower investors and assist them in analyzing and following the investment themes of these great investors, we created the Investor Portfolio Section, which allows you to track their portfolios.

Classification of Investors

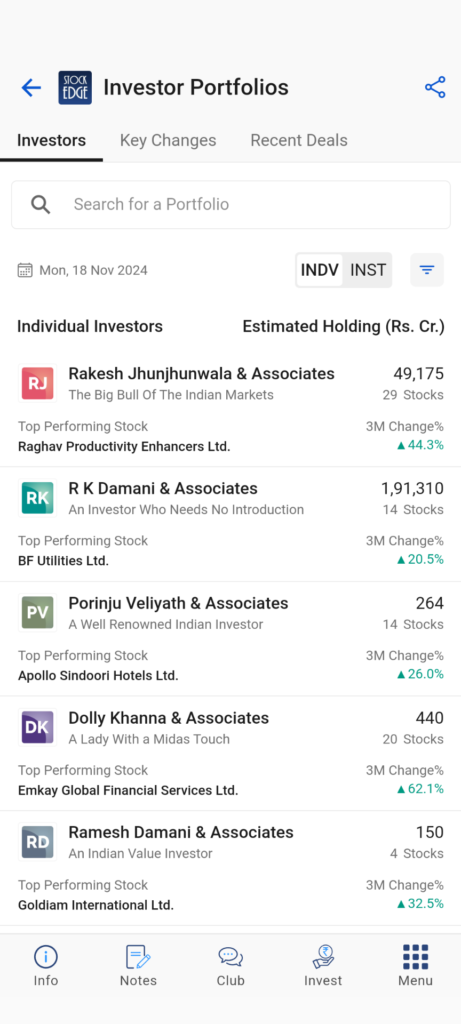

There are different types of investors, each with their own set of resources, capabilities, and motivations. And, depending on your company’s strategy, capital requirements, and size, you may prefer one type of investor over another.

This feature is intended to provide a list of well-known Individual and Institutional Investor Groups. We have assigned similar names to their respective investor groups based on family/spellings/group companies. Additionally, you can view the number of stocks held by each investors along with their estimated holdings and top performing stock in the last 3 months.

Let us explain why this was necessary. As an example: – Rakesh Jhunjhunwala invests in his wife’s and brother’s names, so we’ve included them in the appropriate investor group. So, once you’ve chosen an investor group and clicked on it, you’ll be taken to the investor’s introduction page.

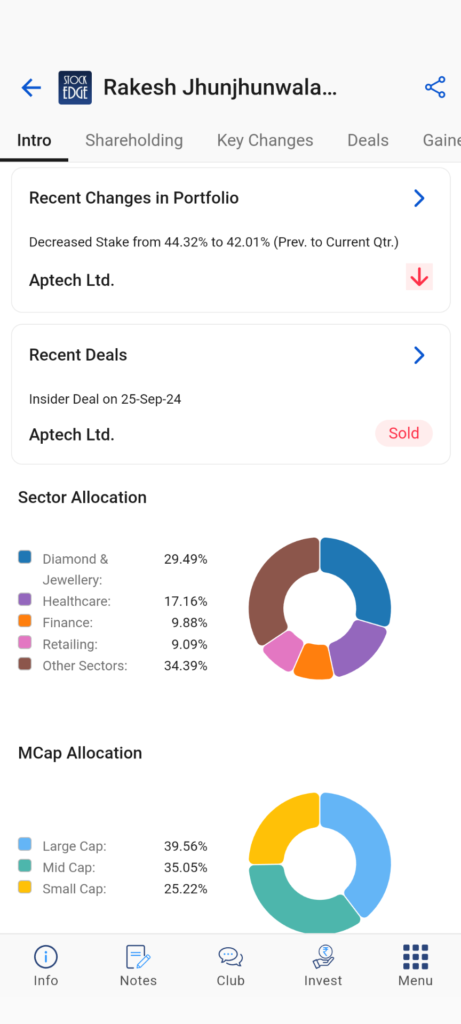

As you can see, with a quick glance of the intro page of an investor you can view the recent change and recent deals made in the portfolio. It also shows the sector allocation and market cap allocation of stocks in his portfolio.

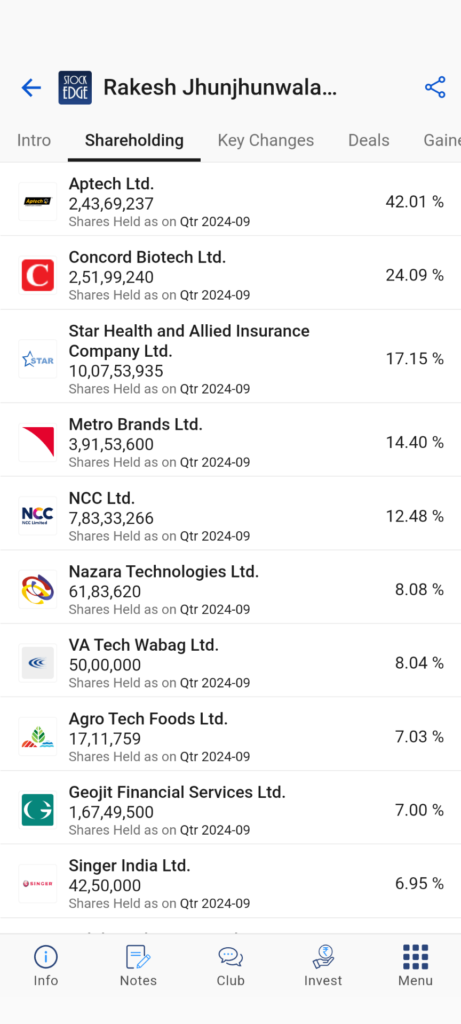

Shareholding (For eg:- Rakesh Jhunjhunwala & Associates)

This section shows the stocks with the respective quantity and the stake in percentage terms according to the latest quarter.

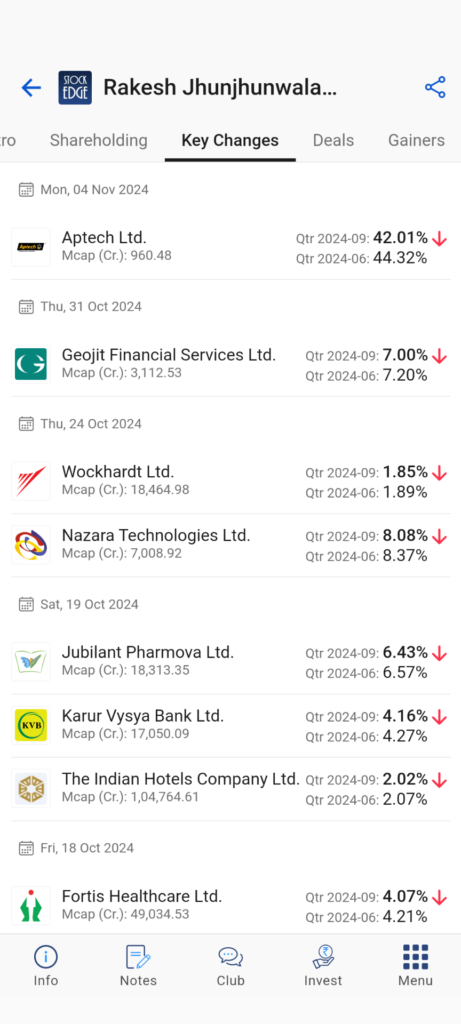

Key Changes

In this section, you will see the respective changes in investors’ shareholding. Click on any particular change in shareholding of an investor (For eg: Rakesh Jhunjhunwala) to get directed to the Key Changes tab of that respective investor, where you will get all the changes made by that investor. It is Updated End of the Day.

One thing to keep in mind is that following the portfolios of successful investors like Rakesh Jhunjhunwala is a good idea. Investing blindly in the stocks in which these Big Bulls are investing, on the other hand, could land you in hot water. So, before you invest, please conduct a thorough examination of the stocks. After all, even the Big Bulls like Rakesh Jhunjhunwala are human and can make mistakes.

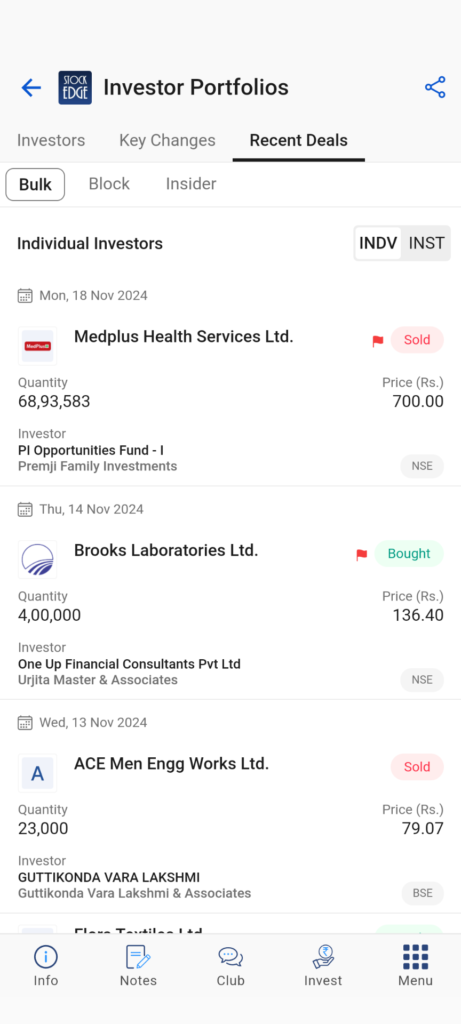

Recent Deals

Here, you will get all the recent bulk deals made by individual and institutional investors like Rakesh Jhunjhunwala, Ashish Kacholia, BNP Paribas Investments, with the most recent deals being at the top.

Clicking on any deal will take you to the bulk deals section of the respective investor, wherein you can track all the bulk deals made by the investor.

In the deals (Bulk/Block/Insider) section, you get to see the actual name of the investor on behalf of whom the trade has been made with the name of the exchange, quantity and price.

This data is also updated End of the Day.

Well, that’s all for this blog. Using these sections along with Investment Ideas and Investment themes by our StockEdge Research team can help you make good returns; we hope this blog is helpful to our esteemed readers. If you’ve any questions, feel free to comment below. We are eager to help you.

You can also visit our Edge Report Section by subscribing to our StockEdge premium plans where we have detailed analysis on stocks.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing and Trading!