Table of Contents

StockEdge has this unique feature of Combination Scan, where one can mix and match different types of Scans be it Technical, Fundamental, Price, etc. to build our own set of Investing strategies.

A combination scan helps in filtering stocks on the basis of multiple criteria, and greatly enhances the utility of scan feature but if we mix it with say Technical or Price Scans, then it would help us to bring out only those stocks which meet the defined criteria.

As we are right now in the middle of turmoil, let’s screen out the companies which have a sound fundamental and are trading around the 52-week high zone.

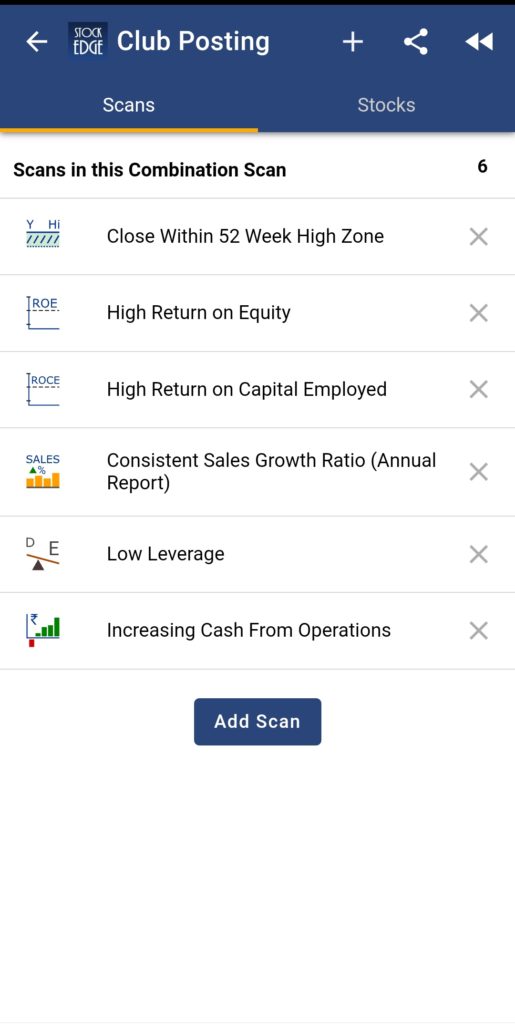

The first step is to go to the “My Combination Scan” tab and save a Scan name. In my case, I have named it as “Club Posting”.

Then, the next step is to click on the “+” sign on the top right-hand corner, to bring out the names of the Scans. Here, we would start building the Fundamental scan first.

Combination Scan Steps:

Step 1:

Clicking on the “Fundamental Scan” tab, we would get a list of the variables available. So, the first thing for a good fundamental company is to have good “ROE” and “ROCE”.

So, as it is related to the profitability of the company, we can find the “Profitability Scans”. We would want a company having a track record of high ROE and ROCE, so we will select “High ROE” and “High ROCE” from the list.

Step 2:

Now for good company Topline growth is a must as it shows that it is able to increase the market share of the product or services. There can be cases where topline is growing but market share is decreasing this happens when the Industry growth rate is higher than the company’s growth rate.

So, we need to put a scan on Sales growth.

Just below the “Profitability Scan”, we can find the “Turnover Scans”. Under that, we have 4 different options related to Sales growth. We would want a company which has consistent high sales growth ratio.

So, we will click on “Consistent Sales Growth Ratio (Annual Report)”. This Scan means that on a yearly basis, the companies have a high sales growth ratio.

Step 3:

Now, debt forms an important part of any company, but during these times when everywhere there is a threat of revenue loss due to lockdowns, we would want a company with low leverage, which means companies with low Debt to Equity ratio.

For that, we will go to the “Solvency Scans”. From there it is clear from the name that we have to choose “Low Leverage” Scan.

Or we can also choose, “Moderate Leverage” but with that, we have to also bring in “High-Interest Coverage Ratio Scan” as for servicing the debts the company must have enough earning capacity. In my case, I have decided to be defensive on this matter and chose low leverage to be a factor.

Step 4:

After scanning the earning capacity of the companies, we need to find companies which have a consistent Cash generation capability, as we all know that ‘Cash is king’. During these tough times, the excess cash will help the company pay off the fixed costs. So, we need to find out companies which have been generating cash from operations consistently.

Just below the Solvency Scans tab, there is a “Cash Flow Scan” tab. Upon clicking that we can find the option “Consistent Cash from Operations”. This scan would bring us the companies which have generated cash from operations consistently over the past 5 years.

Step 5:

The above 4 Scans have been completely related to the Fundamentals of a company. There would be many companies which would fall in the above few categories. Now, let’s filter the companies which would satisfy the above fundamental criteria and also would be trading in the 52-week zone.

For that, we need to go to the “Price Scans”. Under Price Scan, we have to select the option “Close within the 52-week high zone”. These would show the companies which have their closing prices in the 52-week high zone.

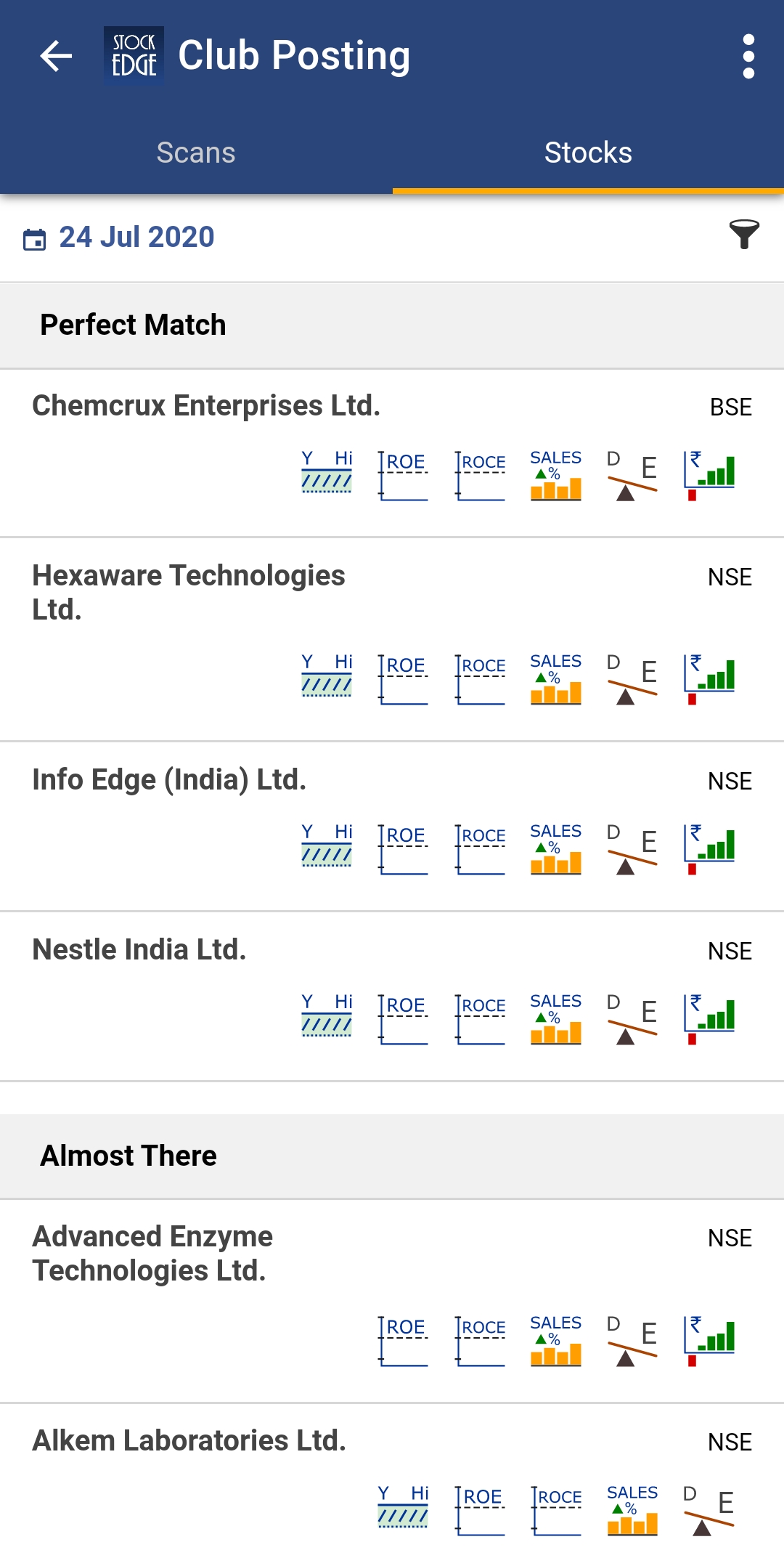

Upon completing all the above steps, now we can see whether there are any stocks which have actually satisfied the criteria. Under the “Stocks” tab, we can see there will be 2 bifurcations- ‘Perfect Match’ & ‘Almost there’.

- ‘Perfect Match’ as the name suggests gives the names of the stocks which have satisfied all the given criteria.

- ‘Almost There’ would show the companies which have not satisfied one or two criteria. Just beside the names of the stocks, you can find the signs of the parameters which has matched your given criteria. By checking that you can analyze as to which criteria have not been matched.

For example, Abbott India is under ‘Almost there’ tab. Out of 6 parameters, only 1 parameter does not meet. From the signs given on the right-hand side, you can see that it does not have “Low Leverage” sign on it, which means the company does not meet the criteria of low leverage.

Just like that, you can also check the companies which are meeting the criteria and the ones which are not.

Please note that these scans just give out the companies which meet the criteria. It is advisable that we do further research ourselves or ask the experts.

For that, you can also join StockEdgeclub where we have Technical & Fundamental Analysts resolving your stock queries on a real-time basis along with many more features.

Conclusion:

Just by the help of these, you can prepare your own combination scans and filter companies according to your strategy. These help you to save a lot of time as compared to manual screening for 5000 companies. The first step is to start with any idea you want. You can mix and match using your own criteria to find out the companies. Just like that, you can use your own thinking and ideas to screen out companies.

Hope now you can generate ideas for yourself and create wealth from Investment.