Table of Contents

Company financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. Company financial statements include:

- Balance sheet

- Income statement

- Cash flow statement.

Investors and financial analysts rely on financial data to analyze the performance of a company and make predictions about its future direction of the company’s stock price. One of the most important resources of reliable and audited financial data is the annual report, which contains the firm’s financial statements. The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential.

Financial auditing refers to an accounting process applied in business. The process involves using an individual body for evaluating the financial transactions and statements of a business. The ultimate purpose of financial audit is presenting an accurate amount of the business transactions of a company.

Audited Financials

Audited Financial Statements are the company financial statements provided by a business, person or an entity after being thoroughly checked and governed by an external individual or institution for providing accurate and reliable information to their shareholders and investors.

Unaudited Financials

Financials released by the organization that are not scrutinized or verified by an external independent auditor. Unaudited financial statements show the same financial data as audited ones. But it is quicker and cheaper to draw them up than to go through the audit process and some of the numbers might differentiate as these are recorded as per the company’s management discretion.

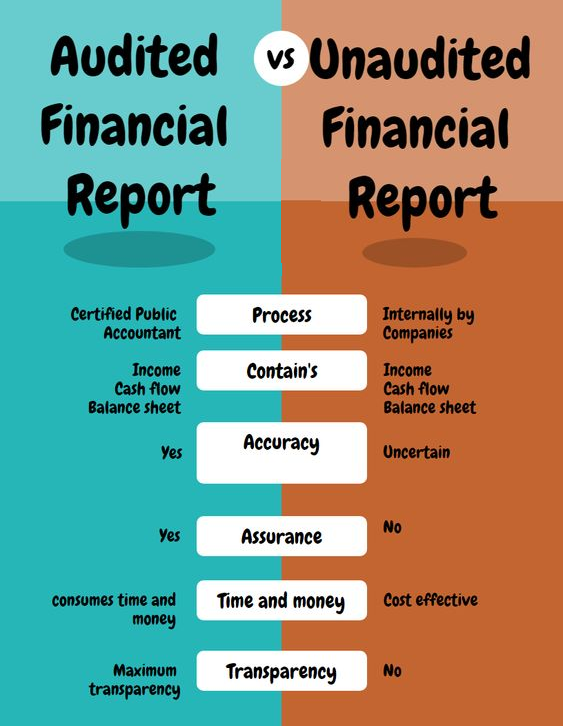

Key differences between Audited Financials and Unaudited Financials Statements:

- Only Annual company financial statements are audited whereas quarterly and half yearly statements are unaudited.

- Audited Financial Statements are reported by the company in its annual report for each year whereas unaudited financial statements are reported by the company during the whole year as per the respective period.

- Audited company financial statements are more well scrutinized and verified than the unaudited ones which acts as a confirming and reliability factor for the investors and shareholders.

- Unaudited results for respective periods are mainly shared by the company just for the sake of providing a brief overview of the current period’s outlook and how the company is operating in the current period for letting the stakeholders know about the whereabouts of the company.

- Audited financials are more costly and are recorded as per the company laws whereas unaudited ones are cheap and recorded as per the management’s discretion.

How do we use it in the StockEdge App?

In StockEdge App, we show both the audited and unaudited financial statements for each stock as and when released by the company. We have two different tabs for the respective showcase of data : Fundamentals And Financials

See also: Understanding the Importance of creating Fundamental Scans

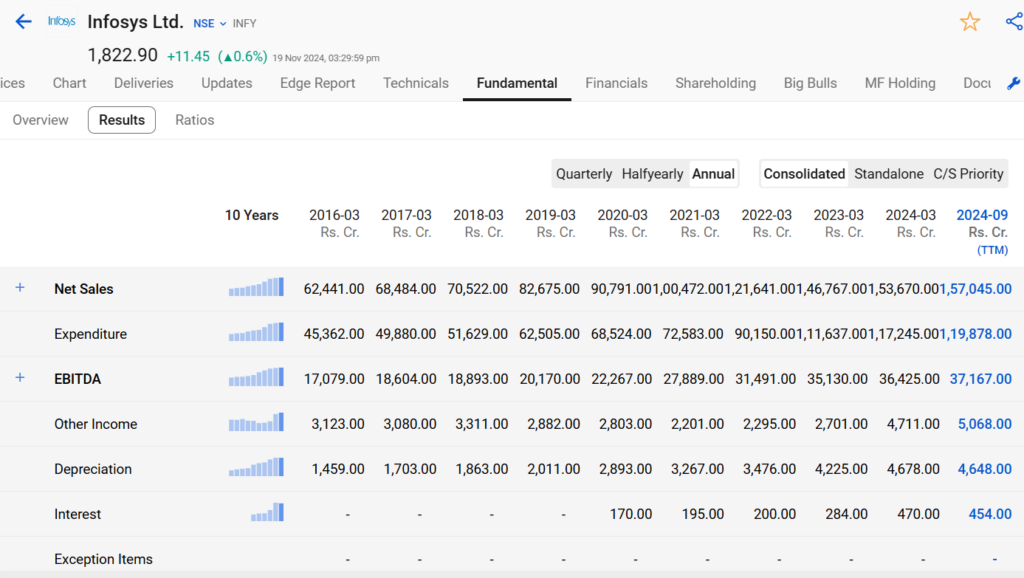

Fundamental Tab :

In StockEdge App, there is a fundamental tab for each stock which is furthermore divided into three sections : Overview, Results and Ratios. In the Results section, the unaudited Profit and Loss Statement of the company is shown for the quarterly, half yearly and annual periods. Both Consolidated and Standalone data can be seen via selecting the desired one with respective period in the drop down box.

In the following image you can see the Fundamental tab of Infosys Ltd displaying the unaudited results for the last 10 years and as of today this is the share price of Infosys Ltd.

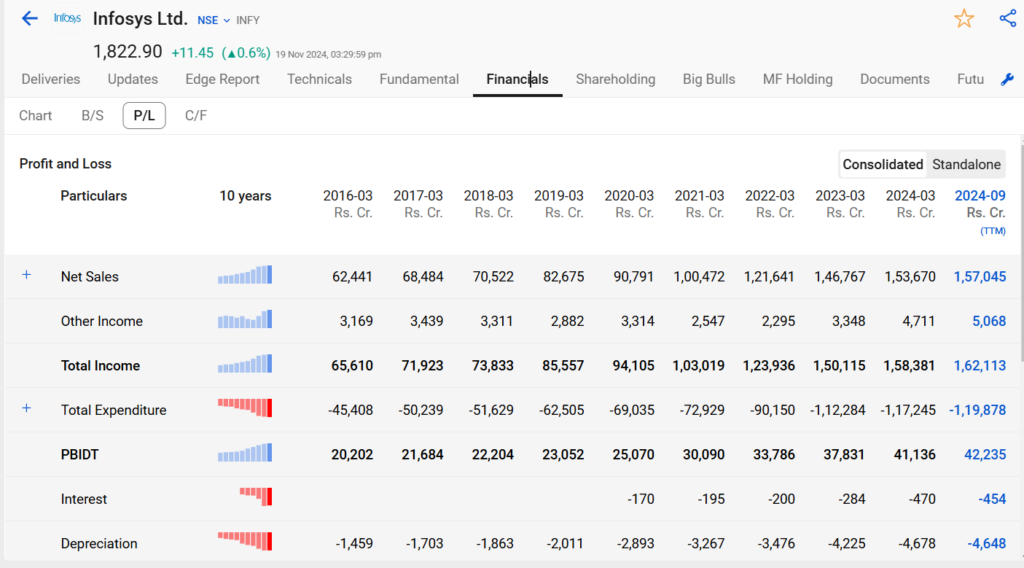

Financials Tab :

In StockEdge App, there is a Financials Tab for each stock, consisting of 4 sub tabs: Chart, B/S, P/L and C/F. These sub tab display the Financials of a stock in a graphical, and tabular form respectively for each specific company financial statement. This tab shows the audited data in Balance Sheet, Profit and Loss and Cashflow Statement which is directly extracted from the company’s annual report as and when published by the same. All line items and heads are shown in the best interest of the users via grouping of heads and showing 9 years of data for better understanding and evaluation of the company financial statements.

In the following image you can see the Financials tab of Infosys Ltd displaying the audited financials for the last 10 years.

Read more about Financial Statements on Elearnmarkets blog.

Bottomline

Data in the Fundamental and Financial tab can differ as explained above, one being audited and the other being unaudited. To access the results immediately after it is published you can refer to

Fundamental tab of stocks and to access Audited results refer to the Financial tab.