Table of Contents

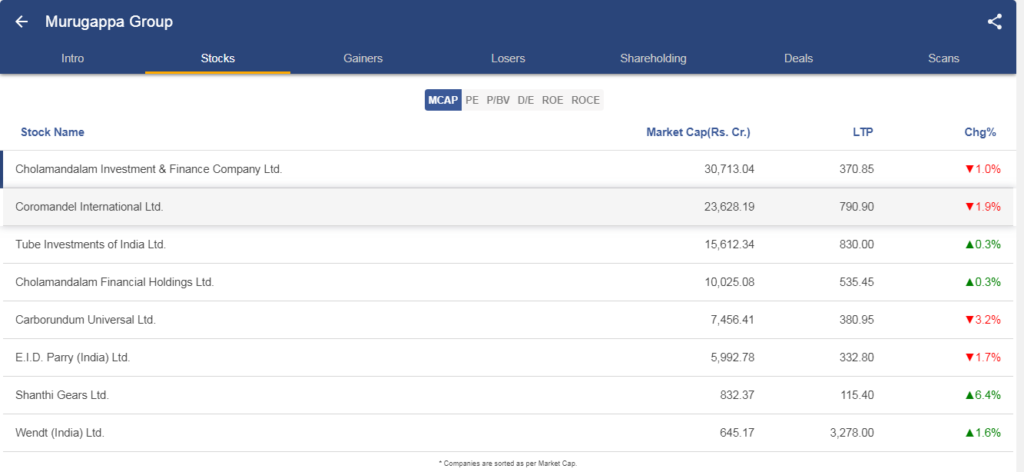

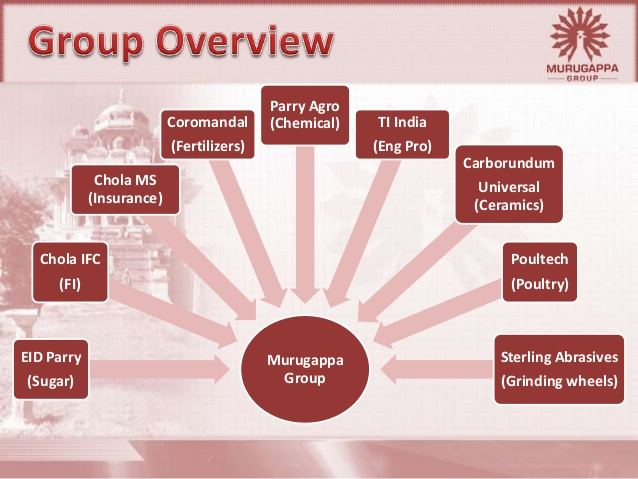

Established in 1900, the Murugappa Group is one of India’s leading business houses. Headquartered in Chennai, the major companies of the group include Carborundum Universal Ltd., Cholamandalam Financial Holdings Ltd., Cholamandalam Investment and Finance Company Ltd., Cholamandalam MS General Insurance Company Ltd., Coromandel International Ltd., Coromandel Engineering Company Ltd., E.I.D. Repel (India) Ltd., Parry Agro Industries Ltd., Shanthi Gears Ltd., Tube Investments of India Ltd., and Wendt (India) Ltd.

The Murugappa Group of Companies has a wide geographical presence all over India and spanning 6 continents. They are market leaders in served segments including Abrasives, Auto Components, Transmission systems, Cycles, Sugar, Farm Inputs, Fertilisers, Plantations, Bio-products and Nutraceuticals, the Group has forged strong alliances with leading international companies such as Groupe Chimique Tunisien, Foskor, Mitsui Sumitomo, Morgan Advanced Materials, Sociedad Química y Minera de Chile (SQM), Yanmar & Co. and Compagnie Des Phosphat De Gafsa (CPG).

Eminent brands like BSA, Hercules, Montra, Mach City, Ballmaster, Ajax, Parry’s, Chola, Gromor, Shanthi Gears and Paramfos are from the Murugappa stable. The Group encourages a domain of polished skill and has a workforce of more than 51,000 representatives.

History

The tale of the Murugappa Group is a tradition of business that began in 1934 and lives right up ’till today. The excursion started in 1898 when 14-year-old Murugappa Chettiar went with his uncle as an understudy to the British area of Burma. He inevitably set up his own financial practice, with his familiarity with Burmese giving him an unprecedented edge. By 1914, he had tied down his inflexible stance’s as second just to The Imperial Bank of Burma.

The extraordinary despondency, World War and developing slant against outsiders cast a shadow on the fate of the business in Burma. Utilizing sharp premonition, Dewan Bahadur had the family reserves moved to India before the Burmese government took over unfamiliar possessions. The sources of the group in India can be followed back to this judicious demonstration. After gaining strong recognition in finance, Chettiar diversified into textiles, rubber plantations, insurance and stockbroking between 1915 and 1934. He also took his businesses to Malaysia, Vietnam and Sri Lanka. The Group has drawn from its legacy and completed authoritative and pioneering changes with straightforwardness; and was one of the first to effectively progress from a family-oversaw gathering to an expertly oversaw corporate house.

Before Independence, the Murugappa Group fortified its essence in the nation, generally in the south. It struck out in various ways, envisioning the business needs of the time. The Murugappas constructed steel safes, ran a sandpaper plant, started an insurance firm and a rubber plant. The differing intrigues established the framework for outstanding amongst other run and biggest family-possessed organizations in South India.

See also: TVS Group- Breaking the Stereotypes – Serving Consumer Delight

Core Company Segments

Coromandel International Ltd. –

Coromandel International Limited, India’s second largest Phosphatic fertilizer player, is in the business segments of Fertilizers, Specialty Nutrients, Crop Protection and Retail. The Company manufactures a wide range of fertilizers and markets around 4.5 million tons making it a leader in its addressable markets. In its endeavor to be a complete plant nutrition solutions Company, Coromandel has also introduced a range of Specialty Nutrient products including Organic Fertilizers.

As of today’s date, this is Coromandel International share price.

Cholamandalam Investment and Finance Company Ltd. –

Cholamandalam Investment and Finance Company Limited (Chola), incorporated in1978 as the financial services arm of the Murugappa Group. Chola commenced business as an equipment financing company and has today emerged as a comprehensive financial services provider offering vehicle finance, home loans, home equity loans, SME loans, investment advisory services, stockbroking and a variety of other financial services to customers.

As of today’s date, this is Cholamandalam Investment and Finance Company share price.

Tube Investments of India Ltd. –

In 1959, Tube Investments of India (TII) was formed by merging the TI Cycles of India and Tube Products of India. It was the Group’s first of many successful Joint Ventures and also its first foray into large scale manufacturing. In 1962, the company saw the potential to leverage its engineering skills to address the market for roll-formed metal products.

As of today’s date, this is Tube Investments of India share price.

E.I.D. Parry (India) Ltd. –

E.I.D. – Parry (India) Limited (E.I.D. Parry) is a listed company engaged in the business of Sugar and Nutraceuticals. Founded in 1788, ‘Parry’ has been a household name for over 225 years. The Company holds the distinction of setting up India’s first sugar plant at Nellikuppam in 1842 and even today continues to pioneer new paths in each of its businesses. E.I.D. Parry is a pioneer and world leader in organic spirulina and microalgal products in the Nutraceuticals space.

As of today’s date, this is E.I.D. – Parry share price.

Carborundum Universal Ltd. –

Coromandel International Limited, India’s second-largest Phosphatic fertilizer player, is in the business segments of fertilizers, specialty Nutrients, crop Protection, and retail. The Company manufactures a wide range of fertilizers and has the capacity to manufacture over3.5 million tons of Phosphatic fertilizers and 1 million tons of single super phosphate, making it a leader in its addressable markets among the other Fertilizer Manufacturers in India. Coromandel has wandered into the retail business and has set up near 800 country retail focuses in the States of Andhra Pradesh, Karnataka, and Telangana.

As of today’s date, this is Carborundum Universal share price.

Conclusion

The Murugappa Group and family continue to build on the example of philanthropy initiated by Dewan Bahadur. His decision to set aside a major portion of his wealth for charitable causes, starting in 1924 when he built a hospital in his home village, commenced a tradition of helping, guiding and supporting others in communities in which the companies do business.

The family has taken steps towards articulating what they stand for by developing their Corporate Values and Beliefs. In the last decade, the Group has looked at its portfolio of businesses with an eye towards future growth. Although many of the Group’s long-term companies are in low margin, old economy manufacturing, there has been a continued focus on investing in and maximising research for the good of the business. The value of supporting research for product innovation is a priority. The group also seeks to balance and reduce its portfolio of companies to the six business areas it knows well and in which it holds leadership positions.

Watch the entire video on the Journey of Murugappa Group here:

Know more about Mahindra Group by using the Business Houses tab in the StockEdge Web

Business Houses are one of the paid tools offered by the StockEdge App

Check out StockEdge Premium Plans.

The article gives enough details of murugappa grp . But it needs a correction . For Carborundum universal ltd u have given details of coromandel fertilizer . 🌸🙏🙏🌸

Very good application👉📱

We are glad you liked the content. Keep following us on Twitter to read more such Blogs!