Read about Hindalco Industries and 4 other stocks below:

The stock of Hindalco Industries Ltd., the flagship company of the Aditya Birla Group, rallied after the company released its July-September quarter results, boosting investor sentiment. This positive momentum was reflected in the broader market, as Hindalco’s performance contributed to the gains of the Nifty 50.

For the quarter ended September 30, Hindalco reported a multifold increase in consolidated profit after tax (PAT) to Rs 3,417 crore.

The results were driven by an exceptional performance by Novelis and the India business, which was supported by favorable macroeconomics, a strategic product mix, higher volumes, and operational stability.

Hindalco Industries reported a consolidated PAT of Rs 387 crore in the previous fiscal year, according to a BSE filing. According to the filing, its consolidated revenue from operations increased to Rs 47,665 crore in July-September 2021, up from Rs 31,237 crore in 2020 and as of today’s date, this is Hindalco Industries share price.

The company stated in a statement, “Hindalco Industries reported its highest net profit in Q2 FY22, outperforming all previous quarterly results. The company’s consolidated PAT increased 783% year on year to Rs 3,417 crore, a nearly nine-fold increase.”

According to the statement, Novelis continued to report a high quarterly Ebitda as a result of an increase in demand for innovative and sustainable aluminum products, high recycled contents, and outstanding operational performance.

This is despite the challenges in the automotive sector caused by a global semiconductor chip shortage, according to the report.

“Our record-breaking performance this quarter is an affirmation of our fully integrated business model, which powers our performance in both upstream and downstream markets,” said Hindalco Industries Managing Director Satish Pai. Pai went on to say that Hindalco had outstanding results in all business segments. “The Indian aluminum business set a near-global industry record by achieving an Ebitda margin of 42%,” he said.

In the second quarter, the copper business achieved its highest-ever quarterly sales, with both smelters operating at full capacity to meet the robust market demand.

Novelis achieved a record Ebitda per tonne once again, owing to higher volumes and favorable metal prices, he said.

“Our product-rich portfolio strategy continues to produce results in a variety of market scenarios.” It motivates us to continue expanding our downstream asset base and market footprint.

“The recent Ryker copper rod unit acquisition is consistent with our downstream Capex (capital expenditure) plans, which we announced earlier this year.” We also continue to advance our ESG (environment, social, and governance) agenda and goals in order to meet our sustainability vision of net neutrality, water positivity, zero discharge, and other initiatives,” he added.

According to the company, the record results were driven by an outstanding performance by Novelis as well as the India business, as well as a sharp recovery in all relevant markets, improved macros, and higher volumes.

The stock rallied after the company reported a consolidated profit after tax (PAT) of Rs 113 crore in the September quarter (Q2FY22), owing to strong operational performance.

The auto parts and Equipment company reported PAT of Rs 25 crore in the June quarter (Q1FY22) and Rs 100 crore in the previous year’s quarter (Q2FY21).

The company’s revenue from operations increased 32% sequentially and 30% year on year (YoY) to Rs 2,114 crore in Q2FY22. EBITDA margin increased 162 basis points year on year to 10.8% for the quarter, up from 9.2% in the previous quarter. In the same period last year, the EBITDA margin was 14% and as of today’s date, this is Minda Industries share price.

Despite the challenges posed by Covid-19, semi-conductor shortages causing production disruptions, commodity pricing pressures, and fuel price increases, Minda Industries delivered another stellar performance, according to management.

The management is confident that the uptrend in growth trajectory will resume, owing to an increase in demand in key markets, a good crop season, and an expected easing of the Covid-19 and semi-conductor situation globally.

“Additionally, with our engine-agnostic portfolio supporting regulatory developments in the country toward electric vehicle (EV) adoption, we firmly believe we are poised to capitalize on these factors and drive long-term growth.” It added.

In the September quarter, the company’s net profit nearly doubled to Rs 33.91 crore (Q2FY22). In Q2FY21, the company that manufactures and trades textile garments made a profit of Rs 4.43 crore. In the June quarter, it had a net loss of Rs 10.18 crore (Q1FY22)

Revenue from operations more than doubled, or increased 142% year on year, to Rs 238 crore from Rs 98.25 crore in the previous quarter. EBITDA increased 686 basis points to 22.1%, up from 15.2% in the previous year’s quarter and as of today’s date, this is Monte Carlo Fashions share price.

During the quarter, the company experienced strong volume growth, owing primarily to the economy’s opening up as a result of a reduction in COVID 19 cases and the removal of lockdown restrictions in the majority of geographies.

The company expanded its retail presence in India by opening 12 new EBOs during Q2FY22, bringing the total number of EBOs in India to 300 across 20 states and four union territories. In addition to focusing on retail network expansion, the company accelerated its digital and omnichannel channels during the quarter.

Meanwhile, the board of directors has authorized the formation of a wholly-owned subsidiary of the company. The incorporation of the wholly-owned subsidiary will capitalize on the growth opportunities in the “Home Textiles” category, specifically Rugs and Mink Blanket Fabric, and will assist the company in becoming more agile and customer-focused.

Under the umbrella brand “Monte Carlo,” Monte Carlo is a leading branded apparel company that offers a comprehensive range of woolens, cotton, cotton blended, knitted, and woven apparel for Men, Women, and Children.

The stock rallied after MSCI, a provider of global indexes has included Zomato in its MSCI Global Standard India Index. The changes will go into effect on November 30, 2021.

Zomato, the country’s largest publicly traded food tech company, surprised Wall Street with a strong top-line performance in the third quarter. Revenue for the company increased 140% year on year (YoY) thanks to a 158% increase in gross order value (GoV) in the Indian food delivery business, as of today’s date, this is Zomato share price.

In the September quarter (second quarter, or Q2), the consolidated net loss increased by 87% to Rs 430 crore from the previous year. Its losses increased by 21% when compared to the previous quarter. “This was due to investments in the growth of our food delivery business,” said Zomato Founder and CEO Deepinder Goyal,

Three specific reasons to be specific are increased spending on branding and marketing for customer acquisition, increased investments and a growing share of our business in smaller/emerging geographies (which are currently less profitable than more mature cities), and increased delivery costs due to unpredictable weather and rising fuel prices.”

The stock rallied after the company reported 15.67% higher total sales on a consolidated basis for the Sep-21 quarter, totaling Rs.603.80cr. On a sequential basis, revenues increased by 9.69% compared to Rs.550.48cr in the Jun-21 quarter.

Among verticals, revenue from rating services increased by 12.1% to Rs154 crore, while revenue from research services increased by 20.83% to Rs382 crore. The revenue from advisory services was also higher, and as of today’s date, this is Crisil share price.

This includes the outcomes of Greenwich Associates LLC. CRISIL has declared a dividend of Rs.9 per share.

Net profits for the September-21 quarter increased by 25.308% to Rs.112.86cr. On a sequential basis, net profit increased by 11.96%.

The operating income from rating services increased by 24% year on year to Rs64cr, while operating profits from the research services vertical increased by 136% year on year to Rs84cr, triggering profit growth in the quarter.

The net profit margin for the September-21 quarter was 18.69%, up from 17.29% in the September-20 quarter and 18.31% in the June-21 quarter.

Read our latest blog on The Paytm IPO

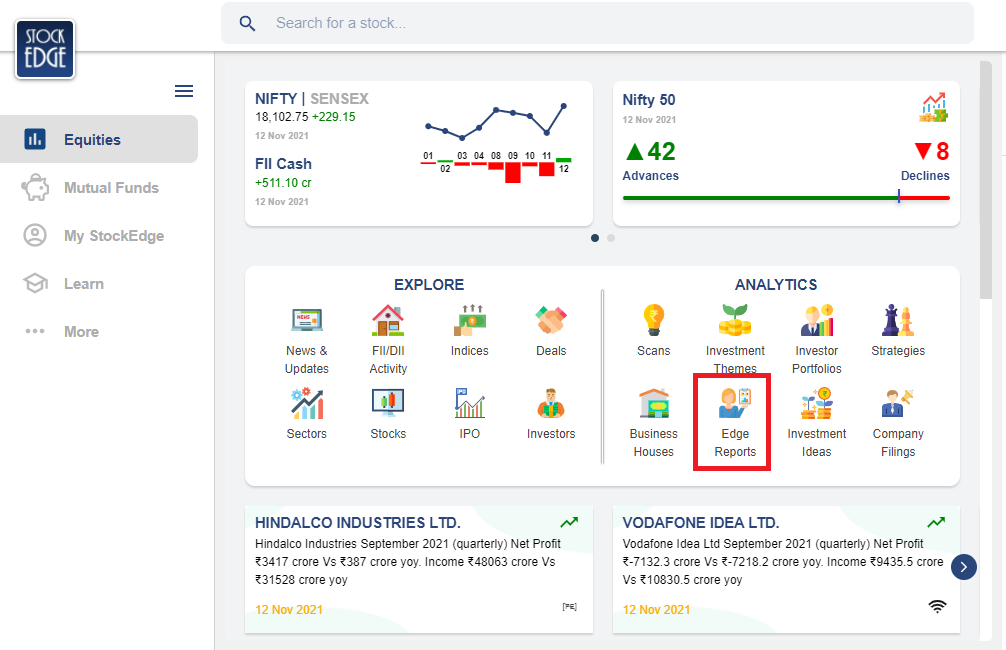

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Good analytical research