Among stock trends, check out the top trending stocks identified by the StockEdge analysts.

Read about Nykaa and 4 other stocks below:

FSN E-Commerce Ventures (Nykaa) made a strong listing debut on the Bombay Stock Exchange, with its shares trading at Rs 2,001, a 78 percent premium to its issue price of Rs 1,125 per share. Following the listing, Nykaa shares touched a high of Rs 2248.10, a 96.30 percent increase over the issue price.

The Rs 5,300-crore initial public offering (IPO) of FSN E-Commerce Ventures, which operates Nykaa, drew strong investor interest and was subscribed to 82.4 times. The institutional investor portion was subscribed to 92 times, the wealthy investor portion 112.5 times, the retail investor portion 12.3 times, and the portion reserved for employees 1.8 times. As of today’s date, this is the share price of FSN E-Commerce Ventures (Nykaa) Ltd.

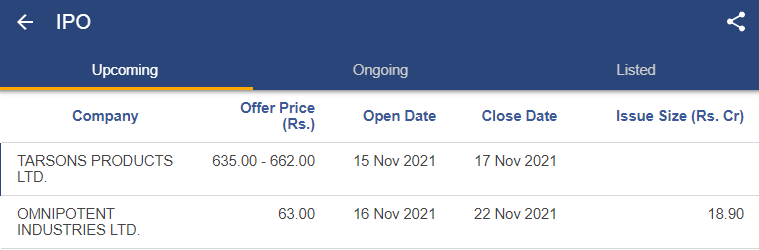

One can check for the upcoming IPO’s in detail, in the IPO section of the app & website.

The proceeds of the new issue will be used to improve brand visibility and awareness, repay debt, and open retail stores and warehouses.

FSN E-Commerce Ventures, also known as Nykaa, is a consumer technology platform that provides consumers with a content-led, lifestyle retail experience through its diverse portfolio of beauty, personal care, and fashion products, including their own brand products.

Nykaa is India’s largest specialty beauty and personal care platform in terms of product value sold in FY21, as well as one of the fastest-growing fashion platforms in terms of GMV growth. Among India’s leading online beauty and personal care platforms, the company has the highest average order value (AOV).

The stock has been rallying after the company posted a strong performance in the July-September quarter (Q2FY22) and gave a strong outlook for the future. As of today’s date, this is KPIT Technologies share price.

The company stated that its revenue growth forecast for FY22 has increased to 18 to 20%, while its, Ebitda margin has been revised to 17.5+%.

According to the company’s management, the company is experiencing a robust demand environment, which is resulting in strong order inflow and pipeline. The company’s revenue and profit forecasts for the year have been raised as a result of improved business visibility.

Meanwhile, despite higher-than-average increments during the quarter, the July-September quarter (Q2FY22) marked the fifth consecutive quarter of margin expansion. In Q2FY22, the company’s Ebitda was 17.6%, compared to 17.3% in Q2FY21. Net profit for the quarter increased by 134% year on year and 8% quarter on quarter (QoQ) to Rs 65.1 crore. In constant currency (CC), revenue increased by 4.8 percent year on year to $80.36 million.

According to KPIT Technologies, sequential CC growth was broad-based within geographies and across commercial vehicles and passenger cars. “During the quarter, the Electric Powertrain and Diagnostics practices led growth. Although other income was lower due to unfavorable currency movements, sequential net profit growth was aided by higher operating margins, in-line depreciation, and a higher yield on cash “.

The stock rallied after the company posted a strong performance in the July-September quarter (Q2FY22).

As of today’s date, this is HEG share price.

Q2FY21 reported a consolidated net loss of Rs 15.36 crore and a profit of Rs 56.77 crore.

Revenue from operations increased by 60% year on year (YoY) to Rs 517.56 crore, up from Rs 322.88 crore in the previous fiscal’s corresponding quarter. It earned Rs 167.28 crore in earnings before interest, tax, depreciation, and amortization (Ebitda) compared to a loss of Rs 25.46 crore in the previous quarter.

HEG stated that the company had previously undertaken an expansion project to increase existing capacity from 80,000 tonnes to 100,000 tonnes and that the same is currently underway. Due to Covid, there were a few months of delay, but management expects the expansion project to be completed in the October-December 2022 quarter and the company to be ready for commercial production in early 2023.

The shares of Sandur Manganese & Iron Ores Ltd. were trading at Rs.2113.65, up by 12% in today’s trading session.

The stock rallied after the company posted a strong performance in the July-September quarter (Q2FY22).

As of today’s date, this is Sandur Manganese & Iron Ores Ltd share price.

In the quarter ended September 2021, sales increased 294.72 percent to Rs 565.68 crore, up from Rs 143.31 crore in the previous quarter ended September 2020. Sandur Manganese & Iron Ores’ net profit increased 342.25 percent to Rs 181.94 crore in the quarter ended September 2021, compared to Rs 41.14 crore in the previous quarter ended September 2020.

Sandur Manganese & Iron Ores (SMIORE) is the Sandur Group’s flagship company. The company’s primary activities include the mining of the finest low grade, low phosphorous, manganese, and iron ores, the production of ferroalloys, and the management of hydroelectric power generation.

The shares of Mahindra & Mahindra Ltd. were trading at Rs.919.65, up by 3.0% in today’s trading session.

The stock has been rallying after the company reported a more than eight-fold increase in its standalone profit after tax (PAT) of Rs 1,432 crore for the second quarter ended September 30, 2021 (Q2FY22), owing to strong sales. In Q2FY21, it reported a standalone PAT of Rs 162 crore. As of today’s date, this is Mahindra & Mahindra share price.

The company’s revenue for the second quarter increased by 15% to Rs 13,305 crore, up from Rs 11,590 crore the previous year. M&M reported a surge in second-quarter profit, aided by strong export volumes while mitigating some of the impacts of a severe global semiconductor shortage that has plagued the Indian automaker.

However, EBITDA profit fell 19% year on year to Rs 1,660 crore, while margins shrank 527 basis points to 12.5% from the previous year’s quarter due to higher operational costs.

“Commodity prices have had an impact on margins in both the Auto and Farm businesses, but a focus on cost management and optimization has helped mitigate some of the impacts,” management said. The management expects to maintain the volume growth momentum from Q3 onwards, thanks to the improved availability of semiconductors. According to management, the company is well-positioned to deliver very strong growth and returns through an exciting new product portfolio.

Read our latest blog on The Paytm IPO

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Your prediction is sure shot sir….nice ,keep posting sir