Table of Contents

Evolution Of Paytm:

It all began in 2010 when Vijay Shekhar Sharma started Paytm as a digital wallet-based platform when people used it for mobile top-ups. A few years later they started utility payment services like paying electricity bills, and that was the time when Paytm started buzzing all around. And that was because they used to give huge cashbacks.

Years later, with the advancement of technology & since India’s demonetization back in 2016, “Paytm Karo” has become the norm for almost every Indian. Today Paytm has evolved into a comprehensive payments ecosystem, covering payments, credit, insurance, merchants, wealth management, e-commerce services, and so on.

The payments ecosystem includes payments (wallet/UPI), FASTag, bill payments, money transfers, and mobile top-ups. On the Paytm app, customers can make payments using Paytm and other payment methods. It also provides online and offline merchant acquisitions via QR, smart PoS, and payment gateway services. So, now we know why it’s called a “Super App”.

Paytm had also set up a payments bank through which it can collect deposits from its customers and offer them payments services. It cannot, however, lend on its own balance sheet and must therefore co-originate loans with other financial institutions (banks and NBFCs).

Paytm also provides its customers with a ‘Buy Now Pay Later’ option for up to 60 days. It also provides its clients with co-branded credit cards.

Market leader in the P2M space

Paytm has a strong and large customer base (wallet) of 333 million, 21 million in-store merchants, and 87 thousand online merchants. It provides a full range of merchant acquisition solutions, including QR codes, point-of-sale solutions, and a payment gateway.

It is India’s largest platform, with a GMV of Rs.4033 billion in FY21. Total GMV increased at a 33% CAGR from FY19 to FY21. You must be wondering what is GMV? Don’t worry we will explain it to you.

Gross Merchandise Value (GMV), also known as gross merchandise volume, is the total amount of sales made over a given time period, typically measured quarterly or yearly. GMV is calculated before deducting accrued expenses. Advertising/marketing costs, delivery costs, discounts, and returns are all accrued expenses.

Companies like Zomato, Nykaa, Flipkart and etc. use this metric. It primarily serves as a comparative financial metric for such businesses, allowing them to compare total sales volume from one recording period to total sales volume from another recording period. Finally, the metric is intended to assist businesses in understanding and quantifying their sales growth.

So How Does Paytm Make Money?

Paytm provides consumers with a mobile wallet and a UPI product, both of which are highly relevant and frequent products. It then uses this as a hook to engage customers and cross-sell its other products, which include short-term loans, credit cards, Paytm postpaid, insurance, e-commerce, brokerage, and others.

It receives a sourcing fee and a collection fee from financial institutions based on a percentage of the loan amount for short-term loans. It earns a distribution fee as well as a percentage of the total annual spending for credit card distribution.

t receives a commission on insurance and mutual fund products. It earns consumer fees for equity broking services, including an upfront account opening fee, transaction fees, and an annual subscription fee. It generates revenue by charging consumers a convenience fee in the travel, entertainment, and ticketing industries, as well as in other commercial businesses.

It provides a full suite of payment products and services to merchants, including Paytm QR codes, Soundbox or POS devices, an all-in-one payment gateway, and solutions to help manage cash flows and payables.

It earns money from merchants by charging them a transaction fee that is a percentage of the amount transacted. It also earns a rental fee on soundboxes and POS devices. It charges merchants a subscription fee and, in some cases, a fee based on the volume of activity on the platforms for software and cloud services.

There are too many competitors.

In India, Paytm has no direct listed competitors. This is due to the company’s presence in various segments. Despite the competition, Paytm has managed to grow and make a name for itself in each of the various business segments that exist.

Let’s look at the Financials

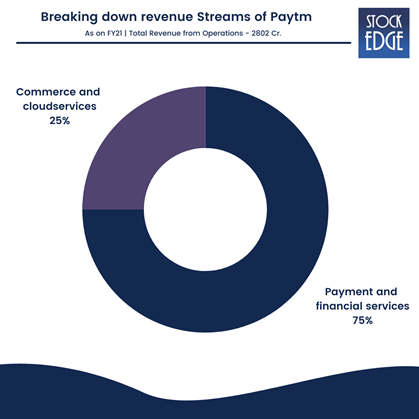

Paytm’s revenue from operations has witnessed a de-growth of 14.6% between FY20 to FY21— from Rs.3281 to Rs.2802 crores, while other income increased by 48.07% from 260 Cr to 385 Crs. But if we look at it segment-wise, then revenue from payment and financial services increased in FY21 from FY20 by 10.6%, while revenue from the commerce and cloud services decreased by 38.04% from Rs.1119 Cr to 693 Cr mainly due to the impact of the Covid-19 pandemic.

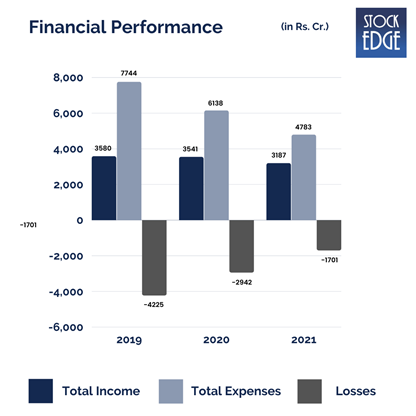

It made a contribution profit of Rs.363 crore for FY21, compared to a loss of Rs.238 crore in FY20. The contribution margin improved to 12.9% in FY21 (v/s -7.2% in FY20). The company’s net losses have narrowed for the last three financial years by cutting costs, but the main concern is Paytm’s stagnating revenues and as of today’s date, this is One97 Communications share price.

What’s the purpose of raising money?

Paytm plans to raise Rs.18300 crores, of which Rs.10000 crores will be paid to existing investors who are cashing out their stake. And the remaining Rs.8300 crores will be used by Paytm for marketing and promotions, customer acquisition, expanding merchant base, improving technology, and investing in new business initiatives, acquisitions, and strategic partnerships.

Anchor Investors Poured Money ahead of the IPO.

Paytm has already raised Rs. 8,235 crores from anchor investors. And these are well-known large financial institutions like BlackRock and Canada Pension Plan Investment Board who have invested ₹1,045 crores and ₹938 crores respectively followed by others.

Road Ahead.

The digital payments industry in India is expected to grow at a CAGR of 27% during FY20-25, driven by policy framework and technology penetration. On the B2C and B2B sides, the digital payments market has been led by companies such as Paytm, PhonePe, GPay, Pine Labs, Razorpay, BharatPe, and others, with businesses offering cash backs, rewards, and offers to entice customers.

Furthermore, the recent pandemic has increased demand for digital wallets, as contactless payment is regarded as the new standard protocol. Pre-Paid Instruments (PPI), Universal Payment Interface (UPI) by the NPCI in addition to Aadhar, and the launch of the BHIM-app, on the other hand, have driven financial inclusion and improved the payment acceptance infrastructure in the country.

Now, if we look at the overall fintech market, which includes online lending, wealth management, insurance technology, and so on, it is expected to grow at a CAGR of 22-23% between 2020-25.

Paytm’s market segments have significant growth potential due to significant lower penetration and the ability of technology to grow the market.

Hey folks, to get a more detailed analysis to know whether to invest or not in the IPO of One97 Communications Ltd., we have an IPO Note on our StockEdge app & website.

If you enjoyed how we presented Paytm’s story, please show us some love by sharing it with your friends and family. Until then, keep watching this space for our weekend editions of ‘Trending Stocks”. Take care and happy investing!