Check out the top trending stocks identified by the StockEdge analysts.

The following are the 5 Stocks in trend:

As of today’s date, this is Gokaldas Exports share price

The stock rallied after the company announced that commercial production at its new manufacturing facility in Tumkur, Karnataka, had begun. When fully ramped up and productive, the unit will contribute about 4.5% of its current capacity.

The company is currently at peak utilization, with a solid order book for the next six months.

Indian textile exports are poised for rapid growth, owing to robust retail and e-commerce demand in key markets such as the United States and Europe.

With China’s export share declining, India has a golden opportunity. So far, India’s share of the global apparel trade has been negligible. With large brands realigning their supply chains to mitigate the effects of COVID-19 and considering a more balanced approach to sourcing, this could be an excellent opportunity for Indian exporters.

Furthermore, the Indian government has announced that the Rebate of State and Central Taxes and Levies (RoSCTL) will be extended until FY2023-24, providing clarity to exporters and pushing for long-term growth in the sector. Furthermore, the Production-Linked Incentive (PLI) scheme has the potential to boost industry growth.

The company has a strong order book and is in the process of increasing capacity in the near term to meet demand and clear a production backlog beginning in the first quarter of FY2021 -22. According to the annual report, the company expects significant revenue growth in FY2021-22 in line with these trends.

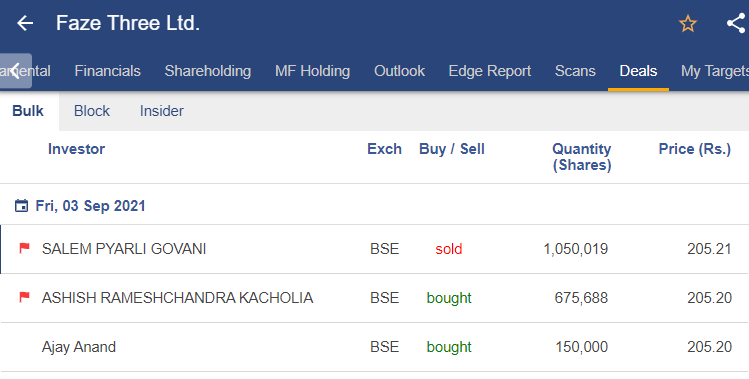

Faze Three share price, as of today’s date.

The stock rallied after ace investor Ashish Kacholia bought a 2.78% stake in the company for Rs 13.87 crore.

According to exchange data, Ashish Rameshchandra Kacholia purchased 675,688 equity shares, representing a 2.78 percent stake in Faze Three, via a bulk deal on the BSE on Friday, September 3, 2021, at a price of Rs 205.20 per share.

On August 18, 2021, Faze Three informed the stock exchange that CARE Ratings had upgraded the company’s credit rating on long-term bank facilities to CARE A- (single-A minus) with a stable outlook for the Rs 87 crore facilities. According to the company, the short-term rating has also been upgraded to ‘CARE A2+’ (A Two Plus).

The rating for Faze Three has been revised due to an improvement in scale of operations despite a weak April-June quarter (Q1FY21) (growth in revenue of 6.50% over FY20). In FY21, the PBILDT margins were 15.27 percent (PY: 12.68 percent), resulting in a higher profit after tax for the company.

CARE believes that the company will continue to benefit from the shift in demand for textile products from American and European markets from China to India, which will result in improved sales visibility in the coming years.

The ratings continue to benefit from the company’s experience in manufacturing home furnishings products, integrated nature of operations, diverse product mix/customer base, growth in operations, improvement in PBILDT margins over time, comfortable capital structure, and debt protection metrics, according to the rating agency’s rationale and key rating drivers.

Goldiam International share price, as of today’s date.

The strong buying at the counter can be attributed to the company’s plan to consider share buybacks. “A meeting of the Company’s board of directors will be held on Monday, September 13, 2021, to consider, among other things, a proposal for buyback of equity shares of the Company,” the company announced on August 30.

The buyback would improve the return on equity by reducing the equity base, resulting in a long-term increase in shareholder value. It would aid in capital structure optimization. Aside from that, a slew of positive announcements appears to have been bolstering the bullish sentiment at the counter for quite some time.

Last month, the company announced that it had received Rs 20 crore in export orders from international clients for larger-carat lab-grown diamond jewelry.

Prior to that, the company reported a strong set of earnings for the first quarter of fiscal year 22 on the back of record total income. The company’s total income nearly tripled to Rs 78.35 crore in the fiscal quarter ended June 2021, up from Rs 8.62 crore the previous year. Net profit increased from Rs 0.47 crore to Rs 14.68 crore during the same period.

APL Apollo Tubes share price, as of today’s date.

APL Apollo Tubes shares hit a record high of Rs 1900.00 on the BSE in intra-day trade, ahead of the 1:1 bonus shares. At their respective board meetings on August 6, 2021, the boards of directors of APL Apollo Tubes and Apollo Tricoat Tubes recommended the issuance of bonus equity shares in the proportion of 1:1, i.e. one equity share of Rs.2 for every one equity share of Rs.2 held by the company’s shareholders as of the record date.

The company has set September 18, 2021, as the record date for determining the eligibility of shareholders entitled to the issuance of bonus equity shares of the company. On September 16, 2021, the stocks will become ex-date for bonus shares. APL Apollo Tubes (APAT) is India’s largest producer of structural steel tubes, which are used in residential and commercial buildings, warehouses, factories, agriculture, and other infrastructure projects. It has a market share of around 50% in India and operates through a network of 10 plants, over 800 distributors, over 1,500 stock-keeping units (SKUs), and 200,000 fabricators serving over 50,000 retailers.

BPL share price, as of today’s date.

The stock is trading at its 52-week high. According to BPL, the electronic industry is poised for stronger growth, bolstered by the government’s ‘Make in India’ policies. Currently, nearly 85% of Printed Circuit Boards (PCBs) are imported, making this one of the components being seriously considered for import substitution. This is a huge opportunity, and the company stated that it has participated in the government’s Production Linked Incentives (PLI) schemes and expanded its capabilities and capacities.

“The size and quality of new business opportunities have grown significantly in recent months. The company has taken appropriate steps to strengthen the PCB Portfolio by developing new products such as RF PCBs. These new products represent a profitable new direction for the PCB Division of the company “BPL stated in its annual report for the fiscal year 2020-21 (FY21).

The company, popularly known as BPL, was founded in 1963 as a private limited company called British Physical Laboratories India. The company began as a single-product manufacturer of high-precision hermetically sealed panel meters for military applications. BPL established a reputation in the consumer durables market as a dependable and strong brand, which it still has. BPL has a presence in India through a distribution network that includes over 7000 channel partners.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.

Good info for the new investors and traders.

hope for next article to be good.

Thank you so much. We are glad you liked the content. Keep following us on Twitter to read more such Blogs!