Table of Contents

Today we’ll talk about one of India’s oldest music labels, youngest movie studio, and one of the country’s most popular content producers, Saregama India Ltd. The company which owns the largest music archives in India and one of the largest in the world and as of today this is Saregama India share price

The Story

A few years back, the company was struggling to sell CDs and was forced to close its chain of stores, including the largest one at the heart of Kolkata, the Park Street Area, which had become a landmark within a few years of opening.

The Music World chain was closed in the summers of 2013 after 16 years of operation because the music retailing business was not able to cope with digital delivery channels and piracy.

However, Saregama, or the former His Master’s Voice and Gramophone Co. of India, still had a massive archive of recordings stored in its factory on Jessore Road on the outskirts of Kolkata.

For over a century, Saregama India Ltd. which is a subsidiary of the RP Sanjiv Goenka Group has been a rich treasure house of music and home entertainment. Since the first recording in India in 1902, the company has been associated with the development of Indian music.

The company owns the most intellectual property (IP) rights to songs, film dialogues, and background scores. The company has a strong presence in licensing and has expanded into other areas of entertainment such as publishing, retail, film production, and digital content.

They sell music storage devices such as Carvaan (a digital audio player), music cards, audio compact discs, and digital versatile discs, as well as music rights. It also produces and sells/telecasts/broadcasts films and TV serials, pre-recorded programs, and deals in film rights.

The Business of Saregama

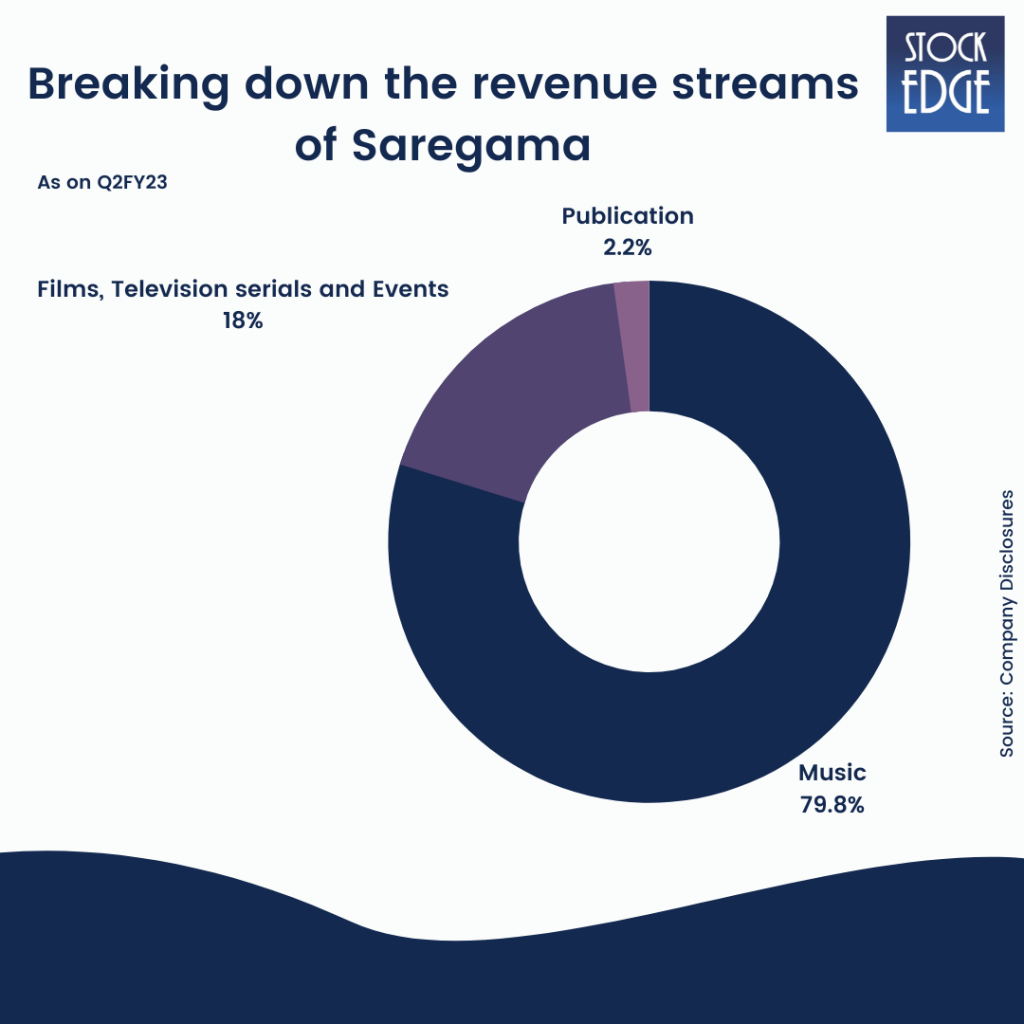

The company primarily operates in three business verticals: music, TV serials and films, and publications.

In more than 18 languages, Saregama has the most diverse catalog, including film and non-film songs, devotional music, classical, ghazals, folk, and indie-pop.

The company owns IP rights to over 1.42 lakh songs, 6,000+ hours of television serials, 65 movies and 1 web series.

Saregama’s Carvaan, a digital audio player, aims to provide entertaining content for people of all ages.

The company uses its media presence, including digital media, to reach out to current and prospective audiences in a fun and engaging way. Under the banner of Yoodlee Films, the company creates award-winning thematic films primarily for digital audiences.

Back with a bang moment!

This was around the beginning of 2018 when I first got my eyes on the retro-looking Saregama Carvaan portable digital music player, quite a few months after its launch in 2017, I thought, this is something my maternal grandfather would really love to have. Uninterrupted old classic music with no advertisements. When I decided to order the product, I came to know it was the hottest selling gift item and I had to wait. But ultimately it was worth waiting.

So basically Saregama used a niche marketing strategy to market its product. Let’s try to understand exactly what it is. Niche marketing is a marketing strategy that focuses on a unique target market. Instead of marketing to everyone who could benefit from a product or service, this strategy focuses exclusively on one group—a niche market—or demographic of potential customers who would most benefit from the offerings.

Things which worked well for the Company for their successful product “Carvaan”.

A product backed by extensive consumer research

The first step in identifying a great product is determining whether there is a market need for it. While many millennials have accepted Gaana, Saavn, and Youtube for their music needs, people over 40 are still struggling to adapt to the new technological changes in the way music that they grew up listening to is now being accessed.

Right Target Audience and segmentation

The product “Carvaan” is aimed at people over the age of 40. It’s for people who enjoy music but find it difficult to download their favorite songs. The plan was simple: fill the device with songs that people in their 40s and 50s want to hear.

Saregama, the music industry’s big daddy before the digital age and piracy hit the Indian music industry, obtained consumption data from 134 partners, including Youtube, Saavn, Gaana, and the lines. It analyzed over 1.1 billion consumption points to create a catalog of 5000 timeless songs.

Positioning of the Product

Saregama Carvaan is marketed as a gifting item. As previously stated, the buyer and the user are two distinct segments for Saregama Carvaan. With a price tag of Rs.6000, middle-class parents in India to purchase this device would have been difficult.

Saregama’s decision to position it as a gift item was the final nail in the coffin. The product was created for someone else, but it needed to speak with someone who would buy it. Saregama couldn’t ignore millennials’ growing purchasing power and disposable income. People between the ages of 20 and 35 are frequently at a loss for what to give their parents or grandparents. As families become nuclear and millennials begin to live away from their parents, the desire to give or do something special and personal for them grows. As a result, Amazon became a key distribution route for Saregama Carvaan, and it swiftly rose to the top of Amazon’s best-selling products.

Financials

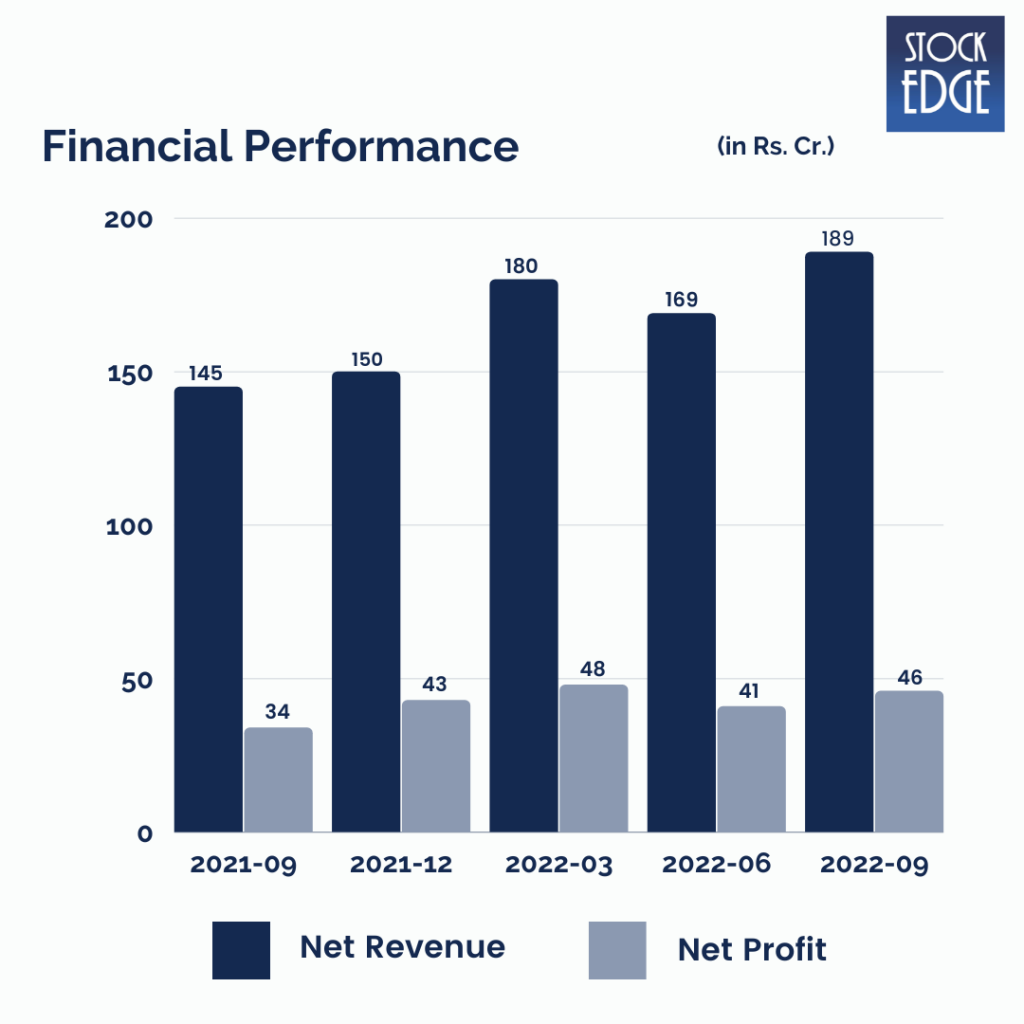

Saregama posted its highest ever revenue for the quarter i.e. Rs.189 Cr. in Q2FY23 up 30% YoY and 12% QoQ. PAT was around Rs.46 Cr up by 35% YoY and 12% QoQ. Saregama’s revenue grew by 167% from Rs.219 Cr in FY17 to Rs.581 Cr in FY22. PAT grew by a whooping 1600% during the same period. PAT margins improved to 26.3% in FY22 from 2.8% in FY17.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Road Ahead

The management reiterated its guidance for 22-25% growth in revenue. Monetization of existing IPs via digital platforms and new music acquisition will aid growth in B2B (licensing) music sales. Minimal marketing spends have benefited the company’s margins, and the company has forecasted low marketing expenses for the next few quarters.

Saregama had launched music of Superstar Chiranjeevi’s God Father, Kalyan Ram’s Bimbisara etc. in Telugu; Anurag Kashyap’s film Do Baaraa and Balki’s film Chup in Hindi; Dhanush’s film Naane Varuvean in Tamil and Diljit Dosanjh’s film Babe Bhangra Paunde Ne in Punjabi.

They also released multiple ‘Originals’ songs sung by Adnan Sami, Satinder Sartaj, Shilpi Raj and Pawan Singh. Overall, Company released 308 films and non-films songs across Hindi, Bhojpuri, Gujarati, Punjabi, Tamil, Telugu, Malayalam, Marathi and Bengali languages.

The other highlight of the quarter was the use of our songs for the film “Vikram Vedha”, “Dharamveer, “Jind Maahi” etc. for digital content like Coke Bangla and Delhi Crime Season-2 and by brands like WhatsApp, Uber, Dettol etc. in their ad films.

Saregama had also announced its long-term partnership with Bollywood music maven Arijit Singh to create multiple original songs and renditions in Hindi and Bengali. The management had anticipated that Yoodlee films will generate 100 crores in revenue within three to five years.

Carvaan continued to regain its momentum. The unit sales grew by 51% YoY, with the help of newly launched variant, Carvaan Mobile. Overall, Company sold 156k units in Q2 compared to 103k last year. Company announced two new Malayalam films, namely superstar Prithviraj Sukumaran’s Khalifa and Asia Ali’s Kasargold.

After a record run of over 2300 episodes, the super successful Tamil TV serial ‘Chandralekha’ was replaced by a new serial Ilakkiya on Sun TV. According to Avarna Jain, Vice Chairperson Saregama India, “Saregama’s strategy of investing in high quality new IP across audio and video has started paying rich dividends. And this is expected to accelerate with the growing digitisation across social strata in India”.

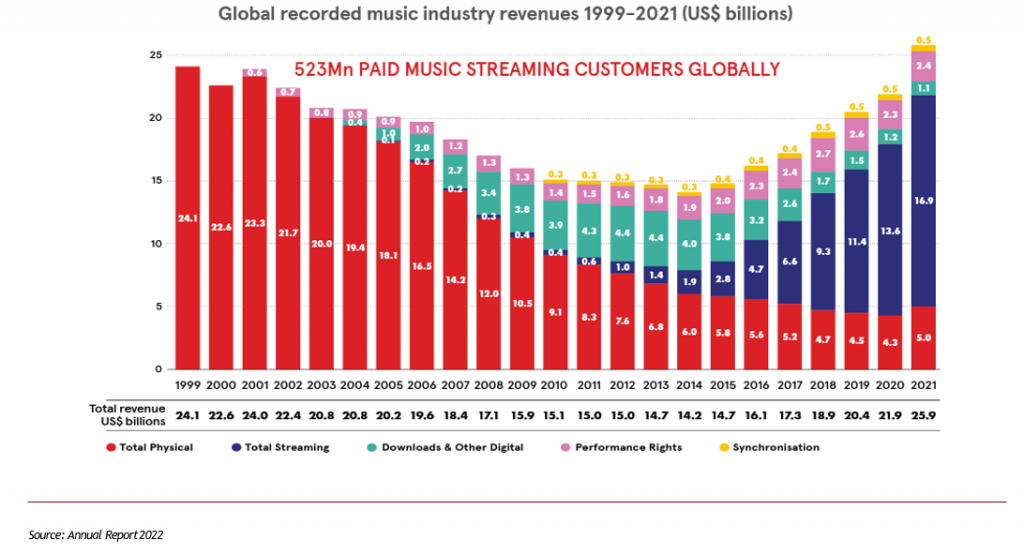

The monetization push driven by digital consumption via streaming and social media platforms, combined with consistent cost discipline, has been really quite surprising. A key metric will be the acquisition and monetization of new music, as well as the pull of older content.

That’s all from our end folks! We hope you liked our quick read. Stay tuned for the next blog and keep watching this space for our midweek and weekend editions of “Stock Insights”.

And, if you loved the way we represented Saregama’s story, show us some love by sharing it with your friends and family. Until then, take care and happy investing!

Very well done!

Thanks

Thank you so much. We are glad you liked the content. Keep following us on Twitter to read more such Blogs!

Very nice. I was wondering what should I do with holding since it had multiplied several times. This article give a fair idea about the growth of the company fir next few years.

Please write article on TIPS industries

Very useful

thanks for your valuable inputs