Table of Contents

The Story

Ramkrishna Forgings, India’s second-largest manufacturer and exporter of commercial vehicle (CV) forgings was established in 1981, which provides open and closed die forgings of carbon and alloy steel, micro-alloy steel, and stainless steel. The management appears to be optimistic about increasing exports, aided by a recovery in Class-8 truck volumes. As of today’s date, this is Ramkrishna Forgings share price

The company is headquartered in Kolkata and has state-of-the-art manufacturing facilities in Jamshedpur, as well as offices in Detroit, Toluca, and Monterrey, Mexico, and Istanbul, Turkey, as well as warehousing facilities in Hagerstown, Louisville, Detroit, Toluca, Monterrey, Mexico, and Westerloo, Belgium. Over time, the company expanded its forging and die-making capacities and its machining and heat treatment capabilities, including isothermal annealing, allowing it to manufacture components for OEMs and Tier 1 companies.

RK Forge is expanding its business across different geographies and newer customers by adding new capacities to cater to the railways, LCV (light commercial vehicles), and PV (passenger vehicles) segments. Domestic medium and heavy CV (M&HCV) recovery, the CV market in the US, UK, and Europe, and incremental revenue from LCV business will be key growth drivers in the near to medium term.

The company supplies a variety of industries, including automotive, railways, farm equipment, bearings, oil and gas, power and construction, earthmoving, and mining, both in India and internationally. In addition, the company is a critical safety item supplier for railway passenger coaches and locomotives undercarriage, bogie, and shell parts. India is a preferred supplier to OEMs such as TATA Motors, Ashok Leyland, VE Commercial, and Daimler. In international markets, it is a preferred supplier to Volvo, Mack Trucks, Iveco, DAF, Scania, MAN, UD Trucks, and Ford Otosan. In addition, it is a global supplier to Tier 1 axle manufacturers such as Dana, Meritor, and American Axles.

The Upcycle in Indian CV Segment

The CV cycle in India is expected to pick up after a two-year lull caused by the economic slowdown exacerbated by the pandemic.

Improving macroeconomic conditions, the government’s emphasis on infrastructure spending and a gradual recovery in replacement demand will all contribute to the growth of the CV industry in the coming years. Ramkrishna Forging has increased its market share with its largest domestic customer, Tata Motors, and this trend is expected to continue. Domestic CV volumes have historically been positively correlated with industrial production and GDP, both increasing.

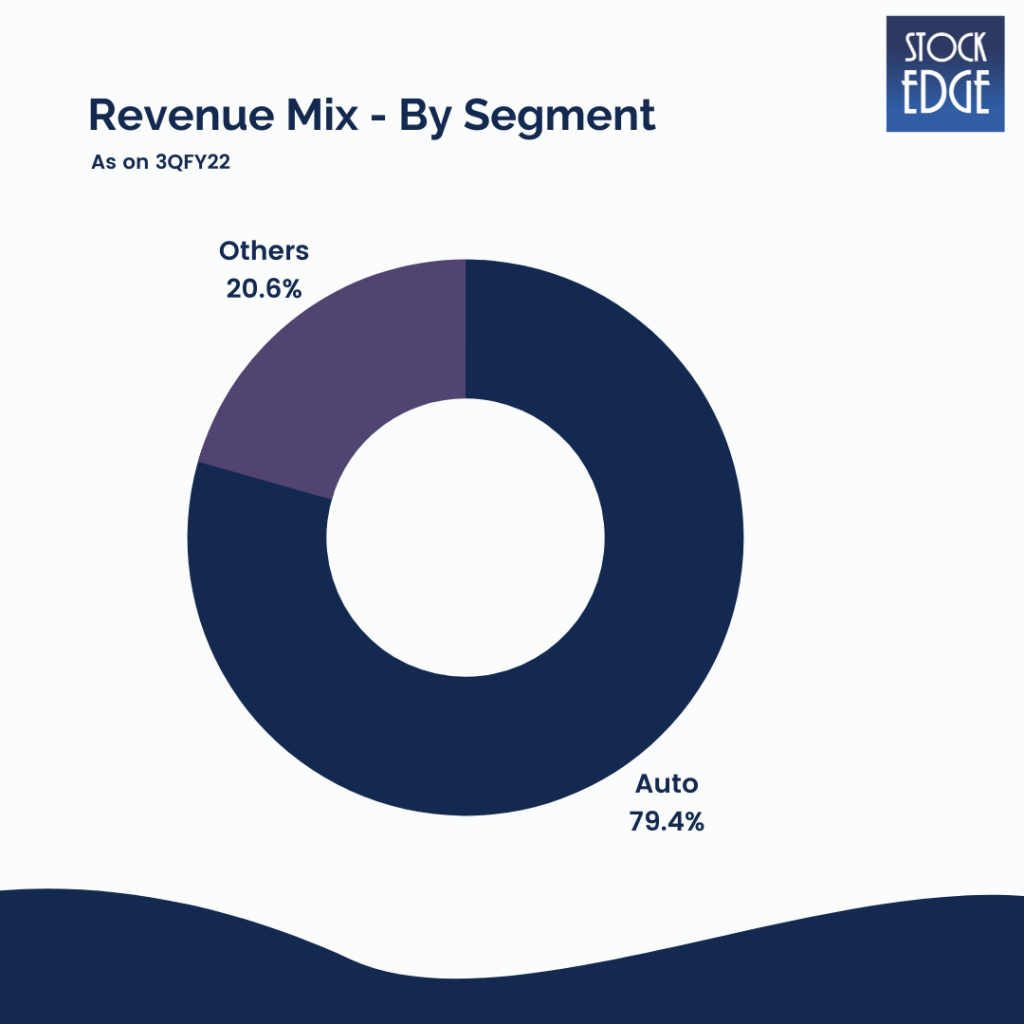

Ramkrishna Forging is also attempting to mitigate the risks associated with the local CV cycle by diversifying its business across segments, geographies, and customers. In Q3FY22, the export geography mix was as follows: North America (37.1%), Europe (14.8%), and others (0.5%). In addition, from September 2020, they have begun supplying axle components to a customer in the South American market.

In the current quarter, they received new orders worth approximately Rs.600 crore from various geographies and business verticals, executed over the next 2-3 years. In addition, they recently signed an agreement with ePropelled (USA) to manufacture their patented Dynamic Torque SwitchingTM (eDTS) motor technology in the electric vehicle (EV) space. This would allow RK Forge to broaden its product offering in the EV market.

Ramkrishna Forging recently announced a partnership with an American axle manufacturer for the light vehicle (LV) segment, valued at Rs 70 crore over five years, with the products used in rear axle applications.

How is Ramkrishna Forgings diversifying?

Ramkrishna Forging is growing its presence in the LCV segment and industrial segments such as railways, oil and gas, and construction equipment. The company is expanding its business in the railway segment in non-auto space. RK Forge has been awarded development orders for the production of locomotive shells. The company stated that its railway business is currently doing well, with revenue ranging from Rs.3 crore to Rs.4 crore per quarter, and that they expect it to double by Q1FY23.

Let’s look at the Financials of Ramkrishna Forgings Ltd.

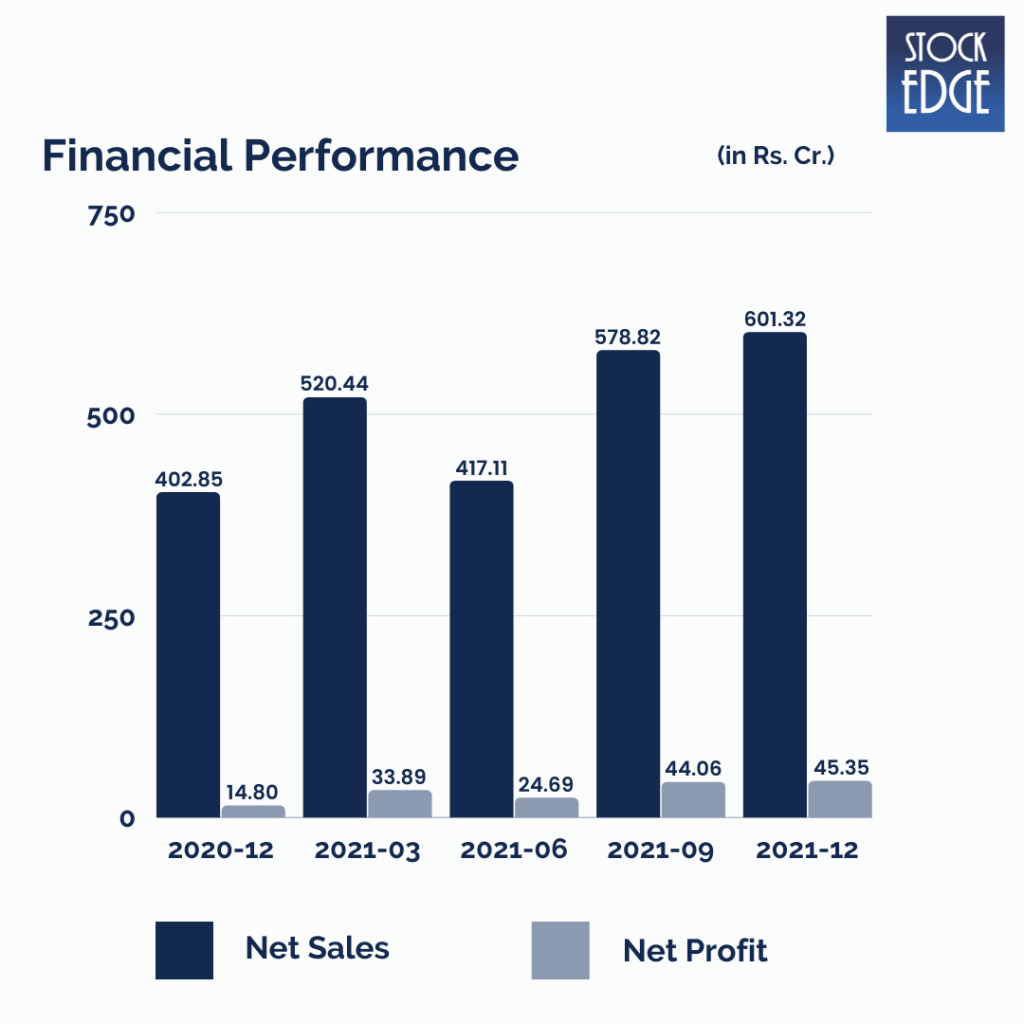

In Q3FY22, Ramkrishna’s revenue increased by 49.26% year on year and 3.88% quarter on quarter to Rs.601.32 crore, with volume increasing by 16% year on year and 4% quarter on quarter to 29,520 tonnes, owing to healthy export volumes. EBITDA increased by 86.03% year on year to Rs.141 crores, while EBITDA margin increased to 23.47% year on year due to improved operating leverage and pricing power. Better product mix with a higher contribution from exports improved operating leverage, which benefited their margin despite higher input costs. Their PAT increased by 206% year on year to Rs.45.35 crores, owing to higher-than-expected EBITDA margins.

Who is the jockey?

The promoter, Mahabir Prasad Jalan, leads the company. He earned his bachelor’s degree in mechanical engineering from BITS Pilani and has over 45 years of experience in the forgings industry. Tribeni Steel Forgings was his first independent venture, founded in 1974. He was finally promoted to Ramkrishna Forgings in 1981 and has been in charge of the company since its inception. Naresh Jalan, the managing director (MD), has an MBA in Finance and Marketing. In addition, he has about 20 years of experience in the forging industry.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Road Ahead…

According to the management, Ramkrishna Forgings aims to be debt-free in three years. Therefore, Q4FY21-22 volumes could be similar to those in Q3FY21-22. For FY22-23, they expect 15%-20% growth over FY21-22. In the first nine months of the current fiscal year, the company has done 79,900 tonnes, out of which 34,000 tonnes came in the last quarter. The company expects a similar tonnage in Q4FY21-22.

The company has successfully passed over 100% input cost inflation to the buyers. Hence, they expect to sustain margins at the current level. They are bullish on margins and hope to improve with better utilization moving into the next financial year.

However, as with such cyclical companies, risks like delayed approval from industrial customers and late launches by automotive players can impact growth and performance. In addition, pricing pressures from automotive OEM clients could affect the company’s profitability.

So we will have to wait and see how the company develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

An awesome and wonderful post. This is very informative one. Thanks.