Table of Contents

Today we will talk about a small-cap company, i.e., Gokaldas Exports, which is minting money due to strong tailwinds in the textile industry. So, let’s dive in.

The textile industry in India has received much attention in recent months. European Free Trade Agreement opportunities, the US-China cotton ban, the Indian government’s focus on developing a conducive ecosystem through PLI schemes, and well-defined export incentives are some of the factors that have contributed to the rising potential of textile players based in India.

The Story

Gokaldas Exports is one of India’s leading apparel exporters with an annual capacity of 25+ million pieces supplying garments to giant global retailers. The company primarily operates in Karnataka, with a few operations facilities in neighboring Andhra Pradesh and Tamil Nadu. As of today’s date, this is Gokaldas Exports share price.

The company focuses on the production of complex garments products and designs. Their functions include cutting, sewing, embroidery, quilting, and printing. They have an impressive clientele of leading international brands like Puma, banana republic, Adidas, GAP, ‘H&M’ etc.

What was wrong with Gokaldas Exports, and how did the turnaround happen?

Garment Manufacturing is a low-margin business. Therefore, increasing inefficiencies and mismanagement, along with higher wastage and rising input cost, will incur losses for the company, which happened with Gokaldas Exports.

What were the inefficiencies?

- The company was divided into six Strategic Business Units, with each SBU in charge of the entire process, from material procurement to manufacturing. As a result, the company suffered from diseconomies of scale.

- The management divided factories based on customers rather than products (all types of products would be manufactured at a single unit). This created two issues: first, not all factories had the expertise to produce all kinds of garments, and second, no further orders could be taken from a customer if capacities at a specific factory were running at full capacity (as prior client certifications would be required to process the order at any other factory) which resulted in both business and financial losses over time.

- Factory-level profit and loss statements were prepared. Instead of looking for ways to improve operational efficiencies and thus generate profits, the loss-making factories were sold or shut down. (In 2007, there were 54 factories; in 2018, 22 factories.)

- The cutting-edge blazer manufacturing unit was sold to Raymond because it lost money. GEXP’s manufacturing bandwidth was reduced due to its ability to produce a wide range of products, resulting in sub-optimal operations.

- Wastages such as rejected garments, style-specific unused fabric, and trimmed raw material could have been reused. High input consumption was also a cost that hampered GEXP’s profitability.

Then in 2017, Blackstone exited and sold their 39.9% stake to Clear Wealth Consultancy Services LLP (owned by Mathew Cyriac, former Co-head Private Equity, Blackstone) for Rs.58 crores. Mr. Siva Ganpathi was appointed as CEO, who has a track record of turning loss-making businesses into profitable ones.

What wonders did the jockey do?

Mr. Siva Ganapathi (MD) graduated from IIM Bangalore with a PG Diploma in Management and a B.Tech from NIT. He has over 27 years of experience and has spent 21 years with the Aditya Birla Group. Before joining Gokaldas Exports, Siva was the Chief Operating Officer of Idea Cellular, where he was in charge of turning around the company’s operations.

The new management implemented several initiatives, resulting in 15 percent CAGR revenue growth between FY18 and FY20. Gokaldas Exports has seen a massive turnaround since the change in leadership and has been profitable since Q4FY18, excluding the quarters severely impacted by the COVID-led lockdown. Over the last two years, the company has increased process efficiencies, effectively and efficiently expanded capacities, increased wallet share with existing clients, and added new clients to the basket.

Mr. Siva conducted a data-driven analysis of each factory to identify inefficiencies and waste, and he took corrective action at the same time.

To fix “Employee attrition and absenteeism,” management implemented an ‘attendance bonus,’ which improved attendance and productivity. They also implemented programs like ‘Hello Sakhi’ to improve the working environment, in which experienced employees mentored new employees for the first six months.

A single ERP system was implemented to streamline raw-materials requisition and procurement to reduce mismatches. In addition, improving material-on-time performance was prioritized to improve sewing efficiency and waste reduction, resulting in increased efficiency.

All of these initiatives contributed to the company’s successful turnaround.

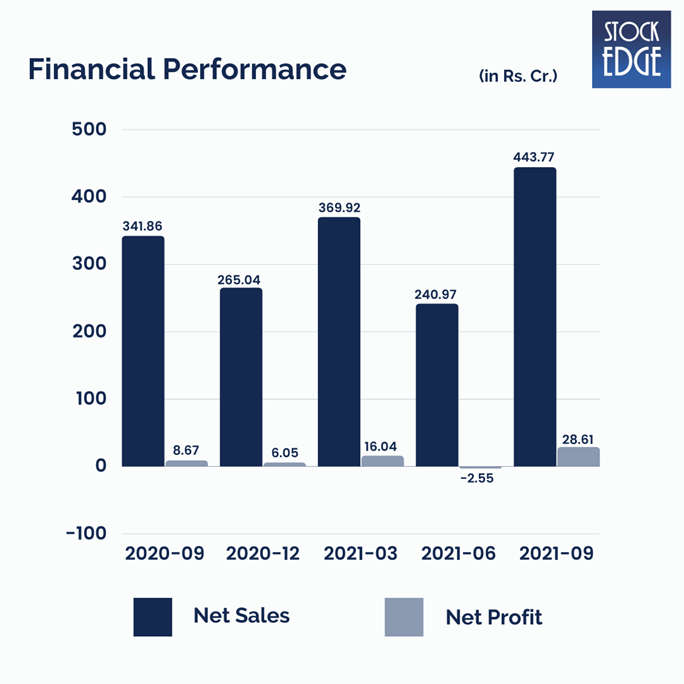

Financials

Gokaldas Exports has reported one of its best quarterly results, fueled by strong demand in the US apparel market. If we look at the revenues, they have increased by 30% year on year and 84% quarter on quarter to Rs.443.8 crores. PAT’s went up by 230% on a year-on-year basis and 1221% on a quarter-on-quarter basis to Rs.28.6 crores. They reported one of its highest EBITDA margins of 12.1% due to positive operating leverage and foreign exchange gain. The net debt to equity is 0.63 in Q2FY22 compared to 0.72 in Q4FY21. Cash generated from operations in H1 FY22 was invested in purchasing plant and machinery for production units and partly for the inventory buildup for Q3 production.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Road Ahead…

Gokaldas Exports specializes in woven garments. Their clientele are both into woven and knitted garments. The company’s management stated that it intends to enter the knitted garments segment and is establishing manufacturing units in low-cost countries such as Bangladesh, which will also help meet its existing customers’ needs.

With productions running at maximum capacity due to a full order book for the next six months, demand from the US apparel market remains strong. As a result, Gokaldas has planned a CAPEX of Rs.340 crores over the next four years (by FY25E), potentially generating incremental revenues of Rs.1350 crores.

The recent fundraise QIP worth Rs.300 crore would further strengthen the liquidity position, with funds being used to accelerate CAPEX, repay borrowings, and fund working capital requirements.

However, as with such companies, there exist risks like currency risks as they are exporters, then there can be unavailability of labor and increase in wage rates which could cause a problem.

Apart from that, raw material price volatility can impact margins, and demand slowdown due to stringent lockdown could give a sidekick to the expectations of good returns.

So we will have to wait and see how the company develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

I want to know how to do trading and future and option with intricate technical analysis. I am 70 . If you feel my age is not conducive for it then inform me that. I know little bit of mathematics and statistics. Because by this once I raised my family.

The concerned person from the team will reach and guide you.