Table of Contents

In today’s blog, we will talk about a chemical company that has been a direct beneficiary of the China plus One Strategy. It is high time we analyze the company profile and Deepak Nitrite share price.

China has emerged as a global manufacturing behemoth in recent decades. Since 2000, its chemical production capacity has increased eightfold. However, in recent years, capacity reductions due to increasing environmental compliance of chemical facilities, a trade war with the US, and, most recently, COVID-19 crisis-led lockdowns have led companies to adopt a China+1 strategy. With supply chain disruption and uncertainty in China, global players are looking to diversify their sourcing, and India provides strong alternatives like Deepak Nitrite with comparable scale, technology, raw materials, and supportive government policies.

The Story

Deepak Nitrite was founded in 1970 by C.K Mehta. It began as a manufacturer of sodium nitrite and sodium nitrate before gradually diversifying its product line. But today, the company is a major player in the chemical intermediates industry. Over the years, the company has become a domestic market leader in inorganic intermediates (sodium nitrite and sodium nitrate), nitrotoluene, and fuel additives. It has six manufacturing facilities located in Gujarat, Maharashtra, and Telangana. It exports to over 30 countries in key geographies such as Europe, the United States, Japan, Latin America, etc.

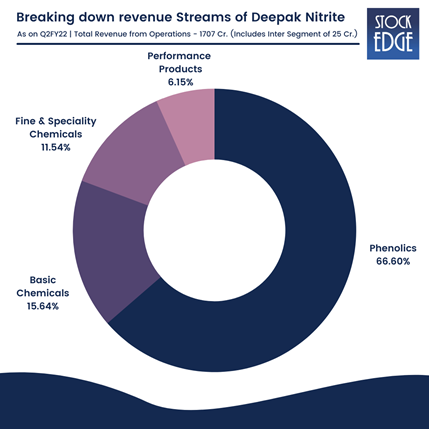

It operates in four segments: basic chemicals, fine and specialty chemicals, performance products, and phenolics which proves to be a Hercules.

Let us try to understand each segment one by one!

Deepak Nitrite makes bulk products like nitrites, nitrogen toluidines, and fuel additives under basic chemicals. It has around 80% market share for sodium nitrite and 50% for nitrotoluene. In addition, it has a market share of 75% in fuel additives. Colorants, rubber chemicals, explosives, dyes, pigment, food colors, pharmaceuticals, and other industries are among the end-user industries for the Basic Chemical segment.

Under specialty chemicals, it manufactures niche and specialized products that require technical skills and technological competencies when dealing with complex reactions. It makes specialty chemicals like xylidines, oximes, and cumidines tailored to the customers’ needs. These are high-margin products manufactured in low quantities. They are used in the agrochemical, pharmaceutical, and personal-care industries.

Let’s look at the Performance Products segment. We get to know that Deepak Nitrite is a fully integrated optical brightening agent (OBA) manufacturer, with operations beginning with the conversion of basic input toluene into para-nitro toluene (PNT), followed by diamino-stilbene-disulfonic acid (DASDA), and finally into OBA. It has around 75 % market share in OBA and a 60% in DASDA. Due to its expertise and technical know-how, Deepak Nitrite has established itself as a preferred supplier. It has also strategically diversified its clientele across geographies and end-user industries.

The phenolics segment produces acetone, cumene, isopropyl alcohol, and phenol entirely through its subsidiary, Deepak Phenolics Ltd. Deepak Phenolics, which began commercial production in 2018, has already established itself as the most trusted player in the domestic phenol and acetone markets, with a market share well above 50%. As the pandemic unfolded and the demand for sanitizers skyrocketed, Deepak Nitrite seized the opportunity and began producing isopropyl alcohol at a plant capacity of 30,000 MTPA.

Let’s look at the Financial Performance of Deepak Nitrite

Click here to check out the entire data.

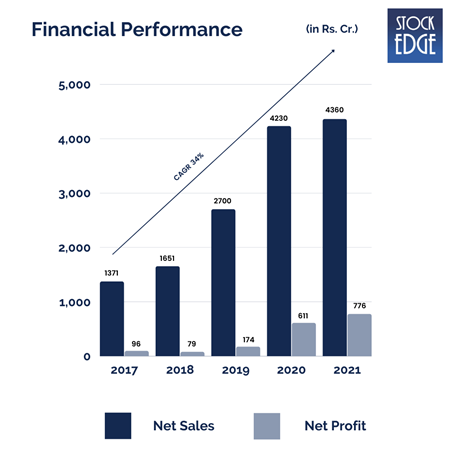

Deepak Nitrite’s revenue has grown at a CAGR of 34% between FY17 to FY21— from Rs.1371 to Rs.4360 crores. PAT has been growing at a CAGR of 73%, from Rs.96 crores to Rs.776 crores. The growth has been so exceptional that the company’s share price has grown by 1892% in the last five years.

Operating margins have been steadily increasing. It reached 29% in FY21 from 10% in FY17. Deepak Nitrite achieved such high margins because of its diverse product base, improved realizations, and better cost control.

Quarterly Performance

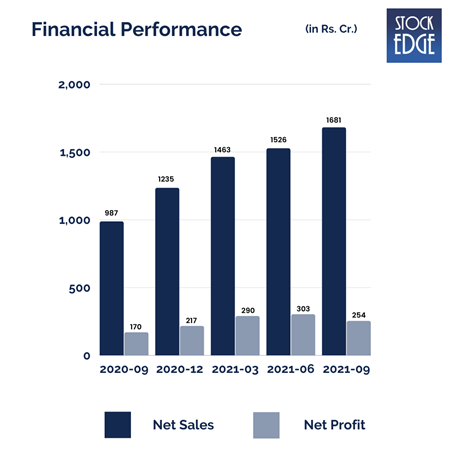

The day before yesterday, Deepak Nitrite reported mixed results for the 2nd Quarter of FY22. The revenue from operations increased due to volume growth across all segments and price increases implemented during the quarter. EBITDA was 855 crore in H1 FY22, up from 468 crores in H1 FY21, an increase of 83 % yearly. During the period, improved operating performance drove EBITDA growth. Despite an unprecedented rise in input prices, the EBITDA margin remained largely stable on a year-over-year basis at 27 % in H1 FY22.

If we look at each segment’s performance individually, then Phenolics was the one that was an outlier as it outperformed other segments, with EBIT margins in the Fine and Specialty Chemicals falling for the fourth consecutive quarter and Basic Chemicals’ margins normalizing.

How good is the jockey?

Deepak Mehta, the company’s chairman, and managing director, currently leads the company. He has been in charge of Deepak Nitrite for the past 49 years. He holds a science degree from the University of Mumbai. He is the chairman of the Gujarat State Council of FICCI and an active participant in industry forums. He is also the chairman of the FICCI’s National Chemicals Committee. He was the past president of the Indian Chemicals Council (ICC).

Last year, Maulik Mehta was appointed as the executive director and CEO of Deepak Nitrite. He completed his bachelor’s degree in business administration from the University of Liverpool. Then he went to Columbia University to complete his Master’s degree in industrial and organizational psychology. With approximately 13 years of experience in business development and he has been responsible for the day-to-day operations of all Deepak Nitrite verticals.

Road Ahead…

Deepak Nitrite aims to become the market leader in solvents by leveraging import substitution. The management team is focused on expanding the Fine & Specialty chemicals segment and closing gaps in the value chain. It has been investing in its market intelligence team, which investigates new and existing market opportunities. The management has shifted its focus to advanced/high-value products, which will help the company’s margin expansion and sustainability.

Until then, stay tuned for the next blog and keep watching this space for our midweek and weekend editions of ‘Trending Stocks”. And, if you liked the way we represented Deepak Nitrite’s story, show us some love by sharing it with your friends and family. Until then, take care and happy investing!

Very good stock details

Very good report and also plz post such analytical reports on balaji amines and other chemical stocks, their next triggers, entry point etc which will benefit the customer s.

You should make multiple report on single topic so it will be easy to understand

Nice information about chemical script.

Nice article, how company products are driving the business is explained in a granualar way.

Very good knowledge, help for newcomer