Table of Contents

In today’s blog, we will discuss one of the market leaders in the Air Express Industry with more than 50% market share and is a fast-growing player in Ground Express Industry in India, i.e., Blue Dart Express Ltd.

The Story

Blue Dart Express Ltd. is in the business of providing integrated air and ground transportation and the distribution of time-sensitive packages to various destinations, primarily within India. In addition, the firm offers courier and express services. InternetDart, ShopTrack, PackTrack, MobileDart, ShipDart, and ImageDart are some of the company’s technology-based business offerings. In addition, domestic Priority, Dart Apex, Dart Surface line, Temperature Control Logistics (TCL), Airport-to-Airport, International Services, Charters, Interline, Smart Box, Express Pallet, and Regional Services are among the services provided by the company. The company serves approximately 220 countries and territories worldwide and covers 15000 pin codes in India. As of today’s date, this is Blue Dart Express share price

Let us try to understand what the express logistics industry is.

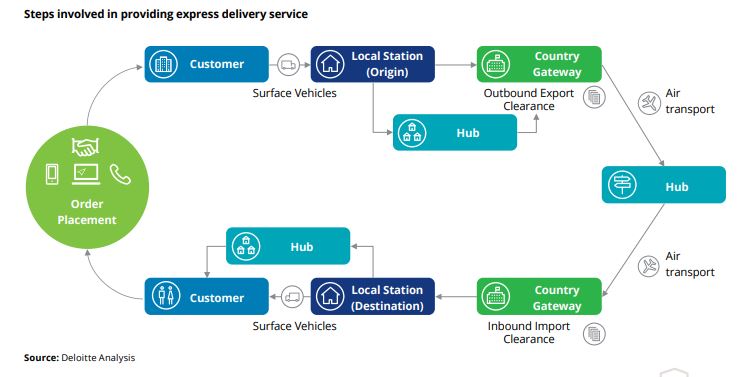

The express industry is a small and niche segment of the Indian logistics industry that provides logistics services for time-sensitive shipments by establishing an integrated chain that includes multi-modal transport modes, both air and surface. The express industry has fine-tuned the logistics process for time-bound deliveries of shipments across domestic and international borders. However, the level of integration and ability to deliver in short time frames is among the best in the industry.

The express industry serves customers who need parcels and documents delivered quickly. Customers for express delivery services come from a wide range of industries. However, specific industry segments account for a sizable portion of the customer base. Automobile components, banking and financial services, clothing, pharmaceuticals, telecommunications products, and IT components are major customer industries. Other customer segments, such as organized retail and e-commerce, also emerge as significant customer segments. Business customers with regular accounts make up a sizable portion of the Express Industry in India’s customer base.

The Indian express industry is highly fragmented, with numerous active participants. Prominent scale players with operations in India and abroad account for 70 to 80 per cent of the market, with medium and small players accounting for the remaining 30 to 20 per cent.

According to a Deloitte study on the Indian Express Industry, 59 per cent of express customers are B2B customers. However, the share of documents has decreased significantly because of digitization, and the segment is now dominated by the automotive, textile, and electronic sectors.

Characteristics of the express delivery services are as follows:

1. End-to-end logistics solution: Express delivery services provide a complete chain of solutions, from shipment collection at the consignor’s doorstep to packaging, transportation, storage, clearances, and final shipment delivery. In addition, express delivery services for cross-border goods movement include customs clearance and payment of applicable duties.

2. One-stop solution: Express delivery services serve as a one-stop solution for customers’ logistical needs. Because of the integrated nature of the service, the customer only needs to deal with one operator throughout the entire value chain of service.

3. Time-bound service: The essential aspect of the express industry is time-bound delivery. Most destinations have delivery timelines ranging from 24 hours to 72 hours. Therefore, besides day-definite delivery, the express industry also offers time-definite delivery services.

4. Tracking and delivery confirmation: Express delivery services provide real-time tracking of shipments to give customers visibility into the movement of goods and delivery confirmation.

5. Global reach: Express delivery services connect to many destinations across regions, giving its customers global reach.

6. Premium pricing: Express delivery services are the premium segment of the logistics industry and are priced higher than traditional delivery services due to their time-sensitive nature. Compared to conventional carrier services, the express industry focuses on fast and dependable delivery of goods with an end-to-end integrated service controlled by a single operator.

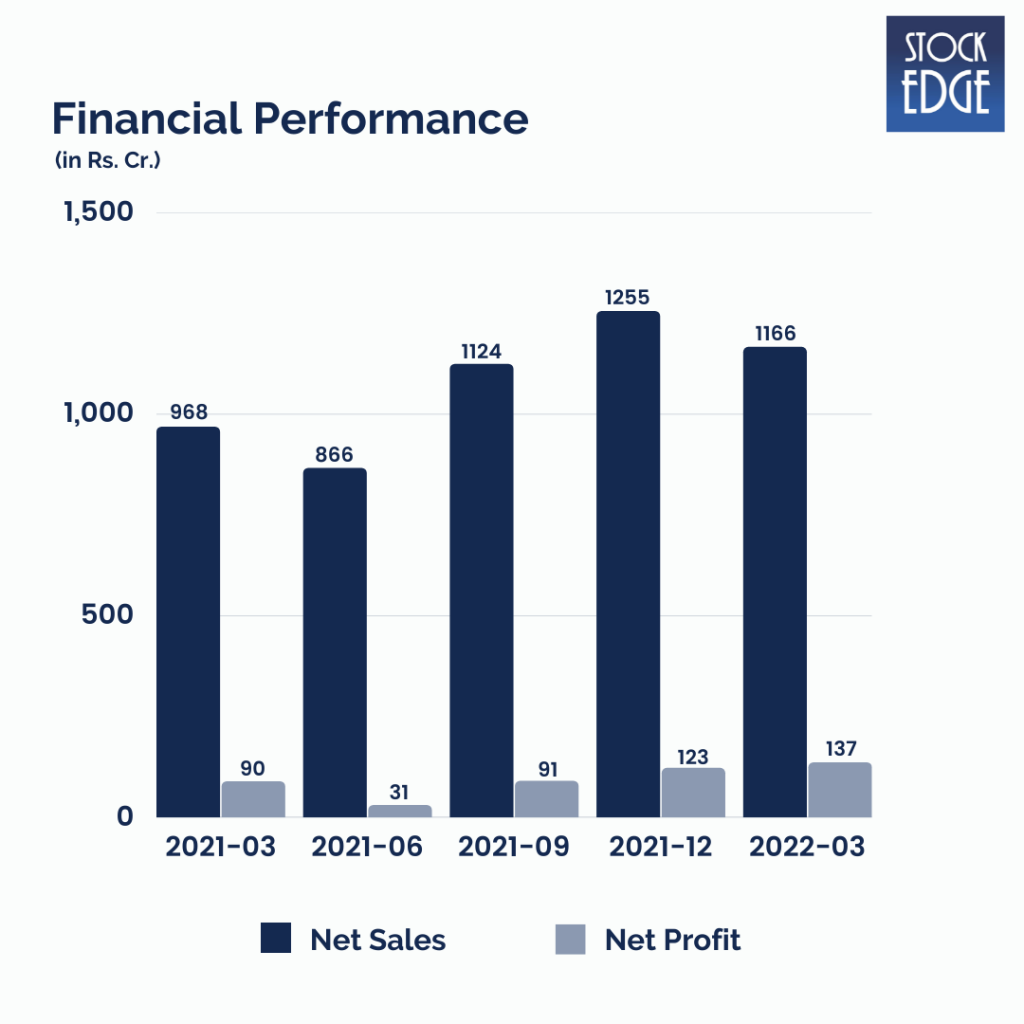

Let’s look at the Financials of Blue Dart Express.

During the quarter, Blue Dart Express’s net sales increased by 20.4 per cent year on year to Rs.1165.9 crore, while its net profit increased by 52.2% year on year to Rs.137 crore. Revenue growth was driven by a healthy mix of volume growth and realization improvement despite the challenging geopolitical environment. In addition, Blue Dart Express’s revenue delivered another outstanding quarter, fueled by strong margin expansion (due to a fall in employee costs).

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Who is the jockey?

Mr Balfour Manuel, a veteran with over 35 years of experience, leads the Blue Dart and has been instrumental in its success. Before he was appointed Managing Director, he served as the company’s CEO, beginning on January 23rd, 2019. He was also the Senior Vice-President in charge of Blue Dart Express’s B2B customers, which were the company’s backbone. He also held a key general management position, where he was in charge of the growth and development of Blue Dart Express’s business in India’s western region.

Road Ahead…

Blue Dart Express’ management is optimistic about volume and pricing. Ground express is expected to grow at a high double-digit rate, while air express is expected to grow at a high single-digit rate. With a month’s lag, the fuel surcharge mechanism will continue to offset higher fuel prices. According to management, belly cargo is not a competitor for BDE. Management anticipates a sufficient profit opportunity in Omnichannel e-commerce. Management expects a 100-200bps decline in EBITDA margins in Q4FY22 due to infrastructure investments and high capacity utilization (applicable for FY23E).

However, with such companies, risks such as high fixed lease costs, higher ATF prices, and INR depreciation impact lease and maintenance costs, impacting the company’s profitability.

So we will have to wait and see how Blue Dart Express develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

Excellent RESEARCH & Report