Table of Contents

An Index Fund is designed to mimic or track the performance of a stock market index. The holdings of Index funds consists of all the stocks of the index it tracks and in the same proportion as present in the index.

An index is a benchmark that helps us in gauging the overall performance of the stock markets. Such indices are also known as a broader market index. They generally include the largest listed entities of the stock markets. The NSE Nifty50 and the BSE Sensex are examples of major Indian stock market indices. On any given day if one has to understand how the stock markets performed, they would refer to the major indices to find out if the markets were up or down.

Apart from the two major Indian indices, there are also other indices which are categorized based on the market cap and liquidity of the companies. Such indices are also broader market indices but their total market cap value would be lesser than that of Sensex or Nifty. Nifty 500 and Small Cap 250 are two examples of other indices.

What are Index Funds?

In most mutual fund schemes, the fund manager is actively involved in the buying and selling of stocks while trying to outperform the benchmarks. They continuously are involved in stock research and make timely adjustments to their portfolio depending on market conditions.

Index funds on the other hand, are passively managed funds. This means the fund manager doesn’t have much of a role to play. They simply clone the stocks of the index in the same proportion and only make adjustments whenever the it makes changes.

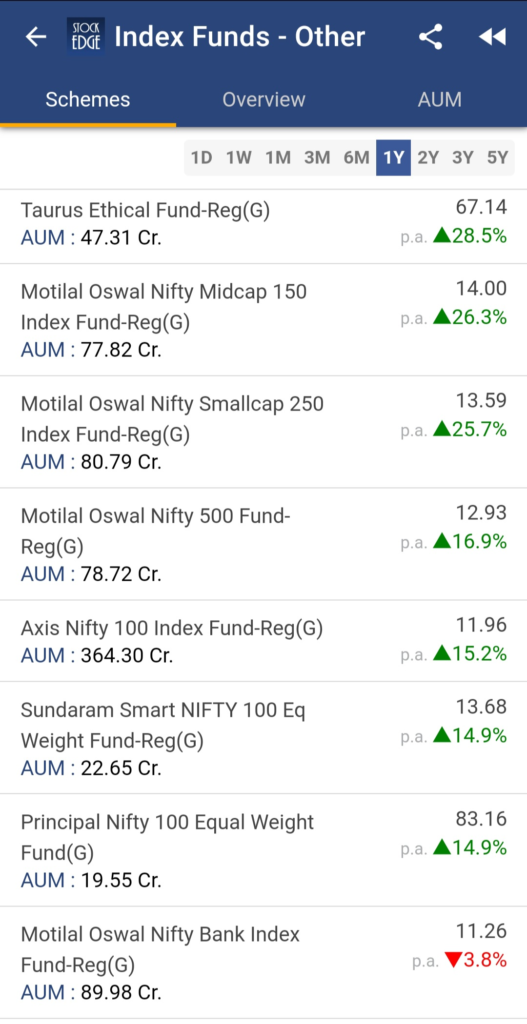

Top Index Funds by 1 year performance on StockEdge App:

Benefits of these Funds:

- Easy to understand – It is important to invest in financial instruments you can understand. Out of all the mutual fund schemes, these Funds are probably the easiest to understand. You do not need to spend a lot of time researching the fund’s features, fund manager, past returns and the holdings of the fund. All you need to do is to choose the index you want to invest in.

- Diversification – Index funds allows an investor to have exposure to a wide spectrum of stocks. For instance, just investing in a Nifty50 index would mean an exposure to 50 stocks from varying sectors. This limits the potential downside of one’s portfolio during hostile events.

- Low Expenses – Since index funds are passively managed, they do not attract expensive commission costs which could be much higher for actively managed mutual funds. Over a longer investment period, this could have a significant impact over your returns.

- Benchmark Investment – Mutual Funds try to outperform their respective benchmark indices. So it is said that if a fund manager outperforms the broader markets then they have done a good job. But many funds fail to outperform the markets. In case of index funds, they are the benchmark itself. They do not try to outperform the index but match the performance of the index.

See Also : What are Index ETFs?

Points to remember before investing in Index Funds:

- Low Risk Return – Compared to other equity based mutual fund schemes, Index funds are generally meant for investors with a low risk taking ability. This is because index funds are not designed to make hefty returns for the investor. They grow as the stock market index grows. Over the past many decades, Indian Indices have had a CAGR return of between 10-12%. For a conservative investor looking for equity exposure, index funds make for a great investment vehicle.

- Tracking Error – Often the returns made from an index fund is slightly on the lower side when compared to the actual index return. This deviation in the two returns is a common error amongst index funds and is known as a tracking error. As a rule of thumb, you should always go for the fund with the lowest tracking error.

- Taxation – Since index funds are equity based mutual fund schemes, they attract the same taxation rules as them. Investments for under 12 months are subject to a short term capital gains tax of 15%. Meanwhile longer term investments are subject to a long term capital gains tax(LTCG) of 10%. LTCG upto Rs.1 lakh is exempt but any amount higher than 1 lakh is taxable.

- Look for Low Expense Ratios – Though index funds have lower expense ratios compared to their actively managed counterparts, it is prudent to invest in the one with lower costs. Over a long term investment horizon of let’s say 10 years, even an expense ratio of just 0.5% can be a deal breaker because of the power of compounding.

Having an Index Fund in a portfolio should equate to about 10-12% returns over a period of 10-15 years. So this makes Index Funds a much more attractive investment than Fixed Deposits and Bonds. Ace investor Warren Buffett once said that upon his passing, he will leave 90% of his fortune invested in the S&P 500 index fund for his wife.

You can also view the video below on Index Funds!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge.