Table of Contents

Investing in a Mutual Fund is very different to investing directly in the stock markets. A mutual fund is a trust which accumulates a pool of money from multiple investors and then invests it in different asset classes such as stocks, bonds and gold.

Stocks on the other hand are equity shares of a company that trade on a stock exchange and anyone with a demat account can buy them through a stock broker.

But there is a distinct mutual fund which is very similar to stock. They are known as Exchange Traded Funds or commonly known as ETFs.

ETFs are essentially mutual funds that are traded on a stock exchange. Similar to regular shares, investors can purchase units of these mutual funds from the stock markets at a market price.

Note: Investing in ETFs is very similar to investing in a mutual fund scheme. Only difference is that here we buy units of an ETF from a stock exchange. In case of Mutual FUnds, their units are purchased at the current NAV rate.

Index Exchange Traded Funds (ETFs)

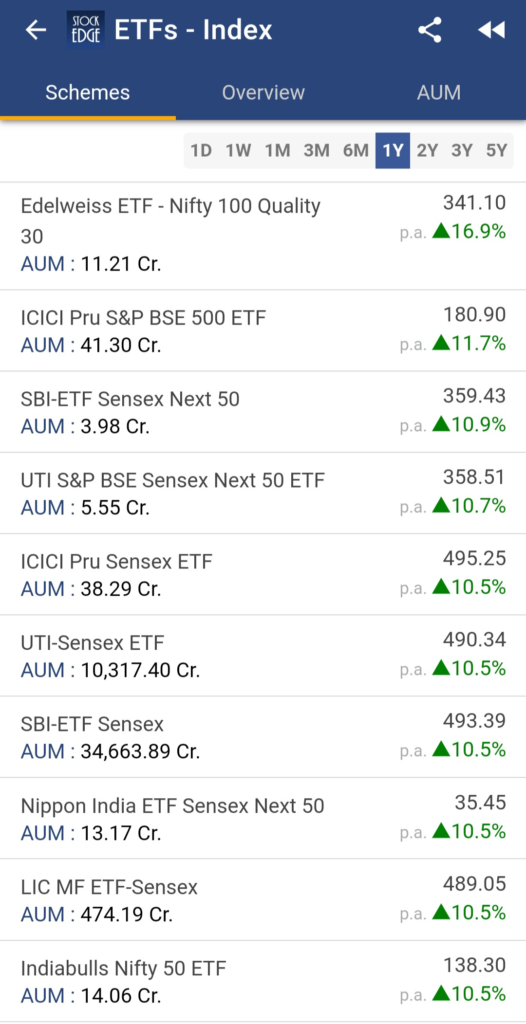

There are many types of ETFs that trade on the Indian stock exchanges. Certain ETFs are designed specifically to cater to a specific asset class while others focus only investing in stocks from different sectors.

An ETF which is designed to mirror the performance of a stock market index is known as an Index ETF.

A stock market index consists of a group of stocks which are brought together to measure the overall performance of a sector, industry or broader markets.

Often people talk about how the overall markets performed on a certain day. But what do they mean by that?

They refer to the market indices(plural for index) such as the Sensex or the Nifty50. The exchange handpicks stocks meeting a certain set of criteria and groups them together to form an index. The value of the grouped stocks is used to create the value of the index.

So an Index ETF invests its funds in stocks from an index it wants to replicate.

Examples:

Nifty50 index – Nippon India Nifty BEes ETF and SBI ETF Nifty50 are examples of two ETFs which replicate the Nifty50 index.

Bank Nifty index – Kotak Banking ETF and Edelweiss Bank Nifty ETF are two examples of ETFs replicating the Bank Nifty index.

See also: What are ELSS Mutual Funds?

Features of an Exchange Traded Funds (ETFs)

- Though ETFs are available in single units and are traded on a stock exchange, they are still very similar to mutual funds.

- ETFs are professionally managed by asset management companies

- They too have a pool of money known as the fund corpus which is then invested in a mix of different stocks and asset classes.

- While Mutual Funds aim to outperform their respective benchmark index, most ETFs are designed to match the performance of their benchmark index.

How to invest in Exchange Traded Funds (ETFs)?

As mentioned earlier, any Index ETF investing is just like investing in an Index Mutual Fund but is to be purchased from the stock markets. There are two ways to invest in Exchange Traded Funds (ETFs) –

- Traditional method over a telephone call to your stock broker and asking them to purchase an Exchange Traded Funds (ETFs).

- Through online trading terminals provided by most stock brokers today. All in all, investing in Exchange Traded Funds (ETFs) is the same way we invest in shares of a company.

Just like for shares, you need to first open a trading and demat account.

Upon the time of buying any Exchange Traded Funds (ETFs), charges such as Brokerage, Exchange transaction fees, GST and Securities and Exchange taxes are to be paid depending on the total amount of your turnover.

Pros of Investing in Exchange Traded Funds (ETFs):

- ETFs allow us to invest and also trade in an Index, which otherwise is only possible through Index Futures and Options.

- ETFs offer the advantage of diversification. Instead of handpicking stocks from a sector, you can simply invest in one sector ETF and still manage to diversify your portfolio.

- ETFs investments can be exited or entered on a real time basis as their prices keep fluctuating based on the underlying stock movements. This makes ETFs much more transparent than Mutual Funds which only report NAVs at the end of each day.

- Certain index ETFs have a lower expense ratio than mutual fund schemes which may have a significant effect on your long term returns.

- One can trade in index ETFs intraday too, something which is not possible in case of index mutual funds.

Cons of investing in Exchange Traded Funds (ETFs):

- Tracking error – Though ETFs are designed to emulate the performance of an Index, sometimes there can be a slight divergence in the current price of the ETF and the index. This divergence in price is known as tracking error. It is therefore important that you invest only in ETFs with a small tracking error.

- Illiquid – Certain ETFs that trade on the stock exchange are very illiquid and have very less volumes on any particular day. This can make investing or exiting an existing position tricky. Choosing an ETF which is liquid is essential.

- Difficult to do SIPs – ETFs don’t have the option for systematic investment plans as they are to be purchased directly from an exchange. Mutual fund schemes on the other hand have automatic SIP options.

ETFs are a great way to invest your savings and diversify your portfolio at the same time. Their advantages certainly outweigh their cons. Though they are unique, they are very simple to understand instruments.

However, proper research is required to make the right investment, something which is akin to investing in any asset class.

You can also view the video below on Index Exchange Traded Funds (ETFs)!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Comments 1