Table of Contents

People who buy shares of a company from the Primary market (IPO) or the Secondary market (Stock Market) are known as the shareholders of the company. Thus in the Shareholding Pattern Promoters are the Owners of the company and their holding is shown under the Promoter category, Foreign Institutional Investors (FII)holding is shown under FII or FPI category, Domestic Institutional Investors (DII) holding is shown under Mutual Funds category. Retail Investors can be HNI Investors or public whose name is necessarily disclosed if their shareholding crosses more than 1% of the total outstanding shares available of the company.`

We will discuss each of them in detail. A shareholding pattern is one of the important metrics for deciding whether the stock should be bought or sold. Now, who are the shareholders? The Shareholders are the owners of the company in a virtual sense and stay with the company only if it is expected to generate qualitative returns for them. We will understand all of these in this article.

Power of the Shareholders

The shareholders can question the working of the company and have the liberty to ask the management on any decisions taken on behalf of the company either directly through con calls or indirectly in AGM. Long-term Investors are the ones who create wealth if the going goes very smoothly for the company. Thus, long-term Shareholders look at the profitability, the growth, and the opportunity a company possesses in the medium to long term and the outlook and plans of the promoters for their company going ahead.

What does Increase or decrease in Promoter Shareholding Pattern Disclose?

The increase in promoter holding sends out a positive signal to the investing community and a decrease in holding sends a negative message about the company. The promoter increases or decreases the shareholding in the company looking at the future potential and the growth prospects of his company. The promoter can increase stake in the company via buybacks and open offers if he feels his company’s future growth looks favorable.

If a promoter continuously decreases stake in the company then that sends out a warning signal about the fundamental of the company going ahead but if the holding decreases due to OFS or offer for sale then there’s no need for actual worry. For eg Satyam promoters before the scam had kept on reducing their stake in the company Quarter after Quarter.

How does FII and DII shareholding the barometers to the health of the company?

The FII and DII invest in companies on behalf of their clients after a careful and detailed investigation into the fundamentals and the futuristic viewpoint of the company. They conduct meetings with the company’s management to understand the working and the potential of growth and opportunity lying ahead and the future outlook of the company and after being satisfied invests into the companies which meet their criteria.

Thus if we see FII or DII holding decreasing Quarter on the Quarter basis in a meaningful ratio in any company then that sends out a warning signal for that Companies growth prospects.

Who are institutional investors?

Companies stock owned by mutual or pension funds, insurance companies, investment firms, private foundations, endowments, or legal entities that manage funds on behalf of others is known as institutional investors. Stocks with a large amount of institutional ownership are looked upon favorably. Institutional investors buy and sell stocks in large quantity which has a sharp change in price on either side.

Increase in institutional shareholding: When an institutional investor increases their shareholding in any company then it may be looked at as a signal to buy such stock as the fund managers of these institutions are experienced professionals and according to them the stock price is undervalued.

Decrease in institutional shareholding: When an institutional investor decreases their shareholding in any company then it may be looked at as a signal to sell such stock as the fund managers of these institutions are experienced professionals and according to them, the stock price is overvalued.

See also: FIIs and DIIs Trading Activity

What do Retail Investors look for in a company?

HNI investors or also known as ACE investors are those people who invest their own money after a detailed investigation into all the financial trends and the valuation ratios of the company. They are generally very long-term investors who closely monitor all the developments taking place in the company.

They look for longevity in the growth potential of the company and can question the management anytime on any regulation or decision which they think can adversely impact the company. Thus if there is any meaningful decline in the shareholding pattern of any Individual Investor then that sends out a very negative signal about the company’s operations and the future prospects going ahead. The promoters are liable to answer every shareholder’s query be they FII, DII, or Individual Investors.

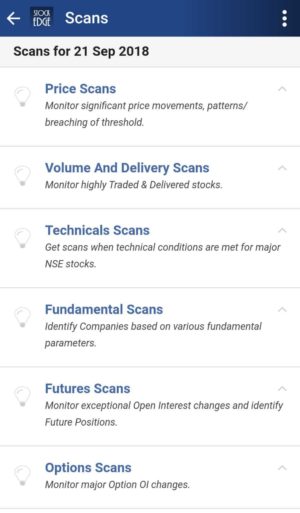

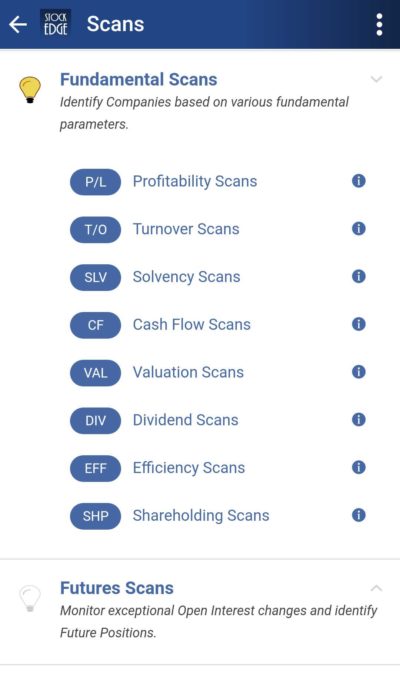

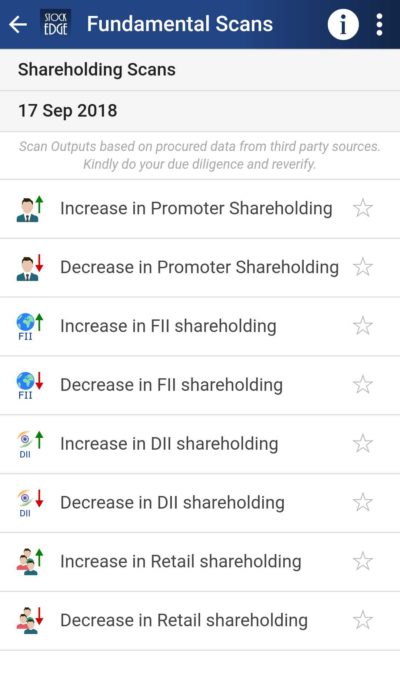

Where can we find all these data for decision making?

All these data are available in our app Stockedge (under Scans- Fundamental Scan-Shareholding Pattern) which will help you filter out the names of the companies. Under the Fundamental Scan, we have the shareholding Pattern scan which helps you to filter out companies based on Increase or decrease in Promoter holding, Increase or decrease in FII holding, Increase or decrease in DII holding, and Increase and decrease in Retail holding.

Additional Feature

In Stockedge App we have My stock edge where you have the Investors group in which you can make your own Investor groups. One can create 50 Investor groups by their Individual names and can add 100 names in each Investor’s head. For example, you can create a group called RJ and under it, u can add names like Rakesh Jhunjhunwala, Rare Enterprises, Rekha Rajesh Jhunjhunwala, Rakesh Radheshyam Jhunjhunwala, etc. Once you are finished creating the group then you can run the scan which will help you to see the names of the companies in which RJ holds a stake.

See also: Track your Favourite Investors.

Bottomline

If you still do not have the StockEdge app, download it right now to use this feature. It is a part of the premium offering of the StockEdge App.

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge.