Table of Contents

Don’t we all not want to invest in companies which generate a good amount of cash from its business operations and thus can give us good dividends or good returns in the long term?

Cash flow of the company is an annual data generated from Cash Flow Statement taking into account the cash inflow and outflow from a company affecting the liquidity of the business.

Thus companies which can consistently increase their cash from operations can sustain any increase in macro headwinds and thus provide a good investment opportunity.

Now you would like to know which are those companies right!!!

Well, the stockedge app helps you to find out much more about it.

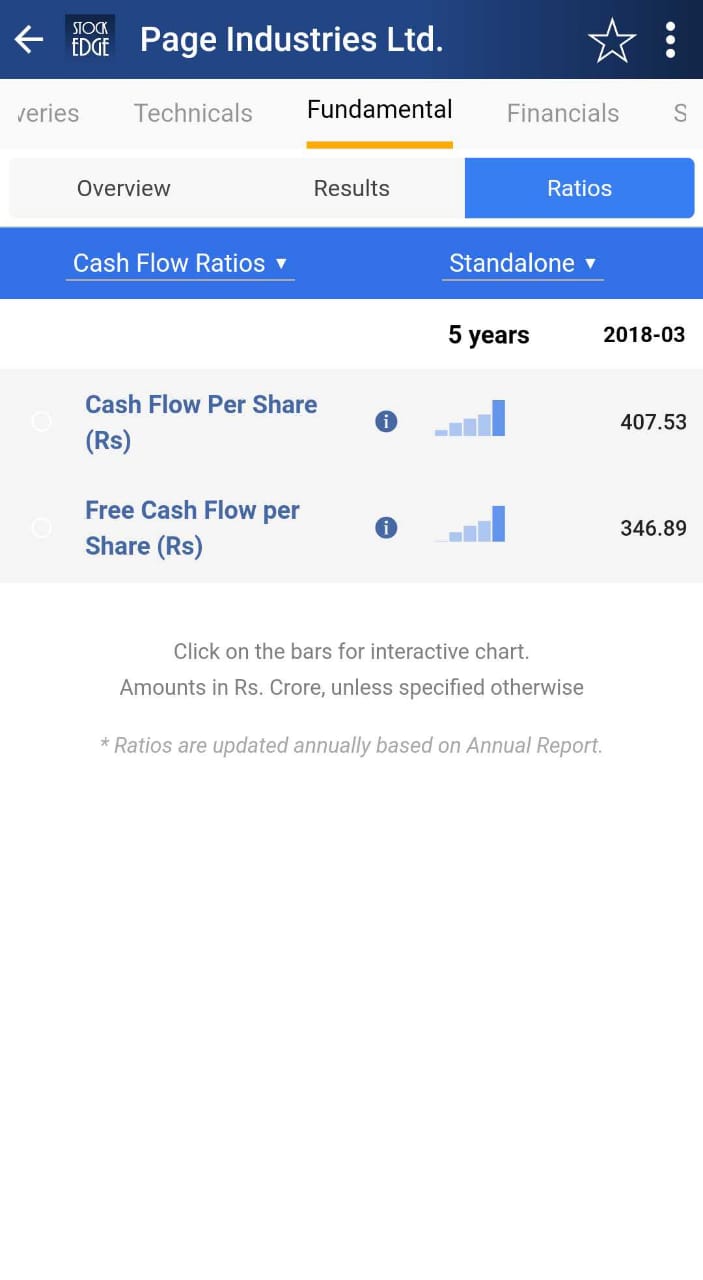

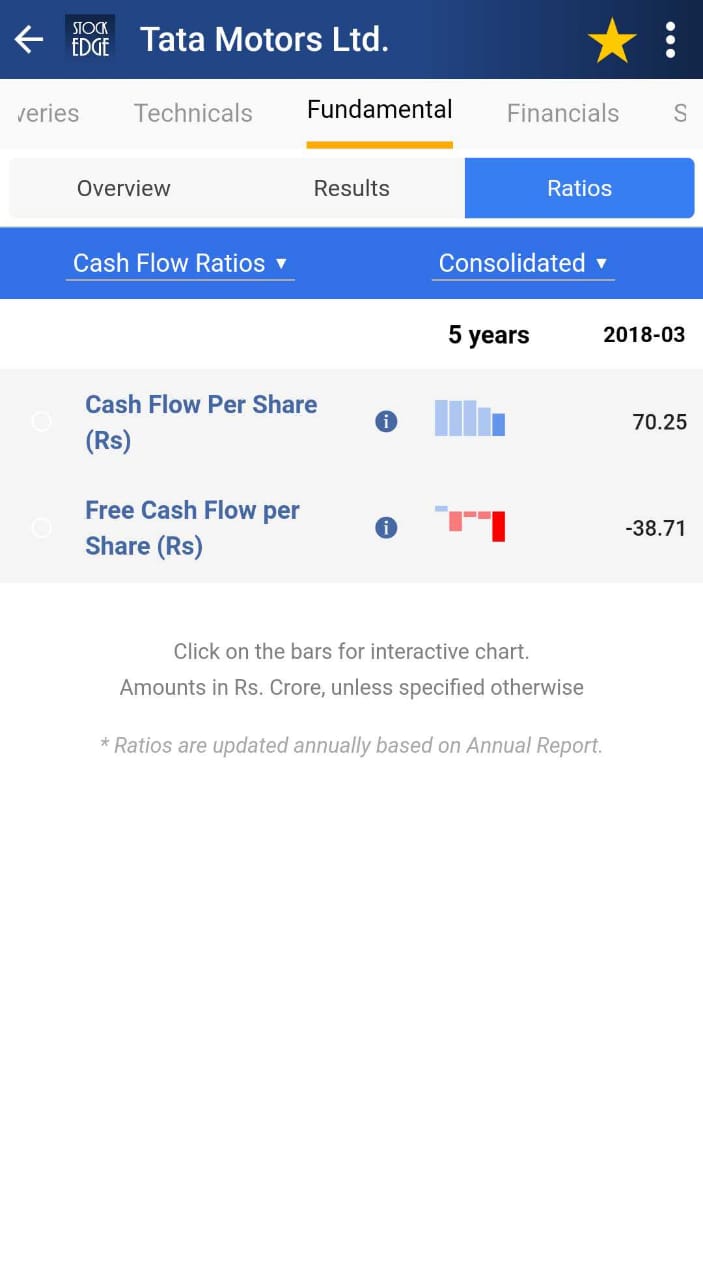

You can see this information in the ratios section under the financial of any stock. Here we can see that in the case of Page Ind cash flow in consistently increasing whereas in the case of Tata Motors it is decreasing.

So let’s understand more about Cash flows and how it works.

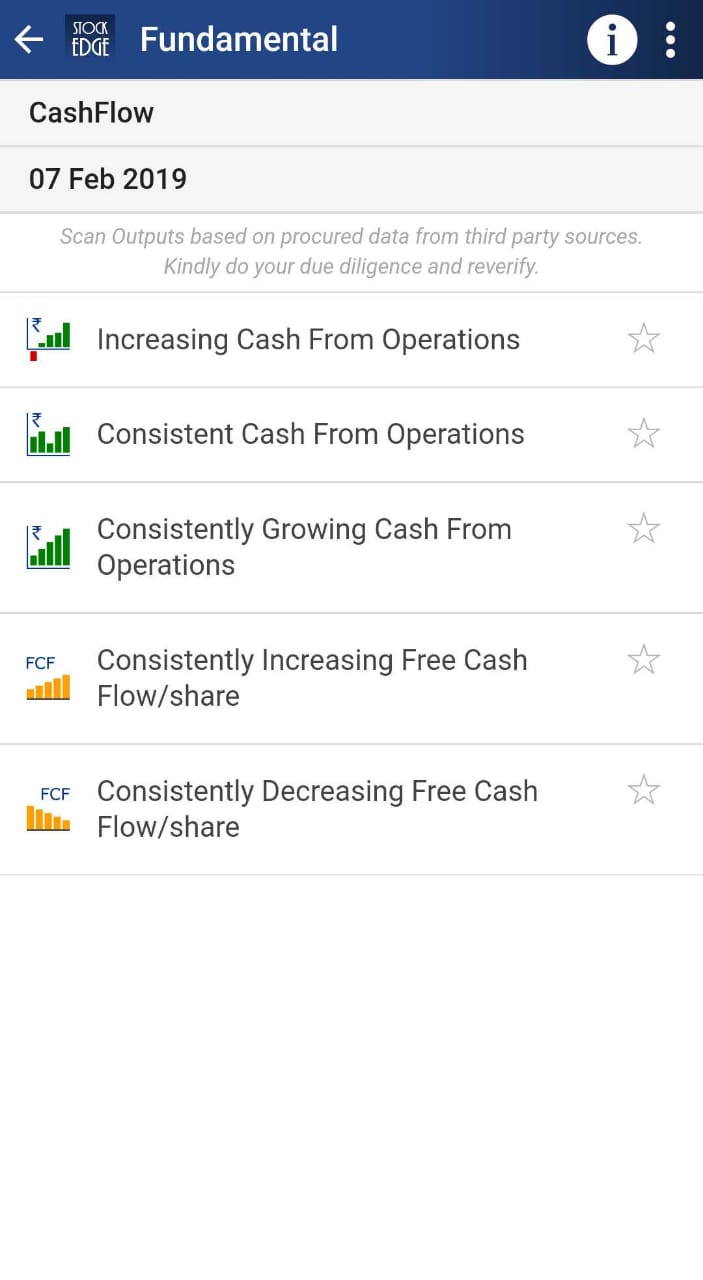

Cash flow Scan

In this scan, the stocks with good operating cash flows are filtered out. Now operating cash flows are those which are left after paying all direct costs (subtracted from sales) involved in manufacturing to the selling of the product. This takes into account the cost of goods sold including taxes and Interest. Thus this is an accurate measure to ascertain a company’s financial strength.

Formula:

Operating cash flow = Sales – Direct Cost

We also have Financing Cash Flows which gives insight into the debt taken by the company from outside or internally for the needs of the working capital requirement of the company thus it’s a payment made for running the business. Thus these requirements can be a short-term or a long-term capital requirement by the company. Dividends, buybacks, acquisition etc are the financing cash flow components. It is found in the long-term capital section of the balance sheet.

Formula:

Financing Cash Flow = Cash & Cash Equivalents – Change in Inventory – Dividends Paid

We also have Investing cash flows which take into account any purchases or Investments made for short term or long term by the company for which cash is used for eg any purchase of fixed asset like Property Plant or Equipment or any new Investments falls under-investing activity. Any joint venture or merger and acquisition for which payment is made also comes under this head. It is found in the non-current head of the balance sheet.

Formula:

Investing Cash Flow = Change in fixed Asset + Change in Investments

What is the significance of the Cashflow scan?

Now you must be eager to know how to use cash flow scan and implement it to generate good investment stocks.

Thus we will discuss all this here to help you filter out companies with good cash flow.

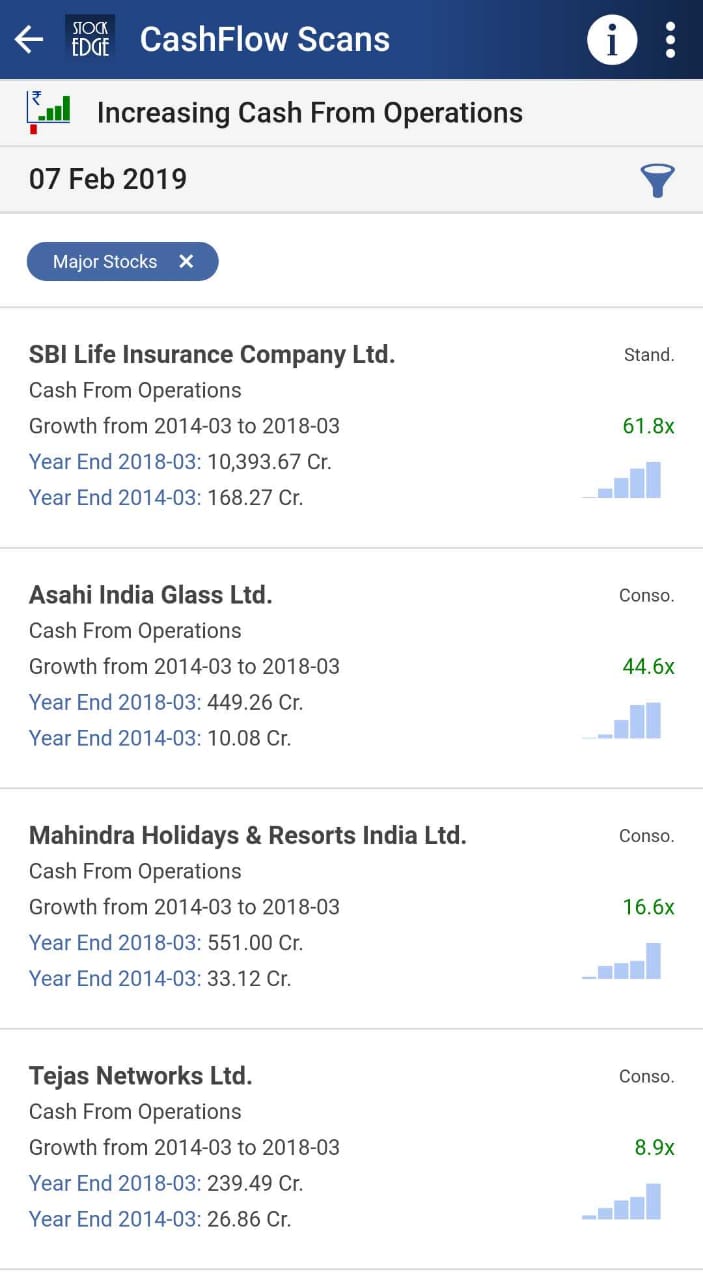

Increase in cash from operations signifies the financial strength of the company due to an increase in earnings. It means that after all the direct costs related to production and distribution of goods is deducted from sales the company generates enough cash from operations. This cash is called the cash from business operations.

Consistent cash from operations means that the company is able to generate positive returns regularly from its business. It means its earning is growing consistently and thus it’s a good growth stock.

Consistently growing cash from operations means that a company is able to increase its cash flow from its operations every year after meeting its business expenses which means it’s able to utilize its financing and investing cash flow very wisely. It also means that the earnings of the company are also growing proportionately thus increasing cash flow for the company.

What do you mean by Free Cash Flow?

Free Cashflow simply means cash left over after a company pays for its operating expenses and Capital Expenditure (CAPEX). It is an important measure which shows how efficient a company is at generating cash. Investors use free cash flow to measure whether a company have enough cash, after funding operations and capital expenditure, to pay its investors through dividend or Buyback.

Formula

Free cash flow = Operating CF – Capital Expenditure

Consistently increasing Free Cash Flow: Companies whose free cash flow is increasing consistently due to revenue growth, efficiency improvement, cost reduction or debt reduction can reward investors tomorrow.

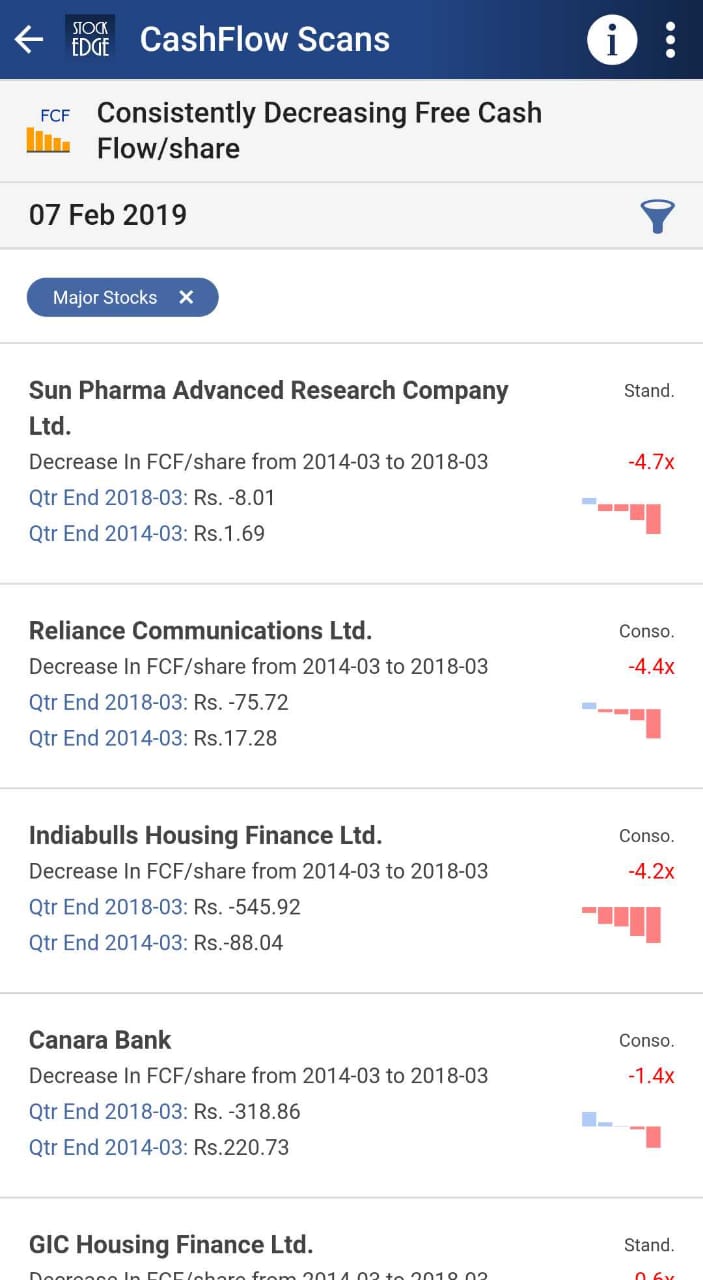

Consistently decreasing free cash flow: Decreasing FCF might signal that the company is not able to sustain its earnings growth. An insufficient FCF for earnings growth can force a company to increase its debt levels or not have the liquidity to stay in business.

Bottomline

Consistent growing Cash Flow from the company is very important as it’s a very big metric to understand the financial strength of the company. Thus to filter out companies generating increasing cash flow from operations in seconds subscribe to Stockedge. If you still do not have the StockEdge app, download it right now to use this feature. It is a part of the premium offering of StockEdge App.

Click to subscribe: https://stockedge.com/premium

If you want to know more about this then click on this link: https://www.youtube.com/watch?v=WTosUj92lp8

Thanks for your detailing of fundemantals and cash flows

It is highrly helpful for the analysis and to improve our analytical skills and increase the scope of making profit

Keep it up StockEdge team

You’re doing very good job StockEdge team, but as a user I’ve one general suggestion.

Here all three options are paid one, you should provide at least one option from each category for non-premium user.

This data is available for free to you under the stock page. The scans are part of the premium services

Sir best app please down paid service charge

Great….kudos to stockedge