Table of Contents

Net Interest Margin ratio helps in understanding the quality and quantity of lending by banks and NBFC’s and its effect on their books. There are a lot of ratios used for the valuation analysis of a company but banks are differently valued using NIM, Yields on advances, etc. Let’s understand one such ratio i.e. Net Interest margin.

You can also watch the below video on Everything you want to know about Net Interest Margin ratio:

Impact of Net Interest Margin(NIM) in Stock Analysis

It is a measure of the difference between the interest income generated by banks and NBFCs and the amount of interest paid out to their lenders relative to the amount of their assets. It is a measure of how successful a firm is at investing its funds in comparison to the expenses of its investments.

It basically measures the difference between the interests paid and the interests received. A negative value signifies that the firm did not make an optimal decision, because interest expenses were greater than the amount of returns generated by investments. If the demand for savings increases relative to the demand for loans, then the net interest margin will decrease. If the demand for loans is higher than the demand for savings than the interest margin will increase.

Exceptions to Net Interest Margin (NIM)

Net Interest Margin ratio is only applicable to banks and Non-Banking Finance companies. So it is extremely restrictive and not applicable to different sectors.

Net Interest Margin Formula

Net interest Margin= (Interest Income Earned-Interest Income Paid)/Total Assets

Suppose a Bank’s interest earned is 3 crores, interest paid is 1 crore and the total assets are 10 crores. In this case, the net interest margin is (3-1)/10 or 20%.

See also: Yield on Advances (YoA) for Banks

StockEdge App

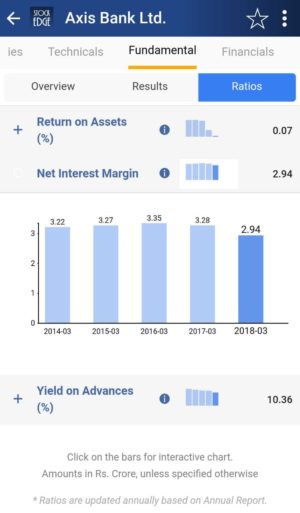

Nowadays we don’t have to calculate NIIM on our own. StockEdge gives us NIIM of 5 years of any Bank or NBFC listed on the stock exchange. We can look at and compare NIIM of any NBFC’s and Banks and filter out stocks accordingly.

Suppose we want to look at the NIIM of Axis Bank of last year. In the Fundamental tab of Axis Bank, click on the Fundamentals tab, and we will get the Ratios tab. Then in the Ratios tab click on Return Ratios, now in Return Ratios click on Return on Assets and we get the NIIM in a fraction of a second.

Bottomline

Net Interest Margin is an important parameter to understand if the bank or NBFC is able to generate good returns on its loans. With the help of these ready-made parameters you can with a click of a button filter out NIIM of every bank or NBFC’s. So, what are you waiting for? These parameters are freely available in all Bank and NBFCs under the StockEdge app. So, don’t wait anymore. If you still do not have the StockEdge app, download it right now to use this feature for free.

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge.