Table of Contents

The Money Flow Index (MFI) is a technical oscillator which uses price as well as volume to identify the overbought or oversold zones of a stock.

Both price and volume are two basic but important indicators in technical analysis for predicting future price movement.

The Money Flow Index is one of the technical tools used in trading.

Let us discuss about this oscillator in details:

What is Money Flow Index?

The Money Flow Index (MFI) is a momentum indicator that identifies the momentum of outflow and inflow of money over a specific period of time.

Money Flow Index Indicator is the same as Relative Strength Index (RSI) but it incorporates volume, whereas the RSI considers price only.

MFI oscillates between the range of 0 and 100. Generally, the oversold region is considered below 20 and the overbought zone is considered above 80.

The formula for calculating MFI is:

Money Flow Index = 100 – {100 / (1 + Money Flow Ratio)}

Where,

- Money Flow Ratio = (14-period Positive Money Flow) / (14-period Negative Money Flow)

- Raw Money Flow = Typical Price x Volume

- Typical Price = (High + Low + Close)/3

To know more about Money Flow Index, watch the video below on StockEdge MFI Scan Tutorial:

Using Money Flow Index in StockEdge App:

We have discussed about the basics of MFI, now let us discuss how to use this technical oscillator to filter out stocks for trading:

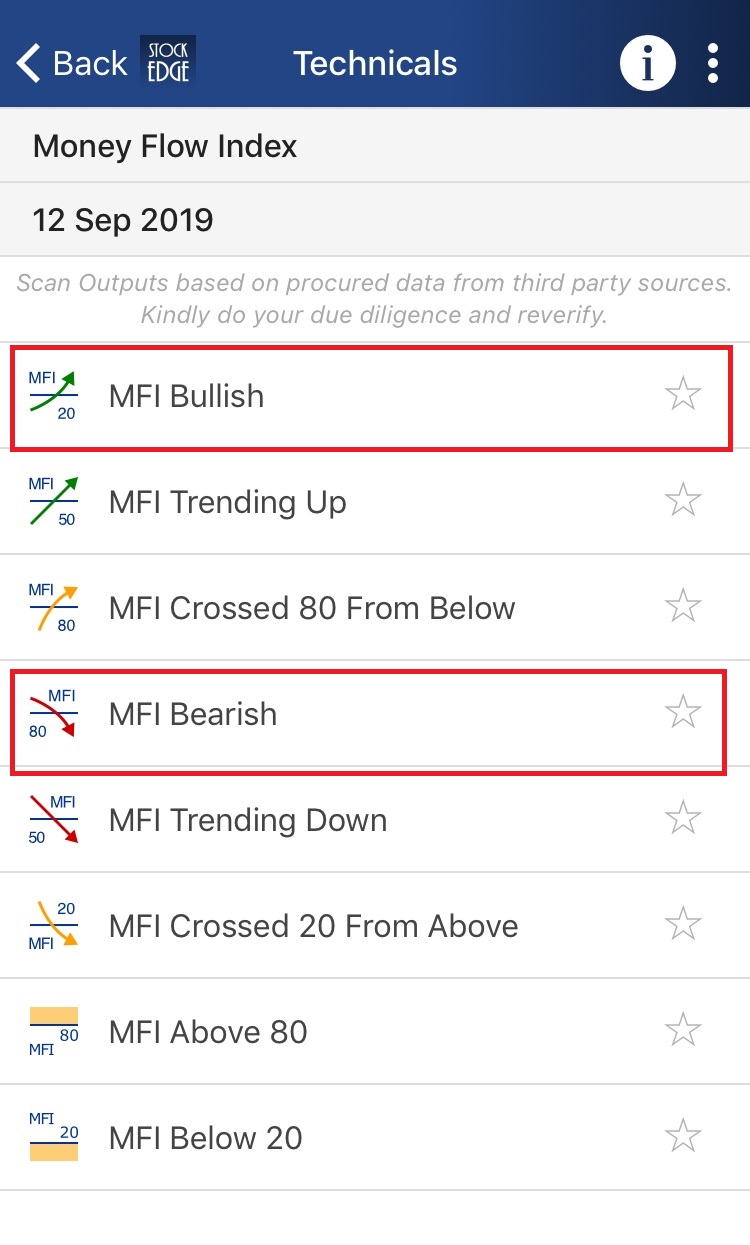

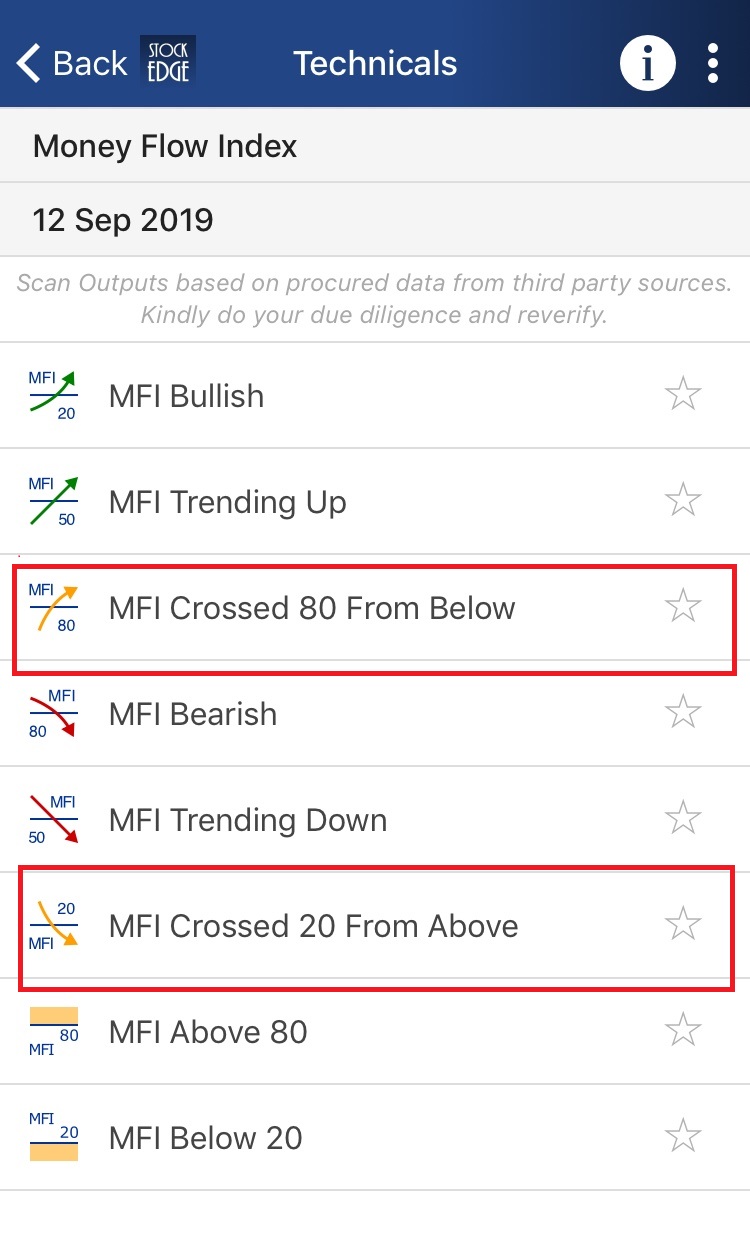

In StockEdge there are many Money Flow Index scans available for filtering out stocks for trading:

Let us discuss a few of these scans:

Example 1: MFI Bullish & MFI Bearish:

MFI Bullish as the name suggests, is a bullish scan which indicates that the MFI has crossed 20 from below meaning the MFI has exited the oversold region and one can take buy position in it.

Whereas MFI Bearish is a bearish scan which indicates MFI has crossed 80 from above meaning the MFI has exited the overbought region from above and one can take sell position in it.

See also: Effect of Strengthening Rupee

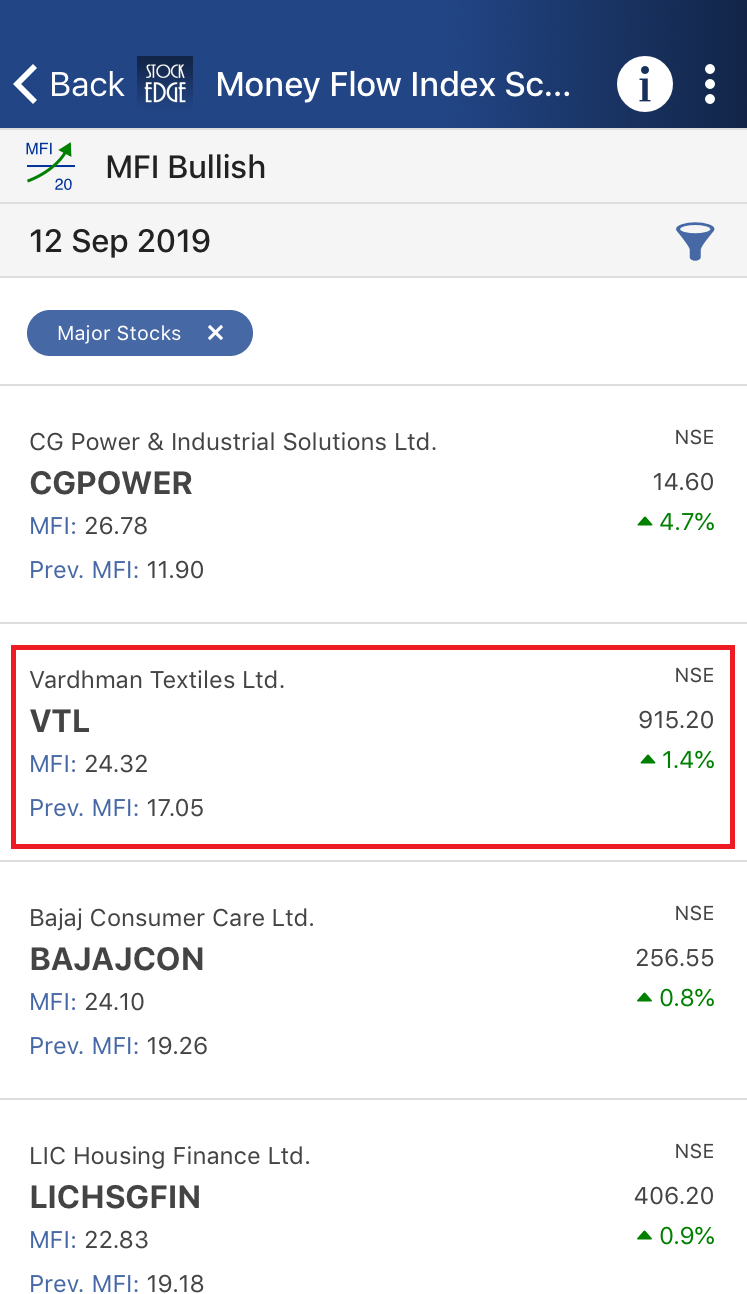

When we click on MFI Bullish scan, we get a list of stocks which fulfill this criterion:

After clicking on Vardhman Textiles Ltd. we get a technical chart with MFI plotted in the sub-graph:

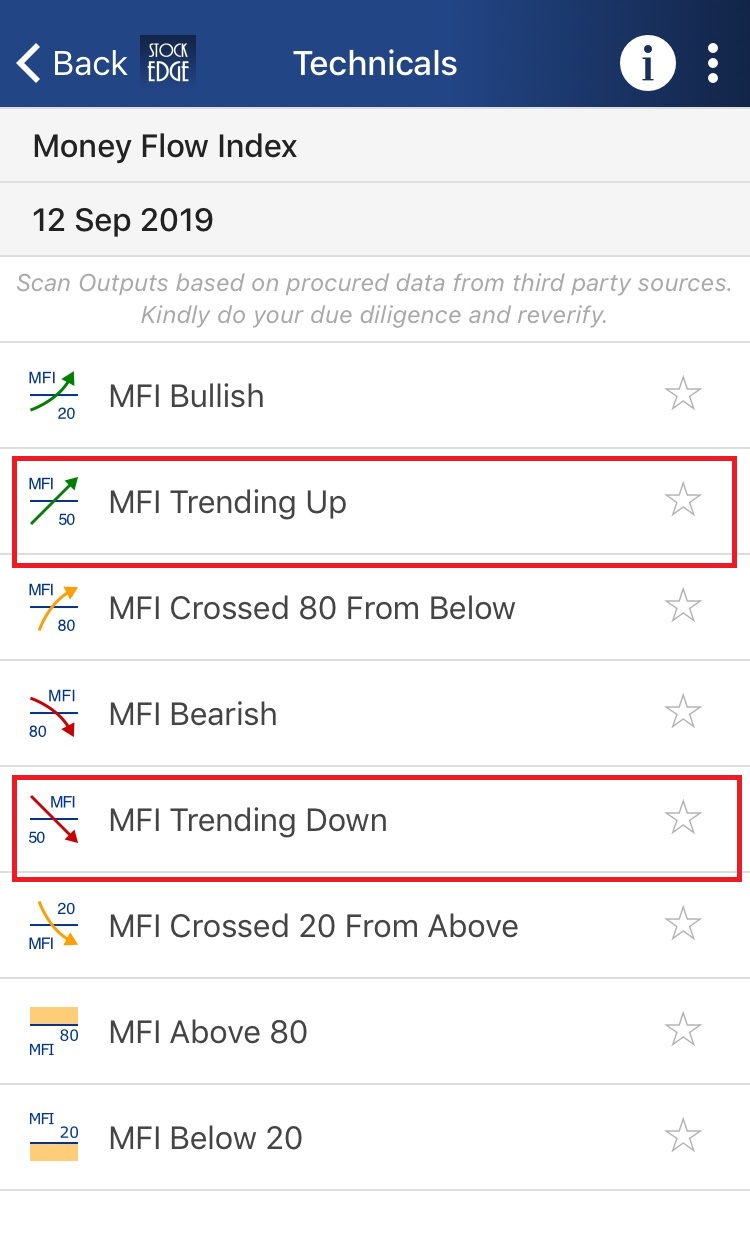

Example 2: MFI Trending Up & MFI Trending Down:

MFI Trending Up is a bullish scan which signifies that MFI has crossed 50 from below.

50 is an important value of MFI. When the MFI crosses 50 from below it indicates uptrend and when the MFI crosses 50 from above just like the MFI Trending Down scan it indicates downtrend.

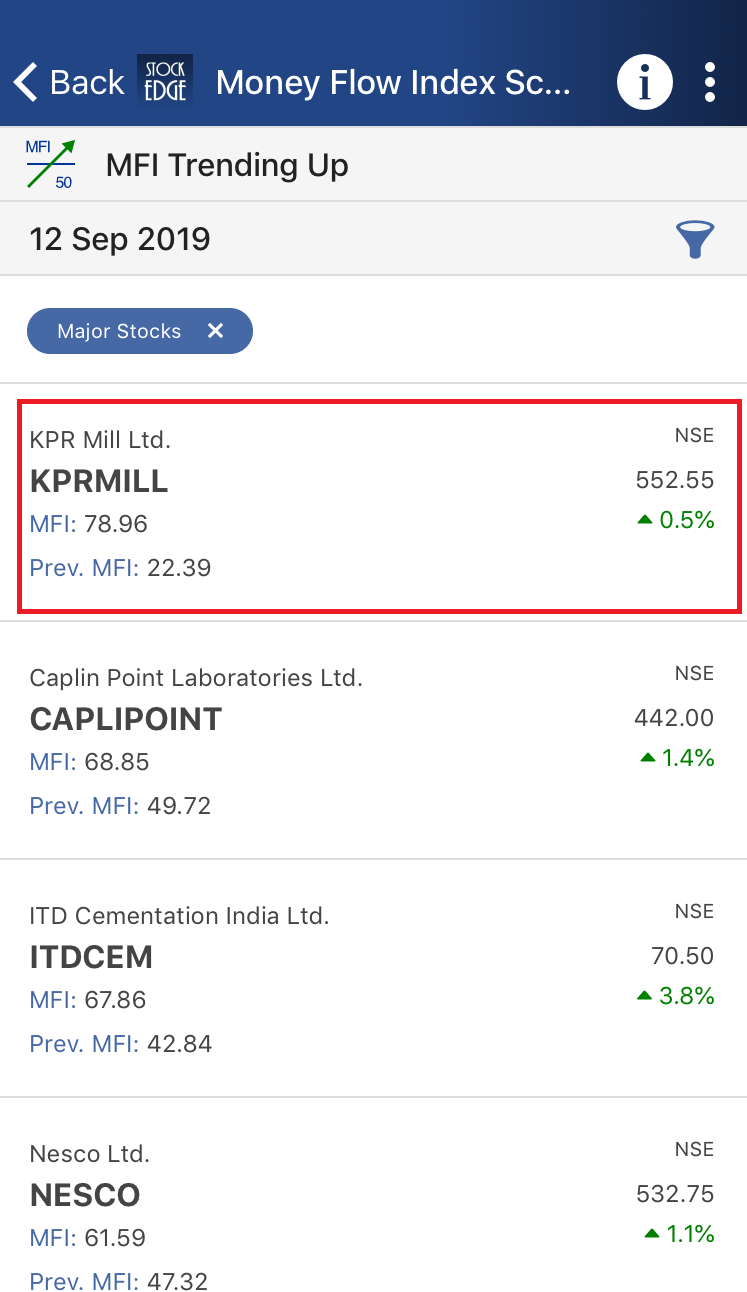

When we click on MFI Trending Up scan, we get a list of stocks which fulfill this criterion:

After clicking on KPR Mill Ltd. we get a technical chart with MFI plotted in the sub-graph:

Example 3: MFI Crossed 80 From Below & MFI Crossed 20 From Above:

MFI Crossed 80 From Below scan indicates that MFI has entered the overbought region which indicates a bullish signal.

Whereas MFI Crossed 20 From Above indicates that MFI has entered the oversold region which indicates a bearish signal.

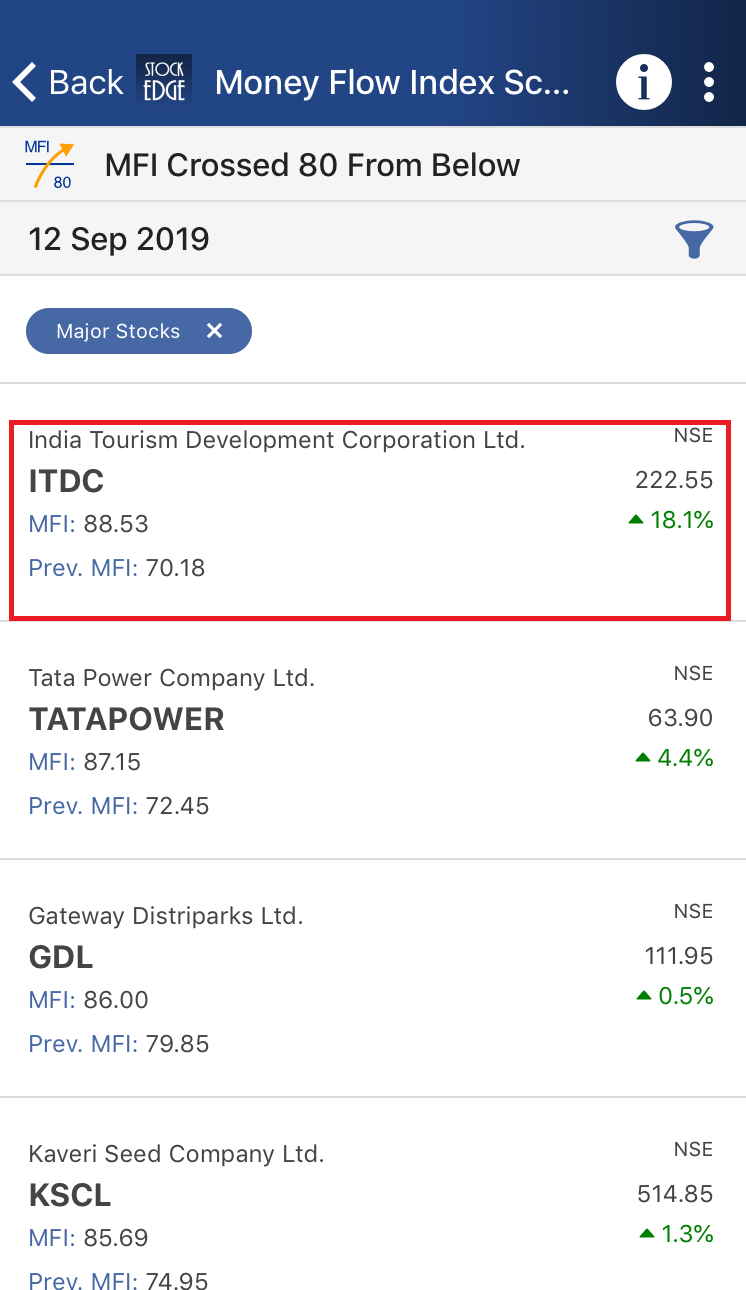

When we click on MFI Crossed 80 From Below scan, we get a list of stocks which fulfill this criterion:

After clicking on India Tourism Development Corporation Ltd. we get a technical chart with MFI plotted in the sub-graph:

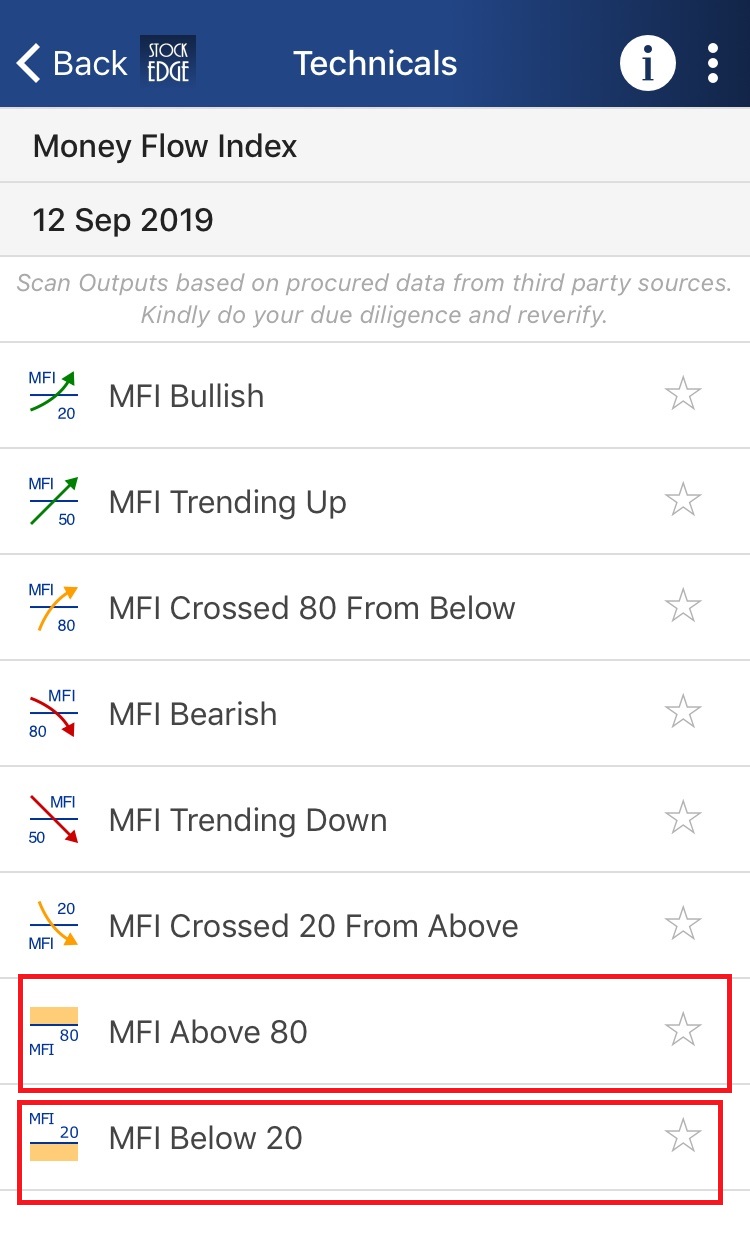

Example 4: MFI Above 80 & MFI Below 20:

MFI Above 80 indicates that MFI is in the overbought zone. Here the prices can continue to be higher if the uptrend is strong.

Whereas MFI Below 20 indicates that the MFI is in the oversold zone. Here the prices can get can continue to be lower if the downtrend is strong.

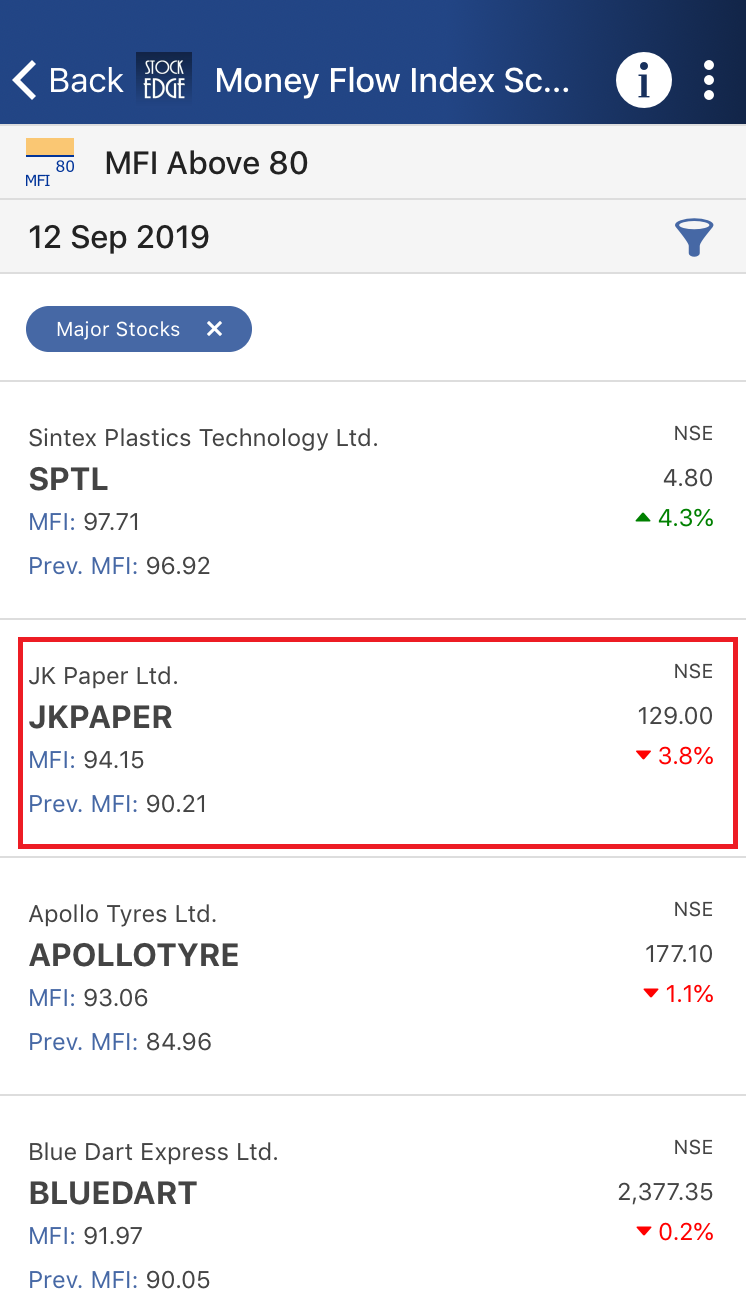

When we click on MFI Above 80 scan, we get a list of stocks which fulfill this criterion:

After clicking on JK Paper Ltd. we get a technical chart with MFI plotted in the sub-graph:

Above are examples of the MFI scans that generates buy and sell signals and also give us a list of the stock which fulfills the criteria of the scans for that particular day.

You can filter out the stocks and can trade accordingly using these scans.

Money Flow Index scans is one of the free tool offered by StockEdge App which you can download from here.

Interactive charts are only available for paid subscribers. You can check out our subscriber plans from stockedge.com.

To get a comprehensive idea of Money Flow Index, log on to elearnmarkets.com.

Super app for share traders

Super app for Equity traders