Table of Contents

Traders look for trends to build, and when it’s built, the most powerful moves take place in the financial markets.

Parabolic SAR is a technical indicator that is used to determine the price direction of stocks and it also draws attention to the traders when the price is changing.

Parabolic SAR is also known as the “stop and reversal system”.

The indicator plots a curved pattern on a price chart, which describes potentials stop and reverse levels.

It was developed by J. Welles Wilder Jr who also developed the Relative Strength Index Indicator.

Let us discuss more this indicator:

What is Parabolic SAR?

The Parabolic SAR (PSAR) helps traders identify the direction of the stock movement and also provides them with the entry and exit.

This indicator on the chart appears as a series of dots either above or below the price bars.

When the Dots are below the price bar is then the price movement is considered to be bullish and when the Dots are above the price bar then the price movement is considered to be bearish.

When the Dots flip direction then it indicates a reversal.

To know more about Parabolic SAR, refer to the video on StockEdge Parabolic SAR scan tutorial:

Using Parabolic SAR, in StockEdge App:

We have discussed the basics of Parabolic SAR, now let us discuss how to use this technical oscillator to filter out stocks for trading:

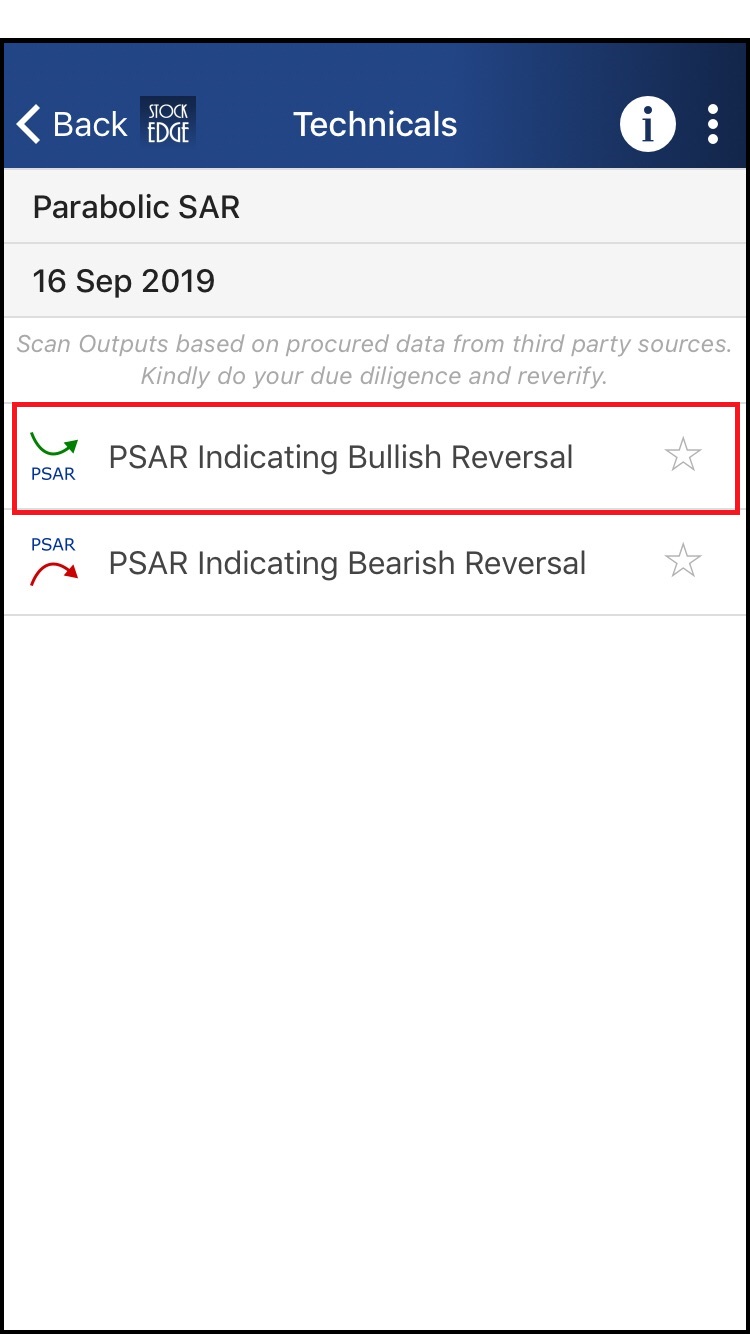

In StockEdge there are many Parabolic SAR scans available for filtering out stocks for trading:

Let us discuss a few of these scans:

Example 1: PSAR Indicating Bullish Reversal:

PSAR Indicating Bullish Reversal scan helps the traders to know that the bullish reversal may take place in the stock as the dots are flipping to the downside of the price bars.

See also: Relative Strength (RS)

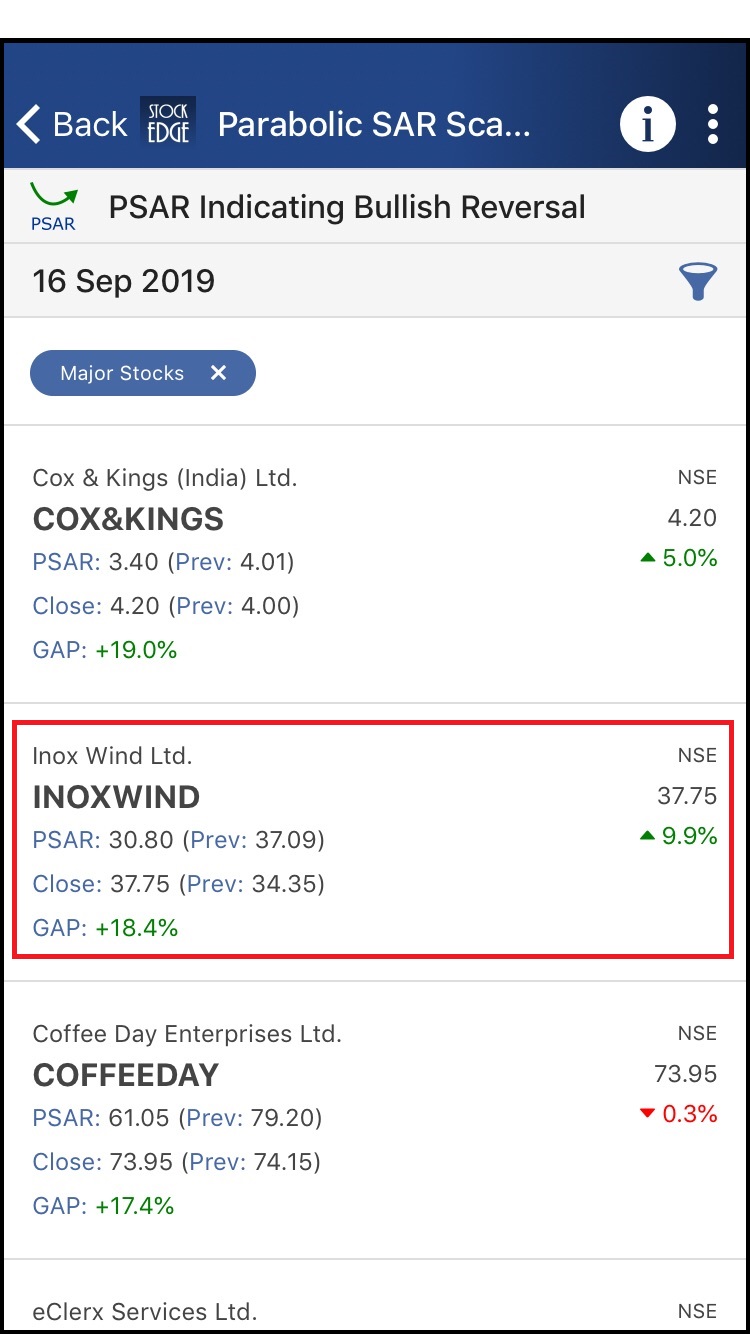

When we click on PSAR indicating Bullish Reversal scan, we get a list of stocks which fulfill this criterion:

After clicking on Inox Wind, we get a technical chart with PSAR plotted in the chart:

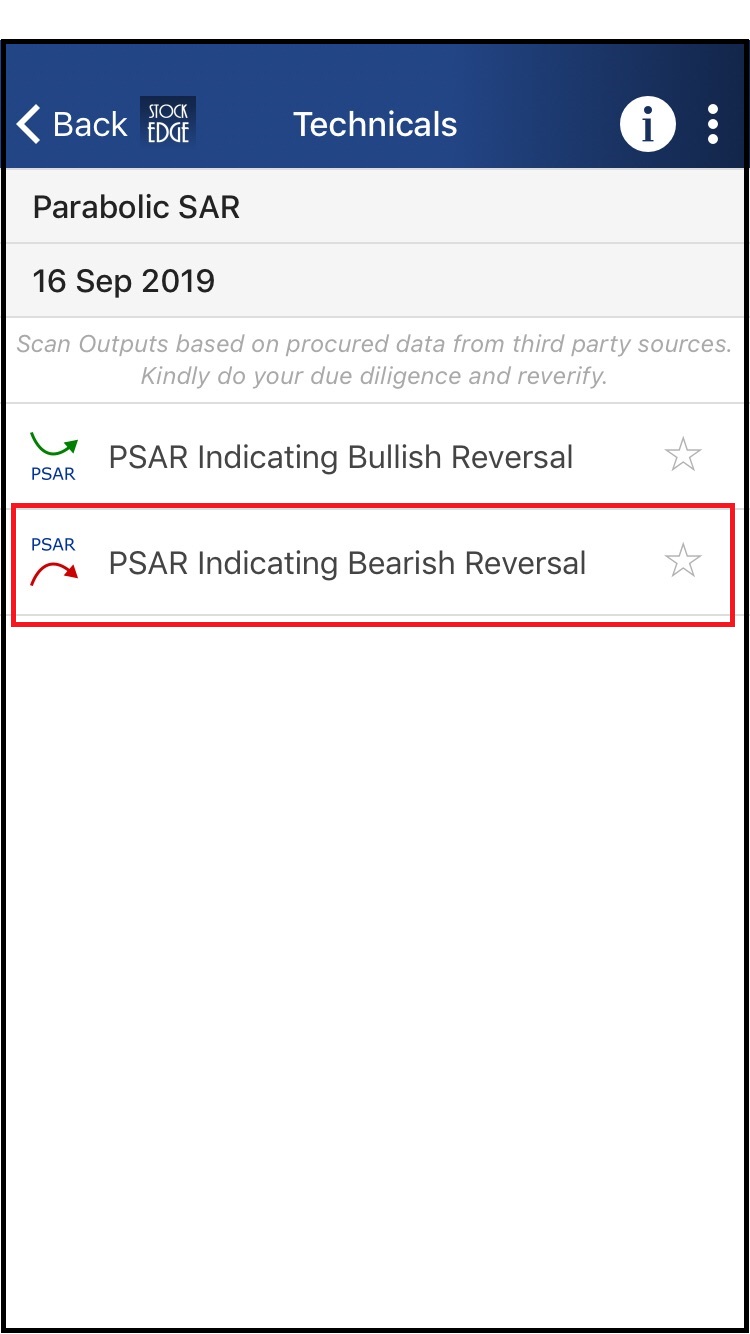

Example 2: PSAR Indicating Bearish Reversal:

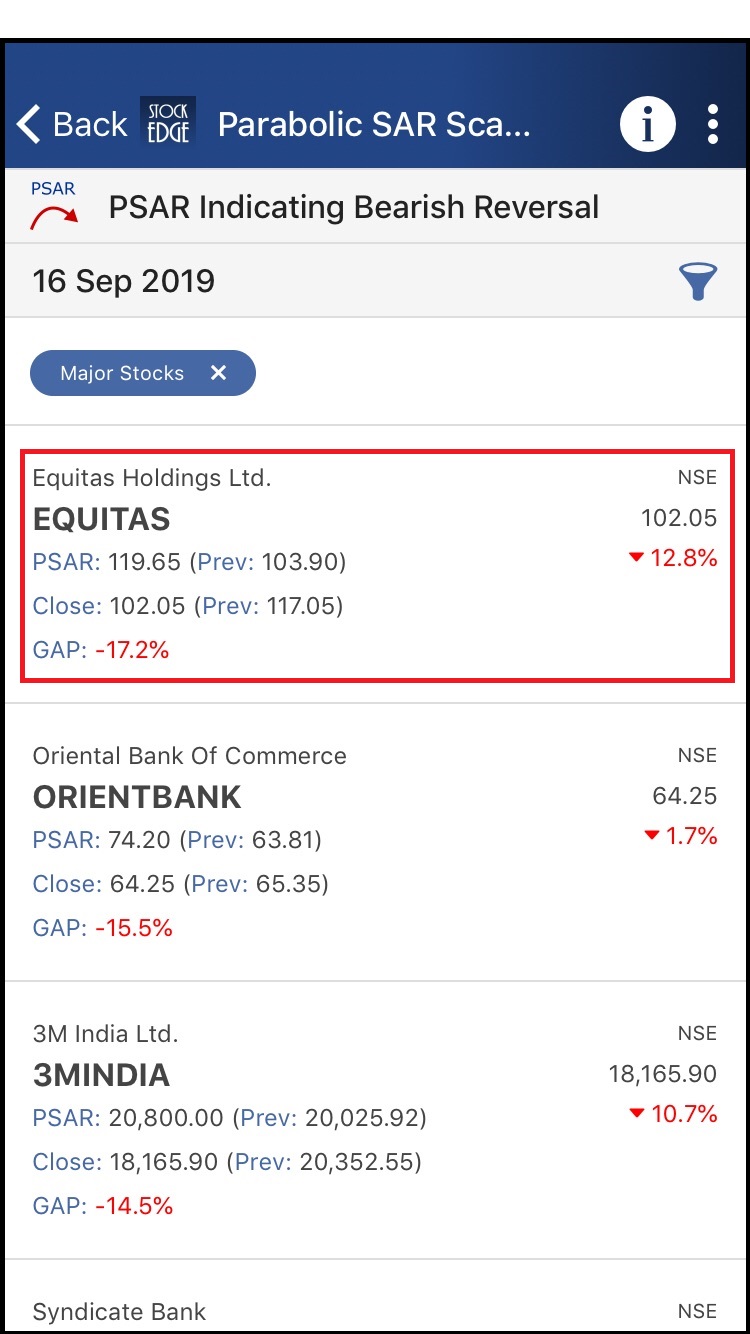

PSAR Indicating Bearish Reversal scan helps the traders to know that the bearish reversal may take place in the stock as the dots are flipping to the upside of the price bars.

When we click on PSAR indicating Bearish Reversal scan, we get a list of stocks that fulfill this criterion:

Above are examples of the PSAR scans that generate buy and sell signals and also give us a list of the stocks which fulfill the criteria of the scans for that particular day.

What does the Parabolic SAR Calculate?

The parabolic SAR is used to track price changes and trend reversals over time. In order to calculate today’s Parabolic SAR, we will need to know the most extreme price (EP), the acceleration factor (AF), as well as the most recent PSAR. We will also need to determine whether there is currently an uptrend or a downtrend.

If the pair is trading under the PSAR you should sell. If the pair is trading above the PSAR you should buy. There are many ways to trade by using this indicator. It can be traded it with additional indicators or on multiple/different time frames.

The “extreme price” will either be the highest high or the lowest low that has occurred within the relevant period. Every time a new EP is established, the trend gets updated. The acceleration factor (which begins at 0.02) will increase by 0.02 for each of the first ten times that the EP has been updated (creating a functional AF “ceiling” of 0.20).

The Parabolic SAR (PSAR) calculation is:

PSAR= Prior PSAR + Prior AF (Prior EP – Prior PSAR); for uptrends

PSAR= Prior PSAR –Prior AF (Prior PSAR – Prior EP) for downtrends

The difference between the uptrend and downtrend formula is whether the second part of the formula is added or subtracted. It’s important to note, without properly identifying the direction of the current trend, your PSAR calculations will be moving in the wrong direction.

You can filter out the stocks and can trade accordingly using these scans.

Parabolic SAR scans and Interactive charts are only available for paid subscribers. You can check out our subscription plans from here.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.