Table of Contents

Unlike China Plus One, which was widely discussed around the world, Europe Plus One has majorly emerged in India lately.

The fanatical crusade against Moscow by EU bureaucrats, closely allied to the US and directed from Washington, is resulting in the collective impoverishment & economic degradation of Europe.

To sum up the current misery in Europe:

- Record inflation is eroding people’s savings and purchasing power.

- Energy commodities are in short supply, which might make life challenging during the harsh winters.

- The average annual heating and electricity bill now exceeds the monthly wages of workers in most EU countries.

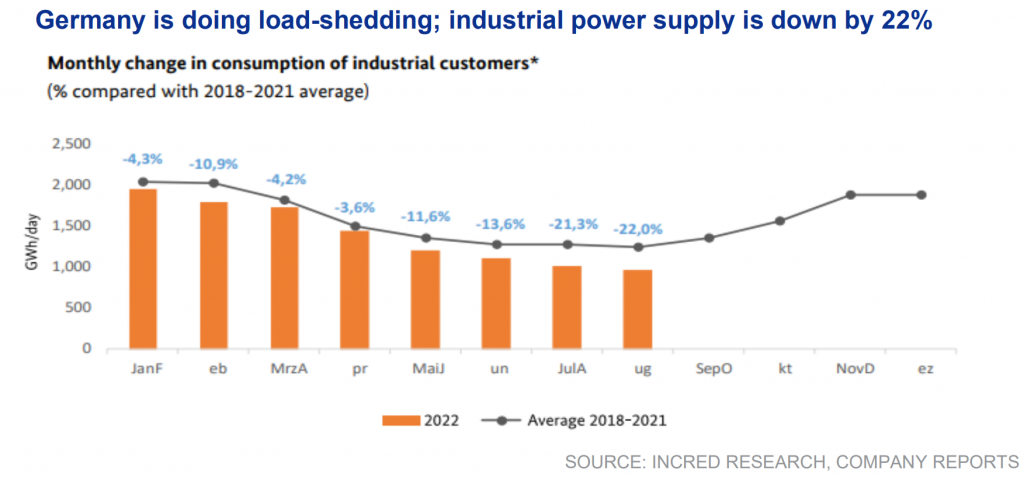

- Production is ceasing, unemployment is rising & industries are leaving Europe.

Faced with exorbitant natural gas prices, energy-dependent industries in Europe, such as the chemical, automotive, cement and many other industries, are facing similar problems. In this desperate situation, European industrialists are actively exploring options for relocating their production elsewhere. Thus coining the opportunity for other countries as ‘Europe Plus One’.

India’s low energy & labour costs and enhanced ease of doing business, makes it a suitable alternative for some European companies to relocate production to.

Case Study : Struggles of a German Company

To demonstrate the magnitude of the ongoing issue, let’s consider Germany.

The largest chemicals company in the world, BASF, of Germany, is heavily dependent on gas as a source of energy and a raw material. It consumes roughly as much each year as the whole of Switzerland. BASF actively participated in ensuring that a significant share of that gas was affordably imported from Russia.

BASF-produced chemicals are used to make anything from toothpaste to vitamins, from building insulation, painkillers to nappies.

This would have disastrous repercussions for the entire European continent and trigger a new global supply chain crisis.

Indian Sectors Which May Benefit :

Energy intensive & export reliant industries in Europe would struggle the most during the energy crisis that is expected to worsen in the coming months.

A prolonged crisis (elevated gas price) would compel European companies to either collaborate (transfer of technology) or shift energy intensive industries out of Europe or outsource till the situation stabilized.

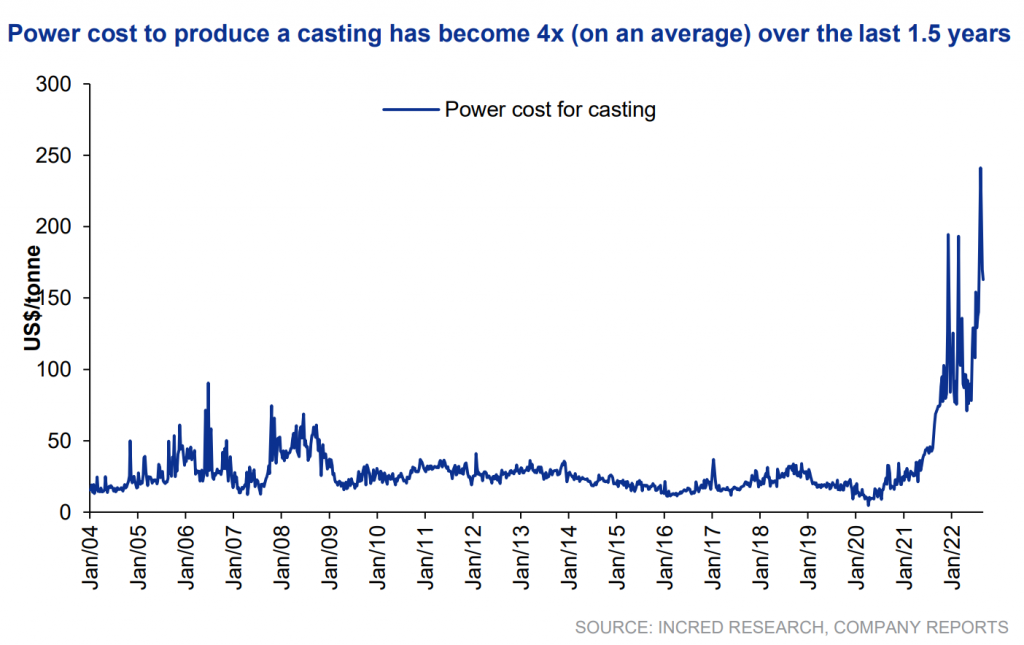

Producers of castings, steel components, forgings and machined components are all heavy power consuming industries which may relocate out of Europe.

Indian Chemical companies involved with base chemicals such as Ammonia, Ethylene, and Propylene which come from crude oil refining companies could benefit in the medium to long term as well.

Indian Industry Commentary : Real or Hype?

In recent months, the top management of many Indian companies have taken cognisance of the recent developments in Europe. We have collated their views below and also included an extensive discussion on the subject by Schaeffler India, a leading precision bearings and metal components manufacturer.

Schaeffler India Concall Q2CY22

Shift from EU to India :

Schaefler has a strategy in place for the future, wherein, some of the products that are being made in Europe would be shifted to India. Accordingly, appropriate restructurings are being made in the Parent Company(Europe).

The management thinks the Indian firm would be exposed to more export opportunities as a result of the energy crisis in the EU.

As a result, it is anticipated that there will be high demand for its exported goods because, unlike the EU, India does not now experience an energy crisis.

India’s Cost Competitiveness and Advantages ?

India offers a degree of cost competitiveness based on the product profile and current competency to produce various items.

Axles, Ball bearings and stacked bearings are among the goods that India is the most affordable site in terms of global cost competitiveness. Raising the prospects for Schaeffler India to become amongst the global hubs for standard and mid-size bearings.

Although India is not the only country in this best cost basket, the management claims that for some product lines, India has an advantage over other best cost nations like Vietnam.

In addition, these factories in India have 2-3 years of production experience and do not have the rising costs problem that Europeans do.

Future Roadmap for India ?

According to the management, India currently possesses the intellectual building blocks for new product development, and Schaeffler India may eventually offer products for the rest of the world under the Schaeffler World brand.

Total Capex earmarked for India Business

It would invest roughly INR 1,000 Crores in capex over the course of three years, from 2021 to 2024. 200 crores were spent in CY21, 400 crores are expected to be spent this year, and 400 crores will be spent in CY2023.

Schaeffler India Q1 CY22 :

India has expertise for a particular range of products within the Schaeffler group as a whole. Such products as a result are getting localized. Although those products are also manufactured in other parts of the world, they are being relocated to India because of this competence.

However, the management highlighted a similar trend unfolding for other products specific to other countries. Denying that not every product would get localised in India, to achieve overall cost and competence efficiency, the group localizes manufacturing in various countries respectively. Therefore Schaeffler has targeted different relocations across the Schaeffler world.

The management of several leading Indian MNCs commented on the genuine opportunity that might be derived from the European crisis, as shown in the infographic below.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Two Sides of a Coin – The Antithesis(Against India)

The oil crisis of the 1970s previously demonstrated Europe’s vulnerability to importing fossil fuels from outside the continent.

Given the disastrous effects of the 1970s energy crisis on European economies dependent on energy imports, the United States chose this very direction to then break up its main economic rival, Europe.

Once again Sharp fluctuations in energy prices and persistent problems in supply chains threaten to usher in an era of European de-industrialization. As European industrialists actively explore options for relocation, they are primarily attracted to countries with no dependence on energy imports, more stable energy prices and strong government support.

In order to lure European industries, it is the United States that has recently become increasingly active in luring European industries into its territory.

According to The Wall Street Journal,

- The chief executive of an Amsterdam-based chemical firm OCI NV, has already announced in September the “expansion of the plant” to produce ammonia in Texas.

- Danish jewellery company Pandora and German carmaker Volkswagen have also announced “expansions” in the United States, while

- Tesla is pausing its plans to produce batteries in Germany and expand it in the US itself, using the Inflation Reduction Act signed into law by President Biden in August.

- Many other European industrialists from various EU countries have similar intentions.

According to analysts and investors, other countries besides the US are also interested in luring European production. In particular, there is already interest from energy-rich countries in the Middle East, as well as countries in Asia, Africa and Latin America, which still have cheap labour.

When and how the war would come to an end is anybody’s guess. One thing appears certain : European Industry is fragile and its loss would be someone else’s gain.

We hope that you liked our coverage on this theme, until then, keep an eye out for the next blog on “Stock Insights.” Also, please share it with your friends and family.

Happy Investing!