Table of Contents

An Equity Linked Savings Scheme, aka ELSS mutual funds is a popular tax saving investment scheme. But what makes ELSS mutual funds so popular? Let’s find out!

Equity Linked Savings schemes are very different to regular mutual fund investments. Investing in ELSS mutual funds has the advantage of tax deductions unlike other mutual funds. ELSS Mutual Funds are the only mutual funds which qualify for deductions under Section 80C of the Income Tax Act of 1961.

Under this scheme, an investment upto Rs.1,50,000 is eligible for deduction from taxable income per financial year. So assume you have a total taxable income of Rs.10 lakhs in a particular financial year. If you invest 1.5 Lakh rupees in an ELSS Mutual Funds then you will be liable to pay tax only on the remainder 8.5 lakhs.

So if you were paying a tax of 20% on 10 lakhs that would equal to Rs.2 lakhs tax.

But now, your total tax to be paid = 20% on 8.5 lakhs which equals Rs.1.70 lakhs.

Total Tax saved = Rs.30,000 per year.

Features of an ELSS Mutual Funds

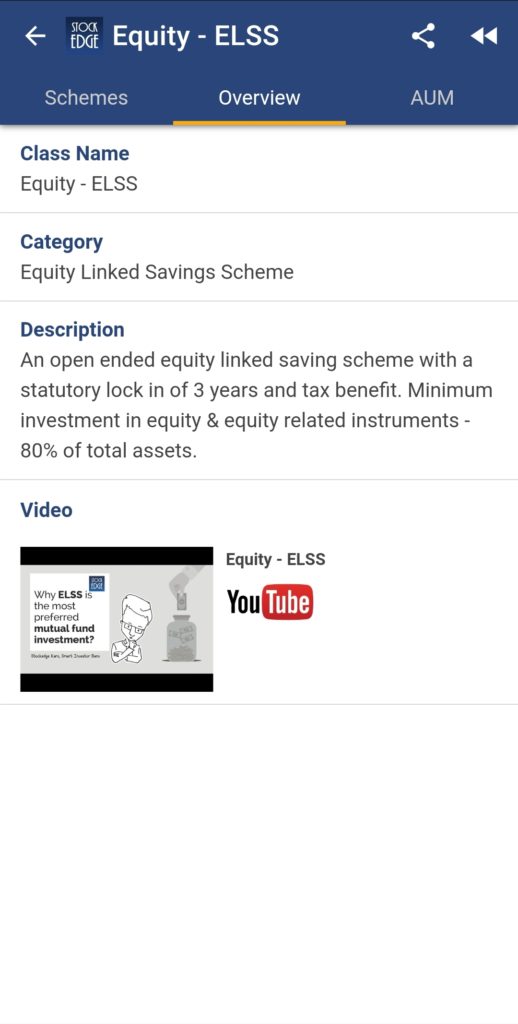

Asset Allocation

An equity linked savings scheme falls under the Equity mutual funds category. This is because according to the Securities and Exchange Board of India(SEBI), ELSS Mutual Funds are mandated to invest at least 80% of their fund corpus in equity related instruments such as stocks. To put it simply, a majority of their holdings include stocks of different companies. The remainder is invested in other asset classes such as bonds and money market instruments.

Lock-ins

Another feature which is unique about these schemes is that they have a lock in period of at least 3 years. This means that once a person invests in an ELSS mutual funds, they cannot redeem or withdraw their investments before 3 years.

Taxation

Apart from the tax deduction benefit which is unique to ELSS mutual funds out of all equity mutual fund schemes, ELSS investors are liable to pay Capital Gains Tax on their profits like other mutual fund investments.

According to the latest tax rules, gains of over Rs.1 lakh made from ELSS investments are subject to a Long Term Capital Gains Tax of 10%.

For eg: Let’s say you invested Rs.10 lakhs in an ELSS fund in the year 2020. After staying invested for a lock in of 3 years, your current profits is Rs.2 lakhs.

Then, your capital gains tax = 10% of (2 lakhs – 1 lakh exempted) = 10% * 1,00,000 = Rs.10,000.

See also: What are Market Cap Funds?

Why invest in ELSS funds?

Investing has many advantages. To build wealth overtime one cannot merely store their savings in a bank or a locker. This is because on a fundamental level, over time money kept at the bank depreciates in value due to something called the time value of money.

To put it simply think about the time when your parents were teens. During those days, one could have bought an entire day’s meal for just Rs.10. Today all Rs.10 can fetch us is a bag of potato chips with lots of air. This mainly because of the fact that with time, the value of cash depletes. A major reason is an economic factor known as Inflation.

So in order to beat inflation, we must invest our savings in instruments which offer returns higher than that of inflation. So with the advantage of investing in mind, let’s move on to the topic at hand. But the advantages of investing are well known. The real question is why should we invest in an ELSS in particular?

- Tax Benefit – As mentioned above, ELSS funds are the only equity based schemes which offer deductions of upto Rs.1.5 Lakhs on the total taxable income.

- SIP – Investing in ELSS funds are very easy and can be done via a systematic investment plan with an investment amount as low as Rs.500. This is something not available in other tax saving schemes. This allows investors to spread their investments over a longer time frame instead of investing lump sum. The advantage of this is that over the long terms, returns can be higher.

- Diversification – ELSS funds invest in a range of stocks belonging to multiple sectors from various industries. They also include other asset classes such as debt and money market instruments in their holdings. This adds a level of portfolio diversification, something that misses in other tax saving schemes.

- Professional Management – One of the best features about ELSS funds is that they are managed by expert analysts who have years of experience in the financial markets.

- Higher Returns – Historically, ELSS funds have offered much higher returns than alternatives such as Fixed Deposits, ULIPs and PPFs. Another feature that sets ELSS schemes apart is that they have a lock in of only 3 years. Investments in PPFs, ULIPs and other government run savings schemes have much longer lock-in periods.

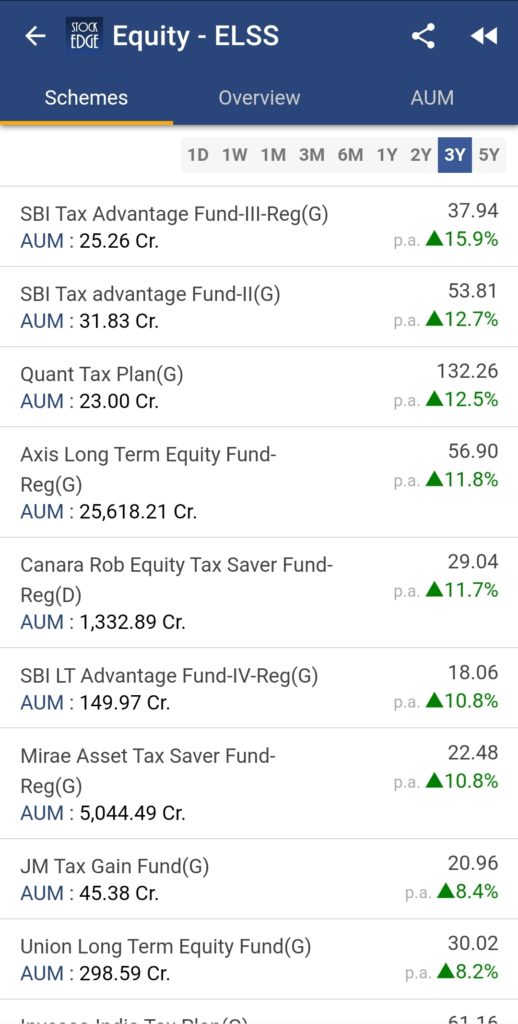

Use StockEdge to find the top ELSS Mutual Funds!

You can also view the video below on ELSS mutual Funds!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Avail the course on Mutual Funds from Elearnmarkets – Mutual Fund Made Easy.