Table of Contents

Admit it, buying stocks at its bottom and selling at its peak is not always possible, especially if you are a retail trader or investor in the stock market. Being a retail trader, you may get close and capture a decent bull run if you track the smart money flow in the stocks. The simple reason being big players, like the HNIs, FPIs and Institutional Investors, are the market movers and not the small retail players of the market.

To identify such trading opportunities, where smart money is entering or exiting the stock, you need to track NSE bulk deals or bulk deals in BSE, which are happening among big institutional investors or HNIs in the stock market. It is important to track the entry and exits of these big players in a particular stock. But the question is, How?

So, how to identify which stocks are in NSE bulk deals today?

You can easily track the latest NSE bulk deals or BSE bulk deals from the “Deals” section, which you can find under the Explore tab of StockEdge (as highlighted in the image below)

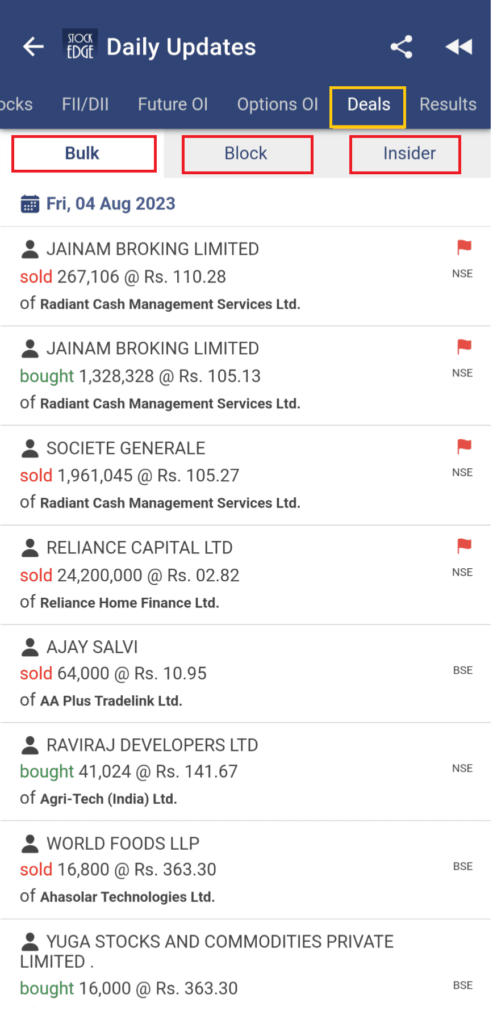

Once you enter the deals section, you will see three different heads under it (as highlighted in the image below). They are as follows:

Now, before discussing how tracking all nse bulk deals or nse block deals can bring investing or trading opportunities, first let’s understand what exactly bulk deals are, block deals and Insider deals.

What is a Bulk Deal?

A Bulk Deal is a trade where a single investor purchases or sells more than 0.5% of a company’s equity shares through a single transaction. So, for example, If Company A has a total number of outstanding shares of 1 Crore, then a bulk deal would involve purchasing or selling at least 50,000 shares (0.5% of 1 Crore) in a single transaction.

All NSE bulk deals are reported to the National Stock Exchange, and all BSE bulk deals are reported to the Bombay Stock Exchange in real-time and are available to the public at the end of the day. So, any bulk deals made on the Nation Stock Exchange are NSE Bulk Deals, whereas if the bulk deals are made on the Bombay Stock Exchange, then they are BSE Bulk Deals. These deals can provide insights into the trading activity of institutional investors, mutual funds, and other large market participants, which may impact the stock’s price and overall market sentiment.

What is a Block Deal?

NSE Block Deals or BSE Block Deals are quite different from Bulk Deals; in the case of block deals, there should be buying or selling of a large number of shares with a minimum value of Rs.10 crores between two known parties at an agreed-upon price. Yes! In a block deal, both the buyer and the seller already know each other, and the deal is negotiated off-market, which means it is not executed through the regular trading platform where most retail investors buy and sell shares. The block deal is executed separately through a single transaction on the special “Block Deal window”, which is generally open for only 35 minutes in the morning session.

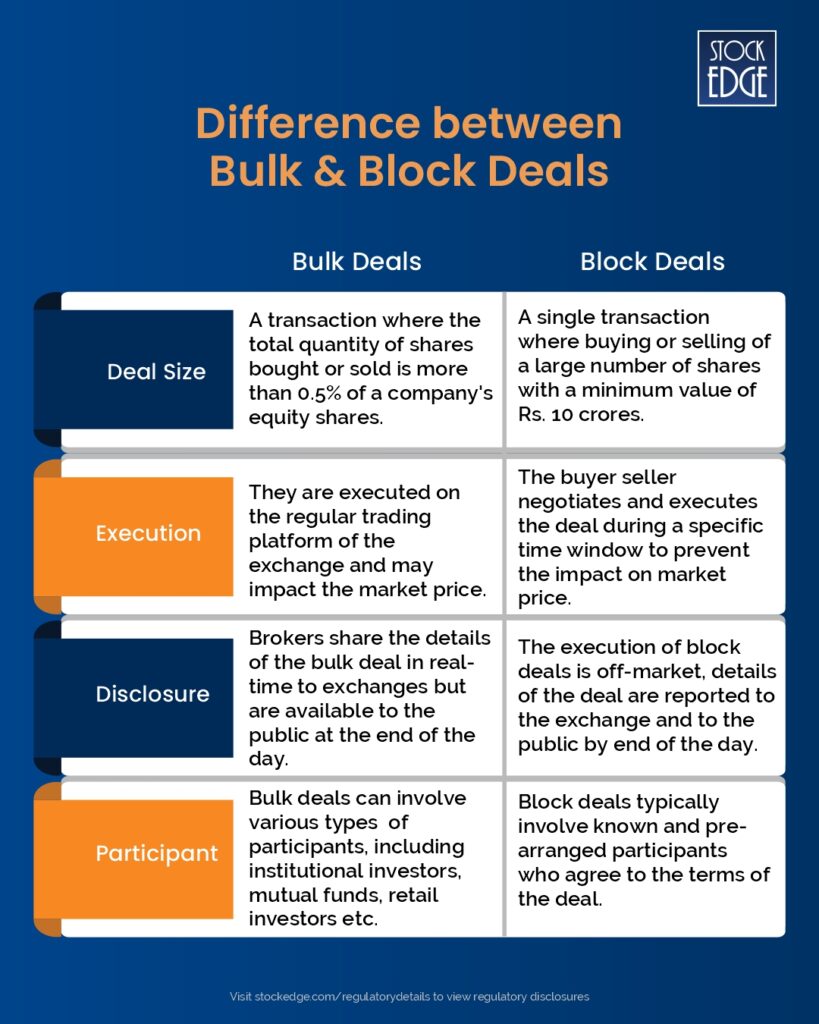

So, what is the difference between the two?

Bulk Deals Vs Block Deals

Although, from a broader perspective, both bulk deals and block deals seem similar, as it involves buying or selling of shares in significant quantities. However, each of them has distinctive characteristics, which are explained below based on four parameters:

Difference between Bulk Deals & Block Deals

In summary, the main differences between bulk and block deals are their size criteria, execution methods, and impact on market visibility. Both deals involve a significant number of shares, but block deals are more focused on absolute quantity/value and are executed off-market to minimize market impact. Bulk deals, on the other hand, are executed on the regular trading platform, which may impact market prices.

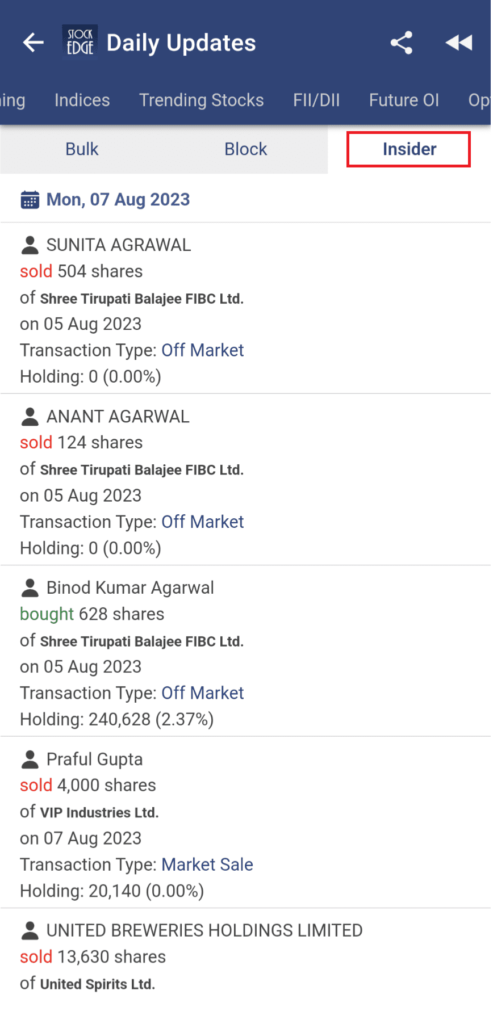

Apart from the two popular types of deals in the stock market, there is one more type of deal that takes place by individuals who are promoters or investor groups with access to internal information about the company. These types of deals are known as Insider Deals. Now let’s understand this in further detail:

What is an Insider Deal?

As discussed above, these deals are made by individuals from promoter groups or investor groups. But as such individuals have access to internal information about the company, such deals are closely monitored by the market regulator, The Securities and Exchange Board of India (SEBI), to prevent unfair advantage or manipulation of the stock.

Insider trading is generally considered illegal when it involves trading stocks based on non-public information by the company individuals. However, it is essential to note that while insider deals are a concern, not all transactions by insiders are illegal. Insiders are allowed to trade their company’s securities under certain conditions, such as following specific reporting requirements and avoiding trading based on material non-public information.

You can view all such insider deals in StockEdge, as shown in the image below:

Now that we have covered the different types of stock market deals, let’s delve deeper into identifying trading or investment opportunities by tracking nse bulk deals, and block deals made by big investors, institutional investors or mutual fund houses.

How to identify trading opportunities using NSE Bulk Deals?

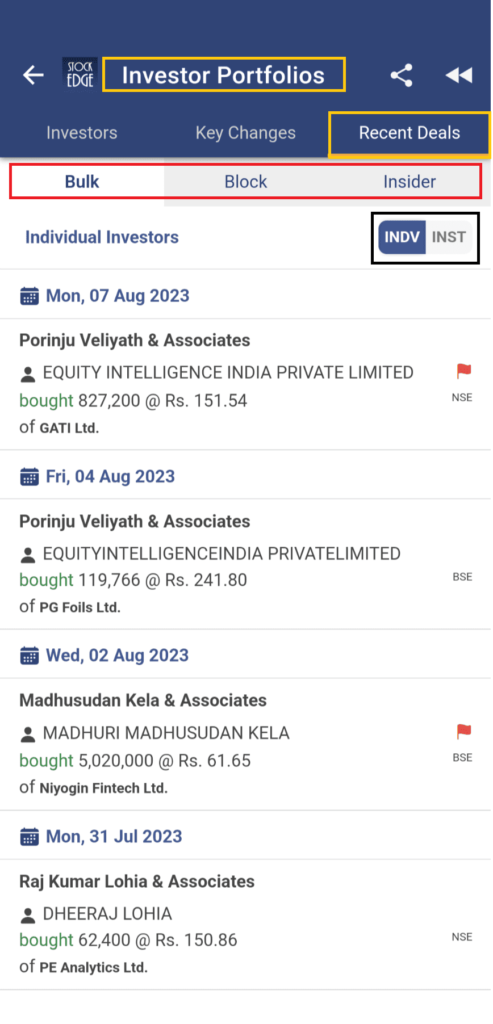

To track the recent bulk deals in nse made by big investors, you can check the deals section of stockEdge as mentioned above, or you can directly visit the Investor Portfolios section and check for recent deals as shown in the image below:

As you can see in this section, it shows date-wise recent bulk, block or insider deals made by individual and institutional investors. The recent data shows famous small-cap investor Mr. Porinju Veliyath made a bulk deal in the company PG Foils Ltd at Rs. 241.80 per share. In no time, the stock is hitting the upper circuit in the market and currently, as of 8th Aug it is trading at 261.80 per share; that’s an 8% jump in share price in just two trading days! That’s just amazing, isn’t it? So, start tracking nse bulk deals, block deals, and insider deals to spot such trading opportunities in the stock market.

Read this blog to learn Using Investor Portfolios Section to track Big Bulls like Rakesh Jhunjhunwala

The Bottom Line

In summary, grasping the disparity between bulk and block deals is essential for traders and investors navigating the stock market. While both involve substantial trades, nse bulk deals influence real-time prices and reveal market sentiment. In contrast, block deals are discreet, pre-negotiated transactions executed off-market to curb immediate market impact. Understanding these nuances can empower you to make well-informed decisions aligned with your trading strategies and risk tolerance, enhancing your skill in the dynamic world of stock trading.

Frequently Asked Questions

What is the difference between bulk deals and block deals?

A bulk deal is one in which the total quantities of shared purchased or sold exceed over 0.5 % of the equity shares of a company listed on the exchange. It is a market-driven deal, which occurs only when brokers provide a trading window during regular trading hours.

Block deals are trades where more than 5 lakh shares or shares worth a value exceeding Rs.5 Crores, of a particular company listed on the exchange, are traded. Block deals may only be conducted during a particular trading window in the early trading hours. The deal must go through between 9.15 AM and 9.50 AM, i.e. the time when the trading window is open.

What are block deals in the stock market?

Block deals are trades where more than 5 Lakh shares or shares worth a value exceeding Rs.5 Crores, of a particular company listed on the exchange, are traded. Block deals may only be conducted during a particular trading window in the early trading hours. The deal must go through between 9.15 AM and 9.50 AM, i.e. the time when the trading window is open.

Does bulk deal affect share price?

Yes, bulk deals affect the share prices of the company because these deals happen during the normal trading window provided by the broker and it is a market-driven deal. The deal is visible to everyone trading on the stock exchange. The broker who manages the bulk deal is required to provide the transaction details to the stock exchanges.

What is bulk order in the share market?

A bulk order is where the total quantity of shares bought or sold is more than 0.5% of the number of equity shares of the listed company. It is a market-driven deal that happens during the normal trading window provided by the broker.

So, now that you know how much important it is to track bulk, block, and investor deals, start tracking it from the StockEdge app to keep yourself updated on a daily basis.

Also Read from Elearnmarkets blog on : The Essential Guide to Bulk and Block Deals

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge.