Table of Contents

Dividends- In this weekend’s blog, we will talk about 5 stocks which are consistently paying dividends.

But, before we get into the company’s names and details, let’s try to understand why companies pay dividends on stocks, as well as a couple of reasons why they might not.

Sharing Profits With Shareholders

Dividends are a way for businesses to share their profits with their shareholders. Dividends can be used by businesses to reward investors and entice them to stay. However, in order for a company to share profits with investors, it must first have profits to share.

As a result, dividends are most commonly paid by well-established companies with consistent revenue. These companies’ stocks are commonly referred to as income stocks because they pay out regular dividends.

To Attract Investors

Dividends can be an excellent way to attract investors because they know they will receive recurring income from the stock no matter what happens to its share price.

Dividends are an especially useful tool during periods when stock prices are stagnant or declining, as they provide investors with an opportunity to profit. Indeed, dividends can entice more investors during these seasons, causing the stock price of the company to rise.

Why do all Companies Don’t Pay Dividends

So, if dividends help to attract and retain investors, why aren’t they paid by all companies? While there are compelling reasons why some companies choose to pay dividends, there are compelling reasons why others do not.

For starters, when companies distribute profits to shareholders, they are not reinvesting them back into the business. Finally, those reinvestments can help the company grow, increasing the stock price.

Dividends stocks are less common among start-ups and other rapidly growing businesses that must reinvest in order to thrive. These stocks, known as growth stocks, are frequently regarded as a good trade-off for investors who anticipate significant capital gains.

Now let’s start with the names of the stocks

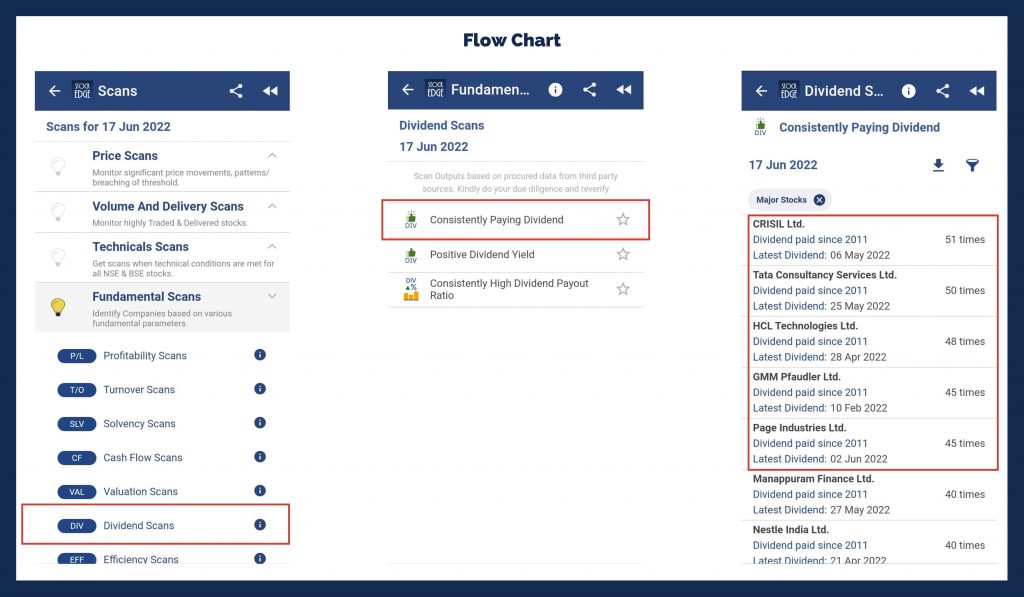

CRISIL Ltd.

CRISIL is India’s leading credit rating, research, risk & policy advisory company having pioneered the concept of credit rating in India in 1987. S&P, the world’s leading credit rating agency by market share, is its major shareholder (67.7%) after the recent open offer. CRISIL is a globally diversified analytical company having ratings, research and advisory services under its fold. As of today’s date, this is the share price of Crisil Ltd.

With market leadership in corporate bonds, bank loan ratings and SME ratings, company is strongly poised to gain from cyclical and structural uptick in domestic ratings segment. With increased interest from parent, strong growth in off shoring services to S&P will continue which will drive its offshore ratings segment.

Last Dividend Details – Date 2022 May 06, ₹7 Interim 1 – FY22

Tata Consultancy Services Ltd.

TCS is one of India’s largest and oldest information technology firms. It was founded in 1968 and serves a variety of industries including banking and financial services, insurance, manufacturing, telecommunications, retail, and transportation. TCS has a large and diverse client base, with a presence in 42 countries. TCS had 592,195 employees (including subsidiaries) at the end of FY22. As of today’s date, this is Tata Consultancy Services share price

TCS is well-positioned to capitalise on the increasing demand for offshore IT services. The company is a serious contender for large deals due to its greater experience than peers in implementing large, complex, and mission-critical projects. TCS’s ability to roll up, improve sales and marketing prowess, and willingness to take multiple big bets (different go-to-market models) are among the key drivers that should help it sustain its high-growth trajectory in the long run.

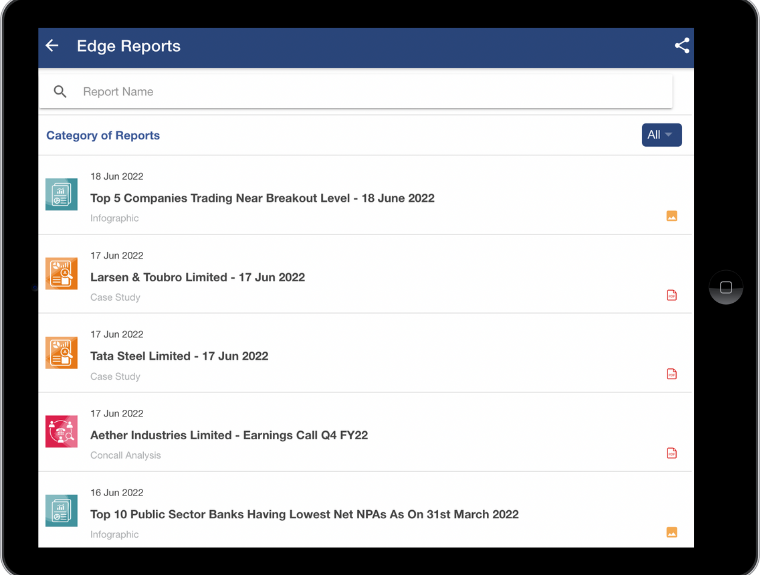

Click the Edge Report Section to get detailed analysis of the stock.

Last Dividend Details – Date 2022 May 25, ₹22 Final – FY22

HCL Technologies Ltd.

HCL Technologies is the fourth-largest IT services provider in India. It offers software-led IT solutions, remote infrastructure management, and business process outsourcing services, with a focus on transformational outsourcing. To deliver solutions across select verticals, the company leverages its extensive offshore infrastructure and global network of offices in 26 countries, including financial services, retail and consumer, life sciences aerospace, automotive, semiconductors, telecom and media publishing, and entertainment. As of today’s date, this is HCL Technologies’ share price.

As a scale player, HCL Technology is expected to gradually increase its share of the total IT pie, owing to its rapidly expanding infrastructure management practice and strong order book. In recent quarters, HCL Technologies has been aggressively pursuing large deals. Its well-established infrastructure management practice, combined with its EAS practice, offers significant cross-selling potential, which could help HCL win some of the larger deals. The ramp-up of the deals over the next two years will drive the company’s revenue growth.

Click the Edge Report Section to get a detailed analysis of the stock.

Last Dividend Details – Date 2022 April 28, ₹18 Interim – FY23

GMM Pfaudler Ltd.

GMM Pfaudler, founded in 1963, is a global supplier of glass-lined equipment and systems for critical applications in the chemical and pharmaceutical industries. GMM, with a 50 percent market share in the glass-lined reactors industry in India, is led by the strong parentage of Pfaudler Inc. As of today’s date, this is GMM Pfaudler’s share price.

They are divided into three sections. Glass-lined equipment, proprietary products, and heavy engineering are examples of these categories. The company’s manufacturing facility is located on a 20-acre plot of land in Karamsad, Gujarat. Mavag, based in Switzerland, is a subsidiary that manufactures proprietary products.

It has a strong capability of producing high-quality reactors and has relationships with large multinational corporations and domestic manufacturers in the pharmaceutical and chemical sectors. GMM’s product quality and performance are reflected in its low warranty costs. Customers prefer GMM for larger-capacity glass-lined reactors due to the critical nature of the product, allowing GMM to have a higher market share and command a premium for larger-sized products.

Pfaudler Inc. is the largest player in the international GL equipment market, accounting for 30% of the market. Its main product line consists of glass-lined reactors and storage vessels, and it competes primarily with smaller European firms. Its technological foundation enables GMM to create world-class, dependable products.

Click the Edge Report Section to get a detailed analysis of the stock.

Last Dividend Details – Date 2022 Feb 10, ₹1 Interim 3 – FY22

Page Industries Ltd.

Page Industries, founded in 1994, is the sole licensee of JOCKEY International, Inc. (USA) for the manufacture, distribution, and marketing of the JOCKEY brand in India, Sri Lanka, Bangladesh, Nepal, the United Arab Emirates, Oman, and Qatar. Furthermore, it is the sole licensee of Speedo International Ltd. in India for the manufacture, marketing, and distribution of the Speedo brand. As of today’s date, this is Page Industries share price

Page Industries’ promoters (the Genomal family) have been associated with Jockey International, Inc. as their sole licensee in the Philippines for over 50 years. Because of the extremely successful relationship with Page’s promoters, when Jockey International, Inc. decided to enter the Indian market, they offered the family the opportunity to take up the India licence and set up operations in the country catering to the Indian market and Bangladesh, Nepal and Sri Lanka.

Page has built Jockey into an aspirational and best-performing innerwear brand in the country driven by leadership across men’s innerwear (#1), women’s innerwear (#1) and athleisure (top five).

The surge in men’s innerwear was driven by branding, positioning (aspirational brand affordably priced) and distribution. Women’s innerwear and athleisure have sprung on the pedestal of brand visibility and distribution created by men’s innerwear and—importantly—right pricing.

However, after the entry of Van Heusen into men’s innerwear, the company has giving good competition to Page Industries.

Click the Edge Report Section to get detailed analysis of the stock.

Last Dividend Details – Date 2022 Jun 02, ₹70 Interim 4 – FY22

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

As we have disclosed all the names, one thing you must consider before investing in them is the risk associated with such companies.

There may be risks like uncertainty in global markets, failure of strategic initiatives , volatility in commodity prices, currency risk, rising competition, etc. which could give a setback or impact the profitability of these companies.

So you have to track them on a quarterly basis and see how the company develops from here on out.

Best way we would suggest is to use the StockEdge App and these stocks in your watchlist. You can use the dividend Scan Section of our app to track and find stocks based on your criteria.

You can also watch our video:

Until then, keep an eye out for the next blog on weekend editions of “Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

Nice information.

Well researched and insightful analytics

Very good information providing for investors thanks a lot