Table of Contents

Today, StockEdge wants to talk about one of the most hot favourite banking stocks marking its presence in everyone’s portfolio which is Axis Bank, which showed a phenomenal growth of 279% after hitting its 52W low on 25th March,2020. The stock hit its 52W high of 799 in the NSE exchange on 15th February, 2021.

Axis Bank, one of the first new generation private sector banks to have begun operations in 1994. The Bank was promoted in 1993, jointly by Specified Undertaking of Unit Trust of India (SUUTI) (then known as Unit Trust of India), Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), National Insurance Company Ltd., The New India Assurance Company Ltd., The Oriental Insurance Company Ltd. and United India Insurance Company Ltd. The shareholding of Unit Trust of India was subsequently transferred to SUUTI, an entity established in 2003. As of today’s date, this is Axis Bank share price.

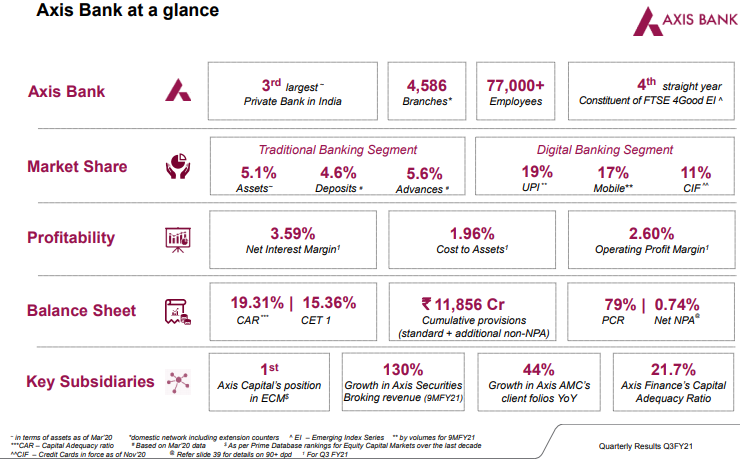

Axis Bank is the third largest private sector bank in India. The Bank has a large footprint of various domestic branches (including extension counters) with huge numbers of ATMs & cash recyclers spread across the country. The overseas operations of the Bank are spread over different international offices with branches at various Cities. The international offices focus on corporate lending, trade finance, syndication, investment banking and liability businesses.

Axis Bank visions to be the preferred financial solutions provider excelling in customer delivery through insight, empowered employees and smart use of technology.

Axis Bank is about to launch its innovation center called Thought Factory in Bangalore. The bank has chosen Zone Startups India, a Mumbai-based technology startup accelerator, to host an accelerator program for them. The focus is on startups developing technological solutions for bank’s internal operations.

Message from MD & CEO

“As the economy continues to combat the unprecedented uncertainty caused by COVID‑19 pandemic outbreak since the start of this calendar year, we have lived up to our promise to the nation of being a responsible citizen, being ‘Open’ to address the needs of our customers, employees and communities.”

– Amitabh Chaudhry

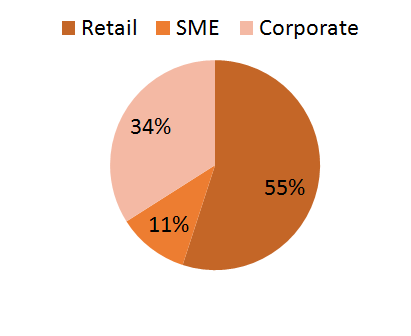

Segment Loan Mix:

Operational Highlights

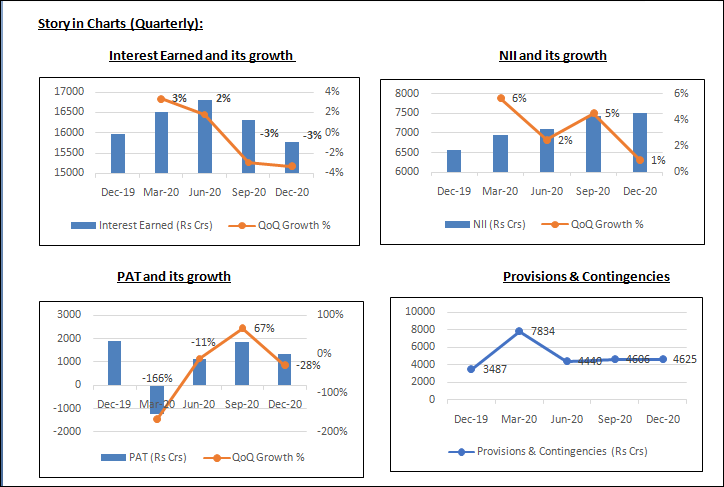

•Net interest income (NII) grew by 14.2% YoY to Rs.7,505.1 crore in Q3 FY21. Reported net interest margin (NIM) stood at 3.59%.

•Including targeted long-term repo operations (TLTRO), the loan book grew by 9% YoY and 1% sequentially. Retail disbursements were at all time high during the quarter which grew by 7% YoY and 34% QoQ and 11% YoY growth in corporate advances

•CASA ratio stood at 42% which saw a growth of 232 bps YoY and 158 bps QoQ. Retail term deposits (RTDs) grew 17% YoY

•Gross non-performing asset (GNPA)stood at 3.44% and net NPA stood at 0.74% as compared to 5.00% and 2.09% as on 31st December, 2019, respectively.

•The restructured loans as at 31st December, 2020 stood at Rs.2,709 crore that translates to 0.42% of the gross customer assets.

For knowing more about Axis Bank and doing research on its peer comparison on the basis of key banking ratios, Kindly Click Here.

Future Outlook:

•Premiumisation strategy focuses on improving account quality of overall balances while increasing contribution from premium segments

•Focus has been on secured lending and deepening deposit base

•Lending opportunities in RuSu markets to complement the Bank’s overall PSL strategy meaningfully

•Continue to invest in partnership business with leading brands so as to be at the forefront of digital innovation

See also: HDFC Bank Limited-Simplifying the financial ecosystem of India

Management Update

•Provisioning coverage ratio (PCR) improved to 75% from 60% last year. It improved 243 bps QoQ. On an aggregate basis (specific provisions, standard provisions, additional provisions and Covid provisions), PCR stood at 116% of GNPA on 31st December, 2020 as against 74% on 31st December, 2019.

•Capital adequacy ratio (CAR) and common equity tier-1 (CET1) ratio for 9M FY21 stood at 19.31% and 15.36%, respectively, improving 59 bps and 103 bps, respectively, on a YoY basis.

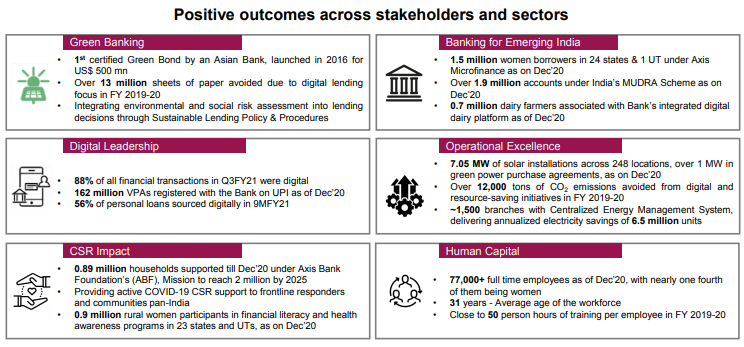

•The bank has 19% market share in the UPI ecosystem and 17% market share in mobile banking.

Additionally, it is a part of Nifty 50, which is the India’s benchmark index. To know more about Nifty 50 stock read; All About NIFTY50, Components of NIFTY50, and How to Invest in it

StockEdge Technical Views:

Axis Bank is trading above the weekly support zone and likely to stay positive till the stock holds the 750-760 zone. Technical parameters look quite positive till now and probable resistance in the near term comes at 820 level. Further breakout to take place above swing high of 830 level.

Bottom Line:

Axis Bank offers a wide range of banking services in India that includes cash and credit management services, retail banking, investment management and treasury services amongst others. The profits of the bank have plunged during the quarter. The subsidiaries of the company like AMC etc are performing well.

The bank is continuously focusing on digital transactions and digital platforms for growth. The core pre-provision operating profit was hit by many one-offs and that the quarter saw low new stress formation. A continued decline in cost of funds, improving growth in secured retail, low restructuring at 0.4 per cent of customer assets, and reasonable cushion of 48-55 per cent on the unrecognized but identified stress is driving improvement in outlook. We remain positive on the stock.

Superb