Table of Contents

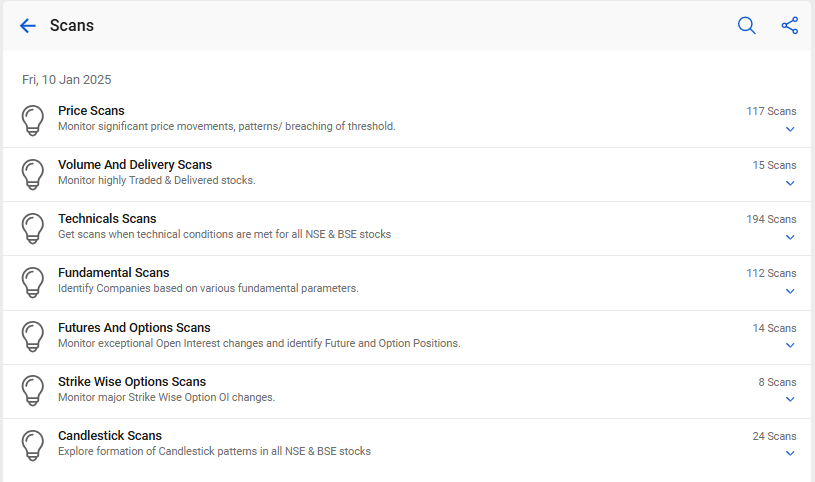

When we start trading, we often get confused about which stock to buy or which to sell. There are so many stocks listed in NSE and BSE that it is not possible to apply technical or fundamental analysis on each stock. StockEdge has many types of scans available, including technical, fundamental, option, candlestick, and so on. Out of these scans, we can choose our favourite scans, which we use daily in our trading and filter out stocks accordingly.

Types of scans

There are many scans available in StockEdge, such as:

- Price Scans: Where we can monitor significant price movements and patterns

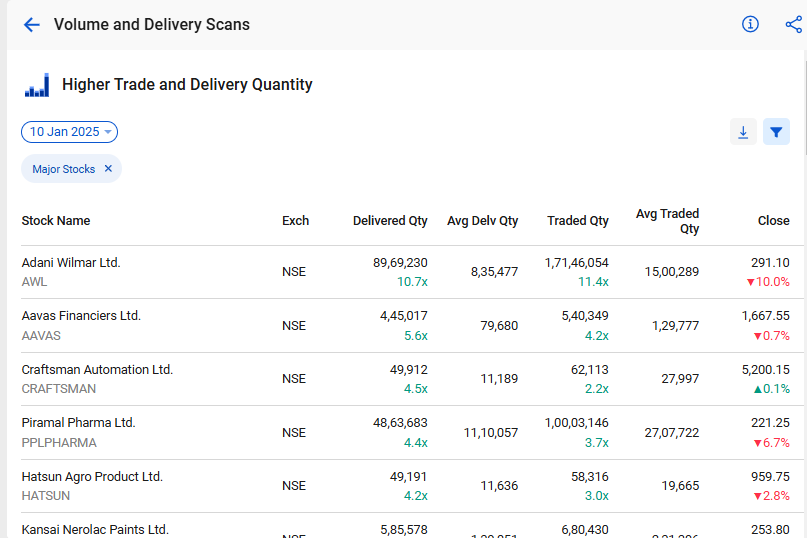

- Volume and Delivery Scans: We can use these scans to monitor highly traded and delivery stocks.

- Technical Scans: Here, we can get scans that fulfill technical conditions for all NSE and BSE stocks like the Relative Strength Index, Money Flow Index, Moving Averages etc.

- Fundamental Stocks: Here, we can filter out the companies based on various fundamental parameters such as Cash Flow, valuation, turnover, etc.

- Future Scans: Here, we can monitor those stocks with open interest changes and identify future positions through open interest scans, long position scans, and short position scans.

- Option Scans: Here, we can monitor major index options and stock options scans.

- Candlesticks scan: Here, we can explore the formation of candlestick patterns in the stocks, such as bullish scans, bullish continuation scans, bearish scans, bearish reversals and so on.

How to make your Favourite Scans List:

In each criterion, there are so many scans available in StockEdge that it is difficult to go to each and every scan and filter out the stocks. Therefore, we can create a list of our favorite scans.

- We can do this by going to “My StockEdge” and then clicking on “My Scans”.

- Click on the “+” sign, and the list of scans will come up.

- From there, click on the star, and automatically, the scan will be added to the “My Scans” list.

The particular scan will help us filter out the stocks that fulfil that criterion. Suppose we choose “Higher Trade and Delivery Quantity”. Then, all the stocks that satisfy this criterion will come for that particular date. As of 28th November 2024, Adani Wilmar Ltd., Aavas Financiers Ltd, and so on fulfilled this scan, so we learned that the volume has increased in these stocks, and people in the market are trading in this stock in just one click.

Similarly, if we use the MACD Technical indicator in our daily trading setup, we can add “MACD Crossing Signal Line from Below” if we want to buy the stocks. Just click on it, and a list of companies that meet these criteria will appear.

If we want to short the stocks, then we can add the technical indicator “MACD Crossing Signal from Above”. Just click on it, and a list of companies that fulfil these criteria will appear.

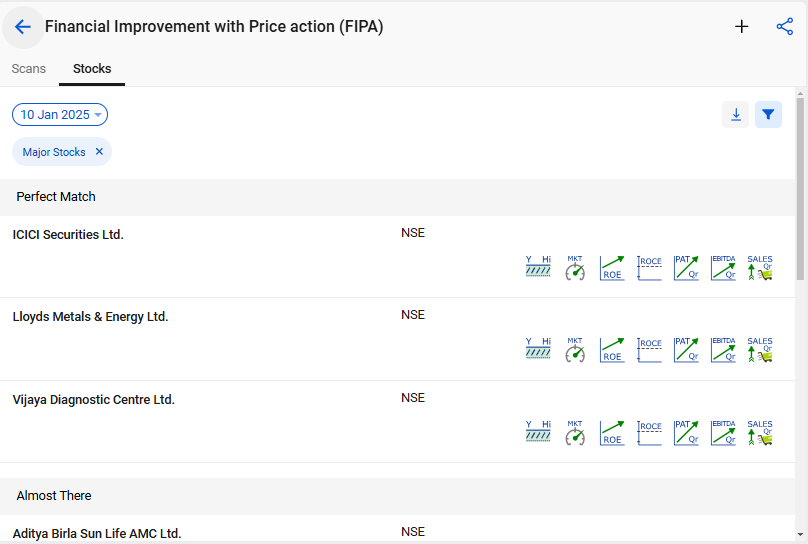

Combination Scans

Combination Scans are one of the powerful features that enable traders and investors to combine up to ten separate scans into a single complete filter. By doing so, you can generate a dynamic and revised stock list that satisfies your particular specifications.

For example, here is a techno-funda scan named FIPA (Financial Improvement with Price action), created by Mr. Vivek Bajaj.

Discover the art of momentum investing with our mentor, Mr. Vivek Bajaj, in the insightful session “My 7 Momentum Investing Profitable Strategies.”

This session is a must-watch for anyone aiming to refine their trading approach and uncover powerful strategies.

Conclusion

As discussed above, this is how we can apply our favourite scans for quick trading ideas. Like this, we can keep choosing the scans that we use in our daily life and keep on adding to our “My Scans” list. There is no limit up to which we can add the stocks. So this is the advantage of “My Scans”. We can add to any number of scans we like. Create a list of your own favourite scans.

Please add weekly and monthly RSI also

I want live update scans