Table of Contents

“Jio” is a famous household name in India. You might remember how India’s largest conglomerate, Reliance Industries, penetrated the telecom space back in 2015. “Free Internet” that’s how they have entered the highly competitive telecom market. They completely changed the industry dynamics by eliminating small players to become the market leader in a span of just 8 years.

Reliance Industries is now on its next big mission to disrupt the financial services sector with its recent listing of Jio Financial Services after demerging from Reliance Industries on July 20, 2023.

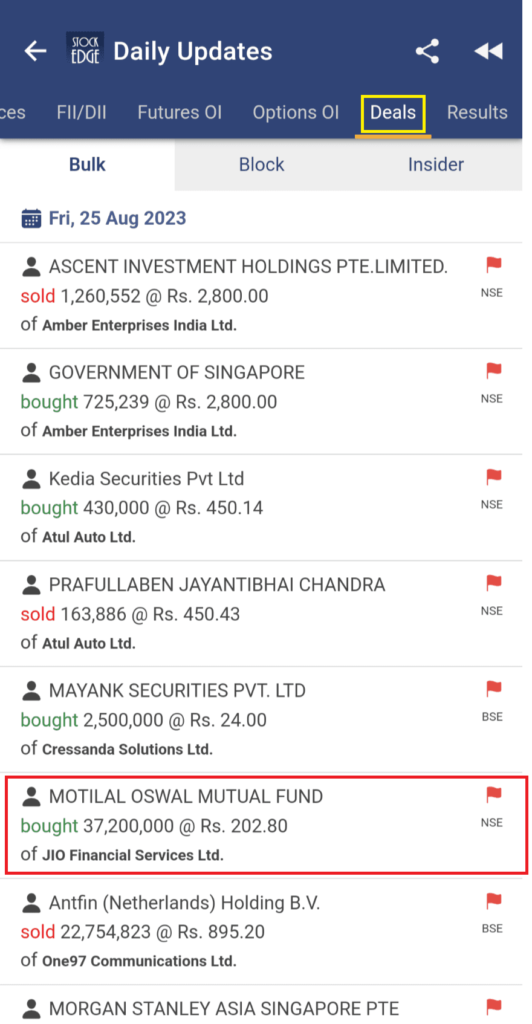

But, yes, after getting listed on the stock exchanges almost a month later on August 21 at Rs. 262 per share, the stock was continuously hitting lower circuit breakers and made a low Rs. 202 per share just before Motilal Oswal Mutual Fund came as a saviour. They made an NSE bulk deal, buying almost 3.72 crores of shares of Jio Financial Services at an average price of Rs. 202.80 per share.

You can easily track bulk deals or block deals for any stock using StockEdge.

To know the difference between the two, we have explained in the blog which you may read for your reference: Difference between Bulk Deals and Block Deals Coming back to Mr. Mukesh Ambani’s vision for Jio Financial Services in the financial sector of India.

Vision of Jio Financial Services

Mukesh Ambani was eyeing to enter the financial service sector long back as it applied for the payments bank license in 2015, which was acquired just a year before it launched its Jio telecom services.

Now, with the demerger of Jio Financial Services, the company is expected to unlock values for its investors as it wishes to enter different avenues of financial services such as loans, asset management, insurance and others.

It has already declared its intent to enter asset management with Blackrock, with each partner investing $150 billion.

Also, in the 46th Annual General Meeting (AGM) of Reliance Industries Ltd, the company announced that Jio Financial Services Ltd will also enter the insurance industry by partnering with potential global players.

It further ensures ubiquitous offerings for both consumers and merchants driving digital adaptation, such as blockchain-based platforms and RBI’s Central Bank Digital Currency (CBDC).

But why is Reliance aiming to tap into the financial services sector? Let’s 1st understand the landscape of India’s financial services sector.

Financial Services: Industry Outlook

The outlook for India’s financial services sector appears promising and dynamic, reflecting a robust growth trajectory over the years. With a commendable Compound Annual Growth Rate (CAGR) of 14%, the market capitalization of shares on the (NSE) National Stock Exchange and the Bombay Stock Exchanges (BSE) has experienced substantial expansion from March 2017 to March 2023. The concurrent increase in the number of companies traded on both exchanges has increased from 4,613 to 6,466 listed shares.

Furthermore, the increase in demat accounts has been remarkable, surging from 27.85 million to 114.50 million between March 2017 and March 2023, at a robust CAGR of 26.57%. This escalating trend signifies retail investors’ growing interest and participation in the stock market.

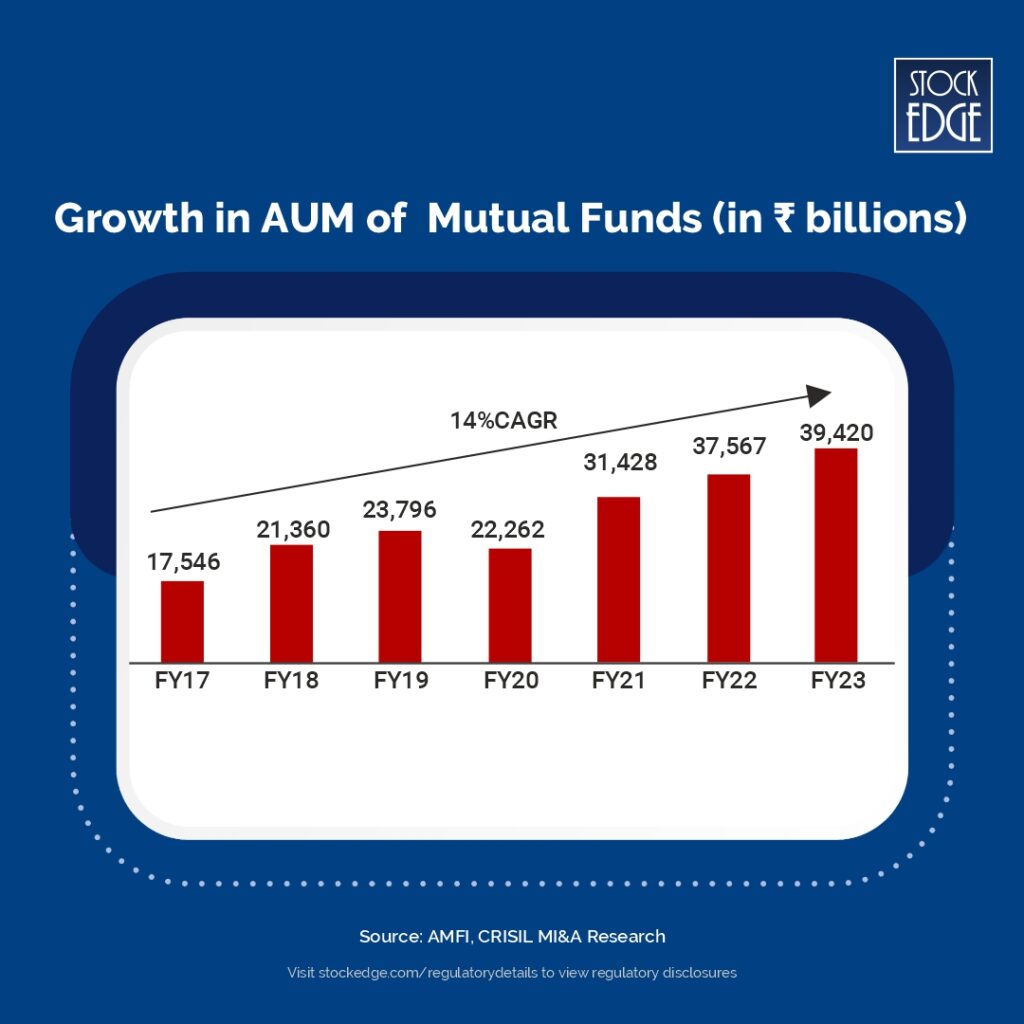

The mutual fund landscape also displays notable growth, with Assets Under Management (AUM) of mutual funds soaring from ₹17,456 billion in March 2017 to ₹39,420 billion in March 2023, reflecting a significant 14% CAGR. This expansion highlights the increasing preference for mutual funds as an investment avenue and underscores the trust investors place in the financial markets.

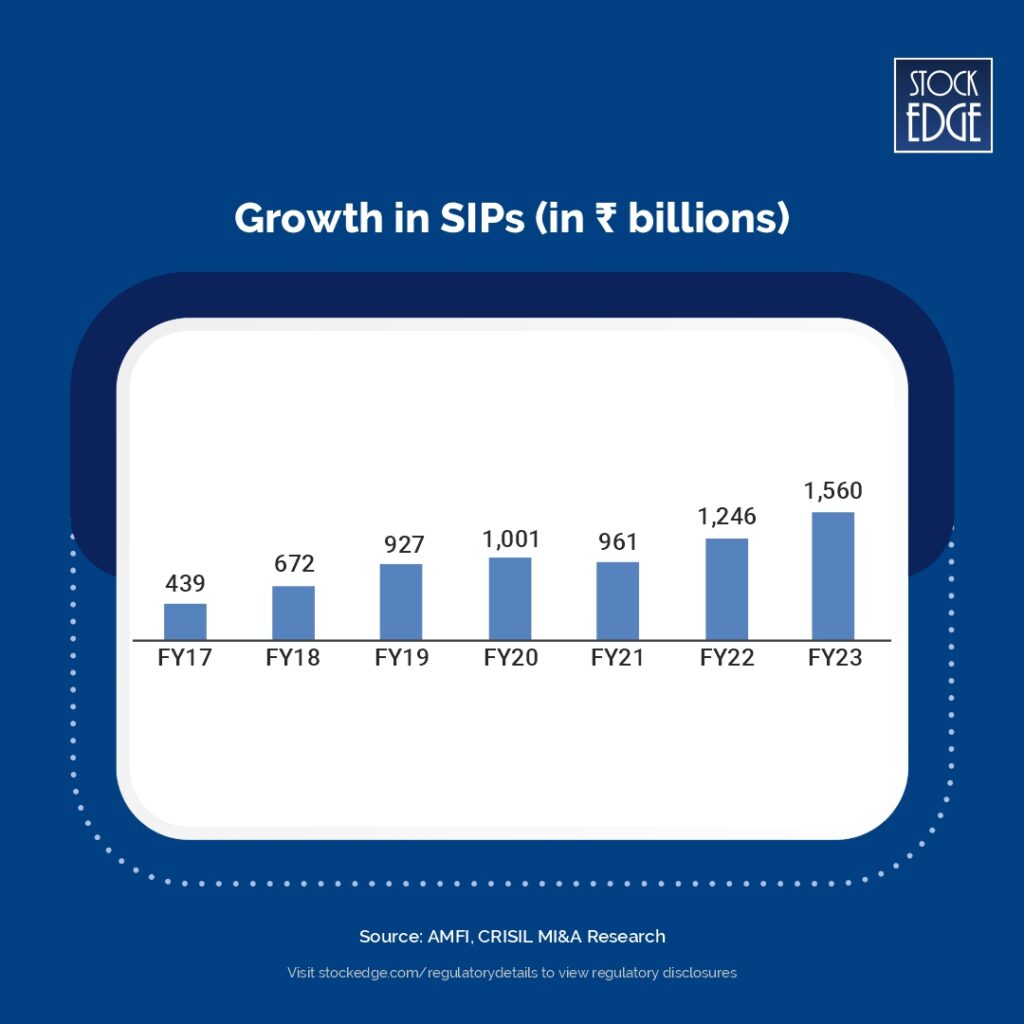

Another pivotal indicator, which is the Systematic Investment Plan (SIP) contribution in mutual funds, showcases a commendable surge at a 24% CAGR from March 2017 to March 2023, ascending from ₹439 billion to ₹1,560 billion. This upward trajectory in SIP contributions signifies a robust culture of regular and disciplined investment, further strengthening the sector’s stability.

Overall, the financial services sector in India appears poised for continued growth and innovation. The substantial rise in market capitalization and an increasing number of traded companies highlight the sector’s expanding opportunities and offerings. The surge in demat accounts and mutual fund AUM demonstrates the rising investor confidence and participation underpinned by robust regulatory measures and technological advancements. The consistent growth in SIP contributions signifies a more informed and engaged investor base, solidifying the foundation for India’s resilient and thriving financial services landscape.

All these factors can create tailwinds for Jio Financial in the upcoming years.

Now you know why the company’s current focus is on the asset management business as it entered into a Joint Venture (JV) with American multinational investment company Blackrock, Inc., which is the largest Asset Management Company in the World with an AUM size of US$8.59 trillion as of December 31, 2022.

To give you an idea, how big is BlackRock, Inc.? India is a $ 3.75 USD trillion dollar economy, and Blackrock’s AUM size is almost double that at US$8.59 trillion.

So, you see, Jio Financial Services is well-positioned after it partnered with the World’s largest asset management company, Blackrock Inc., to capture the untapped market of India’s financial services industry that has endless opportunities. Now, let’s discuss a few strategic growing opportunities for Jio Financial Services Ltd.

Strategic Opportunities for Jio Financial Services Ltd.

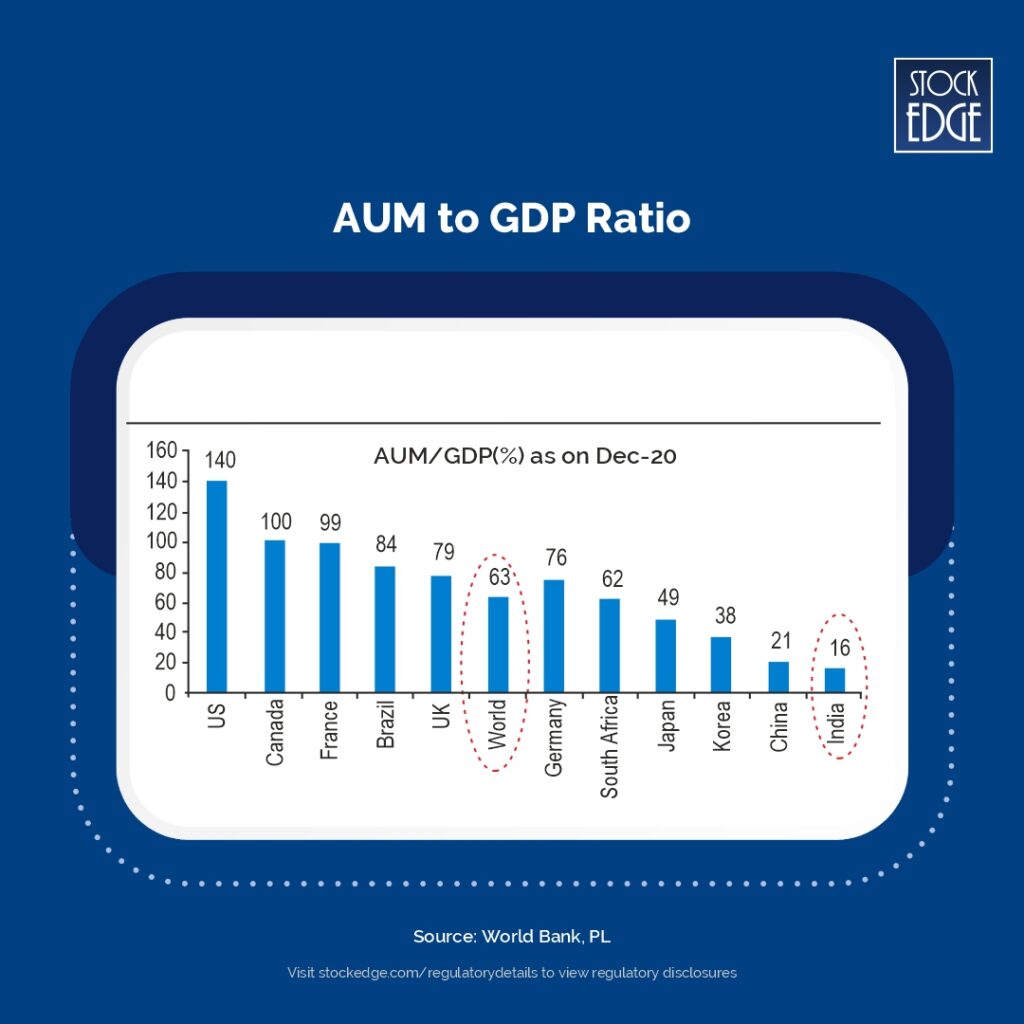

Although India is the 5th largest economy in the world with a GDP of $3.75USD trillion, the country’s AuM to GDP is significantly lower than the world average of 63% and also lower than many developed economies like the US (140%), Canada (100%), France (99%), UK (79%), Germany (76%), Japan (49%) and China (21%).

Hence, a relatively low penetration may provide enormous growth opportunities for Jio Financial Services Ltd. (JFSL)

So, how can Jio sell its financial products? Is there any edge? Let’s find out!

Jio’s Edge in Financial Services

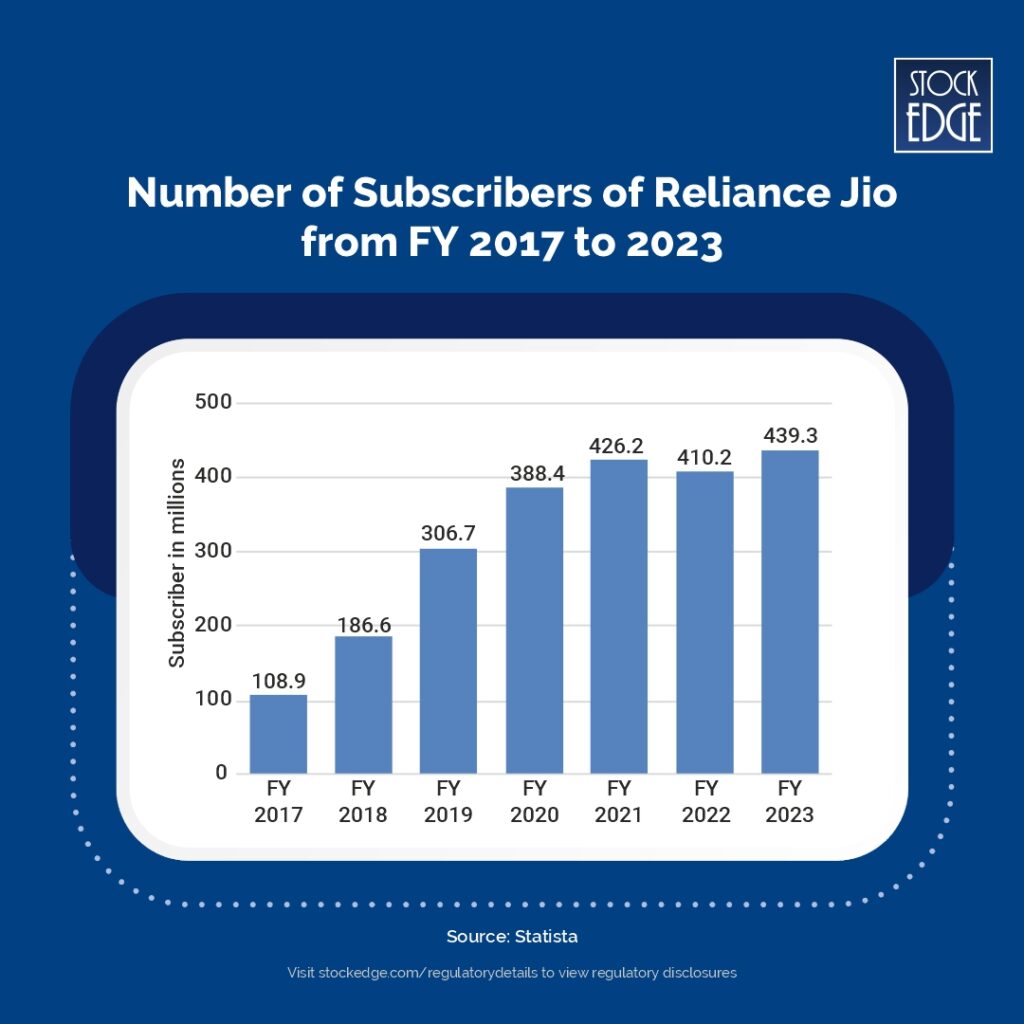

Since the launch of Jio’s telecom business in 2015, the company has rapidly gained customers. In the below image, you can see the total number of subscribers of Reliance Jio in 2017 was 108 million, which increased to 439 million by 2023 in a span of just 6 years.

Hence, the company has access to almost 439 million customers to sell its financial products. That’s definitely an edge for the company.

Infact, Jio’s B2B business, conducted through Jio Mart and recently acquired MetroB2B, ensures that Reliance has access to the buying patterns of tens of millions of small and medium business owners. Also, Reliance is one of the largest conglomerates in India, and collaborations with Blackrock Inc. (the largest AMC in the world) indicate deep pockets, which will allow them to scale up much faster than other companies.

In addition to that, the company’s sizable Retail store networks across India, which make up almost 3% of India’s retail business, are available for the company to grow its retail financing business as well.

Also, the “My Jio” app presence across its telecom network base offers easy access to consumers that will help Jio Financial to cross-sell its products with ease.

No doubt, Jio Financials may capitalize on the growing financial services industry of India. But there are a few more players that could be major beneficiaries, let’s find out!

Best Stocks: Proxy Play the financialization trend

CAMS is the best proxy for India’s mutual fund landscape due to its direct connection with industry AUM growth. Operating as a transfer agency, it provides technology-based financial services to mutual funds and financial institutions. The company has ~69% market share, and they are one of the leading RTA for mutual funds, consistently maintaining robust 30% margins and returns. Investing in CAMS offers exposure to the thriving AMC sector within India’s mutual fund arena.

Kfin Technologies Ltd is a tech-based financial platform offering comprehensive services to India’s capital markets, serving asset managers and corporate issuers across various asset classes. The company operates in three sectors: investor solutions, issuer solutions, and global business services. It’s the largest provider of investor solutions to Indian mutual funds, boasting a ~59% market share. Kfin has a track record of consistently acquiring new clients in all segments.

Angel One stands out as a strong contender in retail broking, excelling in various aspects. It surpasses the industry in client acquisition (19% share in new clients), experiencing a significant increase in average daily turnover market share (4 times since FY20) and NSE active clients (becoming the third largest with around 13% share). This growth is attributed to a rise in direct client acquisition.

BSE also benefits from this proxy approach due to its status as one of the world’s oldest and largest stock exchanges in terms of listed companies. It has evolved into a valuable entity within India’s duopoly equity exchange market. Given the limited investment in financial assets, particularly in Indian equity markets across different demographics, BSE holds a substantial long-term potential.

CDSL, backed by BSE Ltd., is among the two exclusive depositories providing dematerialization for a diverse array of securities, enabling electronic holding and transactions of securities. CDSL also extends KYC services for investors in India’s capital markets to different financial intermediaries. Additionally, it offers online services like e-voting, e-Locker, Registrar & Transfer Agent, and National Academy Depository. Holding a 70% demat account market share, CDSL boasts the highest count of registered Depository Participants (DPs) in this sector.

You can also watch Mr. Vivek Bajaj’s video where he has explained Investment Themes around Jio Financial and how investors can Proxy play the financialization trend in India.

The Bottom Line

Jio Financial could disrupt the financial services industry as Reliance (RIL) did for the telecom industry with the launch of Jio. Also, the collaborations between Jio Financial Services and BlackRock mark a significant stride towards reshaping India’s financial landscape. With a powerhouse like BlackRock’s expertise and Jio’s extensive reach, the stage is set for an innovative disruption in the financial sector. As they leverage technology and strategic collaboration, we can anticipate a future where financial services become more accessible, efficient, and tailored to the needs of the Indian population.

This collaboration promises growth for both entities and has the possibility to impact millions of Indians positively by ushering in a new era of financial inclusivity and convenience. The journey ahead is one to watch as Jio Financial Services embarks on its mission to redefine the financial services sector in India.

Happy Investing!