Table of Contents

In this weekend’s Stock Insights, we discuss Titan, one of India’s most successful consumer brands.

The Story

We have already covered Titan in the past. We all have worn Titan watches at some point in our lives, and so have our parents. But this story isn’t about its “watch” journey. Instead, this story is about a company that ventured into the jewelry business, and today its jewelry division “Tanishq” accounts for roughly 80% of the company’s revenue and as of today this is Titan share price

So, let’s get going.

It was May 2000 when Titan’s Managing Director, Xerses Desai, was absorbed in thinking about its future. He was looking for a worthy successor to carry on his legacy for a long time, but selecting a leader to lead the company was no easy task.

He finally narrowed his choices down to two. On the one hand, there was Bhaskar Bhat, an IIM Ahmedabad Grad with experience working in multiple divisions. On the other hand, Vasant Nangia, an IIM Calcutta Grad, was Tanishq’s Vice President of Marketing and a hands-on man. Xerses selected Bhaskar Bhat to lead India’s largest watch company after much deliberation. Nangia was asked to take over as COO. However, things didn’t turn out well post this decision, and Vasant Nangia resigned.

“On that day, the entire sales and marketing team resigned.” What happened shook the company to its core. Many people believed that this was the final step in Titan’s closure of its jewelry business. “After all, we were in our fifth year of losses at the time,” says Jacob Kurian, COO of the jewelry Business.

And rest is history, Bhaskar Bhat, with a new and admittedly inexperienced team, seized the control right away, steadied the ship, turned the loss-making Tanishq into a profitable company, and wrote a turnaround story for the ages. They took a customer-centric approach and grew to become India’s most trusted jeweler.

Titan’s Jewellery Division – Q2 FY23 Business Update

Titan’s jewelry division revenue increased by 18% year on year to Rs.6980 cr on a high base of Q2FY22, which included pent-up demand and spillover purchases from a COVID-disrupted Q1FY22. Gold jewelry (plain) saw low double-digit growth, whereas studded jewelry sales increased faster than the overall division, owing to strong activation and a higher contribution from high-value purchases.

The product mix improved over last year but remained below pre-pandemic levels. Walk-ins increased in the low double digits year on year, with consistent buyer conversions. New store commissions included eight domestic Tanishq stores, 16 Mia by Tanishq stores, and one Zoya store, bringing the total number of jewelry stores to 488.

How are the other divisions performing?

The watches and wearables division grew 20% year on year, resulting in the division’s highest quarterly revenue.

Strong demand tailwinds, driven by a desire to own more premium/differentiated watches, aided Titan’s growth in the watches category, which was aided by higher volume and average selling prices year on year.

The retail store transformation journey, which aims to provide consumers with a broader selection of premium brands in Titan World, Helios, and multi-brand retailers, also contributed to the division’s overall growth. Titan and Fastrack smartwatches with Bluetooth calling were introduced during the second quarter.

During the quarter, the division added seven new Titan World stores, 14 Helios stores, and two Fastrack stores, bringing the total number of watches and wearables business stores to 905.

For the eyewear segment Double-digit year-on-year sales growth for Titan Eye+ stores was offset by lower year-on-year sales growth across trade and distribution channels, resulting in a 7% year-on-year growth for the Eyecare division.

During Q2FY23, Eyecare expanded its national presence by adding 36 new Titan Eye+ stores and 2 new Fastrack prescription stores (net), bringing the total number of stores in the Eyecare business to 827.

The other segment of Fragrances and Fashion Accessories (F&FA), Indian Dress Wear) remained strong. F&FA increased by 34% year on year, driven by 37% year on year growth in fragrances and 29% year on year growth in fashion accessories. Large format stores (LFS) grew the fastest among key offline channels for F&FA, followed by trade, both growing much faster than the overall division.

Taneira (Sarees) increased by 114% year on year, with significant contributions from new stores opened in the last year. The brand expanded its reach to 31 stores across 14 cities by entering the cities of Madurai, Hubli, and Dhanbad, as well as deepening its existing city presence by opening 5 new stores during the quarter.

Titan Engineering & Automation Limited (TEAL): TEAL reported 139% y-o-y growth, with Automation Solutions Division growing by 240% y-o-y and Aerospace and Defence Division growing by 66% y-o-y.

CaratLane (72.3% owned): Caratlane grew 56% year on year, owing to Raksha Bandhan promotions and hero launches during the quarter. Solitaires grew the fastest across all categories, followed by studded and gold jewelry. Despite a larger base than last year, Studded jewelry continued to contribute 70% of the business.

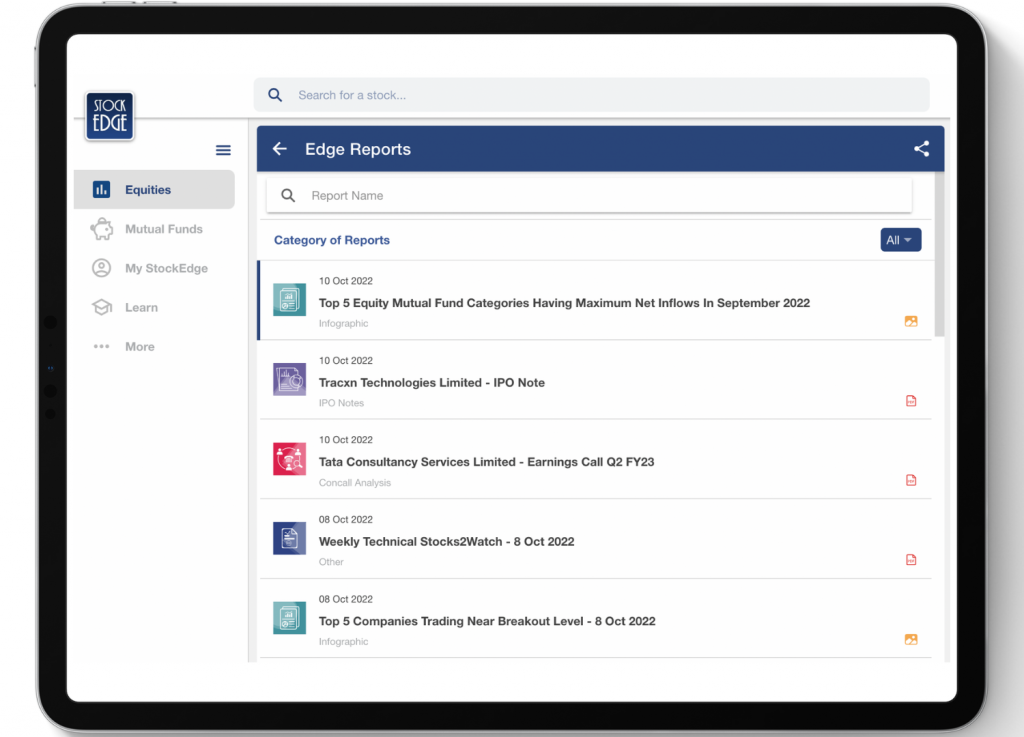

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Road Ahead…

Indians adore gold more than any other people on the planet. So even the poorest Indian will try to obtain even the smallest trinket that serves as both jewelry and the safest long-term investment. There are 10 million weddings in India every year, and people spend close to 2-3 lakhs on bridal jewelry.

We believe with the increasing aspirations of Indian’s, increased sales through the e-commerce platform, a shift to branded players. In addition, expansion of retail footprints in tier 3 and 4 towns, and the likely stabilization of gold prices at lower levels, are expected to drive volume growth for jewelers, which will help maintain the long-term structural story of India’s retail and jewelry industries.

However, as with such companies, there are risks like rising gold prices which could impact the profitability, then slowdown in discretionary consumption and increased competition in highly penetrated categories from unorganized jewelry players.

So we will have to wait and see how the company develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!