Table of Contents

Among the other trending stocks, we are going to talk about a global technology company that specializes in delivering Product Engineering solutions and services to the automotive and mobility industries, i.e. KPIT Technologies Ltd.

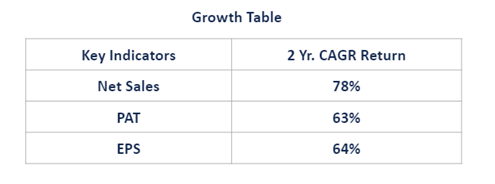

The midcap stock has given a whopping return of 324.55% in the last 1 year.

The Story

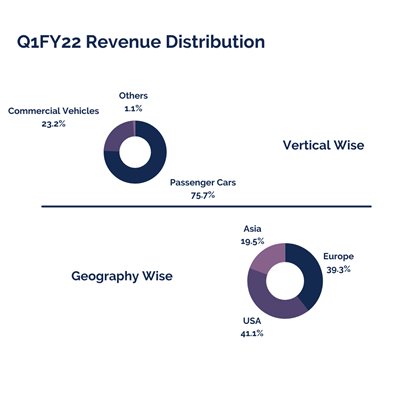

KPIT Technologies is a global technology company that specializes in software solutions to assist mobility companies in transitioning to a self-driving, clean, smart, and connected future. The company’s primary focus areas are powertrain (both conventional and electric), autonomous technologies (vision and control systems), connectivity, and diagnostics. The company’s primary sub-verticals are passenger cars, commercial and off-highway vehicles, and new mobility. The top 21 key clients account for 84.6 % of KPIT’s revenue. The company employs 6,025 people to serve 55 clients. The company’s operations are spread out across the United States, Europe, and Asia. As of today’s date, this is KPIT Technologies share price

Operational Highlights of KPIT Technologies Ltd.

- KPIT began FY22 Q1 on a high note, with 4.3% QoQ cc revenue growth to USD 77.2 million, mostly driven by Autonomous Driving-ADAS practice (14.2% QoQ) and connected vehicle practice (13.6% QoQ). Geographically, Asia (25% YoY, 12.6% QoQ) and Europe led revenue growth (18% YoY, 2% QoQ).

- The management team maintains its top-line guidance of mid-teens growth for FY22, which is supported by a healthy order book. In terms of vertical growth, ‘Passenger Cars’ (which accounted for 75.6 % of sales) and the ‘CV’ segment led the way (3 % and 7.8 % QoQ respectively). The traction seen in CV is expected to continue, as there are numerous opportunities for clients in this vertical to upgrade their technology.

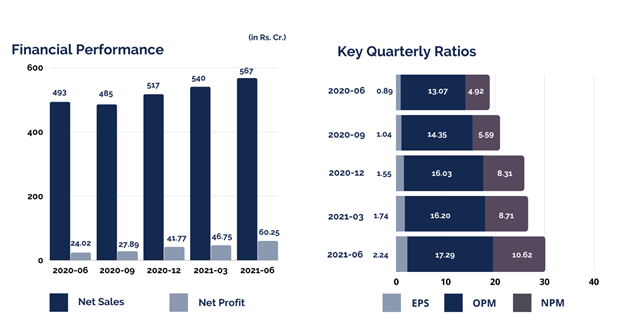

- EBITDA margins increased by 109bps QoQ (422bps YoY) to 17.3 % during the quarter, owing primarily to improved utilization, higher revenues, and lower subcontractor costs.

- Other operating expenses fell 6.2 % YoY.

- EBITDA increased by 12.1 % YoY as a result of these improvements.

- Higher operating margins, higher cash yields, and lower depreciation resulted in QoQ PAT growth of 28 % to ₹602 million.

- The company’s net cash position increased to ₹8.7 billion (up from ₹8.2 billion in 4QFY21).

Future Outlook

According to management, the margin will be impacted in FY22 by steeper wage increases, higher operating costs, and additional headcount. However, management is confident that increased productivity, increased offshoring, and fixed cost leverage will offset the cost increase. Furthermore, the management expects the fixed pricing mix to increase as it provides better margins. The management expects the FY22E EBITDA margin to be in the 16.5-17% range.

Management Update

Despite challenges, the company maintained deal momentum and deepened client engagements in T25 accounts across geographies. This quarter’s new deal wins were primarily in the autonomous and diagnostics sectors, with two new OEMs from China (among the top 4 EV companies in China). The management team also sees a healthy pipeline of electrification projects. Furthermore, the company’s emphasis on top talent retention and talent creation is expected to support earnings and attrition in the coming quarters. At the moment, the attrition rate is 20%, and management is optimistic about an improvement in 2HFY22.

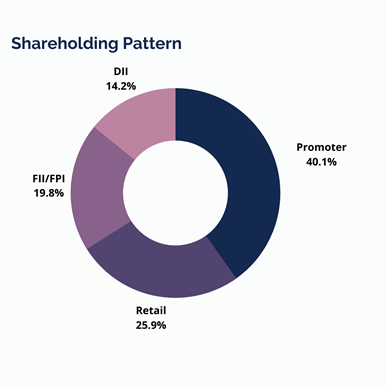

For FY22E, management provided broad guidance and operating plans covering revenue, operational efficiencies, and profitability growth. The management intends to invest in practices relevant to strategic clients to strengthen KPIT’s position in terms of client wallet share. The implementation of a zero-defect delivery process will help increasing Engineering Productivity. The majority of the company’s revenue (85%) is currently derived from repeat customers.

The increased emphasis on electric vehicles, particularly in the United States and Europe, is creating new growth opportunities for the automotive industry as a whole.

Recent Updates

During the quarter, KPIT acquired a 60% stake (₹890 million) in PathPartner Technology (operating system software provider and software for automotive, camera, and radar). The remaining stake will be acquired over two years for a total cost of no more than ₹1.9 billion. The company spent ₹159 million on capital expenditures.

Risks

Uncertainty in Europe and the United States’ macroeconomic environments, as well as Extended Covid-19 woes in the form of a third wave, can have a negative impact, and also stress in the automotive industry can harm the company’s growth outlook and earnings.

Technical View

KPIT Technologies witnessed a breakout from a resistance zone of 316 with good volumes. Above these levels, this stock may show good momentum. Demand zone near 300-295.

Bottomline

Despite the pandemic, the company has continued to win deals in its focus verticals, which are expected to show up on the top line in the coming quarters. The management is optimistic about the company’s long-term earnings growth prospects, owing to its strategic end-to-end client engagement model, healthy cash reserves, debt free status, and traction seen in spending by automakers to build new tech capabilities.

Know more about KPIT Technologies Ltd. and its peers by using the Sectors tab in the StockEdge Web

Check out StockEdge Premium Plans.

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.

Just looking good as reliance has taken stack

Excellent article.

impressed with ur report on Acrysil for valuable information, I’m of d view that it’s going to be a gem

Very informative , specially for those new to trading. Inspires confidence.

Best

All stocks are High growth stocks eye-opener notes