Table of Contents

The legacy of Alembic Pharmaceuticals Limited (APL) dates back to over 100 years. Established in 1907 with an objective to develop and revolutionize the Pharmaceutical and Drug industry in the Indian subcontinent, Alembic Pharmaceuticals Limited today is one of the leading pharmaceutical companies in India.

The publicly listed entity that manufactures and markets generic pharmaceutical products across the globe has grown by leaps and bounds over the last century.

With an emphasis on innovation and technology, the company has established a state-of-the-art research facility – Alembic Research Centre (ARC)-including formulation research, and 150-bed bioequivalence facility at Vadodara, Gujarat. Additionally, Alembic Pharmaceuticals Limited has recently invested in an ultra-modern R&D center at Hyderabad. Alembic Pharmaceuticals Limited is one of the leading players in the industry to have invested about 11% of its turnover in R&D.

As a growth strategy, the company has aggressively started investing in the international generics market with successful ANDA and DMF filings. Alembic Pharmaceuticals Limited has also filings across Canada, Europe, Australia, South Africa & Brazil. The company caters to the rest of the world markets through branded formulation sales. As of today’s date, this is Alembic Pharmaceuticals share price.

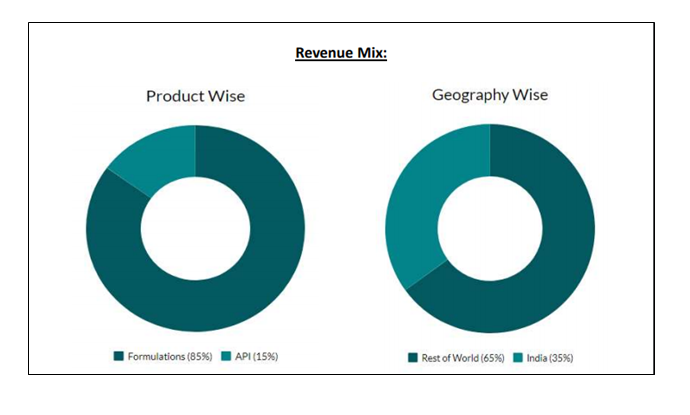

It focuses on anti-infective, analgesic and, cough and cold therapies, such as cardiology, diabetes, gynecology, gastrointestinal, orthopedic, dermatology and ophthalmology. Its APIs include independent manufacturing blocks for Macrolides, non-steroidal anti-inflammatory drugs (NSAIDs) and other drugs. It has 9 manufacturing facilities (3 API and 6 formulation plants) with subsidiaries and joint ventures across the globe.

Financial Highlights

See also: TVS Group- Breaking the Stereotypes – Serving Consumer Delight

Alembic Pharmaceuticals Limited Operational Highlights:

- The company reported steady quarterly performance on the back of robust sales led by growth in the domestic business. Its International, as well as API Business, also continued to perform well.

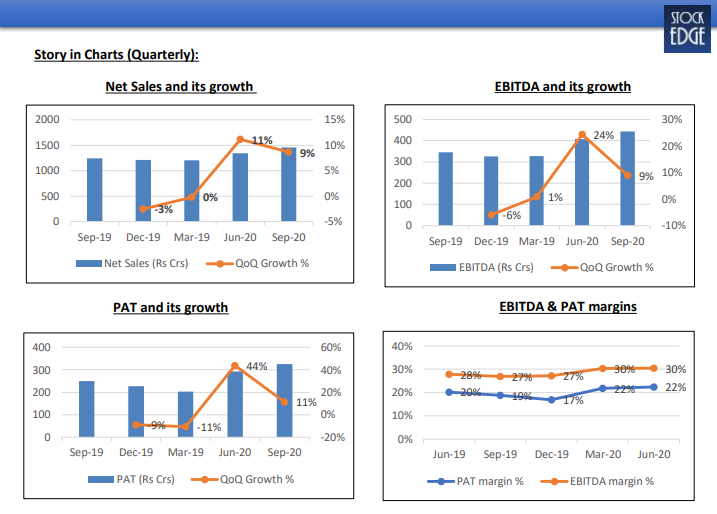

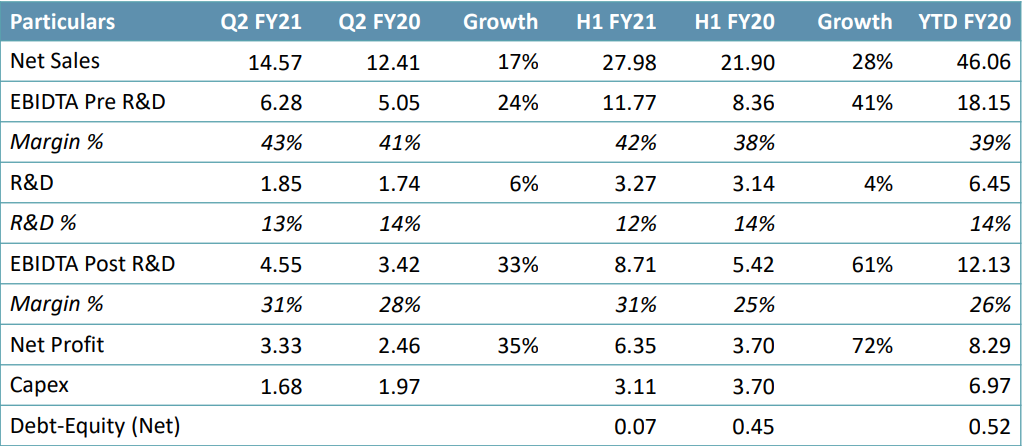

- In Q2 FY21, net sales were Rs. 1,457.10 crore, a growth of 17.42% YoY.

- Revenue growth was led by strong growth in RoW and API segments, which grew 84.1% and 28.9% to Rs. 197 crore and Rs. 263 crore, respectively. The US formulations grew 8% to Rs. 582 crore whereas domestic formulations grew 6.1% to Rs. 415 crore.

- Growth in the US market was mainly due to strong growth in Sartans and new launches. However, Sartans saw some price erosion as a new player entered, which was offset by new opportunities and launches.

- The rest of the world’s growth was mainly due to the resolution of serialization issues in Europe and new incremental orders are coming from partners.

- Strong opportunities arising out of China’s uncertainty and growth in Azithromycin API led to the growth in the APIs segment.

- EBITDA was Rs. 443.43 crore, a growth of 28.33% YoY. EBITDA margin was 30.43%, an expansion of 259 bps YoY.

- Improvement in EBITDA margins was due to better gross margins and lower other expenditure along with lower promotional, traveling and R&D costs.

- PAT was Rs. 325.41 crore, a growth of 29.97% YoY, led by strong operational performance. • Gross debt was at ~Rs. 600 crore (vs. Rs. 1,439 crore in Q1FY21), cash ~Rs. 273 crore; Net Debt:Equity – 0.07

- R&D during the quarter was at Rs. 185 crore (13% of sales).

- For Q2FY21, the company filed seven ANDAs, received six final approvals, and launched three products in the US. Till date it has launched a total 75 products in the US (excluding seven with partner labels).

Future Outlook

- Management Guidance (in absence of any unpredictable circumstances): (I) FY21 EPS to be ~Rs 60 per share and FY22 EPS to be ~Rs 50 per share. Additional expenses of Rs. 450 crore expenses would be impacting the P&L from new plants. FY23 revenue growth to pick up with capacities coming into force. (II) The management also indicated that its long term strategy that includes foray into niche areas like oncology, injectables, derma, etc. 93% of the new launches will be in the speciality segment. Additionally, total 80% portfolio is backward integrated, which is likely to go down, going ahead, as more ophthalmics/complex products will get added.

- The company continues to focus on improving its topline growth by overhauling distribution channels (defocusing on trade generics) and on the back of consistent product launches including limited competition products. It plans to launch 15-20 products every year, especially in the US market.

- The company expects US growth rate to sustain at +US$70 million on the back of established US base amid significant market share gains in Sartans and the current RoW growth rate to be the base, going ahead. The management has also guided for 15-20% growth in the API segment.

- A very high growth trajectory is expected in the US from FY22 onwards, led by commercialization of injectable manufacturing facilities. The new facilities will allow the company to double its base FY22 sales in the US by FY25. In addition, the company will need to cover costs of its newly commercialized manufacturing facilities that should start hitting the P&L in FY22. So, there can be some impact on the margin profile.

StockEdge Technical Views

Alembic Pharma consolidated in a Symmetrical Triangle pattern in the weekly chart and is likely to see breakout above swing high of 1032 level. RSI has been constantly taking support from the 55-60 zone suggesting underlying strength in the stock. Immediate support comes at 955-965 zone.

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge.

Bottomline:

We remain optimistic of the company’s growth prospects on the back of new product introduction in the US, new products filed from recently commercialized Aleor Joint Venture, and improvement in the revenue mix with contributions from general and onco injectables.

Moreover, one-time opportunities in Sartans in the short-term and traction in a company’s low base in the US gives earnings visibility. Steady demand for current products and new product launches in the international and domestic segments should support the growth momentum over the medium term.

These strengths are partially offset by moderate profitability due to sizable research and development (R&D) expenditure, a high share of the acute therapeutic segment in domestic formulations, and exposure to intensifying pricing pressure and regulatory risks.

Disclaimer:

This document and the process of identifying the potential of a company has been produced for only learning purposes. Since equity involves individual judgements, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.